US tariffs come into effect, sparking global trade shakeup, and other international trade stories to know this month

This monthly round-up brings you a selection of the latest news and updates on global trade. Image: REUTERS/Kim Hong-Ji/File Photo

- This monthly round-up brings you a selection of the latest news and updates on global trade.

- Top international trade stories: New global trade order begins as sweeping US tariffs go live; WTO slashes its 2026 trade forecast; EU jobs at risk.

1. Tariffs usher in new global trade order

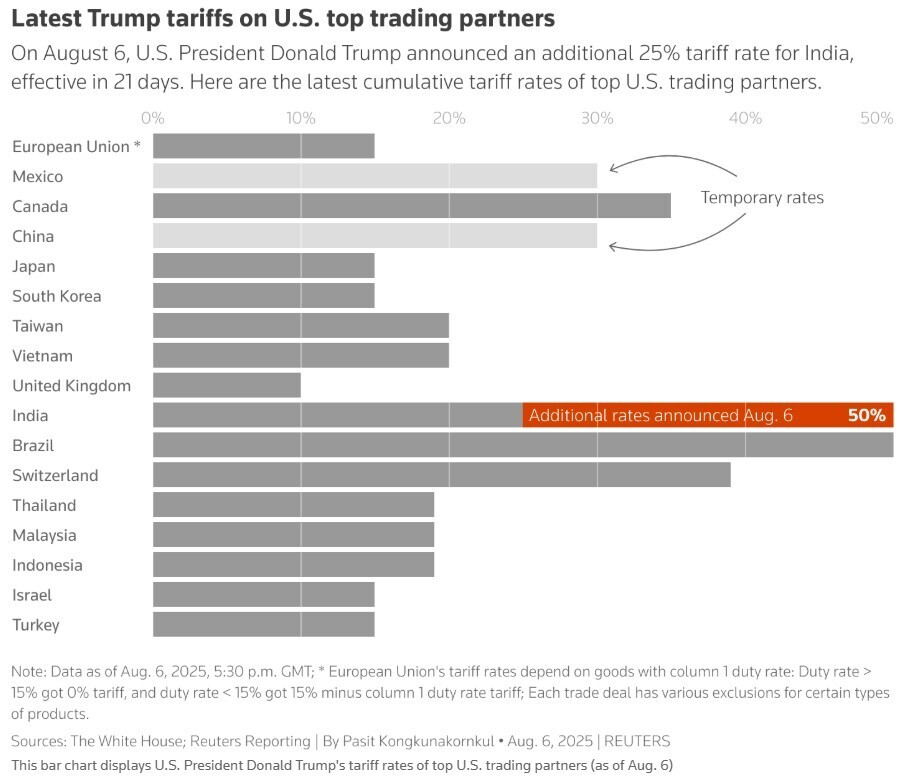

A new global trade order has begun as the US activated sweeping new duties on over 60 nations on 7 August, drawing protests from major partners, including the EU and India, and leaving others, such as Mexico and China, in tense ongoing negotiations. The same day, the New York Times published an opinion article by US Trade Representative Jamieson Greer that detailed the so-called Turnberry system, a name given to the new trade order that originates from the Scottish resort where the EU and the US struck a deal in late July.

From a 100% tariff ultimatum for the tech industry to a deepening diplomatic rift with India, the consequences of the highest US tariff rates in a century are now unfolding.

Major US tariff moves over the past month:

- 3 July: 20% Vietnam; 40% trans-shipments

- 6 July: +10% BRICS-aligned nations

- 7 July: 25–40% on 14 nations starting 1 August

- 10 July: 35% Canada; 15–20% others

- 15 July: 19% Indonesia

- 22 July: Japan deal; auto tariffs 15%

- 27 July: EU deal; 15% tariffs

- 28 July: Warned 15–20% non-deal partners

- 30 July: 25% India; 50% Brazil; South Korea 15%; copper 50%

- 31 July: 10–41% on 69 nations; Canada fentanyl 35%; Mexico reprieve

- 6 August: +25% India for Russian oil links

- 7 August: Sweeping new tariffs on 60+ nations

- 11 August: China truce extended; 30% / US 10% tariffs

US tariffs go live, sparking global scramble

The move establishes the highest average US tariff rate since 1933, according to an analysis by the Yale Budget Lab, which projects the tariffs will cost the average US household the equivalent of $2,400 annually. Lower-income households are likely to feel the effects more acutely, as they spend a greater share of their income on imports.

In response, markets sank then regained losses, with gold futures breaking records then retreating amid uncertainty on whether Swiss gold bars would be impacted by the new duties. The US had hit Switzerland with a 39% tariff on imports, one of the highest rates for any nation.

The chip ultimatum

President Trump trailed a potential new 100% tariff on imported computer chips. The levy would include a crucial exemption for companies manufacturing or committing to build in the US, a measure designed to encourage domestic investment. The policy was accompanied by a deal, reported by the Financial Times, in which chipmakers Nvidia and AMD agreed to give the US government 15% of their revenue from certain AI chip sales to China in exchange for export licenses.

US-India trade dispute escalates

The tariff dispute between the US and India has escalated, impacting the strategic partnership between the two countries, with the White House ruling out further trade talks until it is resolved. The move came after the US doubled the tariff on India to 50%, citing its continued purchases of Russian oil. This has prompted India to freeze its plans to procure new US weapons and aircraft, and ratings agency Moody's to warn that the tariffs could "severely curtail" India's manufacturing ambitions, Reuters reports.

US-China trade truce extended

The US has taken a different approach with China ahead of the 12 August deadline ending their 90-day trade truce. Talks have been ongoing, with Beijing reportedly pushing for looser US chip export controls – the revenue-sharing deal on AI chips with Nvidia and AMD is seen as a key part of these complex negotiations. Late on Monday, 11 August, following a day of market uncertainty, the White House announced that the truce would be extended for another 90 days, a move mirrored by a similar announcement from Beijing. This extension provides temporary relief from the threat of tariffs returning to triple-digit levels.

Elsewhere, Canada's tariff on non-USMCA goods was increased to 35% on 1 August, while some countries remain in active negotiations. Mexico was granted a 90-day delay to continue talks and South Africa is still working to lower its 30% tariff rate.

2. WTO revises up 2025 trade growth, but warns of significant risks in 2026

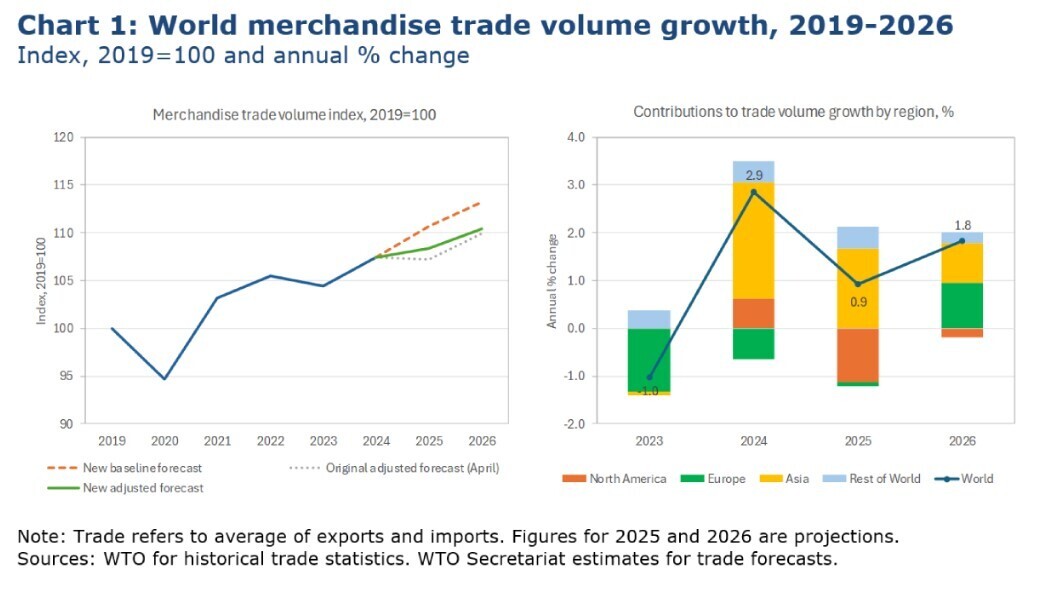

The WTO has sharply lowered its 2026 global merchandise trade growth forecast to 1.8% from 2.5%, warning that the full impact of recent tariff hikes will hit next year, weighing on business confidence, investment and supply chains.

For 2025, the forecast has been revised up to 0.9% from April’s -0.2% contraction. The upgrade reflects a short-term boost from frontloaded US imports in early 2025, as companies rushed to beat higher tariffs that took effect on 7 August. WTO economists caution the surge will fade, with trade growth slowing in the second half of 2025 and into 2026.

Uncertainty remains one of the most disruptive forces in the global trading environment.

”Regional snapshot:

- Asia remains the largest positive driver of global trade in 2025, with export growth now seen at 4.9%, up from 1.6% in April.

- North America’s imports are forecast to fall 8.3% – a smaller drop than expected.

- Europe’s trade contribution has shifted from moderately positive to slightly negative.

The WTO’s downgraded outlook serves as a stark reminder that without easing trade tensions, the global economy risks slower growth and heightened volatility in the years ahead.

3. News in brief: Trade stories from around the world

The Canadian economy lost tens of thousands of jobs in July, with the manufacturing sector hit particularly hard by the trade dispute with the US. The Bank of Canada has stated that US tariffs have reduced hiring intentions for Canadian companies.

Meanwhile, a new analysis from the Centre for Economic Policy Research highlights the exposure of EU labour markets to US tariffs. The report finds that 5.2 million jobs in the EU support exports to the US, with manufacturing sectors in Ireland, Northern Italy and Germany particularly vulnerable.

The global auto industry is beginning to quantify the financial impact of the new tariff regime. Toyota is forecasting a $9.5 billion hit to profits, while US automakers are also bracing for impact, with Ford projecting a $3 billion hit and General Motors between $4-5 billion.

China is to offer interest subsidies on loans to businesses in eight consumer service sectors – including catering and tourism – to boost services consumption amid a slowing economy. Eligible companies can receive a 1 percentage point subsidy on loans from 21 national banks, with a maximum loan amount of up to 1 million yuan ($139,095), according to a statement from nine government departments, including the Ministry of Finance.

US tariffs on Indonesian shrimp, including the new 19% rate, have reduced exports to America, which accounts for 60% of shipments. Indonesia is expanding efforts to sell more to China and other markets like the Middle East and the EU. Industry groups estimate exports could fall by 30% this year.

4. More on trade on Forum Stories

US companies are slashing investments in China amid tariffs and trade tensions, the US-China Business Council’s latest survey reveals. With only 48% planning to invest this year – down from 80% in 2024 – business confidence is shaken by on-again, off-again trade talks and uncertainty over economic growth, reshaping the economic ties between the world’s two largest economies.

What’s next for US-Africa trade as the African Growth and Opportunity Act (AGOA) expires on September 30? Since 2000, AGOA has been vital for duty-free access to the US market, but recent tariff hikes and policy shifts have challenged its effectiveness. African policymakers now have a critical opportunity to forge a future-ready trade strategy focused on regional integration, digital innovation, and geopolitical awareness.

The International Day of the World’s Indigenous Peoples on 9 August highlighted communities managing over a quarter of the world’s land and 11% of its forests. While their role in biodiversity is well known, their economic and trade contributions often go overlooked. The World Economic Forum’s report Enabling Indigenous Trade calls for stronger government support, noting Indigenous businesses – such as New Zealand’s Māori forestry and agriculture sectors – are key economic players.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Maira Martini and Katja Bechtel

February 24, 2026