The world is 'awash with cash', so why aren't we investing in infrastructure?

Most G20 countries actually invest less today in infrastructure than they did before the financial crisis. Image: REUTERS/Ueslei Marcelino

Christopher Smart

Senior Fellow, Mossavar-Rahmani Center for Business and Government, Kennedy School of Government, Harvard UniversityIt is breathtaking to watch world leaders put aside their differences and agree to a single strategy to boost global economic growth. It is heartbreaking when that strategy doesn’t do much good. At the G20’s recent summit in Hangzhou, China – its tenth since the 2008 global financial crisis – member governments once again pledged to invest in infrastructure in advanced economies to boost growth, and in the developing world to fight poverty. But it is still mainly a pledge.

According to the McKinsey Global Institute, the world still invests only $2.5 trillion annually in transportation, water, power, and telecommunication networks, well short of the estimated $3.3 trillion needed just to keep up with current trends. In fact, most G20 countries actually invest less today in infrastructure than they did before the financial crisis, even as national leaders acknowledge that these investments can spur growth.

This is still more confounding at a time when the world is awash with cash. With central banks keeping interest rates near zero – and in some cases even probing negative territory – it is hard to find another time in history when borrowing was so cheap.

While governments may be reluctant to take on new debt, private investors seeking higher returns than government bonds can offer have always participated in infrastructure financing. Even if post-financial crisis regulations are tying banks’ hands, pension funds and insurance companies still need precisely the kinds of long-term, steady-return investments that infrastructure projects offer. So why does so much infrastructure remain unbuilt?

One problem is that, while the infrastructure-investment shortfall is a global challenge, the solutions are mostly local. Investors must look at the specific risks and rewards of the project in front of them. That means that governments at all levels need to start on a long list of granular, targeted reforms that will slowly increase transparency and reduce the risk of these inherently large, complex, and immovable outlays.

So far, G20 governments have done what governments do best: commit money. They have also pushed the World Bank and other global lenders to free up more funding for infrastructure projects. In some cases, they have even conjured new multilateral banks from scratch – witness China’s Asian Infrastructure Investment Bank and the New Development Bank, established by the BRICS countries (Brazil, Russia, India, China, and South Africa).

Because bridges, power plants, and ports are complicated undertakings that often require extensive feasibility studies, environmental reviews, and regulatory approvals, G20 countries are also trying to boost the number of potential projects. After its 2014 summit in Brisbane, Australia, the G20 launched a “Global Infrastructure Hub” to help accelerate project preparation.

These efforts are a good start, but raising more money and generating longer lists of projects isn’t enough. Investors today are focusing overwhelmingly on all the different ways they could lose their money. They are unlikely to be drawn toward infrastructure projects until they get some help in dealing with the potential risks.

This doesn’t necessarily entail government guarantees, but it does mean that governments should make all the contingencies surrounding a project as clear and predictable as possible.

For starters, policymakers can improve the investment climate by making laws clearer, taxes simpler, courts faster, and bureaucrats cleaner. Potential investors will avoid projects where it is too hard to complete feasibility studies or secure licenses. Deficiencies in any of these basic areas are usually the first thing investors complain about, which reflects how important they are.

Governments can also improve their own long-term planning to anticipate future needs and make it easier for investors to understand the context of a project, and to sign up for a second one if the first one goes well.

As a part of planning, governments should help develop an impartial set of benchmarks, based on past and current comparable projects, to set reasonable expectations about returns. If a project’s returns are set too low, it will fail; if they are set too high, people will suspect incompetence or corruption. Benchmarks can help facilitate negotiations and protect both public and investor interests.

Moreover, governments should do more to create model contracts that are easier to analyze and negotiate, regardless of where a project is located. Legal systems differ across countries, but that does not mean that contracts to build similar power plants cannot be more alike.

Governments should also develop local capital markets and encourage more securitization. Despite securitization’s bad name since the United States subprime mortgage crisis, pooling and distributing highly concentrated risks can attract a larger group of potential investors with the right risk tolerance.

Finally, policymakers should embrace the Internet of Things. Cheaper sensors and better data analytics are already enabling infrastructure operators to track maintenance issues and predict investment obsolescence more accurately, and in real time. IoT technology can thus enhance project transparency, to the benefit of governments and investors alike.

While G20 leaders have already given a nod to some of these reforms, a far wider range of officials, regulators, and investors, across many local, national, and regional jurisdictions, must do the difficult work to deliver results. More money and more projects can help, but only more transparency and a clearer view of risks will jump-start progress.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

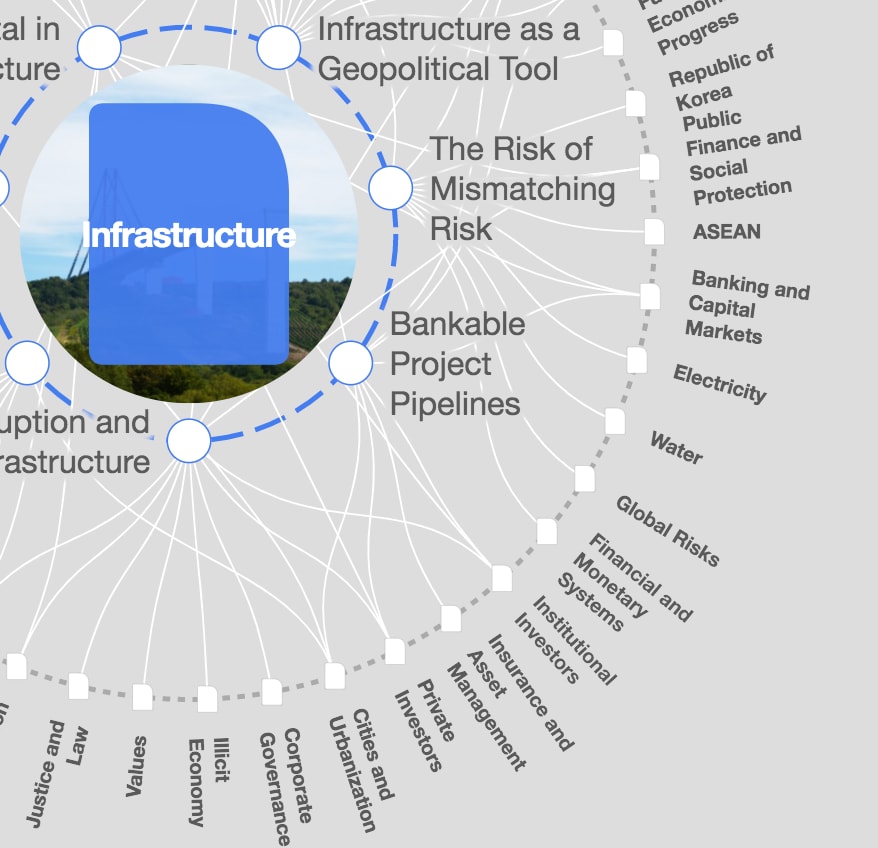

Infrastructure

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Jaime Magyera

November 13, 2025