How will the TPP affect Japan’s economy?

Stay up to date:

Japan

This article is published in collaboration with VOX EU.

A broad agreement on the Trans-Pacific Partnership (TPP) has finally been reached (Menon 2015). Can we expect it to accelerate Japan’s economic growth?

In March 2013, I wrote an article for the RIETI website in which I argued that the TPP would raise Japan’s per capita GDP growth rate by about 1.5 percentage points (Todo 2013a). This estimate was rather high compared to the government’s preliminary calculations in 2013, but if my forecast is correct, the enactment of the TPP will enable Japan to easily meet the Abe administration’s nominal GDP goal of 600 trillion yen.

The reason we can expect such a prominent growth effect from the TPP is that, in addition to deregulation of trade in goods, the deregulation of trade in services (retail, finance, intellectual property, etc.) and foreign investment will have a major impact on the economy. Moreover, the further economic integration will bring more face-to-face communication across borders. Therefore, the TPP will able to contribute to perpetual economic growth by promoting innovation through fully utilising outsiders’ knowledge (see Todo 2013).

Viewed from such a perspective, the recent broad agreement on the TPP is a big step forward, in that the TPP will not only lower tariffs on automotive and other products, but will also deregulate trade in services and foreign investment. In the areas of foreign investment and service trade – such as retail and finance – parties to the TPP as a rule would use negative listing. In other words, all business areas would be deregulated other than those specifically listed by each country. In Vietnam and Malaysia, regulations on foreign capital would be eased. This will encourage Japanese firms to enter overseas markets and further deepen Japanese firms’ production networks in Asia, and should increase the income of the Japanese people. Stronger protection of intellectual property rights in member nations should also raise exports of Japanese technology and copyrighted property.

Additional policies are necessary

However, additional policies are necessary to enjoy the maximum benefit from the TPP. For example, my estimates on the TPP take into account that small and medium enterprises (SMEs) with technological strength start exporting, further enhancing their technological capabilities by using foreign knowledge, and continuing to grow. However, as I have shown (Todo and Sato 2011), although many SMEs are potentially competitive enough to enter foreign markets, they in fact don’t because of insufficient information or manpower, or concerns about the risk. In addition, many of those already exporting are not taking advantage of existing economic partnership agreements (EPAs), due to a lack of information, and the complexity of the application procedures for obtaining a certificate of origin needed to utilise EPAs (Mitsuya and Urata 2011). Therefore, unless the government supports SMEs in obtaining more information (e.g. seminars to promote exporting; explaining how to utilise EPAs), and simplify the application procedures for obtaining certificates of origin, it is very possible that the TPP will not be fully utilised. Furthermore, because firm size matters for the efficient entry of foreign markets, the government needs to support SMEs to promote mergers and acquisitions to expand their firm size.

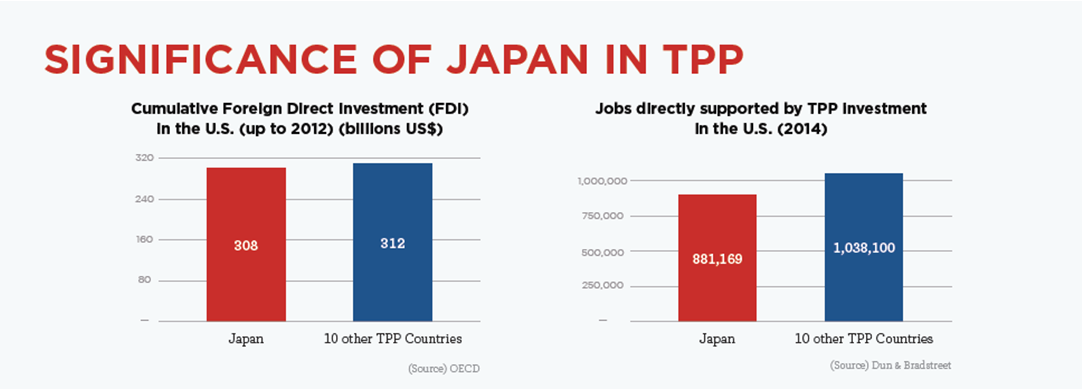

Another key factor is the effect of FDI in Japan. Empirical research shows that knowledge spillovers from FDI in research and development activities in Japan will increase the productivity of Japanese firms (Todo 2006). If the TPP increases FDI in Japan, it would bring new knowledge and information from overseas and prime the pump for innovation in Japan. The FDI will have a major economic impact on Japan as it would also increase employment.

However, FDI inflows to Japan were equivalent to a mere 0.1% of GDP in 2010-2013 on average, significantly lower than the OECD average of 1.9%. Clearly, there is room for FDI to Japan to grow. However, unlike FDI to Malaysia or Vietnam, where the TPP would vastly accelerate deregulation, FDI to Japan is already legally deregulated to a large extent. Therefore, even though the TPP would create a more transparent environment for investment and give a boost to Japan’s expectations for growth, it is not necessarily clear if the TPP would bring much more FDI to Japan, as is expected1.

Therefore, to ensure that the TPP significantly increases FDI to Japan, it needs to be combined with other new policies. In particular, there are very few foreign firms in Japan that invest in areas outside Tokyo, because scarcely any information about these regional economies is available outside Japan. Attracting foreign firms to the regional areas could trigger regional revitalisation by, for example, organising investment seminars that provide information on regional economies, including specific technology and knowledge of universities and SMEs in the regions. Preparing an environment in regional areas to make living easier for non-Japanese to settle there would also be helpful, for example, by providing more English signboards and increasing the number of international schools.

In fact, promoting internationalisation of SMEs and expanding FDI to Japan, as described above, are among the measures that the Abe administration has advocated in its Japan Revitalisation Strategy. The establishment of the TPP would be a good opportunity to actively promote measures to support industry-industry and university-industry partnerships, as well as ties between Japan’s outlying regions and foreign firms. By doing so, Japan could maximise the economic benefit of the TPP.

Protectionist policy is counterproductive

On the other hand, if Japan adopts protectionist policies for protecting agriculture and other domestic industries, the TPP will be of limited effect. Protected industries become exclusive to safeguard their economic rents. Any innovation that can be achieved by ties with outsiders will be nipped in the bud.

The history of deregulation in agriculture shows that domestic production did not fall all that much after the partial deregulation of imports of cherries in 1977 and beef in 1990 (Todo 2013b). That is because farmers learned to be more efficient and successfully differentiated their products. High-quality domestic products could coexist with cheaper imports in the domestic market. So even if the TPP lowers agricultural tariffs, it could in fact make Japan’s agriculture competitive. In that sense, it was most unfortunate that Japan retained trade barriers on products like rice and dairy, thereby missing an opportunity to make production of such agricultural products competitive.

However, even with agricultural products with lowered tariffs, it is necessary to make good use of the wisdom of outsiders by actively collaborating with private sectors and universities and keeping close linkages with overseas to bring innovation and improve its production efficiency, in order for Japan’s agriculture to become more competitive. The government should support agriculture, forestry and fishery, as well as manufacturing and service sectors, to make use of such linkages and thereby maximise the effect of the TPP.

Editor’s note: This column was reproduced with permission from the Research Institute of Economy, Trade and Industry (RIETI).

References

Menon, J (2015) “TPP unveiled”, Voxeu.org, 29 November.

Petri, P and M G Plummer (2012) “The Trans-Pacific Partnership and Asia-Pacific integration: Policy implications”, Peterson Institute for International Economics, Policy Brief (For details:http://asiapacifictrade.org/).

Todo, Y and H Sato (2014) “Effects of CEOs’ characteristics on internationalization of small and medium firms in Japan,” Journal of the Japanese and International Economies, 34: 236-255.

Todo, Y (2006) “Knowledge spillovers from Foreign Direct Investment in R&D: Evidence from Japanese firm-level data,” Journal of Asian Economics 17, 996-1013.

Todo, Y (2013a) “Estimating the TPP’s Expected Growth Effects”, RIETI, Policy Update 048.

Todo, Y (2013b) “True potential power of the Japanese economy and TPP”, in TPP and Japan’s Choice, K Ishikawa, K Umada, F Kimura and Y Watanabe (eds), Bunshindo.

Endnotes

[1] Petri and Plummer (2012) is used to estimate that the TPP will increase FDI to Japan.

Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Yasuyuki Todo is a Professor in the Faculty of Political Science and Economics.

Image: A businessman walks in Tokyo’s business district. REUTERS/Toru Hanai.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Ali Alwaleed Al-Thani and Santiago Banales

July 21, 2025

Juan Caballero and Ana Sampaio

July 18, 2025

John Letzing

July 17, 2025

William Dixon

July 16, 2025

Aengus Collins

July 15, 2025

Guy Miller

July 15, 2025