Can sending money home spur economic growth?

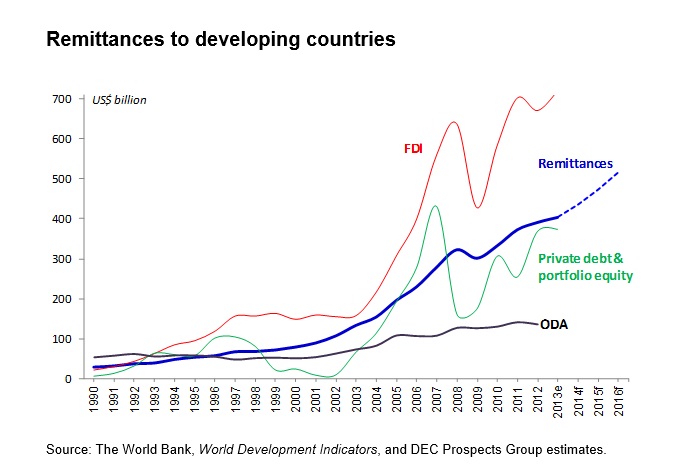

The goals of the post-2015 development agenda cannot be achieved without strong programs and adequate funding. Official development assistance amounts to roughly $130 billion a year; though foreign direct investment and portfolio inflows can help poor economies, additional sources of development finance must be found.

One under-exploited resource is diaspora financing – that is, the remittances and savings earned by nationals working abroad and sent home to family and friends. The challenge is to channel this income effectively.

There are more than 230 million international migrants worldwide, which is more than the population of the world’s fifth most populous country, Brazil. The estimated $2.6 trillion that they earn annually exceeds the GDP of the United Kingdom, the world’s sixth-largest economy. Much of this income is taxed or spent in the host countries. But, assuming a 20% saving rate (close to the average for developing countries), this implies total annual diaspora saving of more than $500 billion.

In 2013, migrants from developing countries sent home around $404 billion (excluding the vast unrecorded inflows that arrive through informal channels). India received $70 billion, more than the value of its exports of information technology services. Remittances to Egypt were larger than the country’s earnings from the Suez Canal. And expatriate earnings accounted for more than one-third of Tajikistan’s national income.

These inflows tend to be larger in poor and small economies, and often provide the main lifeline in fragile or conflict-affected countries. Remittances also arrive first in times of economic hardship and in the aftermath of natural disasters. They tend to be more stable than private capital flows, declining by a mere 5% during the recent global financial crisis and recovering rapidly to pre-crisis levels.

Once the money is back in an expatriate’s homeland, it is put to good use. Remittances have reduced poverty in Bangladesh, Ghana, and Nepal. Children from recipient households in El Salvador have a lower school dropout rate; in Sri Lanka, they have more access to private tutors. The money finances health care, housing, and businesses. Microfinance borrowers can even use remittance receipts as evidence of credit history.

However, despite remittances’ evident value in supporting development goals, it must be remembered that they are private funds and should not be considered a substitute for official aid. Attempts by governments to earmark remittances for specific “productive” uses have failed, especially in countries with weak investment environments. Likewise, taxing remittances can hurt the poor disproportionately and drive the flows of money underground. Conversely, improving the investment climate is likely to increase the share of remittances invested into businesses.

Indeed, reducing high money-transfer charges – currently averaging more than 8% globally – has been shown to facilitate remittances and increase migrants’ savings. The G20 is now working to cut these costs to 5% in five years; a more aggressive target of 1% by 2030 could – and should – be set.

Mobile banking technology can help. So can greater market competition, which has already lowered fees in major remittance corridors such as those linking the UAE to India and the Philippines, and the United States to Mexico. Some banks and businesses now offer zero-cost remittance services to attract customers. Governments could also relax regulations for small remittance transactions. Exclusive partnerships between national postal systems and money-transfer companies should also be abolished.

Another way to better use diaspora savings would be to create new “diaspora” financial instruments. A low denomination security (of, say, $1,000), carrying a 3-4% interest rate, might be attractive to migrant workers who currently earn minimal interest on deposits held in host-country banks. A five-year diaspora bond would have a lower interest rate than a sovereign bond sold to foreign institutional investors, as diaspora investors’ perception of risk in their home country is likely to be lower. The bonds would also be more stable than non-resident foreign-currency deposits in developing countries, and registering the bonds with the appropriate authorities in major host countries would make them reasonably safe.

But diaspora bonds will not be a feasible development instrument unless they are linked to development projects in places where there is sufficient trust in the government. The bonds should be available to all investors, not just migrant savers, and be distributed widely, not kept on the books of a few investment banks. That way, large sums could be mobilized for development at low, stable interest rates, without diminishing migrant workers’ incentive to save.

Published in collaboration with Project Syndicate.

Authors: Mahmoud Mohieldin, Corporate Secretary and the President’s special envoy at the World Bank and Dilip Ratha, head of the World Bank Migration and Remittances Unit and Global Knowledge Partnership on Migration and Development.

Image: A woman carries a sack of cotton in a field near the village of Yakhak, Tajikistan. REUTERS/Nozim Kalandarov

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Banking and Capital Markets

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Jaime Magyera

November 13, 2025