Is a recession needed to end US inflation? Plus other news on the economy you need to read this week

With inflation rising to double-digit territory, households are burning through their savings. Image: Unsplash/engin akyurt

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Financial and Monetary Systems

Listen to the article

- This weekly round-up brings you key economic stories from the past seven days.

- Top Economy stories: ‘Difficult to bring down inflation without a recession’, Fed’s Esther George says; Eurozone banks could be set for a big hit; Japan’s economy unexpectedly shrinks

1. Is a recession needed to end US inflation?

Inflation is at risk of becoming entrenched in the economy because of an overheated job market, making it difficult for the US Federal Reserve to bring down inflation without a recession, says Kansas City Federal Reserve President Esther George.

"I'm looking at a labour market that is so tight, I don't know how you continue to bring this level of inflation down without having some real slowing, and maybe we even have contraction in the economy to get there," George told The Wall Street Journal.

George last week reiterated her support for a slower pace of US interest rate increases, calling for a "more measured" approach that gives the central bank time to judge how the rises in borrowing costs are affecting the economy, Reuters reports.

"I continue to see several advantages for a steady and deliberate approach to raising the policy rate," George has said.

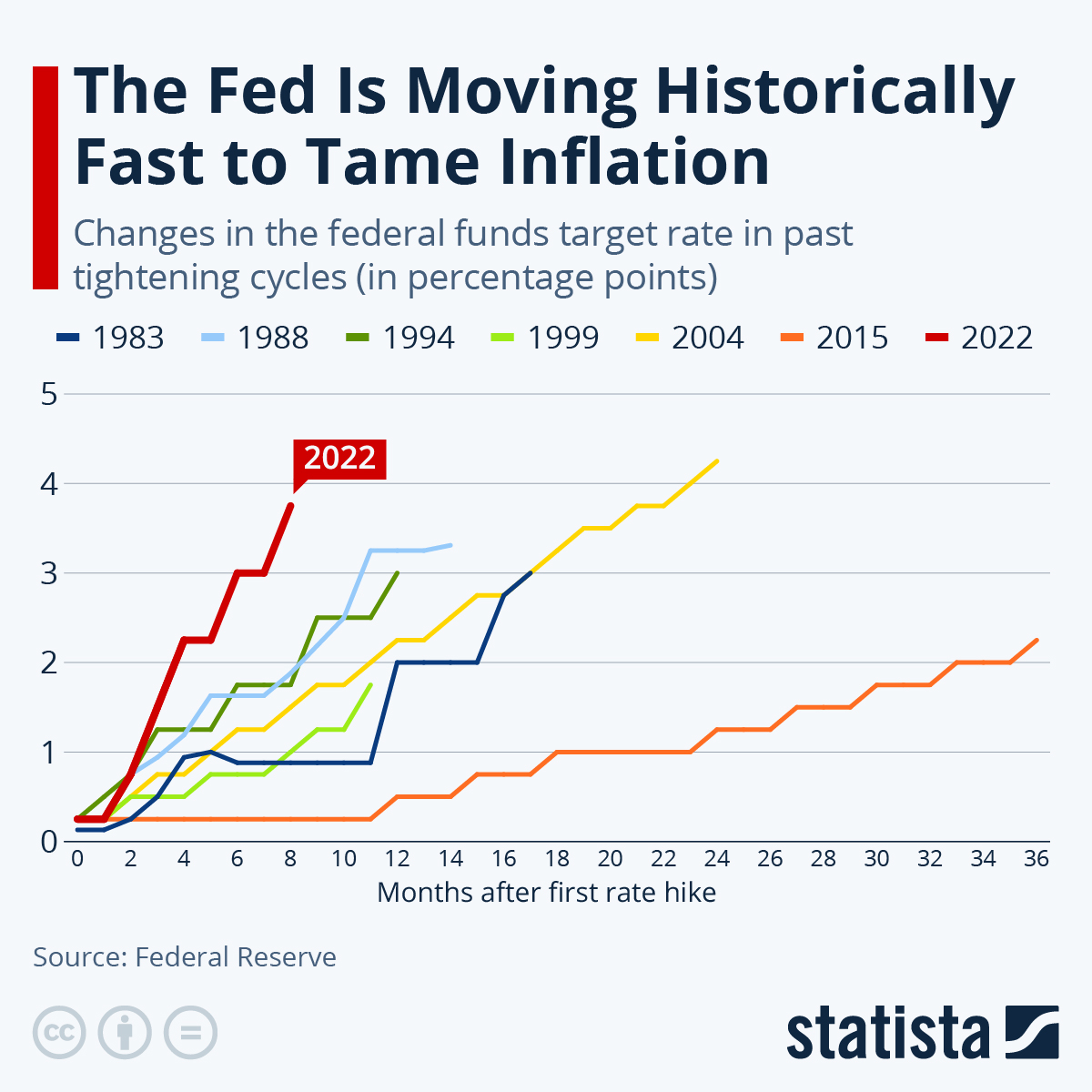

The Fed has lifted short-term borrowing costs at an extraordinarily fast pace this year, including four straight 75-basis-point hikes that have brought the central bank's benchmark overnight interest rate from near zero in March to the current 3.75-4.00%.

2. Eurozone banks could face substantial hit as households suffer, ECB warns

Eurozone banks may see a surge in “soured loans” as rapid inflation and rising interest rates hit household incomes, particularly among the bloc's poorest, the European Central Bank (ECB) said in a fresh study on 15 November. Soured loans are loans where the borrower has made no payment for 90 days or more.

With inflation rising to double-digit territory, households are burning through their savings with little respite in sight as income growth trails far behind. This is especially true for the poorest, who are disproportionately hit by surging food and fuel costs, Reuters reports.

"While outright defaults are likely to increase only slightly, the downside risks to banks’ asset quality are increasing, especially in vulnerable countries," the ECB said.

Europe's banks also risk a significant hit to their profits if house prices across the region begin to slide, regulators and ratings agencies have warned. Banks have "substantially" increased their exposure to mortgages in recent years, and are seeing some early signs of asset quality deterioration, the European Banking Authority said.

What is the World Economic Forum doing about blockchain in supply chains?

3. News in brief: Stories on the economy from around the world

Japan's economy unexpectedly shrank for the first time in a year in the third quarter. This has stoked further uncertainty about the country’s economic outlook, as global recession risks, a weak yen and higher import costs take a toll on household consumption and businesses.

India's annual retail inflation eased to a three-month low of 6.77% in October, helped by a slower rise in food prices and a higher base effect. This has strengthened the chances of the country's central bank making smaller interest rate hikes at its meeting next month.

Signs of weakness are emerging across the Chinese economy, despite authorities bucking the global trend so far this year by deploying monetary and fiscal easing. Exports have fallen, new bank lending has tumbled and inflation has slowed, according to Reuters.

Malaysia's economy expanded at its fastest pace in over a year in the third quarter, outrunning the growth rate in many other Southeast Asian countries. But its central bank says the outlook is clouded by the risk of a global slowdown.

The eurozone swung to a large trade deficit in September from a small surplus a year earlier due to a surge in the costs of imported energy in the wake of Russia's invasion of Ukraine. But the deficit was smaller than expected, data showed.

Israel's economic growth slowed in the third quarter as consumer spending weakened. However, it still appears likely that high inflation will prompt another hefty interest rate hike by the Bank of Israel next week, Reuters reports.

More on economics from Agenda

The Great Resignation, in which tens of millions of Americans left their jobs during the pandemic, lost some steam in September, according to a report. But historically speaking, the number of Americans leaving their jobs is still very high.

A new survey shows that a majority of Americans believe cryptocurrency is the future of finance. With strong appeal to young people and minorities, cryptocurrency has the potential to create a fairer economy.

The US Federal Reserve has signalled that it may soon slow the pace of its interest rate hikes. The change in mood follows a slight easing of inflationary pressure in recent months.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Spencer Feingold

April 16, 2024

Joe Myers

April 12, 2024

John Hope Bryant

April 11, 2024

Spencer Feingold and Johnny Wood

April 10, 2024

Morgan Camp

April 9, 2024