How does mobile money usage differ across regions?

So here’s the puzzle: why do so many consumers across multiple markets continue to rely on agents to make mobile money transactions over-the-counter (OTC), when sending money directly from an account registered in their own name is cheaper, faster and more convenient? If this pattern of behavior continues, are OTC transactions likely to be a permanent modality of funds transfer? Or is agent intermediation functionally equivalent to a pair of training wheels for those new to digital payments – to be regarded as a necessary but transitional stage experienced in the development of every mobile money market?

In this post, we summarize recent research conducted by InterMedia and funded by the Bill and Melinda Gates Foundation that gives us a preliminary picture of how OTC usage may differ across regions. The findings are based on nationally representative survey data collected as part of the Financial Inclusion Insights (FII) program in Bangladesh, India, Kenya, Nigeria, Pakistan, Tanzania and Uganda. While the descriptive statistics presented below do not give us complete answers to the questions above, the data help us to validate existing anecdotal evidence on the profile and behaviors of those consumers who remain persistent users of OTC services. We can then generate and test further hypotheses on the incentives, regulations, product features and support needed for consumers to become independent active users of mobile financial services, including products beyond payments.

Over-the-Counter (Under the Microscope)

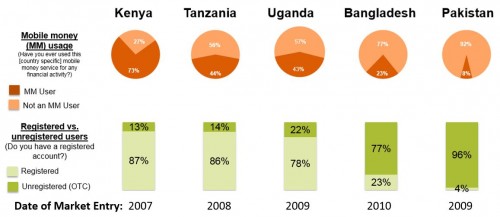

The Financial Inclusion Insights data present some interesting patterns. As the chart by InterMedia below suggests, the percentage of consumers who use mobile money services without having their own account appears to negatively correlate with market maturity: OTC transactions generally constitute a larger share of mobile money use in the countries where mobile money has been most recently established, at least amongst the markets for which we have data. For example, Kenya as the market of longest standing also has the lowest level of OTC transactions, with 13% of survey respondents who reported using mobile money being unregistered.

However, this correlation must be interpreted with care; the supply- and demand-side factors driving OTC volumes are highly complex and market-specific. Additionally, the nature of OTC (formal, informal) varies greatly across markets, making it difficult to draw macro-level conclusions from the data. [1]

Nevertheless, FII data raise hope that OTC may be a stepping stone for some consumers to account registration and independent transactions. In Bangladesh, 56% of bKash users reported making a transaction through an agent either at the same time or prior to signing up for their own account. Similarly, in Uganda, 62% of customers said that they registered for an Airtel Money account only after conducting mobile money activities over-the-counter. The other East African economies demonstrate similar patterns of OTC use that predicated future account ownership: around 20% of Kenyan and Tanzanian Airtel Money account holders surveyed said they first used OTC services before converting to account registration. These statistics suggest that a consumer journey that starts with OTC is capable of continuing beyond reliance on agents to send and access money, although there is a long road ahead to confirm the validity of this linkage.

Barriers to account registration

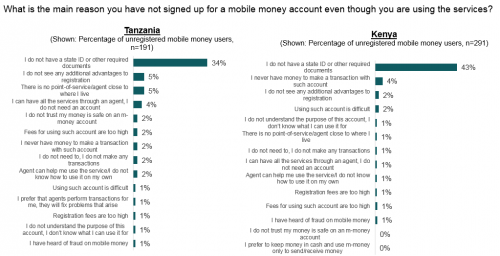

Turning to the million taka question: what is the rationale for customers to incur travel, time and pecuniary costs to send money using the account and expertise of an agent? During our survey we ask people to tell us the main reason they have not signed up for a mobile money account, even though they are using the services. While this question does not capture the views of OTC users that have registered for an account, it sheds light on the real and perceived barriers to account registration. In Kenya and Tanzania, the biggest reported barrier to registration is the lack of necessary identification documents (cited by 43% and 34% of unregistered users respectively).

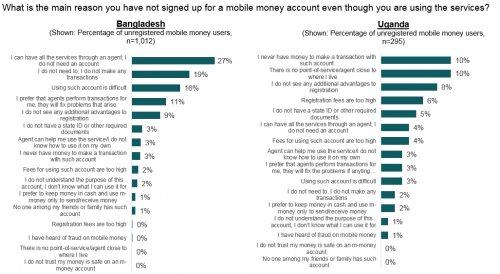

In Bangladesh and Uganda, compliance with KYC requirements appears to be a relatively minor issue from the perspective of consumers (cited by only 3% and 5% of unregistered users), although a more complex interplay of factors obstruct account registration. In Bangladesh, over a quarter of respondents who only use agents to send mobile money report that they do not need an account because they can perform all services they need OTC. A similar number of users reported that they preferred OTC either because agents are able to fix problems that arise or because using an account was difficult. In Uganda, the top reasons consumers report being discouraged from opening their own account is because there are no agents close to where they live or they lack funds.

Demographic and behavioral disparities between registered and unregistered users also emerge from analysis of the FII data. Across the eight markets, unregistered users are likely to be on average younger and less educated. Registered users are more likely to try using mobile money for a wider range of use cases, such as paying school fees and utility bills, and also use the service more often. This profile will not apply across all of the 250+ mobile money deployments currently active across the world, but does provide a starting point for customer segmentation and interventions to target OTC use.

Implications for market development

While much more data and analysis is needed to get to the bottom of OTC usage, FII data summarized provide a deeper understanding of the opportunities and challenges present in the markets under study. In particular, the data suggests that we need to squarely address the registration and usage barriers faced by consumers. Namely, the industry must address the value proposition concerns from Bangladesh and Uganda, and the inability to comply with KYC requirements in Kenya and Tanzania. Encouragingly, the data are beginning to show signs that it is possible to convert some OTC users to registered mobile money users—a hypothesis we will continue to explore and test.

We will continue this series with further statistical analysis of the Financial Inclusion Insights data, as well as a review of additional supply- and demand-side data sources that can help us continue to unpack these issues. Stay tuned!

** We would like to acknowledge the data analysis work by InterMedia summarized in this article. For the primary data and to access more research in the Financial Inclusion Insights program, please visit finclusion.org.

** This blog is the second in a series on global OTC exploration, produced by the Bill & Melinda Gates Foundation and GSMA. Read the first overview post here.

[1] As we pointed out in our previous post, there is a distinction between formal OTC, where a provider chooses to implement an OTC strategy for commercial and regulatory considerations, and informal OTC which emerges informally and organically, despite deliberate commercial and regulatory attempts to limit OTC.

This article is published in collaboration with The Bill & Melinda Gates Foundation. Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Authors: Rebecca Mann is a Program Officer for The Bill & Melinda Gates Foundation. Abed Mutemi is an Associate Program Officer, Financial Services for the Poor at The Bill & Melinda Gates Foundation

Image: A customer withdraws 500 Estonian kroon ($40) from an ATM in Tallinn July 13, 2010. REUTERS/Ints Kalnins.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Fourth Industrial Revolution

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Jaime Magyera

November 13, 2025