2022 was a hard year for crypto — but it may have been just what the industry needed

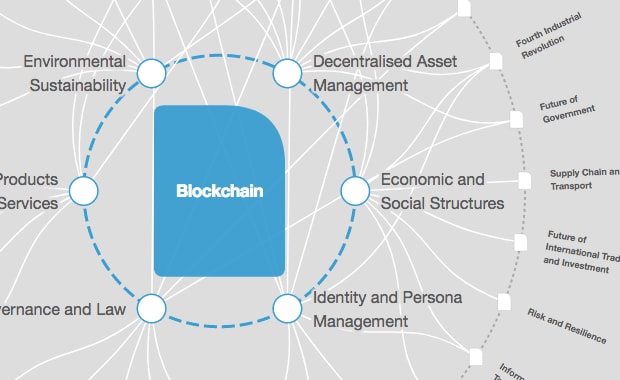

Blockchain is the technological foundation of cryptocurrencies — but its potential applications far exceed the simple exchange of digital currencies. Image: Getty Images/iStockphoto

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Blockchain

Listen to the article

- 2022's crypto collapse wiped out roughly $2 trillion worth of crypto assets.

- As the sector enters a period of stability, good actors must come together to deliver a digital assets industry that promotes the safe, sound and compliant development of blockchain-powered tech.

- The Forum's Digital Currency Governance Consortium is examining how to regulate crypto assets most effectively, without hindering innovation.

Consumers, businesses and investors around the world lost nearly $2 trillion in the digital assets market last year. By any measure, the systemic failures in the digital assets market in 2022 were eye-watering — some argue they are still reverberating in 2023, with correlations in the evolving banking crisis.

Many of 2022’s crypto losses were triggered by a daisy chain of events that began with the collapse of the stable-in-name-only Terra-Luna token, and were punctuated by the collapse of FTX.

The remaining viable players in the crypto industry must take a hard look in the mirror to regain market trust, particularly among regulators and policymakers. Regulators and policymakers, meanwhile, should take heed in not overreacting to crypto risks but responsibly harness the technology.

With jurisdictions adopting policies across the spectrum, de-banking and de-risking are emerging as major threats to the industry. These trends have unintended consequences and, over time, may produce more harm to the countries (and markets) that adopt these policies than the knee-jerk corrections to last year’s financial misdeeds.

Countries that lead in the development of the third generation of the internet (what some are calling Web3), and the novel industries and business models it will produce (including in the core of finance and banking), will prevail in the digital currency race.

Crypto and financial transparency

Crypto assets, like banking or any other sector involving the storage and movement of money, are rife with risks. But one area where the technology works, even in extreme cases such as clamping down on sanctions evasion, is in making financial activity more transparent, unalterable and discoverable.

This is a by-product of three main factors. The first is that even since the earliest days the transactional ledger of public blockchains leave behind proverbial digital breadcrumbs that have enabled an entire crypto forensics and crime fighting industry to flourish. These actors, companies and the cutting-edge tools and financial crime typologies they are using are constantly evolving. This has made anyone with an internet-connected device a part of the collective witness, making illicit activity difficult and, in most cases, making it impractical to hide in crypto markets.

The second factor is attributable to sensible, coordinated global policy under Financial Action Task Force (FATF) virtual asset service provider (VASPs) requirements. Registered VASPs are in effect the onramps to the always-on digital economy. These VASP requirements were later strengthened with FATF recommendation 16, which was first put in place in 2016 and has set a floor for Travel Rule compliance. These firms, like corresponding banking networks before them, have adopted a host of collective defense approaches that have made travel rule conformity possible. They have also collaborated on keeping digital asset networks open, while giving bad actors fewer places to hide.

Finally, and perhaps most critically, the consolidation of risk and financial integrity focused efforts among well-regulated actors in the industry are also driving material improvements in financial crime compliance through collective defense. Examples include the TRUST network — collaborative open-source technologies to address challenges like the global identity gap, which are endemic to the global economy and not just digital assets. The very technologies that have supported trillions in economic activity and spurred global digital wallet networks can be strengthened with privacy-preserving digital ID standards.

The consequences of fragmented policy

Traditionally fintech-forward jurisdictions have some nuanced choices to make. It is encouraging to see that even since the onset of the so-called crypto winter in 2022, Singapore, Hong Kong and Japan have been engaging with the crypto industry through fintech festivals as well as comprehensive consultations. They join other jurisdictions, from the UAE to Europe, in their comprehensive regulatory frameworks to crypto assets.

While these signals are positive, divergence in financial crime compliance standards could have unintended consequences. It could not only create potentially perilous regional differences in conditions, but it could also cause a flight from regulatory stringency that ignores the maturity curve of crypto asset compliance while reducing the aperture of financial risk reporting.

How is the World Economic Forum promoting the responsible use of blockchain?

Crypto regulation that works for all

Rather than adopting onerous or implausible financial crime compliance standards for digital assets focused only on one jurisdiction, jurisdictions around the world should follow a risk-based glidepath, keeping global and cross-border realities in mind.

This includes the following key policy recommendations:

● Adoption of a harmonised approach to the execution of VASP registration and licensing evaluations, including the possibility of passporting VASP registrations standards from stronger jurisdictions to weaker ones.

● Adoption of a risk-based approach on travel rule conformity that incentivises and harmonises regional and global standards on digital asset risk reporting.

● Adoption of a time-bound glidepath that escalates transactional reporting criteria in line with regional or global jurisdictions. For example, escalating up to 60% travel rule reporting over a 36-month horizon. This can follow a stringent evaluation of the holistic compliance programme of registered VASPs in a jurisdiction or across regional networks.

● Promotion and establishment of regional and global public-private collaboration, risk-sharing and reporting networks among participant jurisdictions and digital asset intermediaries, including the review of passporting opportunities.

● Collaboration, development and dissemination of best practices, tools and typologies to track, trace and prevent illicit activity in the digital asset economy; a critical precondition for the safe growth of the sector, including with potential central bank digital currencies (CBDCs).

● Promotion, development and dissemination of digital identity standards and privacy-preserving technologies that can enhance “know your customer” and “know your business” screening throughout digital wallet networks.

The word crypto and the broader digital asset industry is not monolithic. Like all areas of the economy, there are good actors and bad. Now, more than ever, it is critical that the good actors and the good jurisdictions deliver on promoting the safe, sound and compliant development of blockchain-powered, always-on financial services.

The Forum’s Digital Currency Governance Consortium, composed of more than 80 organizations, is examining pathways to regulating crypto assets with a global lens in its forthcoming paper.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on BlockchainSee all

Scott Doughman

December 5, 2023

Shawn Dej and Sandra Waliczek

October 19, 2023

Scott Doughman

September 22, 2023