Fragmentation, private markets and tokenization: The top finance stories of 2025

Global markets navigated a turbulent financial landscape in 2025, with a disrupted new reality in global finance anticipated for 2026. Image: REUTERS/Issei Kato

- Tariffs, geopolitical tension and regulatory divergence dominated 2025's finance headlines, prompting a flight to safe-haven assets.

- However, technological innovation and private capital proved critical in maintaining resilience, even as public markets faced headwinds.

In 2025, global finance adjusted to a more fractured political and trade environment. New tariffs and trade tensions following the 2024 US election shaped market sentiment, but the financial system itself continued to adapt.

Markets reflected that tension. Equity indices saw periods of volatility linked to tariff announcements, while investors shifted towards safe-haven assets. Gold prices, for example, climbed at key points during the year, and demand for US Treasuries increased during periods of market stress, highlighting their role in times of geopolitical uncertainty.

At the same time, the World Economic Forum tracked important shifts beneath the surface. While geopolitics drove fragmentation at the macro level, financial activity became increasingly interconnected through technology and new sources of capital. AI-enabled financial services, asset tokenization and the growing role of private credit expanded access and efficiency, particularly where traditional banks reduced longer-term or higher-risk lending.

Here are some of the stories that defined the financial year.

1. Widening geoeconomic fragmentation

A dominant macro theme of 2025 was geoeconomic fragmentation – shifting from theoretical risk to measurable market impact. Rising trade tensions, regulatory frictions and economic statecraft shaped global finance, with the Forum estimating early in the year that fragmentation could cost the global economy up to $5.7 trillion.

Markets reflected this uncertainty. While the US dollar and Treasuries remained structural anchors, investor sentiment softened at times, and capital flows diversified into non-dollar assets amid tariff fears, yield volatility and geopolitical tension.

Emerging and developing economies (EMDEs) were particularly exposed to market volatility. As noted in the IMF’s Global Financial Stability Report, EMDE currencies swung sharply – some gaining, others under pressure – creating both risk and opportunity for investors navigating a fragmented global financial system.

Concerns over fragmentation were highlighted in Davos at the Forum's Annual Meeting in January 2025, where financial leaders discussed frameworks to safeguard markets and reinforce cross-border capital flows amid rising geopolitical complexity:

2. Private markets grow

As public equity markets faced election‑cycle headwinds – and governments operated with constrained fiscal space – private markets grew, with private capital becoming a primary source of funding for various industrial transformations.

In 2025, global private equity assets reached a record high of $9.9 trillion, up about 10.8% from the end of 2024. The increase, which was driven particularly by strong growth in Asian markets, underscored that private funds are now central to financing long-term transitions even amid market uncertainty.

Moreover, spending for mergers and acquisitions (M&A) soared in 2025. In the US, the M&A sector saw $38 billion worth of transactions last year, more than double what was reported in 2024.

The trend of companies staying private for longer also persisted in 2025. For more, see the Annual Meeting 2025 session "Private for Longer" below:

3. AI in financial infrastructure

Beyond the "bubble" debate, AI became deeply integrated into core financial workflows in 2025, particularly in risk management and inclusion.

In emerging markets, financial institutions utilized AI to assess creditworthiness using non-traditional data points, such as mobile utility payments. Forum insights highlighted how these models are expanding access to capital for unbanked populations who lack formal credit histories, in countries like Egypt:

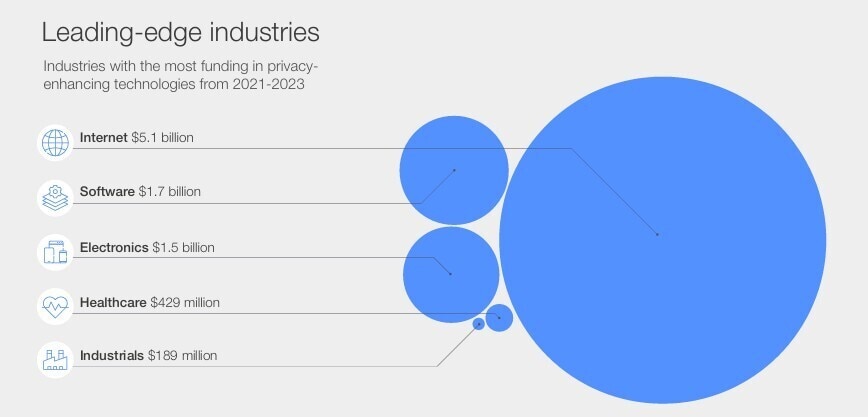

The industry also addressed the risks of AI-driven fraud. Financial institutions increased investment in Privacy-Enhancing Technologies (PETs) – tools that allow data to be analyzed while reducing how much sensitive information is exposed – to secure consumer data against increasingly sophisticated cyber threats. The sector's focus has settled on "responsible deployment" – ensuring that algorithmic efficiency does not compromise systemic stability.

4. Regulatory clarity for tokenization

2025 marked a definitive shift in digital assets towards the "tokenization" of traditional financial instruments. A Forum report released in May defines this not as a crypto experiment, but as the "next generation of value exchange", driven by key differentiators, including:

- Programmability: smart contracts automate complex lifecycle events (like coupon payments), reducing administrative friction

- Unified records: a shared "golden source" of truth reduces reconciliation costs and errors between counterparties

- Democratized access: fractional ownership lowers barriers to entry for high-value assets like real estate and private credit.

This transition was supported by the full implementation of the European Union’s MiCA regulation, which provided the legal certainty large financial institutions required to enter the market.

Industry pilots launched this year, such as the UK's Regulated Liability Network, demonstrated that these rails can drastically reduce settlement times, evolving into essential infrastructure for capital efficiency in a high-rate environment.

Find out more about tokenization in this video explainer:

5. The $400 trillion retirement savings gap

Demographic trends continued to pressure global pension systems in 2025. Data cited by the Forum indicates a potential retirement savings gap of $400 trillion by 2050 if current trends persist – the amount individuals, pension funds and governments would collectively need to bridge to maintain living standards in old age.

This was identified by Yie-Hsin Hung, CEO of State Street Investment Management, in this Meet the Leader podcast recorded at the Annual Meeting 2025 in Davos:

The challenge has reframed the economic conversation around the longevity economy. Reports from 2025, including the OECD’s Pensions at a Glance, emphasize that addressing this shortfall requires more than increased savings rates; it necessitates structural changes to workforce participation among older adults.

A disconnect remains between employers and employees regarding financial readiness, with implications for long‑term savings products, asset allocation and labour‑market policy. In a Forum Stories article, BlackRock's Jaime Magyera suggests that while employers often view their ageing workforce as financially secure, a significant portion of employees report insufficient savings to maintain their standard of living post-retirement.

6. Operationalizing sustainable finance

The discussion on sustainable finance in 2025 centred on the mechanics of valuation and deployment. New frameworks were introduced to factor nature and biodiversity into corporate balance sheets – assigning financial value to ecosystems such as forests and wetlands – and treating natural capital as a core economic asset rather than an externality.

Forum research outlined how land custodians are beginning to quantify these assets for investors. Additionally, the development of financial architectures for carbon removal moved forward, creating credible market mechanisms such as standardized contracts and verification frameworks to fund negative emissions technologies.

In the video below, Standard Chartered’s Chief Sustainability Officer Marisa Drew explains the practical financial instruments needed to move from "pledges to deployment" and close the funding gap:

7. Fintech and retail participation

Fintech platforms in 2025 served as critical infrastructure for emerging economies. At the same time, these digital platforms helped cement the influence of a new generation of retail investors, whose 24/7 access to markets reshaped liquidity patterns and market sentiment.

A Forum report released in June revealed a critical structural shift: the industry's growth is no longer driven by speculative user acquisition, but by the "underserved economy," with 57% of firms now reporting micro, small and medium enterprises (MSMEs) as a primary driver of their customer base. Key findings include:

- AI is the new standard: 80% of fintechs have now integrated AI to drive operational efficiency, moving beyond "hype" to tangible improvements in customer experience and credit scoring.

- Profitability over growth: The industry has normalized, with customer growth rates settling at 37% (down from pandemic highs), but profitability has surged, signalling a shift to healthier business models.

In ASEAN, digital financing tools bridged credit gaps for SMEs, while in Africa, structural innovations like the new African Credit Rating Agency (AfCRA) aimed to "fix the risk premium" that has historically stifled foreign investment.

Simultaneously, the retail investor cohort solidified its influence on global markets. With 24/7 access to trading platforms, individual investors drove significant liquidity, prompting a Forum analysis on behavioural financial literacy to improve resilience against market volatility.

Dive deeper: Read more on the rise of 24/7 markets and what it means for everyday investors here.

How the Forum helps leaders understand change in global financial systems

The outlook for 2026

The September 2025 Chief Economists Outlook suggests that the global economy will face a "disrupted new reality" in 2026. The consensus points to a period of continued friction where growth is tempered by trade barriers and geoeconomic fragmentation.

For the financial sector specifically, the Future of Global Fintech report indicates that the priority will shift to open finance – extending data-sharing frameworks beyond banking into insurance and pensions – and bolstering compliance infrastructure to navigate an increasingly fragmented regulatory map.

As the financial order adjusts to this new equilibrium, 2026 will test how well innovation, private capital and governance frameworks can convert disruption into durable growth.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Peter De Caluwe

February 21, 2026