6 charts showing the economic impact of Coronavirus

The global economy is showing it's not immune to COVID-19. Image: REUTERS/Issei Kato

- The Coronavirus outbreak is having a significant impact on the global economy and markets.

- $6 trillion has been wiped off the value of a basket of nearly 7,000 stocks.

- From interest rates to oil prices, other areas of the global economy are also set the feel the effect.

Capitulation? Perhaps.

The rapid worldwide spread of coronavirus and the economic implications of the outbreak have triggered the biggest weekly stock market rout since the 2008 financial crisis, wiping $6 trillion off global equities.

With travel plans and conferences canceled, airlines grounded and even the Tokyo Olympic Games in doubt, economists are busily slashing their forecasts for company earnings and economic growth.

Bond markets are certainly screaming warnings of recession, with U.S. and German 10-year yields falling 20 basis points on the week, the latter hitting record lows. Even gold, that ultimate safe-haven, fell as traders scrambled to meet margin calls triggered by the big stock market slide.

Below are a series of charts detailing the scale of the damage so far in financial markets.

1. Everybody hurt

Almost every single stock index in the world has spiraled lower but developed markets have borne the brunt. Winners of the week were high-grade government bonds that benefited from the safety bid and rate cut expectations.

2/ $6 trillion and counting...

A basket of nearly 7,000 stocks including developed, emerging and frontier markets have lost nearly $6 trillion or more than 10% of their value since Monday, according to Refinitiv DataStream.

3/ Bears prowl

A 10% drop is deemed to bring a stock or index into correction territory while a 20% slump is a bear market. By that yardstick, almost 80% of South Korean shares, and more than half of Japanese and emerging market shares and a third of the German index have entered bear territory.

4/ Oil slick

Fears of a demand collapse caused by recession are weighing heavily on commodities. Oil prices are headed for their steepest weekly fall in four years, and having fallen nearly a third from 2020-highs, are in a bear market too. Meanwhile, gold hovered near 7-year highs.

5/ Attention Powell, Lagarde & Co

Money markets are betting central banks will slash interest rates fast and frequently.

They now price a full 25 basis point U.S. Federal Reserve rate cut as soon as March, more than two rate reductions by June and more than three by September. The shift has halted the dollar’s rise and its safe haven status =USD.

The European Central Bank is forecast to reduce its minus 0.5% rate by 10 basis points as soon as June.

6/ Vol squall

Wall Street’s fear gauge, the VIX index’s closing high has spiked to levels last seen 2011 at the height of euro zone debt crisis while long dormant currency volatility is also stirring. That’s bad news for traders who have been shorting low-yield currencies such as euro and Japanese yen because any rise in volatility can quickly wipe out these trades. That can send panicked investors scrambling to buy back those currencies.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

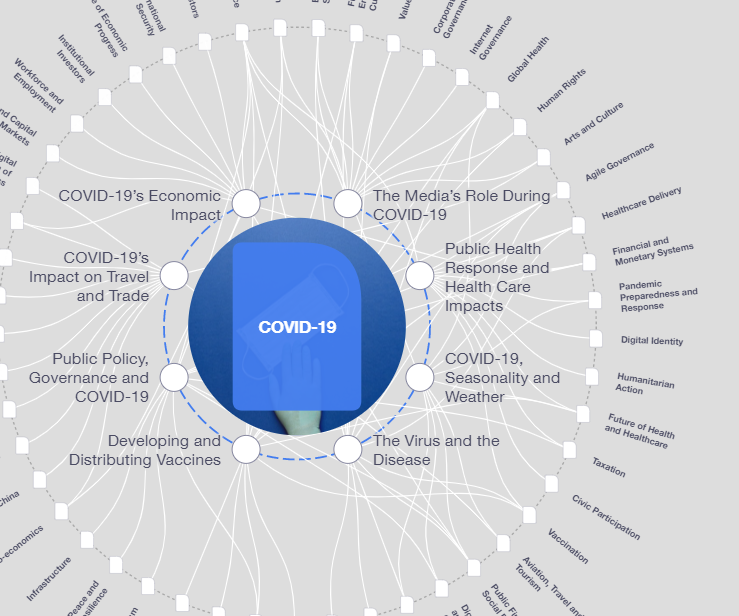

COVID-19

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Health and Healthcare SystemsSee all

Mansoor Al Mansoori and Noura Al Ghaithi

November 14, 2025