Global summits make push to operationalize blended finance models, and other finance news to know

Progress has been made at the G20 and COP30 summits to operationalize 'blended finance' structures. Image: Ueslei Marcelino/COP30/Flickr

- Catch up on the key stories and developments shaping the financial world.

- Top stories: Summits push for private finance; Banking enters the 'agentic era'; Big tech: High value, lower profits.

- For more on the World Economic Forum's work in finance, visit the Centre for Financial and Monetary Systems.

1. COP30 & G20: The systemic scaling of blended finance begins

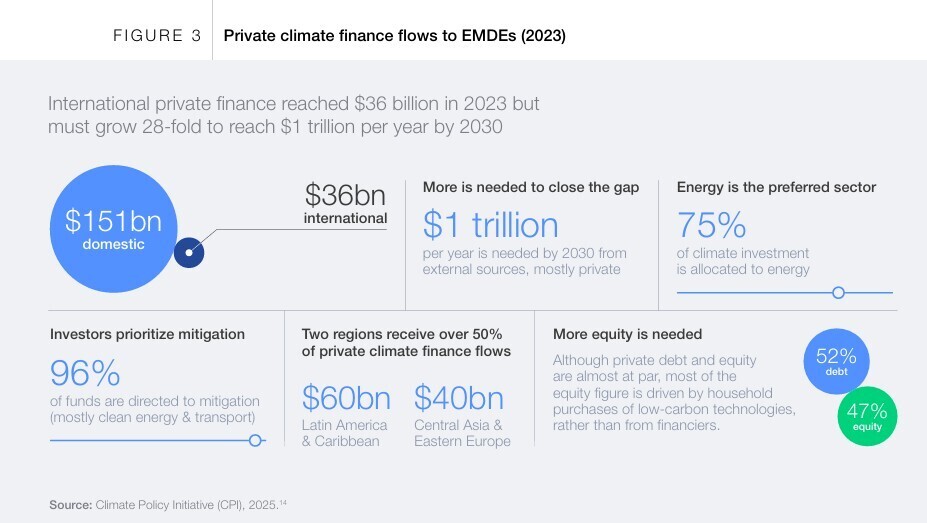

Negotiators at the G20 and COP30 summits have taken significant steps to operationalize 'blended finance' structures, which combine public and private funds to de-risk climate investments.

In a shift from treaty-based pledges to structured financing approaches, two major frameworks were launched in November to address investment risks in emerging-market climate projects:

- The Belém Package (COP30): Adopted on 22 November, this agreement launched the FINI (Fostering Investible National Implementation) initiative. The facility is designed to make National Adaptation Plans investible, targeting a $1 trillion project pipeline by 2028 for resilient infrastructure and water systems.

- The Johannesburg Declaration (G20): Signed on 23 November, leaders endorsed "Mission 300", a finance vehicle to connect 300 million people to electricity using private-sector microgrids. The declaration also established a Critical Minerals Framework to secure transparent supply chains through commercial partnerships rather than state aid. Moreover, the G20 backed pre-arranged risk tools such as parametric insurance and regional risk pools to help countries manage climate-related shocks..

The mechanisms outlined above align with the technical blueprint outlined in a recent World Economic Forum white paper, From Risk to Reward: Unlocking Private Capital for Climate and Growth, which detailed specific risk-sharing tools required to make such projects commercially viable. But as white paper notes, “there’s no silver bullet ... It’s about moving the whole supply chain, from macro stability to project preparation, all at once”.

Shifting to power systems and infrastructure

The focus for the energy transition is increasingly shifting from simply adding renewable megawatts toward financing the system and backbone infrastructure that make those megawatts useful. At COP30, members of the Utilities for Net Zero Alliance (UNEZA) raised their annual energy transition investment commitments by over 25% to nearly $150 billion, while signalling a major pivot toward grid infrastructure with an estimated $1.24 to be invested in grids and storage for every dollar spent on new renewable generation.

There is growing global recognition that rising electricity demand cannot be met without substantial grid reinforcement, storage, digitalisation and demand-side response. As a result, system flexibility is moving to the top of the energy transition agenda, emerging as the critical enabling layer that allows the power system to expand while maintaining security and resilience. For financial institutions, this shift opens up a significant opportunity: investing in transmission and distribution networks, storage, grid flexibility assets, and system-balancing technologies not only provides access to relatively stable, often regulated revenue streams, but also offers exposure to high-growth segments of the energy system while safeguarding the value of existing generation portfolios.

To help unlock this opportunity, the World Economic Forum has launched a new finance workstream under the Future of Power Systems initiative. It will bring together a community of financial institutions, power sector stakeholders and key policymakers through dedicated regional tracks to identify the investment frameworks and regulatory conditions needed to scale capital towards modern, flexible power systems.

COP30 advances action on climate-resilient agriculture

Nine countries endorsed Brazil’s new RAIZ accelerator, a programme launched with UN support to scale the restoration of degraded farmland and promote climate-resilient agricultural systems. The summit also showcased a series of nature-based adaptation initiatives, with countries and partners emphasizing the need to improve water security, restore ecosystems and support communities affected by land degradation. Together, these developments reflect a growing international focus on food, nature and land systems as central pillars of climate adaptation.

These developments align closely with recent World Economic Forum work on financing nature and food systems. A Forum briefing paper, Putting Food on the Balance Sheet: Financing Strategies to Scale Investment in Food Systems Transformation, outlines financing and risk-sharing mechanisms needed to make investments in food system transformation commercially viable. In parallel, a Forum Stories article, Building a Pipeline of 50 Investible Opportunities for a Nature-Positive Economy, highlights emerging investment opportunities across 12 critical sectors — from agriculture and food to mining, energy and technology — based on a systematic analysis of nature-positive business models, with a full report to be published early next year.

2. Beyond GenAI: Autonomous agents set to transform banking operations

Recent surveys reveal how generative AI has matured from experimentation to enterprise scale, paving the way for agentic AI, which are autonomous systems capable of independently reasoning, deciding and acting.

Global adoption: The Capgemini World Cloud Report finds that 33% of banks are developing proprietary AI agents in-house (10% currently operational), with early adopters deploying systems for automated lending and financial crime detection. It adds that "48% of financial institutions are creating new roles for employees to supervise agents".

India as a hub: With a major ecosystem of Global Capability Centers (GCCs) India is leading the shift. The EY India GCC Pulse Survey 2025 shows that 58% of GCCs are investing in agentic AI, with another 29% preparing to scale within a year.

For banks leveraging these hubs, the survey found that investment is concentrating on high-value, complex workflows such as customer service (65%), finance (53%) and operations (49%). Tasks include autonomous dispute resolution, automated reconciliation and straight-through loan processing.

The EY survey also finds that 81% of GCCs are retraining teams specifically for agentic workflows, moving beyond experimental pilots towards enterprise-scale deployment.

The governance gap: This rapid adoption necessitates a fundamental rethink of risk management, according to a new World Economic Forum and Capgemini report, which warns that controls must evolve as agents move from passive analysis to active execution.

The report, AI Agents in Action: Foundations for Evaluation and Governance, highlights the risks of granting agents "transactional authority" – such as autonomously underwriting loans, freezing assets for fraud prevention or negotiating settlements via the new Agent Payments Protocol (AP2). It argues that for these high-stakes operations, banks must adopt a "progressive governance" model, where human oversight scales in direct proportion to the agent’s ability to move funds.

3. More finance news to know

Big US tech stocks are taking up more of the market’s value even as their share of overall earnings declines, Reuters reports. Tech now accounts for about 31% of the S&P 500’s market value but only 20.8% of its earnings in Q3, creating a growing gap between price and profits that analysts say could leave the sector – and the wider market – more sensitive to earnings disappointments.

The European Central Bank has urged eurozone banks with significant US dollar operations to strengthen liquidity and capital buffers in response to rising dollar volatility. Officials highlighted risks from US policy and noted that even major lenders could face strains in dollar markets.

Firms hoarding bitcoin are offloading holdings to support falling share prices, reports the Financial Times, as a $1 trillion crypto rout wipes $77 billion off the market. Analysts warn that a vicious cycle is emerging, with falling crypto prices fuelling a rush to sell.

Britain’s finance minister has outlined a series of tax rises expected to raise more than £26 billion a year by 2029/30, including freezes to income-tax thresholds, higher dividend taxes and new charges on high-value homes and electric vehicles, according to the Office for Budget Responsibility. It downgraded the country's 2026 economic outlook from 1.9% to 1.4%.

Tokyo has launched a review of subsidies and tax breaks after fresh stimulus raised investor concerns over fiscal discipline, contributing to pressure on the yen and Japanese government bonds.

How the Forum helps leaders understand change in global financial systems

4. Read more on Forum Stories

US retirement confidence rises, but employers see gaps: While 64% of savers feel on track for retirement, only 38% of employers believe their staff are prepared. Read more insights from BlackRock’s survey, which highlights the need for employers, policymakers and financial institutions to help workers secure their financial futures.

Who drives AI success – CEO or CIO?: AI delivers value only when vision meets execution. CEOs set the strategy, CIOs build the processes and together they align priorities, ensure readiness and embed AI responsibly. Clear frameworks, an AI manifesto and cross-organizational trust turn hype into measurable impact.

Financial fragmentation threatens global growth: Geopolitical tensions are fragmenting the global financial system, potentially cutting $5.7 trillion from GDP and raising inflation above 5%, two experts from Oliver Wyman warn. Here's why preserving cross-border capital flows is crucial to sustaining economic growth.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Peter De Caluwe

February 21, 2026