As trade slows, what's next for global supply chains?

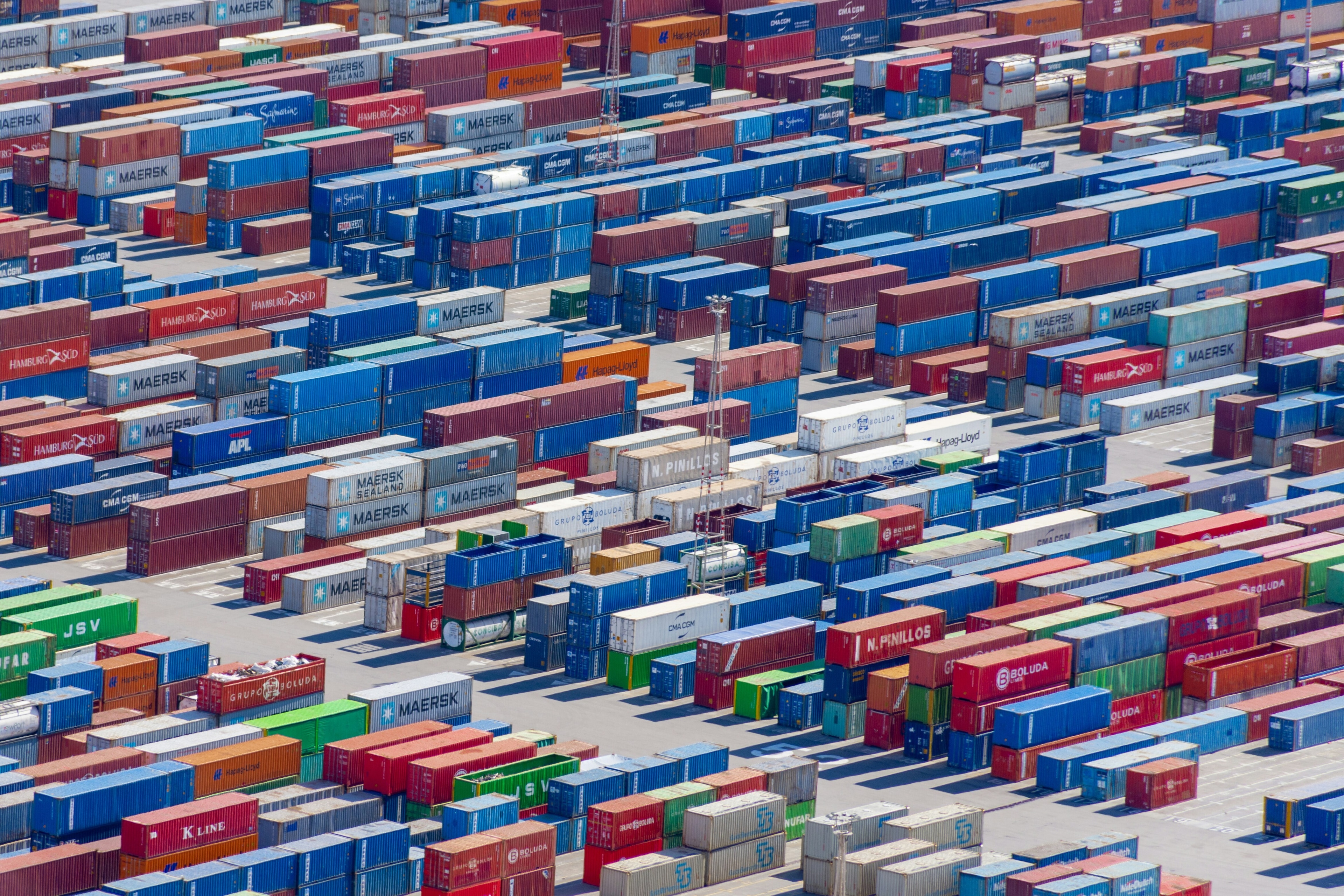

Technology is making supply chains more dynamic Image: REUTERS/Romeo Ranoco

Global trade volumes have plateaued over the past 18 months, after decades of expanding twice as fast as GDP and driving economic growth. Supply chains were crucial to that trade expansion, as countries increasingly linked into the procurement, manufacturing and distribution networks that constitute the chains.

Amid current stagnation, the question is where trade goes next. Public opinion on trade will matter, as will several major shifts in global supply chains.

Diverging public support for trade

Europe is turning inward, despite the fact that 90% of global demand will come from outside the European Union in the next decade. In voting to leave the EU, British citizens rejected one of the strongest multi-nation, regional economic blocs. And European countries’ fragmented response to the migrant crisis bodes badly for EU plans for deeper integration and coordinated borders. In the United States, both Hillary Clinton and Donald Trump have taken strong stands against the Trans-Pacific Partnership (TPP), a preferential free trade agreement binding twelve nations and 40% of global GDP.

In contrast, Asian nations are embracing international trade. For them, the TPP is largely understood as an opportunity. China - not a TPP member - is working to create its own bloc, the Regional Comprehensive Economic Partnership (RCEP) as an alternative to the US-led pact. RCEP, composed of 16 countries, would be the world’s largest free-trade area, reducing barriers to trade in goods and services as well as investment. Meanwhile, the ASEAN Economic Community (AEC) is guiding the region towards a single market, envisioning the free flows of goods, services, labour, investments and capital across the 10 member states. And bilateral agreements proliferate. For example, earlier this year, Vietnam finalized a free trade agreement with the EU.

On the multinational front, World Trade Organization (WTO) members are in the process of ratifying the Trade Facilitation Agreement (TFA) concluded at the 2013 Bali Ministerial Conference. The TFA should make international trade easier, quicker and less costly by removing red tape at borders, such as measures on the release and clearance of goods, and by enhancing cooperation between border agencies. According to WTO estimates, the TFA could cut worldwide trade costs by between 12.5% and 17.5% and create around 20 million jobs - the majority in developing countries.

Trends in global supply chains

Amid this ongoing debate, the very nature of trade is changing owing to three distinct shifts in global supply chains: the “fast economy” is on the rise, new technologies are proliferating and e-commerce is expanding.

Many sectors now prioritize speed to meet customer demand. Brands have adapted to a market for faster products. For example, Zara can design, manufacture and transport clothes to its stores in just two weeks. This model allows brands to avoid high inventory and costly bets, instead only producing more of what sells best. Since fast products require shorter and more regional supply chains, they involve less intercontinental trade.

Technology is making supply chains more dynamic. Information technology, the internet of things, big data and the cloud enable new management processes that allow for longer and more complex supply chains. The Flex Pulse Centre is one example: it streams data on everything from inventories to quality checks to transportation and delivery statuses, allowing central and local teams to remain updated and prepared to address potential disruptions and risks.

This global visibility helps companies to decentralize production and open up new factories and distribution centres across the world, which results in a mixture of short, medium and long distance shipments. Other technological innovations localize and shorten supply chains. 3D printing can move production from factories to shops and homes, and some companies are re-shoring and near-shoring to relocate manufacturing to where technology is most advanced and productivity highest. Both trends reduce cross border trade.

Finally, e-commerce and the rise of digital supply chains may boost international trade. Amazon, eBay and Alibaba, among other e-commerce platforms, enable companies and consumers to buy things globally. They connect millions of manufacturers and billions of consumers, giving even the smallest seller and most distant buyer access to the global market. These connections require logistics and transportation networks that can support the growing number of cross-border transactions as well as regulation suitable to enable transnational e-commerce without jeopardizing sales.

The English economist David Ricardo argued that combining international free trade with industry specialization around a country’s comparative strengths would produce widespread benefits. For this, trade’s slowdown is problematic. While in part due to converging capabilities (developing countries catching up with mature economies in terms of education, skills, infrastructure and logistics) the slowdown is more likely a result of digitization and suspicions among Western publics.

But we might be unnecessarily worried: between 1980 and 1985 trade growth slowed dramatically, only to revive. Today, global production processes are evolving rapidly, and there is still room for deepening supply chains and trade links. The current slowdown represents more a shift than a permanent change.

This article first appeared on the Council of Foreign Relations website.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Trade and Investment

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Supply Chains and TransportationSee all

Isabel Cane and Rob Strayer

November 13, 2025