What’s in Biden’s $2.3 trillion infrastructure plan?

Joe Biden has outlined significant investments in a range of infrastructures across the U.S. Image: REUTERS/Jonathan Ernst

- Joe Biden has outlined his infrastructure plan, which includes spending $2.3 trillion in a range of investments across the U.S.

- It's designed to create new jobs, boost the economy and help the environment.

- From modernizing highways, to funding the care economy, here's how he plans to spend the money.

U.S. President Joe Biden's infrastructure plan includes $2.3 trillion in investments aimed at everything from fixing 10,000 bridges to tearing lead pipes out of millions of homes in the United States.

Here are some highlights.

$650 billion for roads, rail transport

The plan would modernize 20,000 miles of highways and roads, the top 10 “economically significant bridges” and 10,000 other bridges.

It includes $20 billion for road safety programs to reduce fatalities for cyclists and pedestrians, and $20 billion to reconnect neighborhoods divided by highway projects.

It would double federal funding for public transit with a $85 billion investment and invest $80 billion in Amtrak.

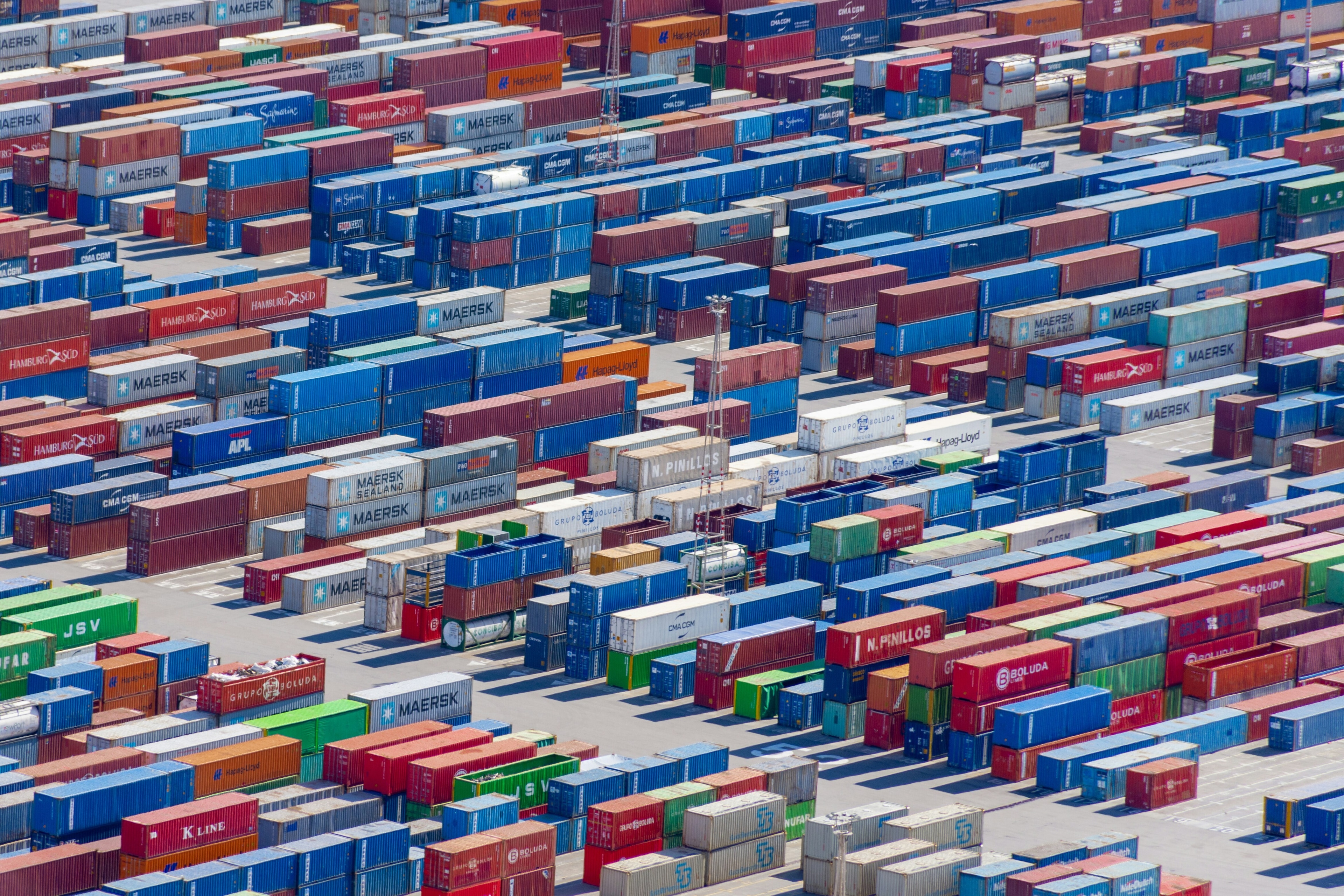

The plan includes $25 billion for airports, $17 billion for inland waterways, coastal ports and ferries, and investments in cleaning port air pollution.

There’s another $25 billion for “ambitious” transportation projects “too large for current funding programs.”

And, in a boost to electronic vehicle makers, a $174 billion investment to “win the EV market” by spurring domestic supply chains and giving consumers rebates to buy them.

$650 billion for 'home infrastructure'

These funds would go to broadband, clean water, the electric grid, and high-quality housing.

Among other things, it would replace 100% of the water-bearing lead pipes and service lines across the country, which the White House says serve as many as 10 million families.

It also proposes broadband access for some 35% of rural Americans who don’t have the service, building or retrofitting two million housing units, and veterans hospitals.

There’s $100 billion to “upgrade and build new public schools, through $50 billion in direct grants and an additional $50 billion leveraged through bonds.”

The proposal includes capping and sealing oil and gas wells and abandoned mines, the which the White House says will create “hundreds of thousands” of jobs in area where oil and mining employment has dried up.

$400 billion for the 'care economy'

One in six essential care workers live in poverty, the White House said.

The plan will fund home or community-based care for hundreds of thousands of senior citizens and people with disabilities, creating “well-paying caregiving jobs with benefits.”

$580 billion for manufacturing, training, research

The figure includes a $50 billion investment in domestic semiconductor manufacturing, $180 billion in research and development with a focus on clean energy, and unspecified amounts as incentives for companies to create new jobs in coal communities and grow the U.S. supply chain.

What is the World Economic Forum doing on infrastructure?

Raise corporate taxes to foot the bill

The plan would make multiple changes to U.S. tax rules, to put the cost of the plan entirely on companies.

These include raising the U.S. corporate tax rate to 28% from the 21% levy set by the Trump administration’s 2017 tax bill, eliminating all fossil fuel industry subsidies and loopholes, and establishing a minimum tax on income companies use to report profits to investors.

The reforms will add 0.5% to U.S. GDP per year in corporate revenue, which the White House says will fully pay for investments within the next 15 years, and reduce the government deficit after that.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

United States

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Supply Chains and TransportationSee all

Isabel Cane and Rob Strayer

November 13, 2025