8 ways blockchain can be an environmental game-changer

Blockchain could one day be used to monitor ocean resources and allocate fishing rights. Image: REUTERS/Pascal Rossignol

Blockchain hype peaked in the media in 2017 when “cryptomania” hit the trading markets. More recently, attention has turned to how it will be regulated, while in a survey released this month more than four out of five executives (84%) reported their organisations had blockchain initiatives underway – dominated by financial services.

Even as an emerging technology, blockchain has so much more relevance than digital finance alone. It is also poised to disrupt how we think about and manage the world’s most pressing environmental issues.

There is good reason for the hype around blockchain. It is fundamentally a new form of computing architecture that brings with it transformational new capabilities, much like the internet brought in the 90s, or the smartphone in the late 2000s.

Try asking a 15-year-old today what life was like before smartphones, or a twenty-something what life was like before the internet. Many would struggle to even conceive of such a world.

To begin to understand just how blockchain could transform our world, it’s helpful to identify its defining characteristics. Most notably, these include its distributed and immutable ledger and advanced cryptography, which bring a powerful new property to large-scale computer networks: Trust. This ranges from trust in owning a digital currency or good, to trust in its origin, or in the veracity of a transaction. It also encompasses trust in blockchain’s decentralized business model, which is neutral by definition, and even the fact the data and code that underpins blockchain technology is open for all to see.

However, despite the hype, considerable challenges will need to be overcome for it to reach the scale and adoption of the internet or mobile phones. These include tackling user trust and adoption, performance barriers (including inter-operability, scalability and energy consumption), security risks (including cyber and identify verification), and legal and regulatory challenges.

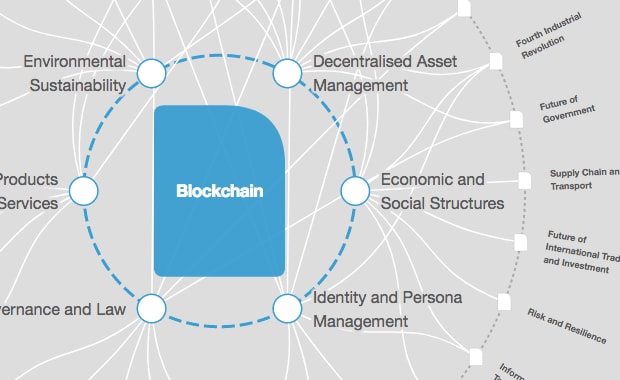

If these challenges can be overcome, then as the technology matures and its application across sectors and systems grows, blockchain could help tackle a range of environmental issues from illegal fishing and deforestation through to better water and energy management. In a new report by the World Economic Forum and PwC, launched at the Global Climate Action Summit in San Francisco, we identify more than 65 emerging use cases where blockchain can help address environment-related challenges.

We also identified areas where blockchain, in combination with other advanced technologies of the Fourth Industrial Revolution, could prove to be a wild card that disrupts not just existing business models, but also the way we tackle climate change and other environmental challenges.

We called these game-changers and there are eight of them.

1. ‘See-through’ supply chains. Transactions all along the supply chain can be recorded through a blockchain and an immutable (unchangeable) record of provenance (e.g. a product’s origin) can be created. This offers the potential for full and radical transparency and traceability of products from source to store. Not only could this fuel a new wave of consumer demand for clean supply chains, but soon such transparency may be unavoidable, transforming how suppliers, purchasers and regulators treat supply chains.

Looking into the future, blockchain has the potential to connect all stakeholders in a global supply chain – from the workers in factories through to logistics, the retailers, consumers, investors, NGOs, and regulators – under one platform. A platform that provides the data, traceability, transparency, control or compliance mechanism that the given user needs would be a truly transformational proposition for workers in the informal economy and consumers alike.

2. Decentralized and sustainable resource management. Blockchain can underpin a transition to decentralized, clean and more resource-efficient energy and water systems at scale. Platforms could collate distributed data on these resources (e.g. household-level water and energy data collected with smart sensors). This is a game-changer because often decision-makers in the systems – both centralised authorities and retail-level users – are making decisions with only partial information. Blockchain-enabled platforms could overcome this and enable more informed decision-making and even decentralized decision-making about the management of those resources or the broader system. This could include traceability and verification of renewable energy sources, peer-to-peer trading, dynamic pricing and better demand-side balancing.

3. Raising the trillions – new sources of sustainable finance. Blockchain-enabled finance platforms could potentially revolutionize access to capital and open up a whole new class of potential investors for projects to address environmental challenges; from investment in green infrastructure projects, to enabling blended finance or charitable donations for developing countries. More broadly, there is the potential for blockchain to enable a system shift from shareholder to stakeholder value, and from traditional financial capital to accounting for social, environmental and financial capital.

4. Incentivising circular economies. Blockchain could fundamentally change the way that materials and natural resources are valued, used and traded, incentivizing individuals and organizations to realise financial value from things that are currently wasted, discarded or treated as economically invaluable. This could drive widespread behavior change and help to realise a truly circular economy. For example, Plastic Bank has created a social enterprise that issues a financial reward in the form of a cryptographic token in exchange for depositing collected ocean recyclable plastics.

5. Transforming carbon (and other environmental) markets. Blockchain platforms could provide cryptographic tokens with a tradable value to optimize existing market platforms for carbon (or other substances) and create new opportunities for carbon credit transactions. An early pilot example is China’s “Carbon Credit Management Platform”, developed by Energy Blockchain Labs and IBM. The aspiration is that with the introduction of smart contracts, the transparency, auditability and credibility of the Chinese carbon market can be increased. Further into the future, it is conceivable that blockchain could underpin a global carbon trading market for individuals, households or organizations.

6. Next-gen sustainability monitoring, reporting and verification. Blockchain has the potential to transform sustainability reporting and assurance, helping companies better manage, demonstrate and improve their performance and enabling consumers and investors to make better informed decisions. Automatic data collection and management (e.g. of greenhouse gas emissions) could be realised through smart contracts in order to access real-time, trustworthy data and minimise fraud. Improved GHG accounting via the blockchain could increase the effectiveness of carbon taxation as the performance of such mechanisms is contingent on transparent and trustworthy GHG emissions data.

7. Automatic disaster preparedness and humanitarian relief. Blockchain could underpin a new shared system for multiple parties involved in disaster preparedness and relief to improve the efficiency, effectiveness, coordination and trust of resources. A well-designed system could enable a wide range of actors to share crucial information automatically in the event of a disaster through smart contracts. This could, for example, mobilize emerging resources more quickly and effectively, redirect supply chains automatically, and enable relief agencies to better coordinate their efforts in response to emergencies.

8. Earth management platforms. New blockchain-enabled geospatial platforms, which enable a range of value-based transactions, are in the early stages of exploration. They could enable new market mechanisms to protect the global environmental commons, from life on land to ocean health. These applications are further out in terms of technical and logistical feasibility, but remain exciting to contemplate. For example, a global ocean data platform to monitor ocean resources could incorporate blockchain to secure and enforce fishing rights to communities or fishers.

If blockchain lives up to its hype and if directed at the right problems, it has real potential to enable a shift to cleaner and more resource-preserving decentralized solutions, to unlock natural capital, and to empower communities. This is particularly important for the environment, where the tragedy of the commons and challenges in capturing the non-financial value are currently so prevalent.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Blockchain

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on InnovationSee all

Awais Ahmed and Srishti Bajpai

November 11, 2025