This is how COVID-19 is affecting the music industry

Emily dressed as Elton John and Molly as Lady Gaga watch the concert One World: Together At Home, as the spread of the coronavirus disease (COVID-19) continues, Henton, Britain, April 18, 2020. Image: REUTERS/Eddie Keogh

- The music industry has been hit hard by coronavirus with live performance revenue the biggest casualty. A six-month shutdown is estimated to cost the industry more than $10bn in sponsorships, with longer delays being even more devastating.

- The industry is fighting back with new ways to monetize music consumption and innovative models: Fortnite hosted a live rap concert that attracted nearly 30 million live viewers.

- The crisis is likely to accelerate underlying trends in the music industry, based on the importance of streaming, which has grown from 9% to 47% of total industry revenues in just six years.

The business model of music

The global music industry is worth over $50 billion, with two major income streams. The first, live music, makes up over 50% of total revenues and is derived mainly from sales of tickets to live performances.

The second, recorded music, combines revenue from streaming, digital downloads, physical sales and synchronization revenues (licensing of music for movies, games, TV and advertising). Recorded music today is close to the industry’s pre-piracy peak, a testament to the growing adoption of streaming services by both music labels and consumers. Streaming now makes up almost half of recorded music revenue.

The effects of coronavirus on the music industry

1. Sales and streaming

In the wake of the pandemic, physical sales, which represent a quarter of recorded music revenues, are down by about one-third – unsurprising given the closure of retail stores – while digital sales have fallen around 11%. This aligns with general falls in discretionary spending.

Evidence also shows that the way people listen to music is changing in light of coronavirus. In China, Tencent Music Entertainment (TME) reported changes to listening behaviour during the pandemic, with more consumers using home applications on TVs and smart devices.

“While there was some impact on our social entertainment services, we have started to see a moderate recovery recently. In the first quarter of 2020, online music subscription revenues increased by 70.0% year-over-year. The number of online music-paying users reached 42.7 million, a year-over-year increase of 50.4%.” Tsai Chun Pan, Group Vice President, TME Content Cooperation Department.

Spotify, which also added subscribers during the first quarter of this year, has likewise noted the change in consumers’ routines, saying that daily habits are now reflective of weekend consumption, as well as relaxing genres rising in popularity.

In terms of the amount of music consumed, initial data showed a reduction in streaming of 7-9% in some markets – though this appears to have recovered. At the same time, on-demand music video streams have increased. The reasons are linked to a change in behaviours: the pandemic has intensified peoples’ focus on news media (especially TV), while fewer commuting journeys and the gym closures have shifted listening to different parts of the day.

2. Advertising spend

The music industry is also subject to reductions in advertising spending that are happening worldwide. A survey by the Interactive Advertising Bureau shows that around a quarter of media buyers and brands have paused all advertising for the first half of 2020, and a further 46% have reduced spending. This, combined with an approximate one-third reduction in digital ad spending, will affect ad-supported music channels – and therefore both total industry revenue and individual income for artists. Spotify announced that it missed its first quarter advertising targets in light of changes to ad budgets.

3. Distribution

On the distribution side, there is a growing list of artists delaying releases to later in the year. In part this is due to the inability to use tours to promote new albums, and live music in general has been dramatically affected. An extensive list of major concerts and events have been cancelled.

As long as bans on large gatherings continue, live performance revenue is almost zero – effectively cutting the industry’s total revenue in half. Ticket and merchandise sales aside, a six-month shutdown is estimated to cost the industry more than $10bn in sponsorships, with longer delays being even more devastating.

In addition, the post-pandemic outlook appears challenging and growth forecasts for live music are expected to be revised significantly. Rebuilding consumer confidence in the sector will be difficult: one survey shows that, without a proven vaccine, less than half of US consumers plan to go to concerts, movies, sports events and amusement parks when they reopen. This will affect artists hugely – they generate around 75% of their income from live shows, even as data shows that a growing share of live music revenue goes to the top 1% of performers (60% in 2019, versus 26% in 1982).

In response to the immediate pressures, the industry has developed actions to mitigate the impact of COVID-19.

Public-private support mechanisms for artists and crews

The industry has rallied around its community with several funding efforts available to people whose incomes have been affected by coronavirus. These include significant donations from Universal Music Group (UMG), Live Nation Entertainment, as well as streaming giants such as Spotify, Amazon Music, TIDAL, YouTube Music and countless others. China’s largest music platform, Tencent Music Entertainment, is also joining efforts through its parent company.

Many providers have set up mechanisms that allow consumers to donate directly to funds of their choice; other examples include interest-free advances on royalty payments for hardship cases resulting from suspensions in music and event production.

The public sector is also responding. Governments around the world have developed aid packages for industries and workers affected by the crisis, collectively amounting to trillions of dollars in spending, grants and loans. These stimulus bills are not specific to the music industry, but many contain provisions for media, arts and culture businesses, as well as widening safety nets for workers affected.

New ways to engage with fans

In the initial wake of bans on mass gatherings, some venues offered livestreaming of performances. However, even these formats have been suspended as those sites have closed. Now, artists are going direct to fans from their own homes, using services like Twitch, Instagram TV and others. This is not new, but the pandemic has expanded the audience available, and record labels are facilitating it by providing live streaming equipment to performers. Streaming platforms have also enabled new monetization methods, including memberships to artist channels that allow early or exclusive access to content, as well as virtual gatherings and paid-commenting features.

In China, Tencent Music Entertainment released data about the impact of these measures. Tsai Chun Pan says that, through its programme Tencent Musicians, “More than 80% of the musicians receiving exclusive income incentives saw their income increase by over 50%, while more than 40% of the artists reported their income increased by 100% or more.”

These new ways for musicians, labels and venue providers to engage with followers might be a strategy for stronger long-term connections with audiences. The industry is getting behind such efforts: Vivendi, for example, has developed a platform for artists to perform, engage with fans and share content – it makes no money from the platform itself, but indirectly benefits from royalties and sponsorships. And Verizon is working with partners such as Live Nation Entertainment to organize virtual events and video series.

Long-term gains?

Looking to the long-term, the core value chain of the music industry is likely to remain largely unchanged. Professional artists release music via one of the big three record labels – UMG, Sony Music or Warner Music – or alternatively through an independent publisher. This operating model represents 97% of recorded music by market share and may see fluctuations – but upheaval is unlikely.

In addition, the integration of songwriters, composers and post-production engineers in the development of music is not expected to change, though more work may take place remotely. Artists and labels will retain close links to streaming platforms, venue operators and event promoters to distribute music.

The crisis may accelerate underlying trends in the music industry. These are based on the importance of streaming to the industry, which has grown from 9% to 47% of total industry revenues in just six years.

”

Record labels have increased their valuations in recent years, attributed largely to the growth in consumers using paid streaming services, and several are now preparing to go public.

As consumption has grown, spending habits have changed. While some consumers take on more subscription services at home, others have opted out of subscriptions under financial pressure. Services with a dual business model are able to retain their customer relationship through the crisis, churning into a free-to-consumer, ad-funded model until the economy recovers. As consumption patterns have shifted to in-home during the crisis, device- and platform-agnostic services have been able to follow listeners.

Maintaining adaptable monetization strategies may open new avenues for the industry to work with other sectors in the future. For example, gaming and TV integrate songs, compositions and musical scores into their content – but these synchronization revenues currently account for only 2% of recorded music revenue. The business frameworks for synchronization deals are currently underdeveloped, so there is an opportunity for growth – even if it is a long way from reaching a comparable share of revenue to streaming.

China provides an indication of how flexibility could work in practice. During the coronavirus crisis, music streaming platforms there introduced tipping as a new way for consumers to support artists. In the future, platforms could take a cut of these payments, thereby developing a new revenue flow built on streaming.

What is the World Economic Forum doing to measure the value in media?

As music consumption is increasingly digital, there is a growing role for third-party platforms in shaping music distribution, discovery and consumer behaviour. During the pandemic, Fortnite hosted a live rap concert that attracted almost 30 million live viewers, underlining the potential for cross-industry partnerships to engage users and promote artists in a new way. It is likely that rights owners and distributors will continue to adopt similar approaches going forward.

Furthermore, it suggests that the industry is thinking about ways to do this without relying entirely on streaming and physical performances. Streaming may be highly effective in reaching consumers, but it leaves rights holders more reliant on third-party platforms, but a quirk in the streaming business model showcases how the relationship with these providers may change in the future. In general, platforms pay rights holders a minimum proportion of revenue from subscriptions – for Spotify, around 65% – with additional compensation determined by number of streams.

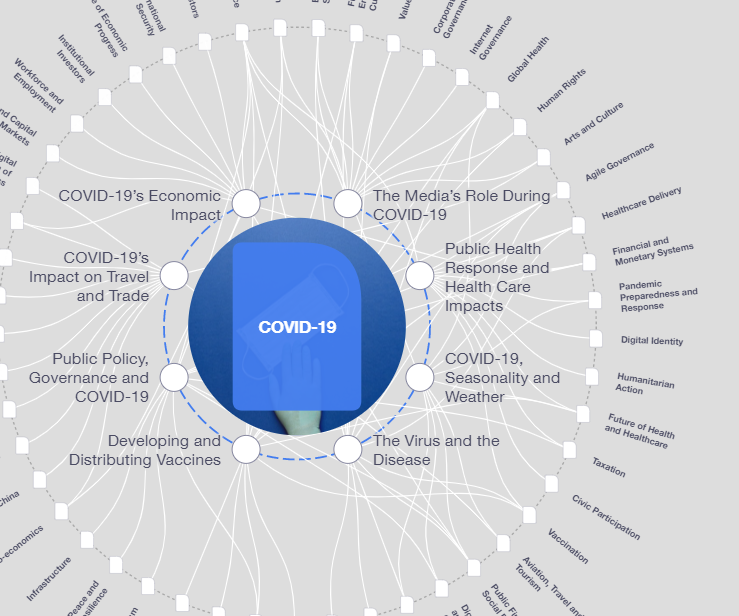

What is the World Economic Forum doing to manage emerging risks from COVID-19?

This arrangement has two implications for the industry. First, it incentivizes streaming services to drive consumption toward non-licensed audio forms, such as podcasts. Evidence suggests the shift has already started: since 2014, music as a share of total audio consumption has decreased about 5%, and spoken-word consumption has increased across every age group. If the proportion of music streaming declines, it creates scope for platforms to renegotiate their relationships with record labels.

The second implication relates to the content itself. Research has shown that songs are getting shorter and snappier, mainly in response to the need to boost the number of individual plays. Other players are adapting, as Tsai Chun Pan describes: “Short video is a new entertainment model. This model has a huge demand for music content, which has not only brought us many new opportunities but also provided us with a new content promotion and distribution channel.” TikTok, already changing how consumers discover music, is developing its own streaming service that is expected to contribute to these evolving dynamics.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Media, Entertainment and Information

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Health and Healthcare SystemsSee all

Mansoor Al Mansoori and Noura Al Ghaithi

November 14, 2025