Stewardship is how businesses can build value for future generations

Firms embracing stewardship strengthen their competitiveness, durability and boost value creation for future generations. Image: Gustavo Quepons/Unsplash

- Businesses face structural challenges in finance, ecology and talent that demand long-term stewardship beyond short-term profits.

- Firms embracing stewardship strengthen their competitiveness, durability and boost value creation for future generations.

- Stewardship balances responsibility with resilience, attracting patient capital during the largest generational wealth transfer in history

Businesses operate in an increasingly complex environment today. From navigating supply chain bottlenecks to securing grid stability; a constantly shifting regulatory landscape; workforce transformation; and a crucial need for investments in cybersecurity—CEOs, their C-suites and boards today face a host of challenges extending far beyond their traditional remits and experience.

To deliver performance and build value within their companies, many executives and their boards must make decisions for the long-term–the potential merits of which are not always captured on a quarterly basis, or via strictly financial forms of reporting.

Today’s leading businesses should make decisions in response to three sets of structural forces rippling through our macroeconomy. The first concerns changing fiscal conditions (related to aging populations, record high levels of public debt, the return of fiscal populism, sticky inflation and ructions in bond markets). The second pertains to the scramble for natural resources to meet rising energy demand (as well as changing ecological conditions which impact business operations, productivity and GDP growth). The third concerns the availability of talent and skills for the future (including the need to seed technology investments and to instill measures in order to support workforce talent). These three forces are semi-sovereign problems: according to which solutions cannot come from one government alone—increasingly, the private sector will need to step in.

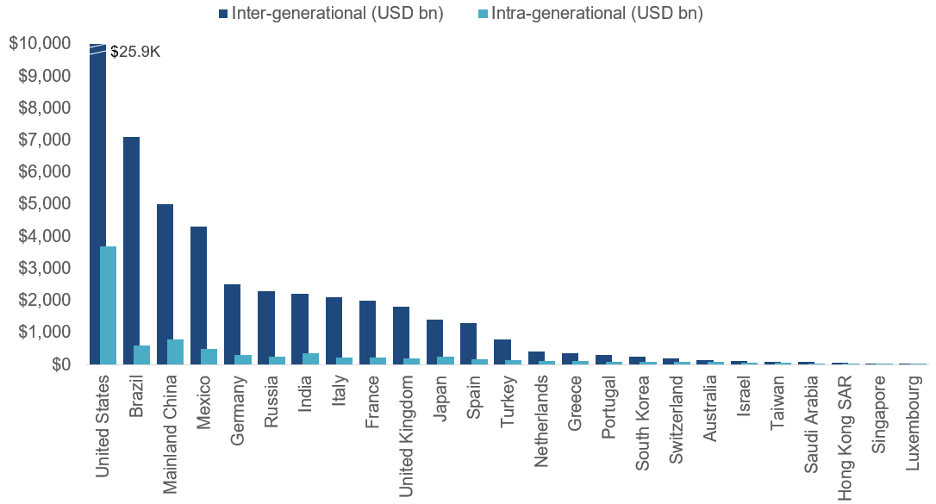

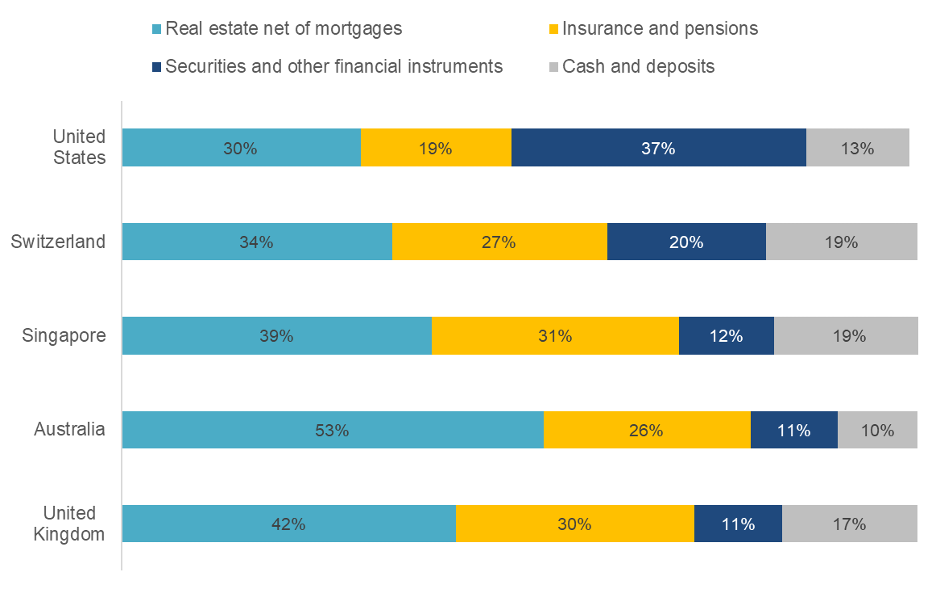

Executives and investors navigate this complex environment amidst the largest wealth transfer in history: and in the US, some 37% of these assets are securities and other financial instruments (read: liquid). Companies that in real time forcefully master these three enduring challenges–financial, ecological and talent–will be able to magnetize these patient pools of capital. Accordingly, these organizations can also be resilient amidst inevitable shifts and shocks that are likely to emanate from cultural change and activism that is now embedded in our society.

We offer a balanced, latent and actionable approach for business leaders that we call the “stewardship concept”. By inculcating these practices into their management teams and corporate cultures, companies will be in the position to build value for future generations, their employees, customers and investors.

How the Forum helps leaders understand change in global financial systems

What’s the origin of stewardship?

The concept of stewardship has a long and enduring history. For example, a rich body of work exists within Catholic social teaching (CST) regarding economic life. In it, it posits that God is the universal origin and destination of all goods. As business owners and operators, we are ‘administrators’ of the gifts that we have received. These goods should be ‘used properly, preserved, and increased.’ Additionally, due to the ‘increasing complexity’ of their operations, business owners must consider the ripple effects of their own actions on society—including ‘ecological effects.’

At the same time, profits are ‘necessary’, as these ‘make possible the investments that ensure the future of a business and they guarantee employment.’ Equally, CST encourages the ‘creative dimension’ in business, ‘manifested in the areas of planning, innovation’, and in harnessing entrepreneurial activity. In essence, a culture of stewardship is put forward: one which recognizes the ripple effects of business operations in society (which can be both positive and negative), as well as the potential benefits imparted by business by generating employment, entrepreneurship and even risk-taking to create wealth in society today.

Effectively, the stewardship concept hovers in between the decades-old debate between stakeholders vs shareholders. It is aligned with the view that much in the way that economic progress should be defined in far wider terms than GDP, so the book value of businesses can be determined and enhanced by far more than just a narrow definition of profits or shareholder returns.

Why care?

Some executives reading this might ask: why care? After all, US equity indices are hitting historic highs at a time when ESG and the considerations of the stakeholder community, as well as sustainability, seem to be a distant memory.

We are in the largest generational transfer of wealth in history, with an estimated $83 trillion to be transferred in the next 20-25 years. Over a third of this will take place in the US.

And in the case of the US, the majority of wealth is currently held in financial assets (rather than real assets, such as owned real estate).

This means that as this wealth transfer takes place, successive generations in the US are likely to be a driving force of investing in companies, as well as in private markets.

What kinds of companies and funds are these family offices likely to invest in?

Multifamily offices will likely want to take stakes in companies that embody a practice of stewardship for future generations. In so doing, executives will be taking a page from the book of large institutional investors such as pension and sovereign wealth funds, who, themselves acting as stewards for generating wealth over the long-term, have long held sway in standard-setting for deploying capital to companies which fit the playbook for durable investments.

Signs of stewardship

The good news is that – in spite of the current macro noise and uncertainty – the seedlings of stewardship are being sown and generating benefits in a world beset by asymmetries of wealth and information.

For example, in the financial realm, the ability to maintain a fortress balance sheet has the potential to render an organization resilient amid inevitable bouts of financial instability. In private equity, collective and connected efforts to provide ownership to the employees in portfolio companies, including providing financial literacy for employees, are laudable efforts. These should be amplified.

Also, in a blend of bolstering both financial as well as human capital, some of the world’s largest private equity houses and institutional investors have joined up in efforts in forging paths to expand employee ownership within their portfolio companies, as well as to strengthen financial literacy programmes.

In the ecological realm, some of the world’s largest food companies have made clear commitments to invest in regenerative agriculture, a practice which has manifold benefits including greater food security, as well as enhancing biodiversity. And acting as stewards of human capital, some of America’s largest companies are learning how to balance their investments and exploration with GenAI and improving productivity and also providing on-the-job skills and management training as well as a wider range of financial and non-financial benefits.

The stewardship concept is not designed to be a revolutionary break from the past, nor is it an entirely new approach in conducting business. Rather, it is bringing to the fore existent guiding mechanisms which leading individuals, families and institutional investors have put into practice over a long horizon, distinguishing these firms from others in competitive markets.

Those who focus on stewardship now may be more likely to benefit from a potential flight to quality from pools of patient capital – to the tune of $83 trillion. Finally, the practice of financial, ecological and human capital stewardship may help firms and funds be resilient against the inevitable winds of activism, from whatever direction these may blow.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Corporate Governance

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Peter De Caluwe

February 21, 2026