Why the world needs public investment

A. Michael Spence

Philip H Knight Professor Emeritus and Senior Fellow at the Hoover Institution, Stanford Graduate School of BusinessThe world is facing the prospect of an extended period of weak economic growth. But risk is not fate: The best way to avoid such an outcome is to figure out how to channel large pools of savings into productivity-enhancing public-sector investment.

Productivity gains are vital to long-term growth, because they typically translate into higher incomes, in turn boosting demand. That process takes time, of course – especially if, say, the initial recipients of increased income already have a high savings rate. But, with ample investment in the right areas, productivity growth can be sustained.

The danger lies in debt-fueled investment that shifts future demand to the present, without stimulating productivity growth. This approach inevitably leads to a growth slowdown, possibly even triggering a financial crisis like the one that recently shook the United States and Europe.

Such crises cause major negative demand shocks, as excess debt and falling asset prices damage balance sheets, which then require increased savings to heal – a combination that is lethal to growth. If the crisis occurs in a systemically important economy – such as the US or Europe (emerging economies’ two largest external markets) – the result is a global shortage of aggregate demand.

And, indeed, severe demand constraints are a key feature of today’s global economic environment. Though the US is finally emerging from an extended period in which potential output exceeded demand, high unemployment continues to suppress demand in Europe. One of the main casualties is the tradable sector in China, where domestic demand remains inadequate to cover the shortfall and prevent a slowdown in GDP growth.

Another notable trend is that individual economies are recovering from the recent demand shocks at varying rates, with the more flexible and dynamic economies of the US and China performing better than their counterparts in the advanced and emerging worlds. Excessive regulation of Japan’s non-tradable sector has constrained GDP growth for years, while structural rigidities in Europe’s economies impede adaptation to technological advances and global market forces.

Reforms aimed at increasing an economy’s flexibility are always hard – and even more so at a time of weak growth – because they require eliminating protections for vested interests in the short term for the sake of greater long-term prosperity. Given this, finding ways to boost demand is key to facilitating structural reform in the relevant economies.

That brings us to the third factor behind the global economy’s anemic performance: underinvestment, particularly by the public sector. In the US, infrastructure investment remains suboptimal, and investment in the economy’s knowledge and technology base is declining, partly because the pressure to remain ahead in these areas has waned since the Cold War ended. Europe, for its part, is constrained by excessive public debt and weak fiscal positions.

In the emerging world, India and Brazil are just two examples of economies where inadequate investment has kept growth below potential (though that may be changing in India). The notable exception is China, which has maintained high (and occasionally perhaps excessive) levels of public investment throughout the post-crisis period.

Properly targeted public investment can do much to boost economic performance, generating aggregate demand quickly, fueling productivity growth by improving human capital, encouraging technological innovation, and spurring private-sector investment by increasing returns. Though public investment cannot fix a large demand shortfall overnight, it can accelerate the recovery and establish more sustainable growth patterns.

The problem is that unconventional monetary policies in some major economies have created a low-yield environment, leaving investors somewhat desperate for high-yield options. Many pension funds are underwater, because the returns required to meet their longer-term liabilities seem unattainable. Meanwhile, capital is accumulating on high-net-worth balance sheets and in sovereign-wealth funds.

Though monetary stimulus is important to facilitate deleveraging, prevent financial-system dysfunction, and bolster investor confidence, it cannot place an economy on a sustainable growth path alone – a point that central bankers themselves have repeatedly emphasized. Structural reforms, together with increased investment, are also needed.

Given the extent to which insufficient demand is constraining growth, investment should come first. Faced with tight fiscal (and political) constraints, policymakers should abandon the flawed notion that investments with broad – and, to some extent, non-appropriable – public benefits must be financed entirely with public funds. Instead, they should establish intermediation channels for long-term financing.

At the same time, this approach means that policymakers must find ways to ensure that public investments provide returns for private investors. Fortunately, there are existing models, such as those applied to ports, roads, and rail systems, as well as the royalties system for intellectual property.

Such efforts should not be constrained by national borders. Given that roughly one-third of output in advanced economies is tradable – a share that will only increase, as technological advances enable more services to be traded – the benefits of a program to channel savings into public investment would spill over to other economies.

That is why the G-20 should work to encourage public investment within member countries, while international financial institutions, development banks, and national governments should seek to channel private capital toward public investment, with appropriate returns. With such an approach, the global economy’s “new normal” could shift from its current mediocre trajectory to one of strong and sustainable growth.

This article is published in collaboration with Project Syndicate. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with Agenda subscribe to our weekly newsletter.

Author: Michael Spence, a Nobel laureate in economics, is Professor of Economics at NYU’s Stern School of Business, Distinguished Visiting Fellow at the Council on Foreign Relations, Senior Fellow at the Hoover Institution at Stanford University, Academic Board Chairman of the Fung Global Institute in Hong Kong, and Chair of the World Economic Forum Global Agenda Council on New Growth Models.

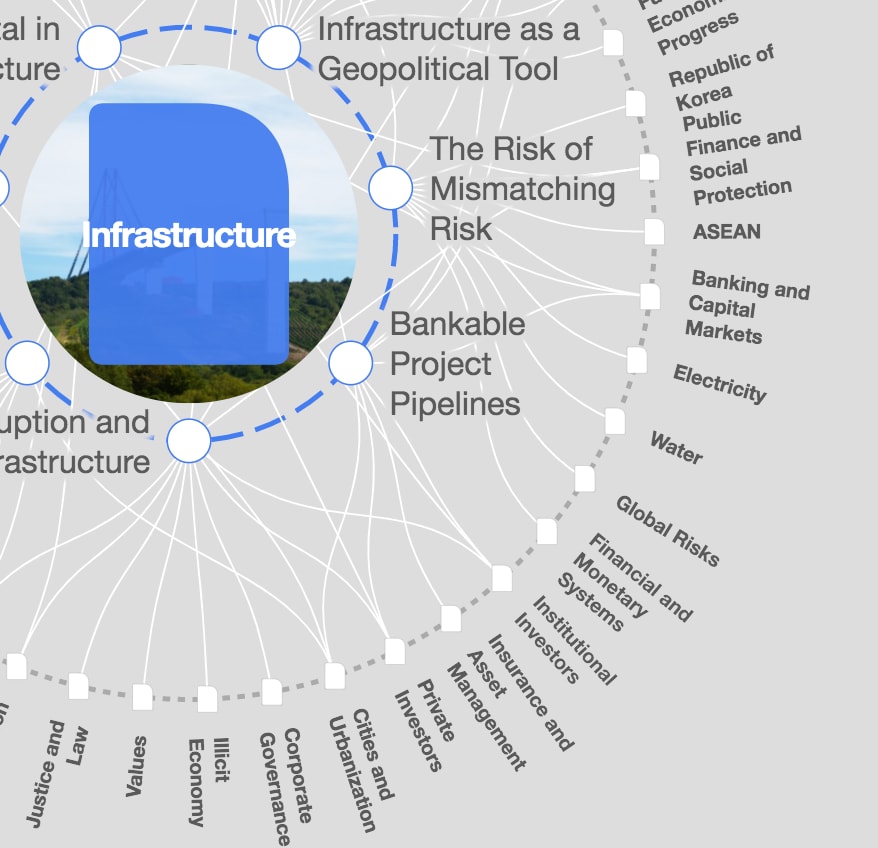

Image: Newly-built residential buildings are seen next to the partially-frozen Songhua River and a bridge in Jilin, Jilin province February 3, 2015. Fourteen Chinese provinces plan to invest a combined 15 trillion yuan ($2.4 trillion) in infrastructure and other projects starting this year as part of their effort to help set a bottom on a slowdown in the economy. REUTERS/Stringer

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Infrastructure

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Jaime Magyera

November 13, 2025