China’s shifting trade footprint, and other international trade stories to know this month

China’s leading automakers are expanding production abroad to offset slower domestic growth and tariffs. Image: REUTERS/Anderson Cohelo

- This monthly round-up brings you a selection of the latest news and updates on global trade.

- Top international trade stories: China trade round-up; Wave of US trade deal announcements; New trade coalition holds first ministerial meeting.

1. China’s shifting trade footprint

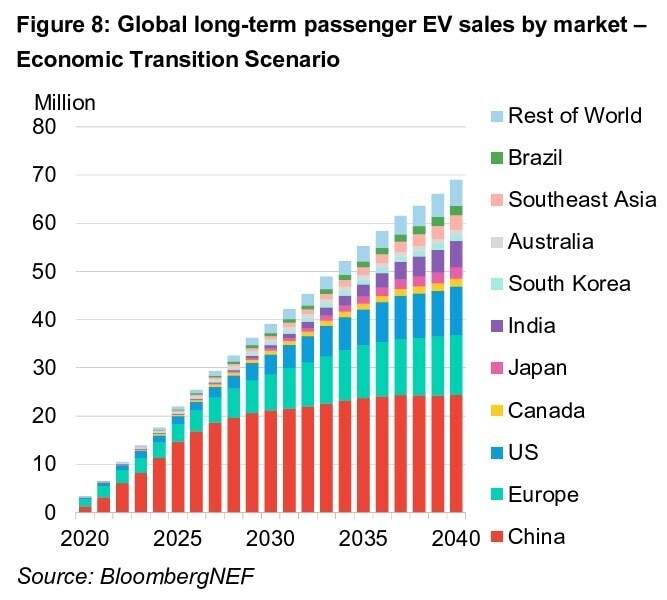

Amidst ongoing trade tensions, evolving regional trade deals and a global push towards electric vehicles (EVs), China has taken several recent steps in trade, market access and overseas auto investment.

US-China trade: Washington and Beijing reached a one-year pause in their trade war after Presidents Trump and Xi met in Busan in October. The agreement reduces some tariffs and freezes new restrictions, though major structural disputes remain unresolved. Some details include:

- The US halved tariffs on Chinese goods linked to fentanyl opioid precursor chemicals, bringing the overall tariff rate on Chinese imports to roughly 47% from 57%.

- China paused new export controls on rare-earth minerals and other strategic materials, while lifting retaliatory tariffs and non-tariff barriers imposed since March.

- Both sides agreed to pause expanded export-control blacklists and new port fees for a year, easing pressure on global supply chains.

- Beijing committed to resuming large-scale US soybean purchases and strengthening oversight of fentanyl opioid precursor exports.

Analysts describe the Busan deal as a temporary easing, aimed at stabilizing trade flows and calming markets ahead of 2026.

ASEAN free-trade pact adds green and digital provisions: China’s upgraded trade deal with ASEAN took effect in October 2025, expanding coverage for the digital economy, e-commerce and green trade standards. The pact deepens Beijing’s regional integration, offering manufacturers and EV supply chains broader access to Southeast Asian markets.

EV makers move south: Leading automakers are expanding production outside of China to offset its slower domestic growth, and respond to increased tariffs: US EV tariffs are 100% (plus charges), and up to 38% in the EU, where Chinese EVs have been gaining market share, although subsidies on imports are under review. BAIC, BYD, Chery and Geely are all targeting Africa and Southeast Asia.

- BAIC is moving from SKD to CKD (semi-knocked down to completely knocked-down) assembly in South Africa, boosting local jobs and aligning with the country’s Automotive Production and Development Programme, which promotes local content.

- Chery is also exploring local assembly in South Africa to strengthen its footprint.

- Regional investment is further supported by China’s ASEAN free-trade upgrades, which ease access for EV and battery supply chains.

China’s trade data for October showed exports fell 1.1% year-on-year to $305.35 billion and imports rose 1% to $215.28 billion, leaving a trade surplus of $90.07 billion, according to the South China Morning Post. This underscores the impact of ongoing volatility, even as recent high-level talks have eased tensions.

2. US trade deal-making wave across Asia

The US unveiled a flurry of bilateral trade deals on the heel of President Trump’s tour across Asia, marking a strategic push to deepen trade ties. Three agreements were signed:

- The US and Cambodia signed a reciprocal trade agreement. The US will maintain a 19% reciprocal baseline tariff while granting zero-tariff access to selected products. Cambodia will eliminate all tariffs on US industrial, food and agricultural imports, and committed to enforce international labour and environmental standards.

- On the same day, the US also signed a trade agreement with Malaysia, maintaining the 19% reciprocal baseline tariff. Commitments range from removal of barriers for digital trade and investment and securing partnerships for critical minerals and rare earths.

- The US also signed a framework on critical minerals and rare earths with Japan with the aim to support production of advanced technologies and investment in mining and processing.

During the tour, new trade frameworks were also announced with two ASEAN countries: Viet Nam and Thailand. The governments are now working to finalize these pacts.

Following the tour, the US and South Korea released details on their Strategic Trade and Investment deal, which covers auto, shipbuilding, semiconductors, pharmaceuticals, critical minerals and more.

3. News in brief: Trade stories from around the world

US, Switzerland seek to cut US tariffs: The US and Switzerland announced their aim to conclude an agreement that would see US tariffs on goods from Switzerland fall from 39% to 15%. Swiss tariffs on industrial goods are already at 0%, but tariffs and other restrictions would be eased on a range of agricultural and other goods. In addition, Swiss businesses would target $200 billion of investment into the US.

Trade coalition holds first ministerial meeting: The Future of Investment and Trade Partnership (FIT-P), co-convened by Singapore, New Zealand, Switzerland and the UAE, held its inaugural meeting in Singapore. The coalition brought together 16 nations with Malaysia and Paraguay newly joining in since the bloc was announced in September. The ministers also adopted a declaration on supply chain resilience.

US joint statements with Latin American partners: The US announced separate joint statements with four strategic partners in Central and South America: Argentina, Ecuador, El Salvador and Guatemala. The frameworks aim to expand market access, ease non-tariff barriers, strengthen investment ties and reduce tariffs on food, agriculture and other goods.

US government reopens, easing pressure on supply chains: As the longest US government shutdown in history ends, the administrative toll on global trade is expected to ease. Air cargo was affected as FAA staffing shortages slowed flights, with knock-on effects for cargo at major hubs. Trade balances, export-sales reports and data for other key indicators were paused, reducing transparency for supply-chain planning.

Next phase for EU-US trade: The European Union (EU) plans to propose a detailed action plan to the US to implement the next stage of the trade agreement reached this summer. The proposal will cover tariffs, market access, standards, digital trade, steel and aluminium cooperation and strategic investments in liquefied natural gas and chips, writes Bloomberg. The move follows US requests for a legally binding plan to address regulations affecting American businesses and precedes upcoming talks between EU trade chief Maroš Šefčovič and US counterparts.

Intensified trade policy among G20: A new WTO report monitoring trade measures across G20 economies from October 2024 to October 2025 reveals a sharp rise in trade policy activity. The value of imports affected by tariffs increased fourfold since October 2024, hitting a record high. At the same time, G20 economies have introduced measures facilitating trade, with the volume of trade covered within such facilitation measures doubling in value over the past year.

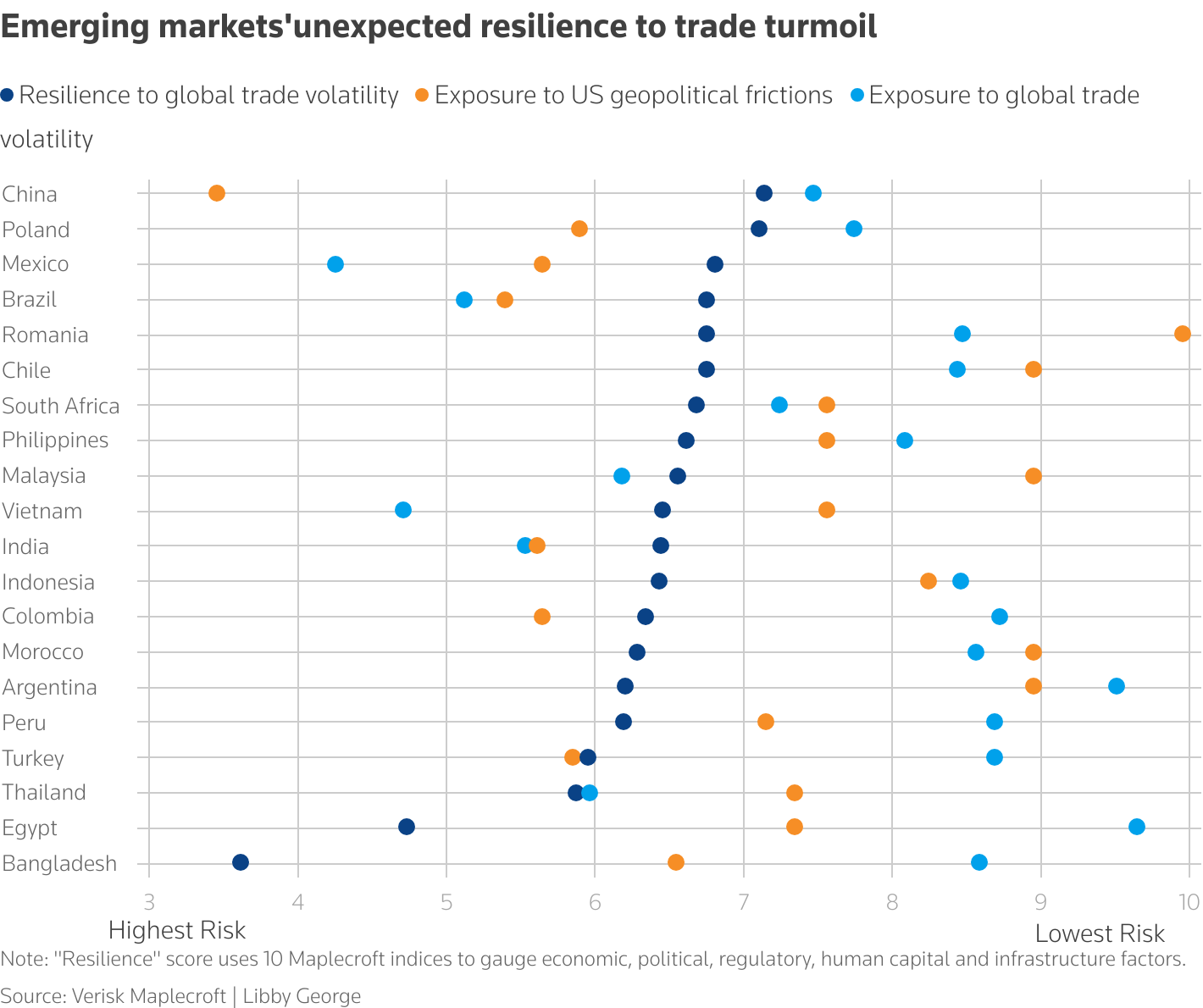

Emerging markets’ resilience: Most major emerging economies, including China, Brazil and India, can withstand US tariffs without severe disruption, according to a new study. The analysis of 20 key markets assessed factors such as debt levels and export-revenue reliance. Mexico and Viet Nam were among the most exposed, while Brazil and South Africa are strengthening ties with other trade partners to mitigate future risks.

4. More on trade on Forum Stories

ASEAN’s micro, small and medium enterprises (MSMEs) are missing out on digital policy benefits due to complex regulations and limited outreach. While the ASEAN Digital Economy Framework Agreement could unlock $2 trillion in growth, experts and small business owners say the focus must be on simplicity, speed, affordability and practical support to help the region’s 71 million MSMEs thrive.

How can businesses tap into Asia’s growing carbon markets? The World Economic Forum's Sha Song, Wee Kean Fong and Laia Barbarà explain how China’s expanded emissions trading system and regional cooperation are creating new opportunities. This is helping companies to strengthen decarbonization plans, reduce transition risk and gain a competitive edge in the low-carbon economy, they say.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Hassan Zebdeh

February 20, 2026