How sustainable investments can help accelerate the energy transition

Sustainable investments for seamless energy transition is our best response to the crises we face today Image: REUTERS/Jean-Paul Pelissier

- The energy transition represents the most effective response to the current environmental, economic and social crisis.

- In these uncertain times, accelerating the energy transition through sustainable investments is a 'no-regrets' course of action.

- Sustainable investments can create value not just for shareholders, but for all of us. This is the heart of the system value approach.

2020 will be remembered as the year in which the world was hit by the worst pandemic in recent history, and when global leaders were forced to quickly take decisions that would change our lives in the long-term. The shock of COVID-19 has acted as an extraordinary accelerator of phenomena and trends that were already in motion, such as digitalization and the progressive replacement of fossil fuels with renewable energy sources, creating a new sustainable and inclusive paradigm for businesses, governments, financial markets and wider civil society.

The energy transition, with the opportunities it brings in terms of investment and job creation, represents the most effective response to the current environmental, economic and social crisis. Just look at the funding flows, which are and will be increasingly oriented towards wind, solar and other sectors of the green economy, including electric mobility, storage systems and green hydrogen produced from coupling electrolysers with renewable sources.

The growing penetration of renewables must be read from an economic perspective. The continuous competition within markets has led to a steep reduction in the costs of these technologies, making them more competitive compared to fossil fuel alternatives in many geographies around the world. In addition, these technologies have solid economics, offer a shorter “time to EBITDA”, and provide prompt and sustainable investment solutions to both decarbonization objectives and to increasing energy demand.

But does a shift in energy investments affect only the energy system? Does the energy transition have a role to play in the post-pandemic recovery?

Sustainable investments

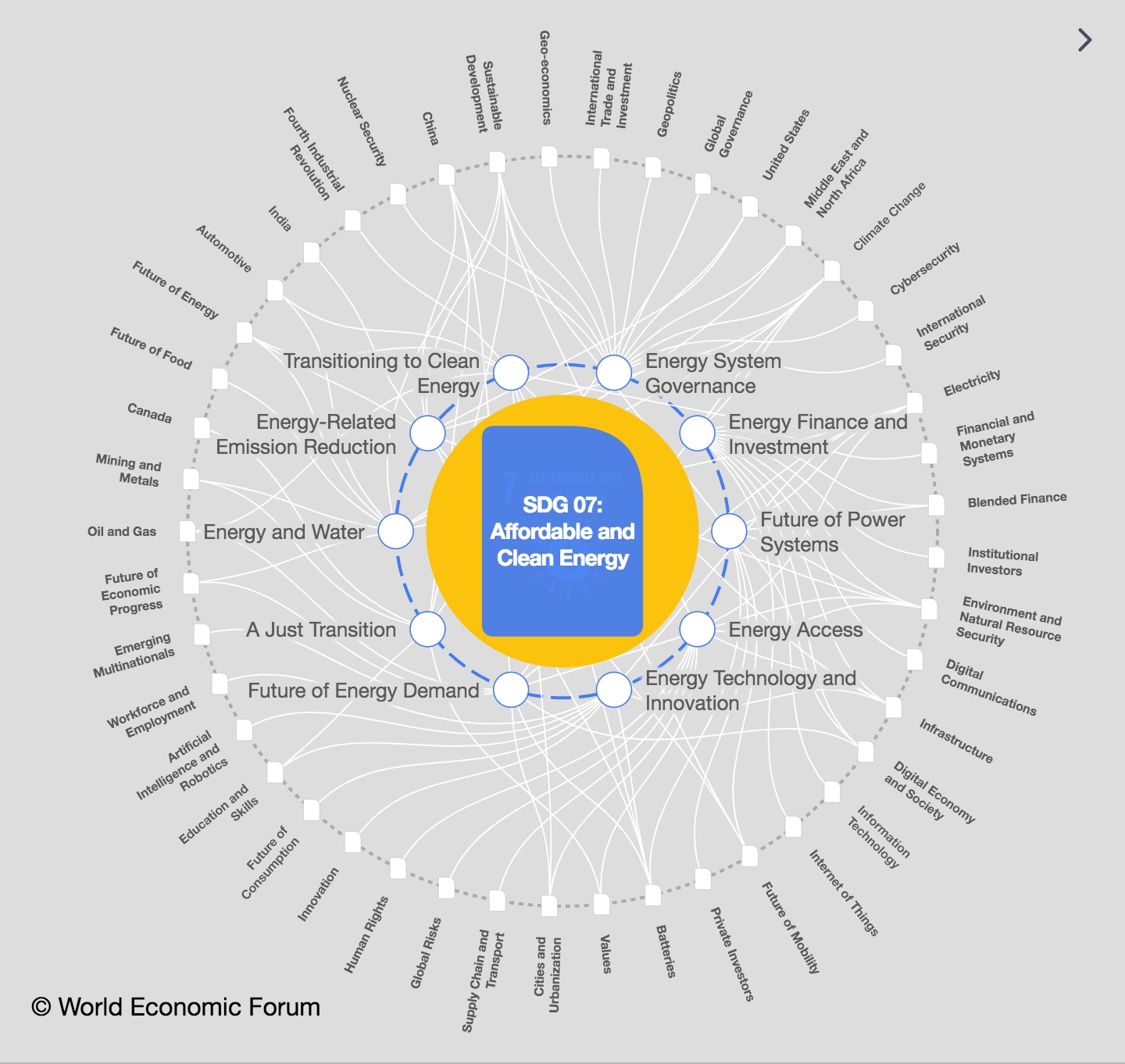

Sustainable investments can create more value not just for organizations themselves, but also for the wider set of stakeholders. This is the underlying rationale of the system value framework, which has been developed by the World Economic Forum’s Electricity Industry community, with support from Accenture. The framework more holistically evaluates the economic, environmental, social and technical outcomes of potential energy solutions across markets, aiming to broaden considerations beyond cost to include greater value dimensions. An approach that can be – and should be – applied by both companies and governments to evaluate the impact of new sustainable investments and policies respectively.

The system value framework also aligns well with Enel’s strategy to take the measurement of societal impact one step further. Enel has adopted an assessment methodology, Total Societal Impact (TSI), that expresses the economic and social benefits of its sustainable investments.¹ This integrated approach applies advanced economic models, in line with the best practices adopted by multilateral organizations, with the aim to provide rigorous, reliable and transparent evaluations.

Sustainable investments approach

With this model, it is possible to measure direct, indirect and induced effects of sustainable investment projects on selected contexts which may be linked to other indicators of interest with a flexible approach. For example, this model was applied to evaluate a project in Italy aimed at strengthening the quality of the grid infrastructure, mostly through digitalisation and automation. The results indicated that an initial investment of €1.1 billion ($1.29 billion), compared to a no-investment scenario, could amount to a GDP increase of more than €3.5 billion and the creation of more than 2,700 jobs.²

Another example of choosing sustainable investments is the socio-economic impact of Nxuba, a 141 MW wind farm currently in development in South Africa with around $90 million of local capex spent across the construction and operation phases. This sustainable investment would amount to a GDP increase of approximately $0.4 billion, and the creation of over 400 jobs over the entire lifecycle of the investment.

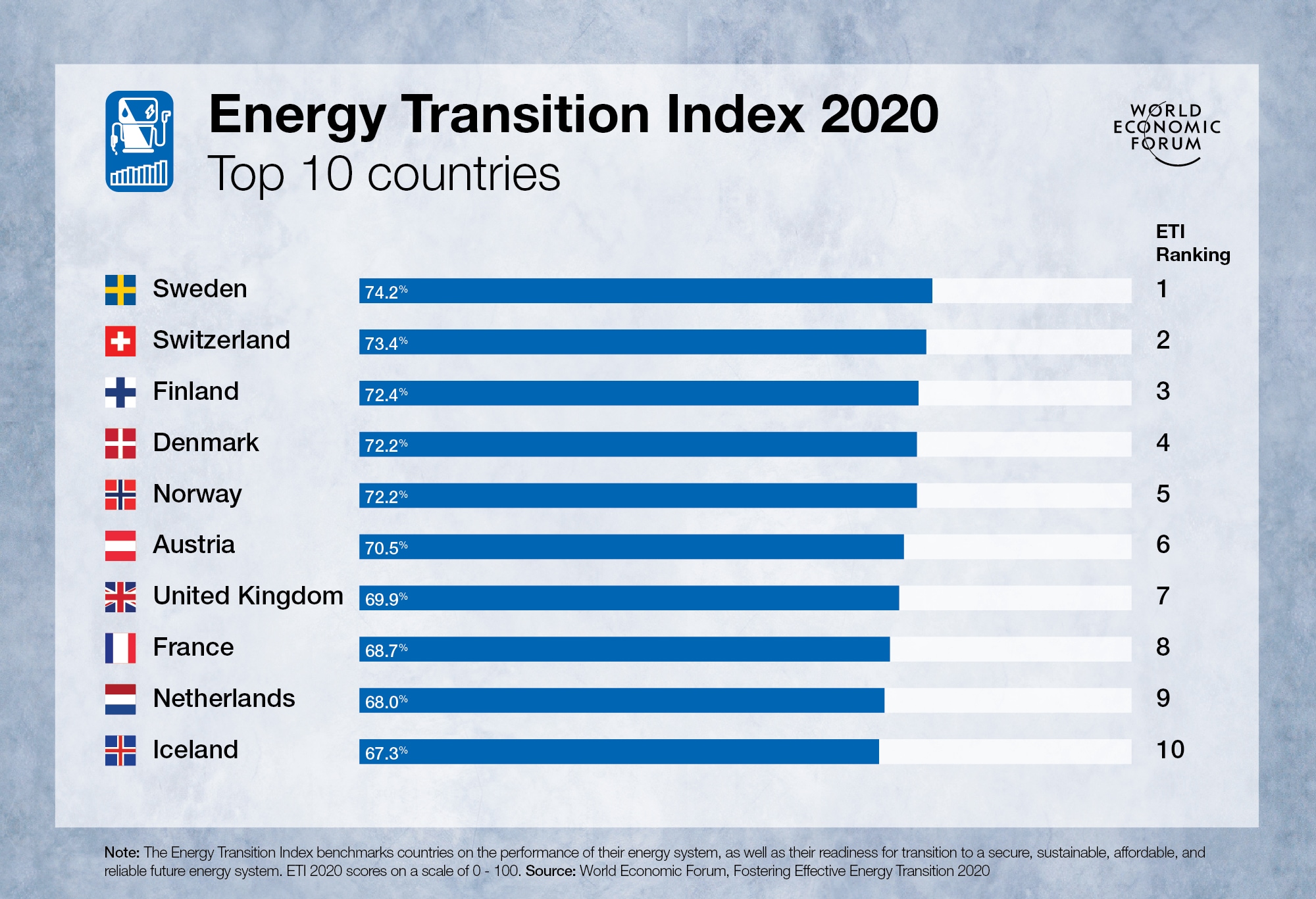

What's the World Economic Forum doing about the transition to clean energy?

This new approach maintains the key role of technology while integrating it within a more holistic vision, using open governance and circular economy principles to achieve economic competitiveness, environmental sustainability and social inclusion.

The transition towards a mentality in line with a system value approach, both within companies and governments, is addressing the issues we are all facing today, and represents an essential step towards improving the quality of life for the next generation. In these very uncertain times, accelerating the energy transition together with sustainable investments can create value for the wider system at multiple levels.

For more on the World Economic Forum’s System Value work, please see https://www.weforum.org/projects/system-value

[1] The TSI methodology currently incorporates economic and social dimensions, with environmental dimensions in development.

[2] As a potential average full-time equivalent for the entire timeframe based on an average salary of €33,000 ($39,000).

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Decarbonizing Energy

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Roberto Bocca

November 17, 2025