How financial regulators are using technology to protect consumers and strengthen the financial system

Central banks and other financial regulators are collaborating with tech companies on suptech applications. Image: iStock/Cecilie_Arcurs

Whitney Wellington

Lead, Regulatory and Supervisory Technology, Financial Services, World Economic Forum- Central banks and other financial regulators must constantly innovate to both keep up with the firms they supervise and protect consumers.

- Supervisory technology or “suptech” can help regulators to foster a more resilient, transparent and accountable global financial system.

- By collaborating with cutting-edge technology firms, financial regulators can gain valuable expertise and access to these new digital tools.

As the global financial system becomes increasingly complex and digital, financial regulators are under growing pressure to innovate and digitally transform their practices to keep pace with the firms they supervise and the challenges their economies face. Central banks and other financial authorities play a crucial role in safeguarding the integrity of markets and protecting consumers.

In particular, as the financial sector embraces artificial intelligence (AI), machine learning (ML) and other advancing technologies, new risks for consumers and institutions are emerging. This makes the job of central banks and other financial authorities more demanding. AI tools can streamline decisions in areas like lending, for example, but they may inadvertently amplify existing biases or deliver inconsistent results when markets shift.

This means that financial supervisors must modernize their own practices to ensure effective, forward-looking oversight. Supervisory technology, or “suptech,” is rapidly evolving as a way to keep up with financial innovation while reinforcing consumer protection and fostering a resilient, transparent and accountable financial sector.

Where is suptech being used today?

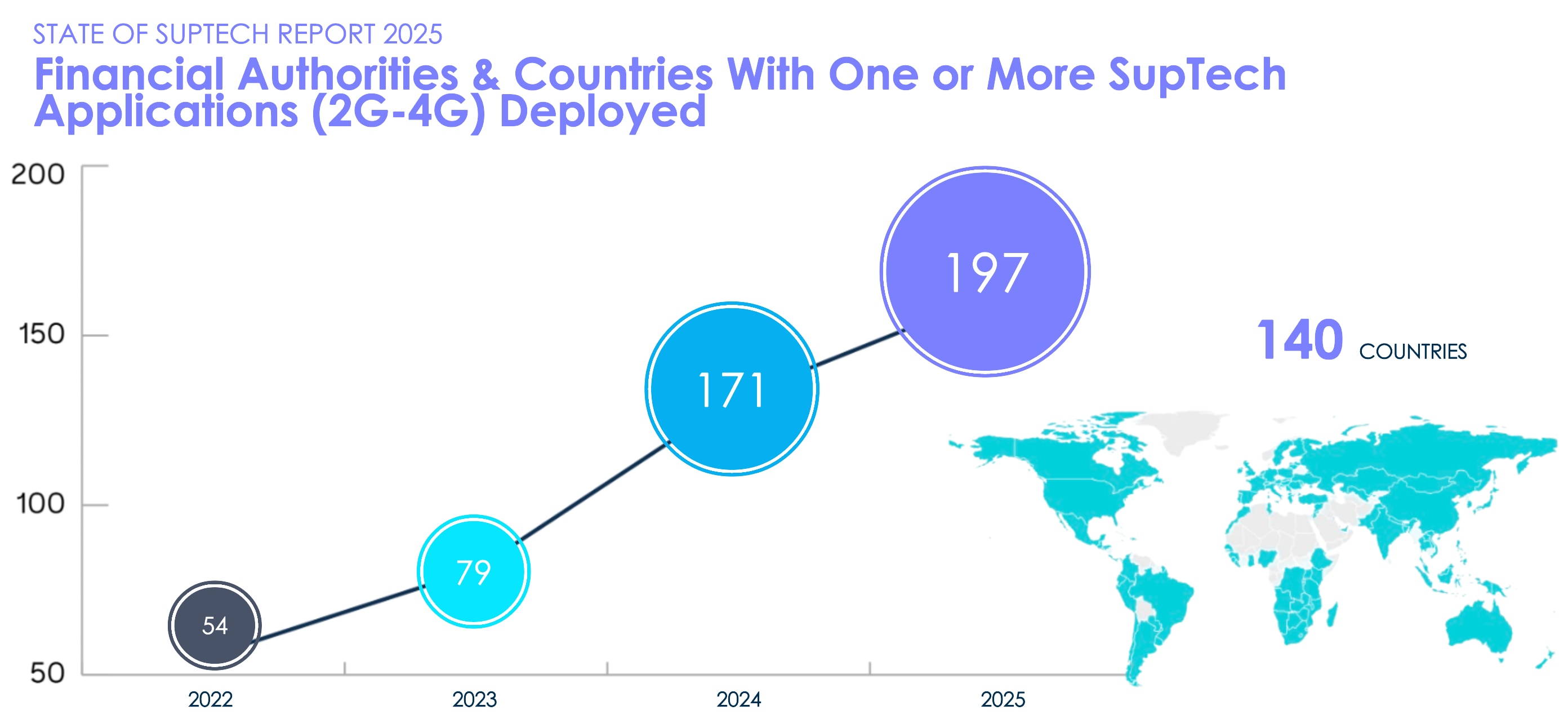

Suptech adoption has accelerated globally as regulators look for ways to reduce oversight lag, detect systemic risks earlier and shift from reactive responses to proactive supervision. The State of SupTech Report 2025 notes that 197 financial authorities across 140 countries have deployed at least one suptech solution – a significant increase from 54 financial authorities reporting suptech usage in 2022.

These tools range from predictive analytics for climate risk identification, to AI-powered analysis of consumer complaints and interactive dashboards that use geospatial data to map financial inclusion.

Importantly, emerging markets and developing economies (EMDEs) are expanding their use of suptech. This is helping to close the adoption gap with advanced economies, which have traditionally led in this area. Authorities in EMDEs are specifically prioritizing foundational market access and operations, leading suptech implementation in areas such as licensing and financial inclusion.

To increase the adoption of suptech and drive collective progress, the Public-Private Secondments for SupTech Innovation (PPSSI) initiative, co-led by the World Economic Forum and the University of Cambridge SupTech Lab, pairs experts from the private sector with financial supervisors to deliver suptech projects.

These short-term, remote secondments allow industry experts to apply their knowledge in a public-sector context. The following PPSSI projects are already demonstrating how targeted secondments that offer support to resource-constrained authorities can address global financial supervisory challenges.

Using AI for consumer complaints and protection

Central banks receive thousands of complaints from the public each year related to unfair practices, service quality, product misrepresentation and regulatory breaches. This is a critical but underused source of supervisory intelligence, often because complaints are received in unstructured formats such as handwritten letters and scanned images, or in multiple languages. Manual processing of these complaints is time-consuming and prone to inconsistencies.

But a central bank in the Middle East is exploring the use of AI to automate the extraction and structuring of complaint data. As part of the PPSSI initiative, a dedicated team from Abhi, a fintech infrastructure company based in Pakistan, has collaborated with the central bank to build an AI system design that can read, interpret and structure consumer complaints.

Once operational, complaints can be submitted in Arabic or English and the system can accept scanned images, PDFs and handwritten documents. The proof of concept developed by Abhi extracts text, identifies key themes and converts each complaint into a structured record in seconds. It also generates concise bilingual summaries to help supervisors quickly understand the issues outlined in the complaint.

This system is expected to significantly improve operational efficiency and accuracy. All components are open source and designed for secure, on-premise deployment. This supports the central bank’s technology requirements while building capacity within its supervision and IT teams.

“When we democratize access to advanced AI, we empower developers to build localized, high-impact solutions that transform raw data into actionable insights [and that] continually improve through human-in-the-loop feedback,” says Ejaz Anwer, Senior Vice President (Technology), Abhi.

The central bank is now exploring operational deployment and how to extend the system to link complaints to predefined resolution actions, taking into account urgency and regulatory significance. This would allow it to move from reactive complaint handling to intelligent resolution, in line with broader digital transformation goals.

Reassessing workflows for efficiency

As part of another PPSSI secondment, Regnology, a regulatory reporting technology company, is working with the Financial Regulatory Commission of Mongolia (FRC Mongolia) to improve efficiencies through suptech tools.

They began by assessing FRC Mongolia’s supervisory flows and processes to determine where suptech can help more effectively oversee financial institutions and protect consumers. The project identified several key challenges for FRC Mongolia, including a high degree of manual steps in supervisory processes, limited data quality checks and the use of Excel-based workflows for core tasks. Processes such as risk assessment and complaint handling are also not digital, leading to inefficiencies and increased potential for errors.

To respond to these challenges, Regnology developed a suptech roadmap that provides a structured approach for integrating new technologies into supervisory workflows, prioritizing automated data reporting. This roadmap is crucial, as financial authorities without a formal suptech strategy tend to report greater implementation hurdles. FRC Mongolia is now preparing to use these insights to deploy a priority suptech use case before launching its suptech solution.

“As a developing country, we continually face resource constraints – whether human, financial or technological,” says Batchimeg Batbold, Director, Sandbox Unit, Financial Regulatory Commission of Mongolia. “Having a clear roadmap allows us to prioritize effectively, identify where we can create the greatest supervisory impact and modernize our processes based on the realities of our capacity and needs.”

The future of suptech

Suptech tools empower financial supervisors to better protect consumers and ensure financial system stability in an increasingly digital world.

By continuing to invest in suptech innovation and fostering collaboration between public and private stakeholders, financial authorities can keep pace with technological change, while advancing both consumer protection and the long-term stability of their economies.

These efforts are critical to driving the evolution of suptech and to advancing financial supervision around the world.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Cybersecurity

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Spencer Feingold

January 26, 2026