Issue Briefing: What’s next for decentralized finance (DeFi)?

Listen to the article

- Decentralized Finance (DeFi), a category of financial services that doesn't rely on central institutions, aims to transform traditional forms of finance by reconstructing and reimagining services.

- Interest in DeFi rose sharply during the pandemic, and governments are closely watching cryptocurrencies and decentralized applications.

- Watch the issue briefing to learn what are the ways in which we could accelerate the benefits and mitigate the risks of DeFi.

Over $58 billion USD is now locked in blockchain-based decentralized finance (DeFi) – and governments around the world are starting to pay attention. Join this issue briefing to hear from experts on the future of decentralized finance and the global policy outlook for this quickly evolving space.

Speakers:

Robert Leshner, Founder and CEO, Compound Labs

Paul Maley, Managing Director, Deutsche Bank

Miller Whitehouse-Levine, Policy Director, DeFi Education Fund

Jehudi Castro-Sierra, Digital Transformation Advisor, Presidency of Colombia

Sheila Warren, Head of Blockchain & Digital Assets, World Economic Forum

Moderator:

Deirdre Bosa, “TechCheck” Co-Anchor, CNBC

Have you read?

On the opportunities of DeFi

DeFi is like the early Internet: its success was a result of not constricting how it gets used and where it gets used. It was a global technology, and it’s one that was completely unexpected and disruptive. Its success came from allowing it to flourish without prematurely adding rules for how and where and why it should be used.

”We as a human society should be thinking about access to financial services and basic financial services which are pretty much a prerequisite to wealth creation. The Internet provides a very efficient way to bring people into the financial system and an Internet native financial system like decentralized finance could be a great solution.

”There are huge opportunities here - especially for Colombia - the opportunity for inclusion is very important.

”Our goal is to provide democratized access to the broader part of the population. We have to examine the likelihood that our current regulatory environment doesn't necessarily lead to that.

”On when to regulate:

Regulators are going to have to look at this from a different angle when they think about what types of regulation should exist. It's not going to look like the same problems that exist in the current financial markets, it's going to look like entirely new problems.

You can't regulate this space without understanding why this technology provides such novel opportunities.

”When the technology is as new as AI, crypto, and DeFi, it’s not a good idea to regulate straightaway. Most of the regulation for the traditional financial system depends on central institutions as a touch point. We shouldn't make it fit. We first need ways to learn, as governments and innovators, and to allow innovation.

”User safety doesn't come from trying to protect how users interact with it. It comes from making sure the infrastructure is safe.

”The regulators don't actually want to regulate the technology. What they want to do is regulate financial products and they want to look after end users and customers.

”On traditional banking and DeFi

Adoption is coming from fintech companies in the middle. Large banks and institutions are going to have to work really, really hard to not be left behind.

”It's necessary for any bank that wants to compete in the future, to make sure they have an ability to interact and interoperate with DeFi systems as they emerge.

This is actually going to happen, but the question everyone has been asking is how and in what order. We don't know the answer to those.

”There's a massive competitive advantage to whichever banks dive into this first.

”Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

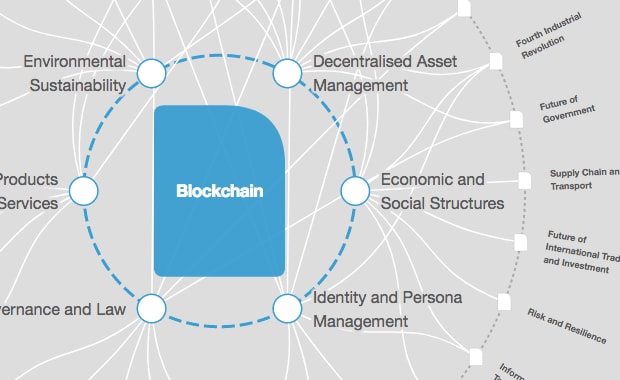

Blockchain

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Emerging TechnologiesSee all

Dr Gideon Lapidoth and Madeleine North

November 17, 2025