Why blockchain's final touches may well be human

Human intervention and judgment will ensure the success of the blockchain network, a report indicates. Image: REUTERS/Darrin Zammit Lupi

- Blockchain does not yet eliminate the need for trust.

- Limitations are due to the fact it is impossible to construct a contract that accounts for every scenario that may unfold.

- Human intervention can help bridge the gap via governance and dispute resolution.

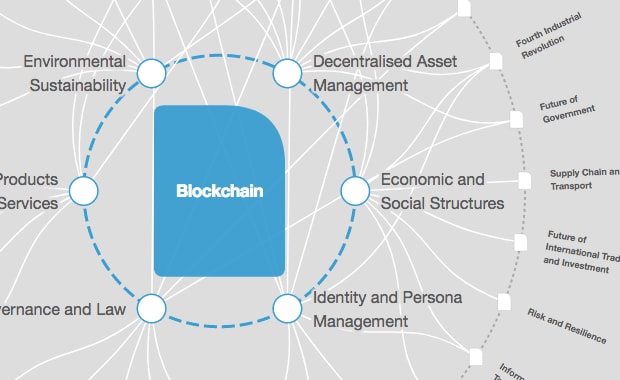

Blockchain technology has been touted as general-purpose technology with the potential to be as powerful and disruptive as the internet.

However, one common misconception is that it eliminates the need for trust.

In blockchain, actors can conduct transactions – exchanging goods, services and perhaps more – with the distributed ledger reducing the need for third-party middlemen, clerks and other human intermediation.

But what happens if there is a dispute about a transaction that occurs on the blockchain? A new research report, Bridging the Governance Gap: Dispute Resolution for Blockchain-Based Transactions, by the World Economic Forum in collaboration with Latham & Watkins LLP, including input and review from Prsym Group and others, delves into this under-studied topic

In widely cited research by Gartner, Inc., blockchain is expected to generate $3.1 trillion in new business value by 2030. Much of this will be led by enterprise adoption of the technology. And, as we have written before, blockchain technology is not so much a technological breakthrough as an economic one.

Blockchain solves one of enterprise's longest-lasting economic dilemmas: the hold-up problem. Using a shared, distributed ledger, competing enterprises can form consortia to pursue mutually beneficial endeavours and research that would previously not have been strategically viable.

It is impossible to hard-code the entirety of potential events that would allow for a fully autonomous blockchain.

”As enterprises figure out how to unlock this $3.1 trillion in new value, they will be developing the bilateral and multilateral contracts needed to dictate the rules of engagement for these platforms. For many projects, the goal will be to automate these transactions completely. But economics tells us that automation may not be possible.

In 2016, Prof. Oliver Hart and Prof. Bengt Holmstrom won the Nobel Prize in Economics for their work on the topic of contract incompleteness. The crux is that no matter how thorough a contract is, and how much time has been put into drafting it, it is impossible to construct one that accounts for every scenario that may unravel in the future.

There are always events that could arise in which the contract does not specify what should happen, or where the participants would like to revisit the agreement.

What does this imply for enterprise users of blockchain and the future of the technology?

As described in the Forum's report, between the uncertainties created by regulation, technological development, economic conditions and trivial errors and malfunctions, it is impossible to hard-code the entirety of potential events that would allow for a fully autonomous blockchain. Processes that incorporate human intervention and judgment are imperative to the success of the network.

How to intervene to improve the blockchain

Governance is one such process and it is is garnering increasing attention in enterprise blockchain. It can be understood as the system of collective decision-making that members of a consortium use to upgrade a protocol when conditions have changed, and to make decisions when a course of action has not been previously specified.

The design of governance varies from consortium to consortium, but across the board it is an essential ingredient in convincing enterprises to adopt blockchain.

Dispute resolution, often considered a component of governance, is another process that is required because contracts are incomplete. In contrast to governance, which typically involves most of a platform’s stakeholders, dispute resolution helps users to resolve disagreements that arise during individual on-chain transactions.

Dispute resolution may be needed even when none of the participants in a transaction have behaved incorrectly. External events such as an oracle providing incorrect information as inputs into a payment, or a coding error resulting in a misfire, may result in parties entering into a dispute.

As discussed in Bridging the Governance Gap: Dispute Resolution for Blockchain-Based Transactions, the design of a dispute resolution process depends on the types of participants in the system and the types of transactions they engage in. A system that functions well for a peer-to-peer retail marketplace may not work as well for an enterprise consortium. Enterprise blockchain users are typically much more sophisticated than retail users and engaged in far larger transactions, requiring a different level of infrastructure.

The report outlines four approaches to designing dispute resolution for enterprise:

- Private In-Network Resolution, in which disputes are resolved by the network operator or a committee of a network.

- Semi-Private Industry Fora, in which disputes are resolved by industry participants who may participate in resolving other disputes.

- Third-Party Arbitration, in which disputes are resolved by a professional arbitrator or standards body.

- Litigation, in which disputes are resolved in court in the applicable legal system.

Chronicled’s Mediledger project, for example, resolves disputes privately through an off-chain process involving the members of the network.

According to a survey facilitated by the Wharton Cryptogovernance Workshop, “The working group is the venue for airing issues and finding resolution. The rules do have an escalation path, which has been never used; all participants seek to avoid it.”

Common to all of these models of dispute resolution is that human engagement and judgment is a necessary input. But that does not mean that no planning is required.

Outlining rulebooks, processes and guidelines in advance will ensure that the adjudication process will work smoothly when it is needed.

So, where does this leave blockchain as a technology? If a system that fully eradicates the need for trust is not yet possible, does blockchain still stand a chance at capturing the $3.1 trillion in value as projected by Gartner Inc.? We think so.

With further research in developing processes arising from contractual incompleteness, including governance and dispute resolution, enterprises can fill in the gaps created by unknown unknowns and fully harness the potential of the technology, allowing for future use-cases that once seemed impossible to be clearly identified, designed and governed over the course of time.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Blockchain

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Emerging TechnologiesSee all

Dr Gideon Lapidoth and Madeleine North

November 17, 2025