How to scale-up investment in sustainable mobility

DC Circulator, Washington DC electric passenger bus. The transportation sector is the third largest contributor to global GHG emissions. Image: Photo by Mario Sessions on Unsplash

- The current pace of transformation towards decarbonization is too slow and barriers to zero emission road transport must be addressed.

- Key barriers include a lack of coordinated investment which could be mitigated via a collaborative multistakeholder approach.

- A new report from the World Economic Forum in collaboration with McKinsey & Company proposes six sustainable mobility investment cases.

- The importance of large scale investments to accelerate the transition in the mobility sector was discussed in two sessions at the World Economic Forum’s Sustainable Development Impact Summit: Globalizing Sustainability Mobility Transition and Financing Green Investments in Cities.

Just six years after signing the Paris Climate Agreement and the culmination of extreme global weather events, climate change and decarbonization are at the forefront of many minds in government and industry. Research suggests that greenhouse gas (GHG) emissions need to decrease much faster than anticipated to meet the 1.5℃ temperature increase cap from pre-industrial levels target.

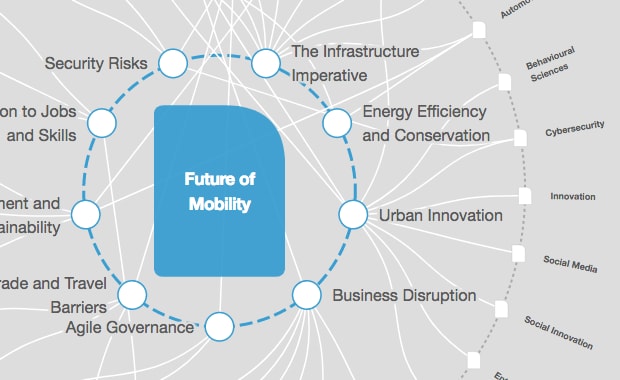

The transportation sector is the third largest contributor to global GHG emissions, and the only sector where emissions are still increasing even in developed countries, making it vital in our climate crisis battle. Yet the current pace of transition from internal combustion engine (ICE) to zero-emission vehicles is unlikely to be sufficient, largely due to lack of coordinated large scale financing and business models that can attract it.

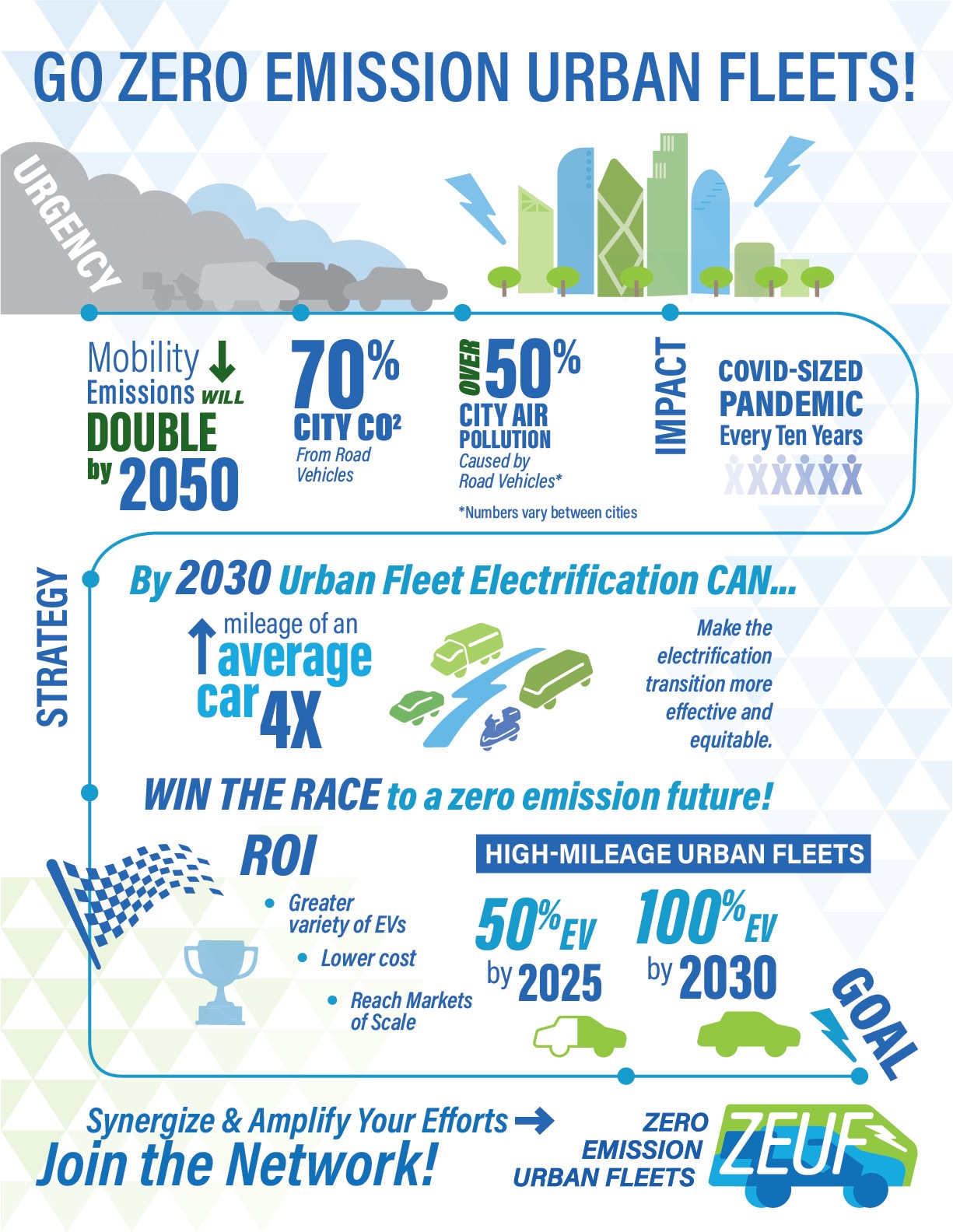

Fleets – a large number of vehicles managed by a single entity – represent an opportunity to accelerate the zero-emission transition in transportation for two reasons: by targeting fleets, particularly those of larger operators, multiple vehicles can be transitioned to zero emissions at once; most fleets consist of commercial vehicles, which typically have a higher vehicle usage rate that private vehicles, hence higher CO2 emissions, than their non-commercial counterparts.

According to several studies, concentrating efforts on electrifying fleets rather than privately owned vehicles could accelerate reductions in CO2 emissions by up to four times in the next 10 years.

”Derived primarily from the insights of industry, investors, and public-sector representatives gathered through working sessions and interviews, we identified the following key barriers to a faster transition to zero-emission transportation:

- Long investment horizons to achieve positive business cases.

- Chicken-and-egg problem of limited charging and refuelling infrastructure in advance demand take-up (at scale) of alternative powertrain vehicles.

- Need for significant large-scale investment.

- Non-negligible risk – at least for a single industry player or private investor.

As part of a collaborative effort between the World Economic Forum, the Long-Term Investment Organization (LTIO), and McKinsey & Company to advance the scale-up of road mobility finance, we scoped initial investment archetypes that overcome these challenges.

The Forum in collaboration with McKinsey & Company has launched a joint report, Unlocking Large-Scale, Long-Term Capital for Sustainable Mobility: Introducing Key Mobility Investment Archetypes, that introduces six proposed sustainable mobility investment cases. These sustainable mobility investment cases propose collaborative solutions to collective transition barriers along the domestic transport sub-asset classes that make up 95% of emissions in the sector: buses, passenger cars, trucks, and last mile delivery vehicles – plus charging infrastructure, which is a key enabler for all sub-asset classes.

How is the World Economic Forum helping to scale vehicle electrification?

These investment cases are designed to unlock large-scale capital flows to sustainable mobility by aggregating and matching demand and supply. They also propose a private-public partnership approach to unleash investment from the private sector. The proposed solutions mitigate the chicken-and-egg problem, thus allowing a scaled solution that moves beyond one-off projects and is quickly scalable beyond pilot locations.

The report and the cases described are meant to introduce the programme; they are by no means exhaustive. While the investment opportunities presented largely focus on early-adopter regions in Organisation for Economic Co-operation and Development (OECD) nations, the intent is to also deploy them in developing economies as rapidly as possible. McKinsey & Company estimates that €28 trillion of additional investments will be required to reach net-zero emissions by 2050 in the 27 European Union members alone, compared to a scenario with no climate action.

The domestic transportation sector alone accounts for 21% of European GHG emissions (10% for transport globally) and up to 40% of the total investment need (€12 trillion), highlighting the need for abatement in this critical sector in this region. In emerging markets, the opportunity to leapfrog unsustainable transportation ecosystems is too large to ignore. To name a few first movers: the Indian government created an aggregated demand model for e-bus and two- and three-wheeler fleets; some Chinese cities introduced far reaching regulations in favour of vast bus and taxi electrification; and in Latin America grid companies, banks and operators are crafting joint investment opportunities.

The challenges facing these investment cases differ, but they share common ground in two ways: significant funding would be needed to reach global climate targets and individual players will likely not be able to go the way alone. A collaborative solution to the unpreceded challenge faced by the sustainable mobility sector today would focus on leveraging the combined power of industry leaders, governments, regulators, and global long-term investors to achieve a mutually beneficial solution. Such a large-scale effort is unique and will not come without challenges, however, if successful, could have the potential to change the transportation industry landscape for good.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Mobility

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Roberto Bocca

November 17, 2025