Trade and policy pressures test market stability, and other international trade stories to know this month

Vulnerabilities embedded in global trade have come back into focus in recent weeks. Image: REUTERS/Brendan McDermid

- This monthly round-up brings you a selection of the latest news and updates on global trade.

- Top international trade stories: US-China trade tensions rattle markets again; WTO, UNCTAD upgrade 2025 forecasts – but flag 2026 risk; EU steel tariffs hit carmakers.

1. Trade tensions resurface as global finance chiefs meet

Vulnerabilities embedded in global trade have come into focus in recent weeks, as renewed US-China tensions triggered the very market volatility that top financial leaders have been warning about. The events provided a cautious backdrop as finance ministers and central bankers gathered in Washington last week for the annual IMF and World Bank meetings.

According to Reuters, a market decline linked to renewed US-China trade tensions earlier this month has deepened, with global equities sliding as investors flock to safe-haven assets. The caution followed US President Donald Trump’s warning of a “massive” tariff increase on Chinese imports, as both nations began imposing reciprocal port fees on each other’s ocean shipping firms. US officials have since said that a planned meeting between the two leaders remains "on track".

The market volatility reflects concerns raised by several financial leaders. JP Morgan CEO Jamie Dimon recently told the BBC he was worried about a "serious fall in US stocks", citing geopolitical uncertainty and questions over the country's reliability as a trading partner. His concerns were echoed by the Bank of England, which also pointed to the risk of a "sharp correction", flagging potential "material bottlenecks" in the global AI supply chains as a key vulnerability, as reported by The Guardian.

However, on specific trade negotiations, Dimon suggested a deal to resolve the high-profile tariff dispute between the US and India may be near. “I’ve spoken to several of the Trump officials who say they want to do that, and I’ve been told that they are going to do that,” he said.

The latest developments shifted the focus of the Washington meetings from the global economy's surprising resilience to the emerging risks of a renewed trade conflict.

2. Data reveals trade's resilience amid rising risks

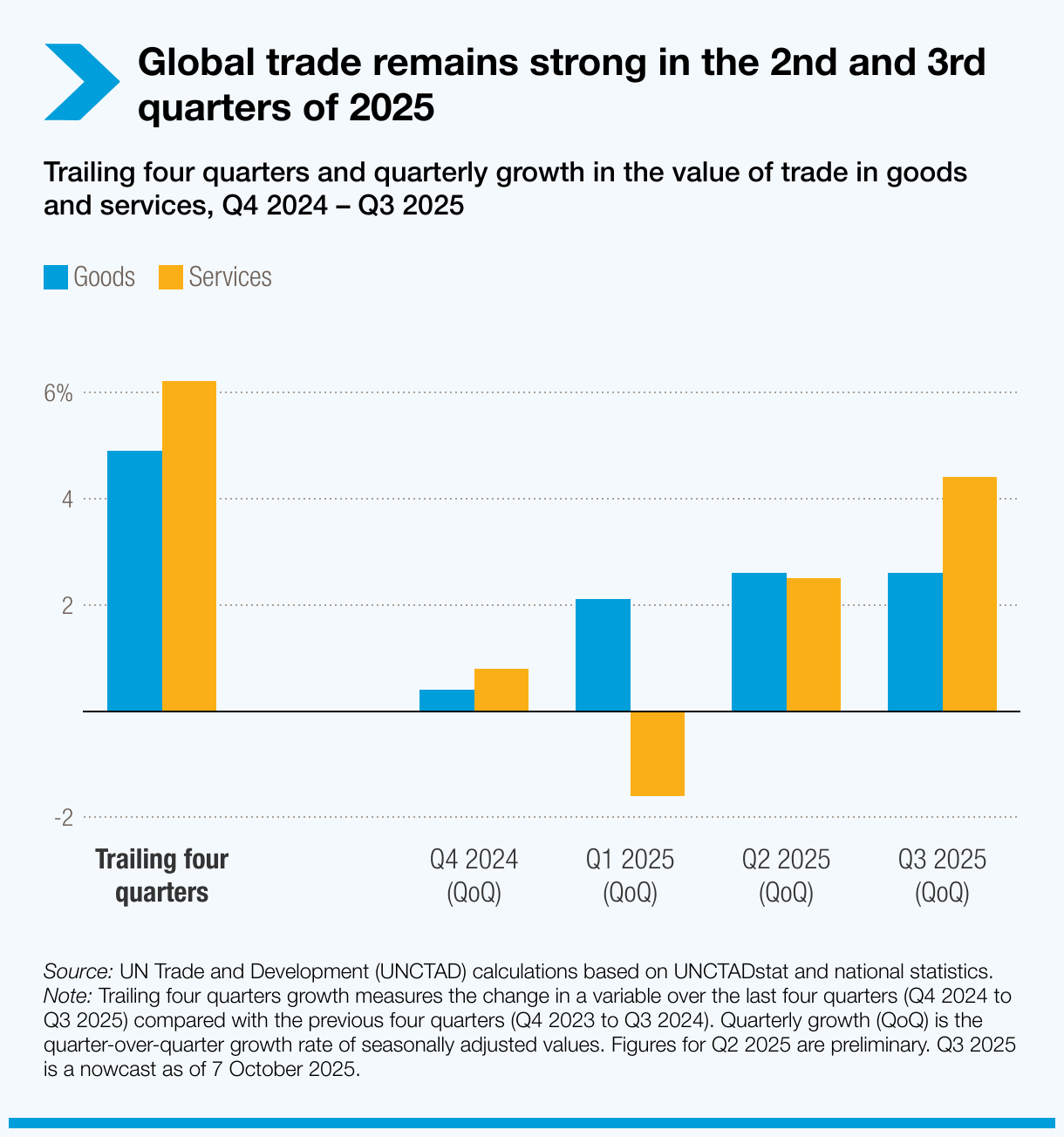

Trade data shows a fairly resilient picture to date. The UN Conference on Trade and Development (UNCTAD) reports a $500 billion trade expansion in the first half of the year, while the World Trade Organization (WTO) has revised its annual merchandise trade forecast up to 2.4% growth.

Both organizations note, however, that much of this growth reflects short term factors, such as increased imports ahead of potential tariffs and strong demand in manufacturing and technology, which may not be sustained into 2026.

The stronger-than-expected performance in 2025 has been driven by a few key factors, according to both organizations:

- Manufacturing and tech: Manufacturing, led by the electronics and automotive sectors, was the main driver of growth. Trade in AI-related goods – including semiconductors and servers – surged 20% in the first half of the year, according to the WTO.

- "Frontloading" imports: A surge of imports into North America in early 2025 provided a temporary boost as companies rushed to build inventories ahead of anticipated tariff hikes.

- Developing economies lead: Growth was driven primarily by developing economies, with both organizations noting a rise in South-South trade.

UNCTAD said that while growth in the first half of the year was driven mainly by higher trade volumes, in the third quarter it will be partly fuelled by rising prices. The organization also noted that global trade imbalances have narrowed, largely reflecting US trade policy shifts that have seen China's surplus with the US decline.

"Trade resilience in 2025 is thanks in no small part to the stability provided by the rules-based multilateral trading system," said WTO Director-General Ngozi Okonjo-Iweala. "Yet complacency is not an option. Today's disruptions... are a call to action for nations to reimagine trade."

The WTO's outlook for commercial services is more subdued, with growth expected to slow from 6.8% in 2024 to 4.6% in 2025 and 4.4% in 2026.

3. News in brief: Trade stories from around the world

China has expanded its rare-earth export controls, adding five new elements and tightening rules for semiconductor users. The world’s largest producer – supplying over 90% of processed rare earths and magnets used in everything from electric vehicles to military systems – now requires foreign companies using Chinese materials or equipment to obtain export licenses. Analysts suggest the impact will partially depend on implementation strength.

Global companies have cut their projected US tariff costs from over $35 billion to about $21–$23 billion for 2025 and $15 billion for 2026, according to an analysis by Reuters. New trade deals, the analysis found, have eased exposure to tariffs and have given businesses clarity to be able to plan and adjust prices.

China’s suspension of US soybean imports is expected to increase the flow of supplies to Europe, as the bloc leans on the US and Brazil to meet livestock feed demand, reports Euractiv. While European farmers may benefit from lower prices, experts caution that the shift could deepen structural dependence on a limited group of exporters.

In the US, the federal government shutdown has halted key farm data, leaving traders and farmers without crop estimates, export sales or market reports during the peak harvest. This comes amid low grain prices and concerns over drought and crop diseases, adding uncertainty to global commodity markets.

Shares of Europe’s largest carmakers fell on 8 October after the EU proposed higher steel tariffs and lower import quotas, prompting concern that the measures could squeeze the region’s auto sector. The Stoxx Automobiles and Parts index ended the session down 2.1%. This led to concern in the UK and among continental carmakers, as the EU’s steel tariff hikes and quota cuts aim to protect domestic producers but risk adding pressure to already struggling manufacturers.

The Common Market for Eastern and Southern Africa (COMESA) has launched a Digital Retail Payments Platform to let businesses settle cross-border trade in local currencies, starting with trials between Malawi and Zambia. The initiative aims to cut transaction costs and support small and medium enterprises across the 21-member bloc.

4. More on trade on Forum Stories

Global trade is being reshaped by digital innovation – but regulation is struggling to keep pace. A new Forum report, developed with the UAE Ministry of Foreign Trade and Abu Dhabi’s Department of Economic Development, explores how emerging technologies from digital trade documents to stablecoin payments are redefining cross-border commerce and what policy shifts are needed to unlock their full potential. Read Advancing Digital Trade – Insights from the UAE TradeTech Sandbox

here.

Can ASEAN turn trade shocks into unity? Tariff shockwaves have tested ASEAN’s cohesion – and created a moment of opportunity. Under Malaysia’s chairmanship, initiatives like Regional Payment Connectivity and digital economy frameworks aim to strengthen integration and strategic autonomy. Read more about how the bloc is navigating these disruptions.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Hassan Zebdeh

February 20, 2026