How should financial institutions navigate a fragmented world?

Financial institutions face cross-border challenges and must assess exposure, manage geopolitical risks and plan for multiple future scenarios. Image: Ivor Saveliev/Unsplash

- Rising trade barriers and global tariffs are fragmenting the global financial system, with global growth projected to slow to 2.3% in 2025.

- Financial institutions face cross-border challenges and must assess exposure, manage geopolitical risks and plan for multiple future scenarios.

- Long-term strategies include diversifying partnerships, adjusting market positioning and clearly communicating the financial impact of fragmentation to stakeholders.

The world has changed dramatically since the beginning of 2025, with an unexpectedly severe escalation in the use of tariffs and other trade barriers threatening the global economy.

This escalation was precipitated by the implementation of the sweeping 'Liberation Day' tariffs by the United States, announced on 2 April 2025. These tariffs were the most significant US tariff hike since the 1930s, and sparked market volatility and global trade disruptions while raising the specter of rising inflation and reduced economic output. The predicted impacts are starting to appear in economic data, including in a recent World Bank report indicating that global growth is expected to weaken to 2.3% in 2025 and that the deceleration is “linked to a substantial rise in trade barriers and the pervasive effects of an uncertain global policy environment”.

In the context of increasing fragmentation in the global financial system stemming from tariff policy, conflict between the US and China has been a driving force. Restrictions have caused a 35% year-over-year decline in US imports of Chinese goods, among other impacts. More signs of fragmentation are appearing, with tariffs and restrictions imposed and the threat of further action on the horizon between the US, China and other countries.

Higher fragmentation and ongoing uncertainty make it more difficult for financial institutions to operate across borders and drive investment and economic growth around the world. What steps can these institutions take to weather the volatility ahead?

How the Forum helps leaders understand change in global financial systems

Update on the global economic picture: Higher baseline fragmentation

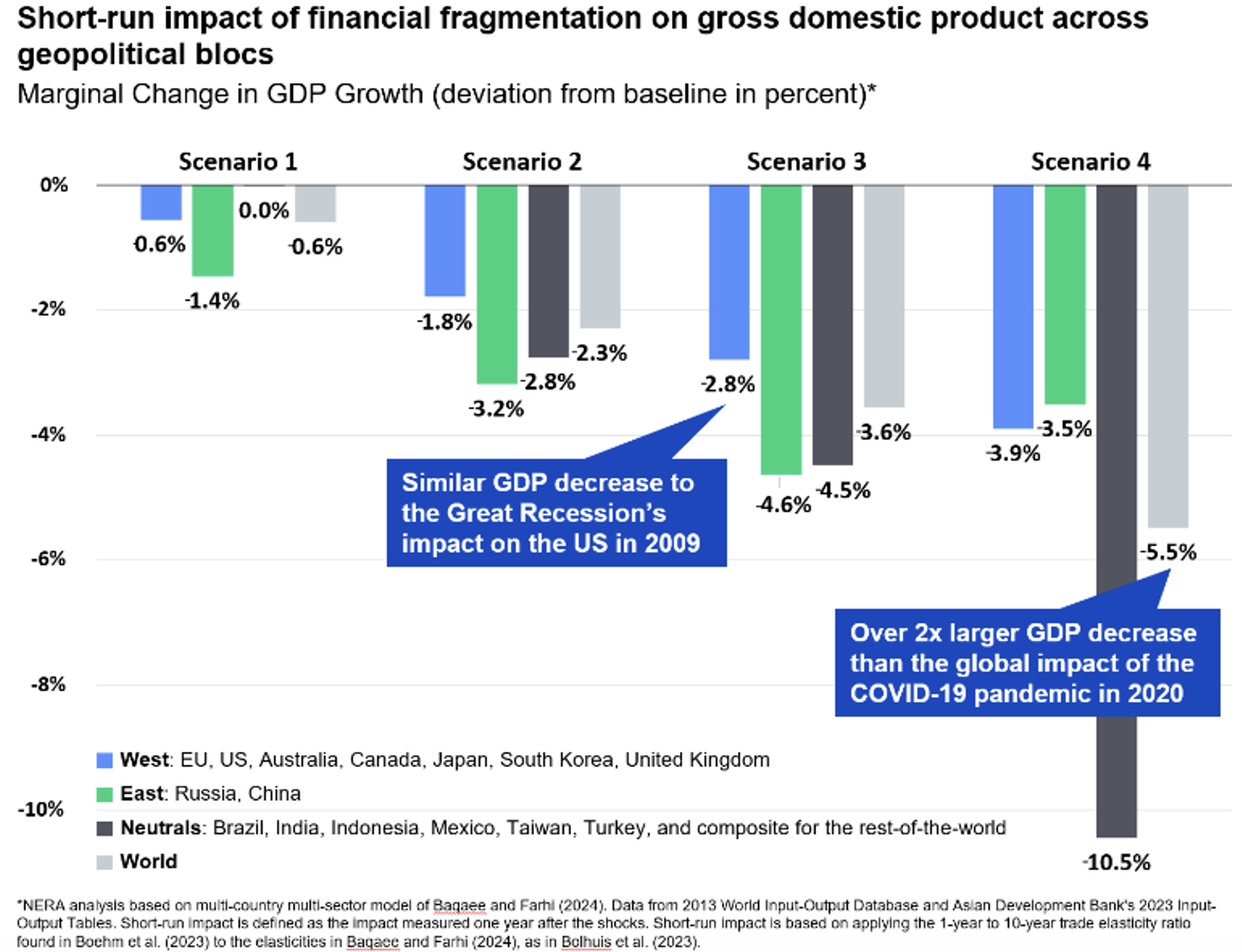

The World Economic Forum, partnering with Oliver Wyman, addressed this topic by estimating in January 2025 that the potential cost of global financial system fragmentation, or the increasing disintegration of the interconnected global financial landscape into distinct blocs, ranged from $0.6tn to $5.7tn. The cost depends on the degree of fragmentation, which was represented in four scenarios: low, moderate, high and very high fragmentation between three blocs (the West, the East and Neutrals).

There is still considerable uncertainty in the policy landscape and macroeconomic outlook stemming from ongoing trade negotiations. The range of potential outcomes and these developments have already shifted the world beyond the report’s ‘low fragmentation’ scenario, which assumes only capital and trade restrictions in certain sensitive areas between East and West.

The central conflict driving fragmentation and the largest single factor behind fragmentation is the deteriorating geoeconomic relationship between the US and China. Effective US tariff rates on Chinese goods are more than double what they were at the beginning of 2025 and Chinese tariffs on US goods are more than 50% higher. There is a high likelihood that after trade negotiations conclude, there will still be moderate to severe restrictions on East-West trade, not only via tariffs but also via investment restrictions such as those on US stock listings for Chinese companies and on Chinese investment in US private equity.

In addition to moderate to severe East-West restrictions, the US has imposed a 10% minimum levy on most goods from most countries, exceeding the ‘low fragmentation’ scenario assumption that trade between Neutral countries and those in the East and West would not be restricted. The 12 May 2025 agreement between the US and UK, which would maintain the 10% tariff on most goods despite the US running a trade surplus with the UK in 2024, signals that the 10% rate is a minimum which the US will maintain on most imports from most countries after negotiations have concluded. Additionally, the US is exerting greater pressure on Neutral countries to enact restrictions on China and China is in turn indicating that it will retaliate against any such restrictions, effectively forcing Neutrals to choose a side in the escalating conflict.

Strategic actions financial institutions can take amid uncertainty and fragmentation

The escalating tensions and fragmentation between geoeconomic blocs are keenly felt by leaders of private financial institutions, who must account for elevated volatility as they make business decisions. Despite the challenges inherent in planning for the future in an uncertain environment with higher baseline fragmentation, there are steps the leaders of these institutions can take to weather the uncertainty and hedge against potential worst-case outcomes.

Near term (< 3 months)

- Understand exposure to geopolitical risk through clients, counterparties, business locations and contractual relationships.

- Conduct scenario planning, formulating potential scenarios to inform projections and better understand fragmentation’s impact on the business given exposure to geopolitical risks.

- Communicate with stakeholders and actively provide updates on response strategies according to the defined crisis playbook.

Medium term (3 months - 1 year)

- Build a geopolitical risk management capability, including by defining geopolitical risk within the bank’s formal risk taxonomy and ensuring a well-defined crisis playbook is in place to manage acute risks. Banks have, for example, launched efforts to help clients assess geopolitical risk.

- Conduct enterprise scenario analysis, incorporating scenarios developed in the near-term scenario planning exercise to assess the reliability of the existing enterprise risk management framework and associated risk models. Use the results of the analysis to map out opportunities for optimization and highlight risk areas.

- Apply lessons from the scenario analysis to improving credit portfolio and asset-liability management by developing a tariff impact heatmap to highlight sectors which are particularly exposed and considering impact on interest rate, funding and liquidity risks. Major financial institutions have, for example, recently done work to illustrate tariff risks for different sectors and geographies.

- Enhance third-party risk management capabilities by assessing and managing supply chain risks to identify areas of exposure to disruption, incorporating geopolitical risk.

Long term (> 1 year)

- Assess market structure impacts and explore potential shifts in competitor landscape, barriers to entry/exit and product and service differentiation.

- Adjust strategic positioning, reassessing strategic priorities and partnerships and considering diversification strategies to mitigate rising geopolitical risks.

Have you read?

Next steps

Elevated uncertainty will most likely persist for the foreseeable future, creating challenges for financial institutions as they plan for future investments and operational changes. In this environment, financial institutions can still take the above steps confidently, giving them the ability to more precisely quantify the cost of existing fragmentation and make clear to shareholders and the public what the cost of further fragmentation would be.

The Navigating Global Financial System Fragmentation initiative is working to convene financial sector leaders to understand and articulate the financial costs of geo-economic fragmentation and to develop and share approaches to implementing commonsense guardrails that protect the ability of the global financial system to continue to deliver greater prosperity around the world.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Financial and Monetary Systems

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Ali Mammadov and Kanan Mammadov

February 6, 2026