Emerging markets with fossil fuels need to rethink growth strategies. Here’s why

The global shift towards a decarbonized economy is challenging tried and tested models of development. Image: REUTERS/Raheb Homavandi

This article is part of the World Economic Forum's Geostrategy platform

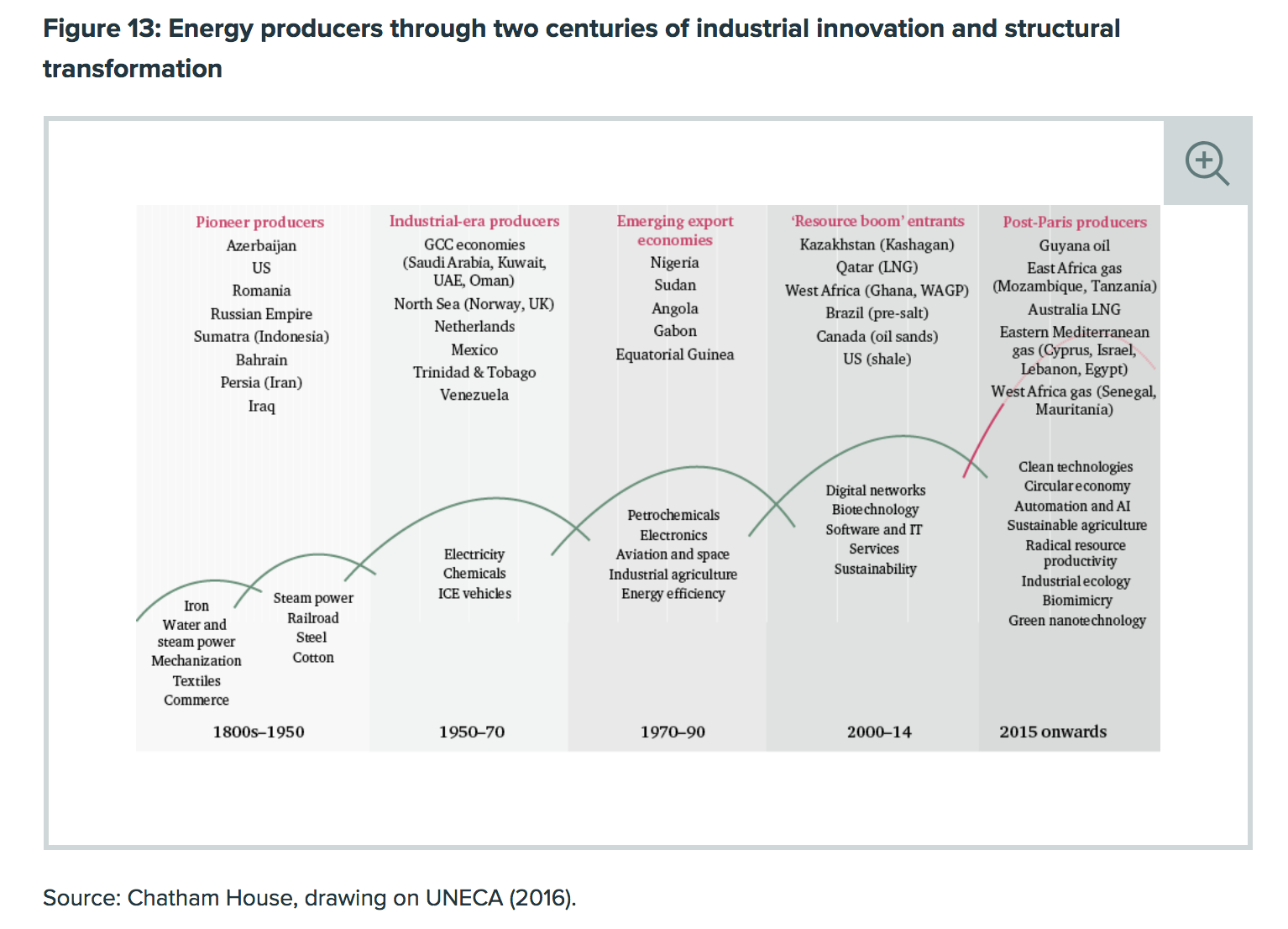

Over half of the world’s least developed and lowest income countries are currently exploring for oil and gas or hoping to expand existing production.

Yet tightening climate policies and shifting energy investment trends suggest that the time frame for profitable oil and gas production will be limited.

This fundamentally changes the prospects for developing countries that hope to use fossil fuels as a ‘leading sector’ for growth over the next decade.

Central banks and regulators, investors and companies in advanced economies are assessing their exposure to high-carbon assets that will lose value throughout the energy transition, and testing their resilience against 2°C scenarios.

Development assistance is re-aligning with the Paris Agreement, reforming policies relating to the fossil fuel sectors and accelerating climate finance.

Lower-income countries that are banking on their fossil fuels lack the capacity to assess carbon risks, and may be left behind by shifts in investment and credit.

Decisions made between now and 2020 have the potential to lock-in political incentives, physical infrastructure and unsustainable spending and consumption patterns that will complicate transition and limit scope for increasingly ambitious nationally determined contributions (NDCs) under the Paris Agreement.

Meanwhile, decarbonization trends are likely to amplify many well-known resource curse challenges, from managing volatile revenues to sustainably diversifying the economy and reducing fossil-fuel dependence.

Developing countries with fossil fuels would benefit from new approaches to carbon risk and resilience.

Countries with established production such as Nigeria and Ghana should assess the implications of the energy transition for domestic fiscal stability, and harness revenues and energy and industrial policy to reduce risks to public finance and support transition. Countries at an earlier stage, such as Guyana and Tanzania, have a chance to limit their exposure to carbon risk and follow a cleaner pathway from the outset.

Multilateral development banks (MDBs) and donor agencies should engage with the carbon risk and economy-wide transition issues facing countries with fossil fuels. They should take clear positions on fossil fuel finance, carbon pricing, and the alignment of assistance with country NDC and long-term emissions reductions plans to 2050.

Building country-level capacities to assess and mitigate carbon risks and working with other public and private providers of development finance to better align strategies can help avoid the promotion of conflicting development models.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Oil and Gas

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Roberto Bocca

November 17, 2025