What keeps Chief Innovation Officers up at night when engaging with deep-tech startups

A new IESE study looks at the top 7 concerns keeping CINOs awake at night. Image: iStock

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Emerging Technologies

- Global investment in deep-tech startups has quadrupled in recent years, rising from $15 billion in 2016 to $60 billion in 2020.

- An IESE study analyses more than 100 companies working with deep-tech startups to understand the challenges they face as well as the best practices to better collaborate.

- The top concerns for CINOs partnering with deep-tech startups include tech evaluation, risk of short-term view, internal alignment of KPIs, regulation and regional fragmentation.

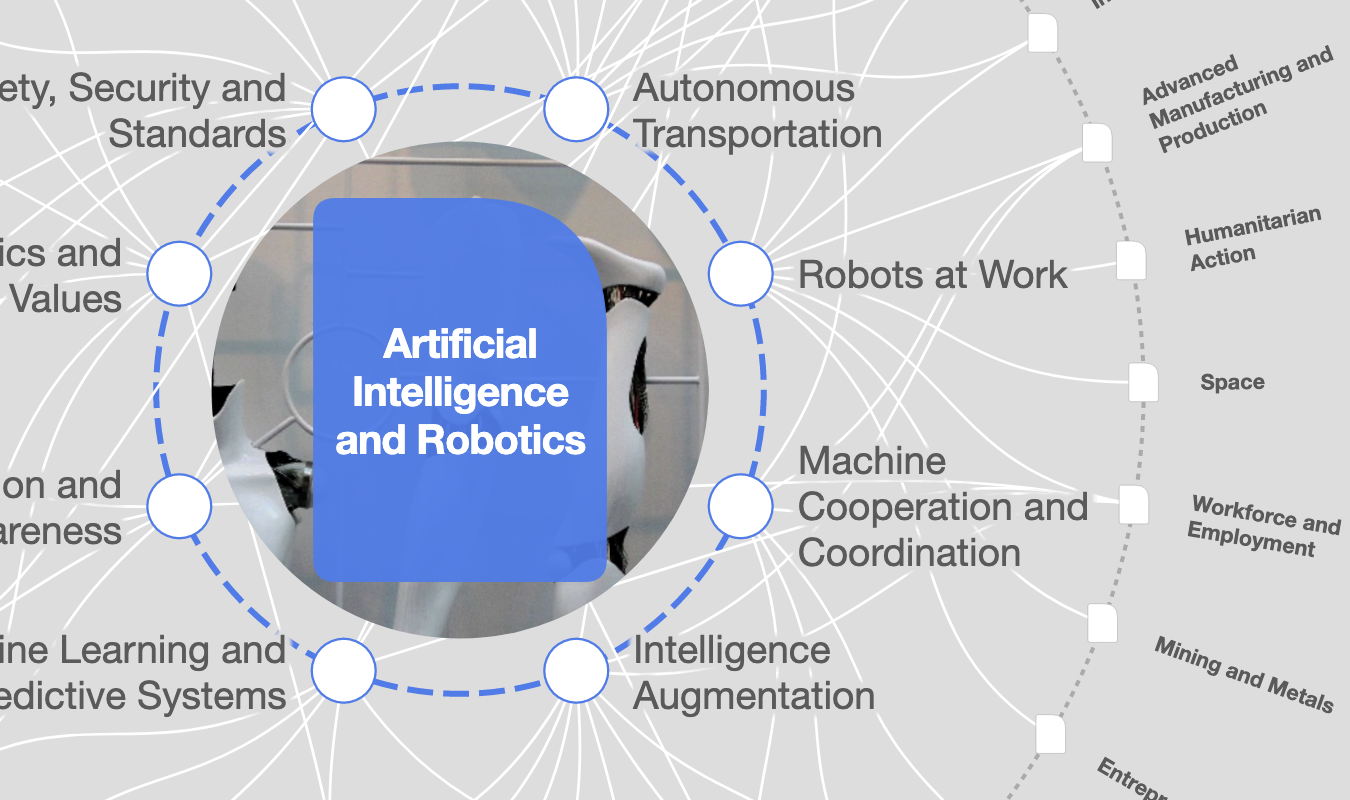

Global investment in deep-tech startups has quadrupled in recent years, rising from $15 billion in 2016 to $60 billion in 2020, according to BCG data. These technologies are often based on scientific discoveries or meaningful engineering innovations, offering a substantial advance over established technologies and a path to tackle some of the world's fundamental challenges. The list includes artificial intelligence, advanced materials, biotechnology, blockchain, robotics and drones, photonics and electronics, as well as quantum computing.

Large companies such as Toyota, Alibaba and Lenovo are already innovating through partnerships with startups in the deep-tech field – that is, with ventures in emerging technologies. For instance, the startup IonQ raised a $55 million funding round co-led by the tech conglomerate Samsung to collaborate in the quantum computing field.

Diving into this rising development, a new IESE study analyses more than 100 Asian companies collaborating with startups – a practice known as corporate venturing – to understand the challenges faced as well as the best practices applied between corporations and deep-tech startups to better collaborate, keeping in mind that in 2019 Asia accounted for 40% of corporate venturing investments in the world.

Major challenges

Deep-tech-based products are often developed by highly qualified experts, often PhDs. They tend to take more time and capital to develop, as they often require long developments, in-depth testing and periodic reviews. Many deep-tech initiatives have their roots in academia and are funded by government grants. After getting a viable prototype, the products’ time-to-market are long, even exceeding five years. And the ventures carry a lot of risks – risks that can be compounded by a lack of business expertise.

Larger companies that have partnered with deep-tech startups are already innovating, while they also face particular challenges. Based on 77 interviews with innovation leaders and the analysis of more than 180 Asian companies, the top seven concerns keeping chief innovation officers (CINOs) awake at night are: technology evaluation, risk of a short-term view, internal alignment of KPIs, regulation, regional fragmentation, silos between R&D and corporate venturing teams, and top-down management.

Four tips for collaborating with deep-tech startups

The report offers up 17 points that could be helpful to companies partnering with deep-tech startups. Below is a brief selection, looking at issues of governance, hierarchies and risk perception.

1. Secure an unbiased technology evaluation for the deep-tech startup. To help R&D and corporate venturing teams be open towards solutions created outside the company, consider two variables. Firstly, who has the technical knowledge for conducting the technology evaluation? That would most likely be the R&D department, the corporate venturing team, or an expert outside the corporation. Secondly, is the R&D department biased towards its own developments? If so, some companies are leveraging the opinion of an independent expert, outside the corporation, avoiding internal biases. Others have a shared mandate across both teams: R&D and corporate venturing. If they have different mandates, then they have a joint boss with expertise in both the venturing and the technical side to provide a safe solution.

2. Design an innovation architecture that takes into consideration the particular risks of each corporate venturing mechanism. Of all the corporate venturing options for deep-tech startups, the three riskiest were perceived to be startup acquisitions, corporate venture capital and venture builders. The safest, in terms of corporate perception, were hackathons, scouting missions and challenge prizes. Evaluate the amount of risk that your company is willing to take on, among other factors, to pick the best mechanisms for you. You can also minimise risk by building a simple test environment (sandbox) to carry out the minimum proof of concept and then gradually increase the resources allocated to the project. One example is the Developer Sandbox, created by the Thai Siam Commercial Bank. The platform enables developers and entrepreneurs to test third-party apps in an interface that mirrors the bank’s live environment.

3. Work to counteract the disadvantages of a top-down corporate venturing approach to boost employee motivation, creativity and faster approvals. These policies may include, for instance, shortcutting bottom-up approvals by securing a sponsor in the executive committee to speed up corporate venturing decisions, or by having a flexible upper-management involvement depending on thresholds of resources required (e.g., a $20-million investment in a deep-tech startup may require a higher involvement of upper management than launching a hackathon in deep tech). For example, the Chinese tech giant Tencent sought to grow through its WeChat app. The company combined two distinct paths to innovation. It launched WeChat with a traditional top-down approach to provide an unequivocally clear vision, with precise information coming from a single architect. But when incremental innovations were sought to keep growing, a bottom-up approach allowed more input for improvements.

4. Tailor your pitch and focus on use cases rather than technology. Other executive committee members may prefer arguments related to long-term strategy. Drilling down, business units might favour more focus on the short or medium term. Once your corporate venturing team achieves a success case in one business unit, ask them to take it to the rest of the company. Moreover, in this pitch, tell them not to start with the technology but with a problem to solve through a clear use case, focusing on the quantitative and translated impact. Involving business units in the creation of this use case could help increase acceptance along the way.

The IESE report, “Open Innovation: How Corporate Giants Can Better Collaborate with Deep-Tech Start-ups. The Case of East and Southeast Asia”, was released in the Corporate Innovation Summit hosted by the Hong Kong Science and Technology Parks Corporation (HKSTP).

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Emerging TechnologiesSee all

Juliana Guaqueta Ospina

April 11, 2024

Simon Torkington

April 8, 2024

Nikolai Khlystov and Gayle Markovitz

April 8, 2024

Victoria Masterson

April 4, 2024

Gareth Francis

April 3, 2024