Private sector investors must now step up to quell the COVID-19 crisis

Private investment has a huge role to play in everything from vaccines to future preparedness Image: REUTERS/Athit Perawongmetha

- Nothing can match governments' speed and scope in tackling COBID-19, but the private sector has a huge role to play, too.

- We must establish new private sector mechanisms that can be mobilized quickly to help deal with pandemics and other natural disasters.

- Any short-term costs will be far outweighed by the long-term benefits.

Governments around the globe are spending breathtaking sums of money defending against the health and economic battering the COVID-19 pandemic has dealt the world.

Researchers at the Center for Strategic and International Studies have estimated that, as of the end of April, the G20 countries alone had already committed $6.3 trillion in fiscal spending, or about 9.3% of their combined 2019 GDP, to save lives and assist economies, at levels that exceed their responses to the 2008 global financial crisis. An International Monetary Fund analysis, meanwhile, calculated that the world's nations are collectively spending close to $8 trillion through direct fiscal costs, public sector loans, equity injections and other liabilities – and we are only a few months into what could very well be a protracted crisis.

Nothing can match governments’ scale, speed and authority when it comes to tackling this crisis, but the private sector can and should also play a significant role. Many businesses are already rising to the challenge, and there is good reason to believe institutional and retail investors will do far more.

Indeed, in the global investment community today, there is a strong and growing impulse not just to do well but to actually do good for society. Assets professionally managed under sustainable investment strategies have exploded worldwide to a total of $30.7 trillion. Investors can place their funds in a wide range of sectors or initiatives, make short- or longer-term commitments and finance these in a variety of currencies. Between 2016 and 2018 global purchases of social bonds grew from $2.4 billion to $13.4 billion.

As impressive as that record is, however, it pales by comparison to the nearly $100 trillion managed by the 500 largest global asset managers. And it is only a small fraction of the huge economic losses sustained by the private sector thanks to our failure to invest earlier in socially responsible initiatives. Such investing is no longer a nice gesture but, I believe, a duty of the private sector and a must for every portfolio.

Investors must – and can – do much more. This crisis is a call to arms to establish new private sector mechanisms that can be mobilized rapidly to address this and current global disease outbreaks or natural disasters of any kind.

Such mechanisms, for example, can support major international global health collaborations – of the scale of The Human Genome Project and CERN (the European Organization for Nuclear Research) – that will bring the best minds and enormous resources together to produce and deploy vaccines, therapeutics and other instruments to combat the virus.

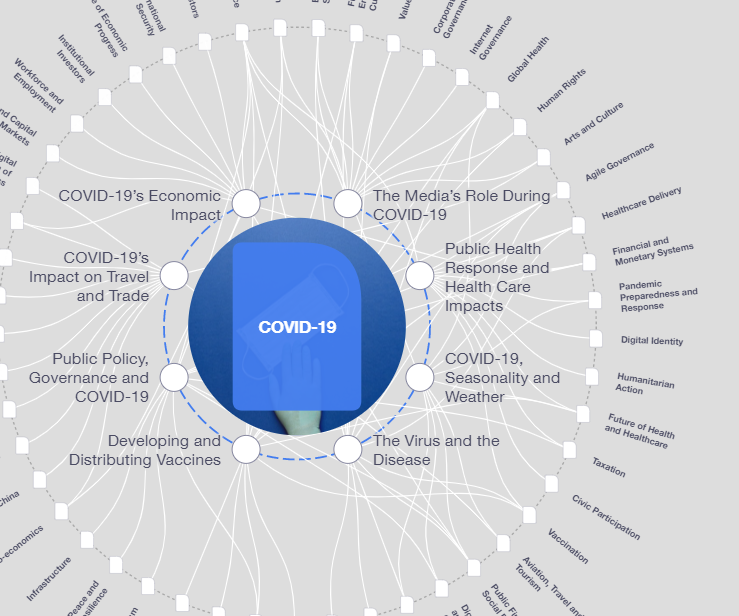

What is the World Economic Forum doing about fighting pandemics?

The short-term cost of such initiatives will be huge – though modest by comparison to the benefits. Because of this, governments that are already spending unprecedent sums of money will struggle to procure this financing right now. However, innovative financing solutions can play an important part in solving this problem. The International Finance Facility for Immunisation ( IFFIm) is one such instrument. IFFIm issues bonds that private investors buy on global capital markets to finance immunisation campaigns supported by Gavi, the Vaccine Alliance in the world’s poorest countries. Backed by multi-year pledges from 10 sovereign countries totalling $6.6 billion, IFFIm’s vaccine bonds have raised $6.1 billion since 2006 in the capital markets and provided $2.6 in funding to Gavi. (In early June the UK government hosted Gavi’s third donor pledging conference, which raised $8.8 billion for vaccine programmes in low-income countries.)

The IFFIm mechanism is ideally suited to supporting major social initiatives that require large surge financing. It is flexible and long term. Governments can spread their financial outlays over many years alleviating immediate budgetary constraints while utilizing IFFIm to tap global markets to mobilize the resources immediately. This helps reconcile immediate financing needs with governmental budgetary constraints and long-term social and economic gains.

IFFIm will soon be issuing a new $200 million bond against a multi-year commitment from the Norwegian Government for the same amount to Gavi. The proceeds of the bond sale will go to the Coalition for Epidemic Preparedness Innovation, or CEPI, to give a critical early boost to a number of projects at the cutting edge of COVID-19 vaccine development. Other institutions, such as the African Development Bank, the International Finance Corporation and the Inter-American Development Bank, are also issuing record volumes of social bonds to raise immediate financing to combat COVID-19.

An IFFIm-style structure with long-term commitments built into asset management mandates could provide a large pool of resources that could be mobilized when required. A 0.1% contribution from portfolio returns over 10 years from 10% of institutional funds under management will create a fund of close to $100 billion. Such a facility would be activated on the basis of predefined criteria. It would also be an effective means of fulfilling the sustainable investment strategies incorporated in institutional investment portfolios.

Public sector responses to slaying the monster of COVID-19 are necessary – but not sufficient. Now, more than ever, the private investment community has an opportunity – and, I would argue, an obligation – to meet this need, and it has the means to do so. The stakes are too high to shrink from this historic challenge.

Cyrus Ardalan is writing in a personal capacity.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

COVID-19

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Health and Healthcare SystemsSee all

Mansoor Al Mansoori and Noura Al Ghaithi

November 14, 2025