How tech innovations are transforming private equity

Illustrative image of Wall Street in New York City. Image: Robb Miller

- Private equity firms are embracing the tech revolution to drive digital operations and unlock value across sectors.

- AI and machine learning are transforming private equity exit strategies by accelerating due diligence, enhancing portfolio monitoring and enabling faster, data-driven buyer analysis.

- Advanced tech tools, including predictive analytics and ESG dashboards, not only support smarter investment decisions but also boost exit attractiveness by showcasing long-term value creation.

The mid-market and small-cap private equity sector is facing turbulence, driven by inflation and political instability, fueling uncertainty and volatility.

Due to this, firms are prioritizing environmental, social and governance (ESG) practices, emerging markets and technologies like artificial intelligence and machine learning (AI/ML) for quick and accurate investment calls.

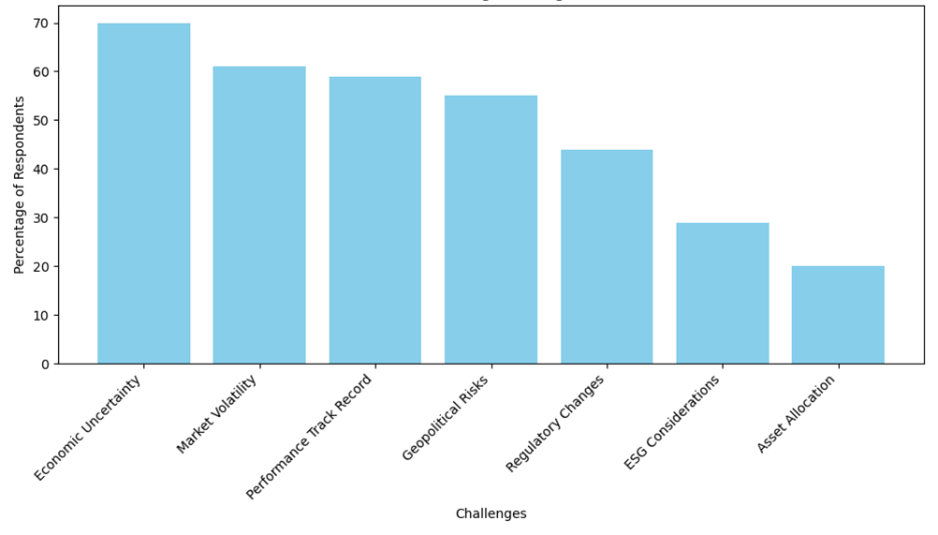

Fundraising remains a challenge, with over 70% of investors citing economic uncertainty and market volatility as top concerns.

Globally, private equity firms are sitting on $2.1 trillion, which can be used for new opportunities (“dry powder”). Most firms have allocated 30% of their capital to dry powder amid cautious optimism.

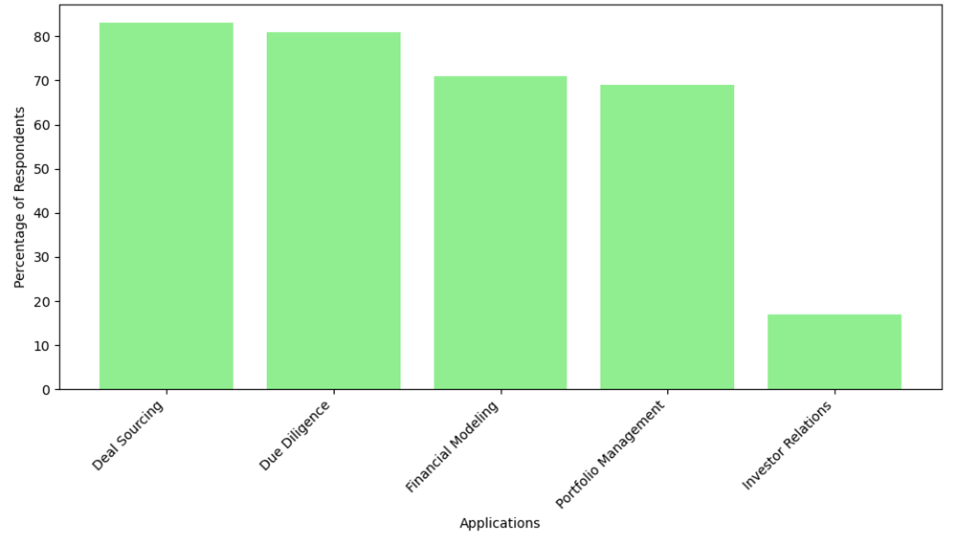

At least 80% of private equity workflows already rely heavily on technologies to source deals, conduct due diligence and manage portfolios; 95% of these firms are planning to multiply AI investments in the next 18 months.

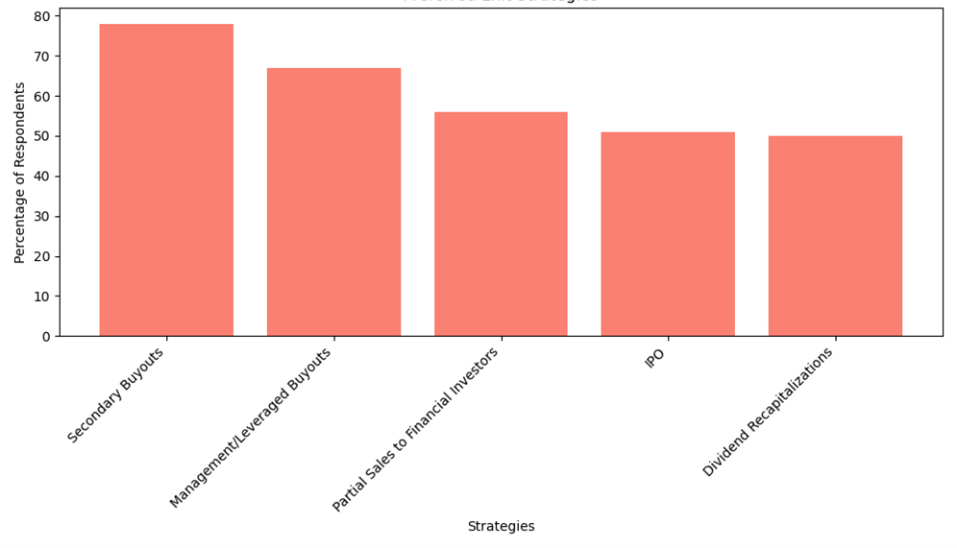

This reliance has led to an evolution in exit strategies. Secondary buyouts and management/leveraged buyouts are making the most headway. To curb uncertainty in the market and challenges pertaining to liquidity, firms are exploring continuation funds and preferred equity options.

The private equity industry, despite sitting on a lot of dry powder, is encountering insurmountable pressure from Limited Partners (LPs) for efficient allocation of capital. General Partners (GPs) find themselves caught up with due diligence demands and allocation requirements amid market contraction risks.

Technological advancements have become enablers with AI, robotic process automation (RPA) and blockchain driving operational efficiencies. This encourages compliance and helps with decision-making. S&P Global found that 41% of private equity firms are in nascent adoption stages, 13% are at the advanced implementation stage and 7% have fully integrated technology.

In deal sourcing, AI can identify 195 relevant companies in the time it would take a junior analyst to evaluate one. Firms like Blackstone and EQT are investing in solely owned platforms like EQT’s Motherbrain, which consolidates 140,000+ data points for real-time M&A insights.

AI also assists with post-deal requirements like live portfolio monitoring and exit readiness by putting together information for a quicker turnaround on the buyer analysis for decision-making. Firms that delay tech adoption risk falling behind in fundraising and corporate governance and risk being left behind by competitors. Simultaneously, these advances have a real-world impact on the people in the industry, reducing the need for entry-level employees.

The investment projectile has evolved across four major phases: workflow automation and BPM services (before 2018); low-code/no-code platforms (2018-2020); early adoption of intelligent automation across the value curve (2021-2023); and a new era of intelligent automation powered by generative AI (2024-present).

Private equity firms are embracing the tech revolution to drive digital operations and unlock value across sectors.

The allied risks and limitations

AI has a significant impact on the private equity space, although there are reservations about its adoption and scope in the future. In light of the limited adoption rate, it is clear that only a fraction of private equity firms are exploring AI application use cases. These reservations are emanating from cybersecurity threats, opaque workflows and limited visibility on returns.

Having said that, it does contribute to operational efficiency and better portfolio performance. It also supports analysis, given its ability to skim through large and complex data sets, and is useful to entry-level employees as a learning and development tool.

These tools do enhance accurate decision making without negating human judgement, allowing organizations to act swiftly with precision. This has a cascading effect on revenue optimization, cost reduction and improved performance reporting and monitoring. For example, AI can help monitor KPIs across portfolios and processes in deal exits and capital distribution.

However, this shift brings significant risks. Kearney highlights seven key scenarios: rising ownership costs, unreliable data, questionable model outputs, cyber threats, IP disputes, AI-driven ESG platform concerns and negative socioeconomic impacts – all amid evolving regulatory pressures on governance.

It also emphasizes the importance of establishing robust governance frameworks and ethical guidelines to mitigate these risks. For example, some firms have created internal compliance forums to define acceptable AI use and ensure data protection. To successfully integrate AI, private equity firms must align AI initiatives with strategic goals, focus on high-impact use cases and ensure their technology infrastructure is ready. Standardizing and improving data quality across portfolios is also critical, as inconsistent data remains a major barrier to effective AI deployment. Firms that invest in preparing their data and tailoring AI models to their specific needs will gain a competitive edge.

Propelling the ESG engine forward

Private equity firms are leveraging state-of-the-art technologies of AI-driven predictive analytics and powering ESG data platforms to monitor and integrate metrics into their investment strategies. According to EY, private equity funds that have a well-integrated ESG framework have the potential to achieve an initial rate of return, which could be 8% higher than their competitors. This is mainly thanks to more accurate predictive models that provide organizations with the ability to assess value creation potential and sustainability risks over long periods at both deal and portfolio levels.

Bain and Company reports that, despite a low adoption rate of ESG initially, there has been an uptick in interest due to the consistency of data ESG operations provide and its potential long-term assurances. Firms now leverage AI/ML and natural language processing (NLP) to assess regulatory disclosures, sentiment analysis and supply chain data for ESG risks. This approach allows investors to pursue short-term value while staying aligned with long-term goals, supporting broader global efforts by businesses and governments to achieve the UN Sustainable Development Goals (SDGs).

The World Economic Forum highlights a market shift from “grey to green,” where ESG-focused digital dashboards and predictive modelling tools are helping private equity firms measure investment impact across ESG metrics. This builds transparency and trust, and enhances exit opportunities by demonstrating ESG-aligned value creation to potential buyers.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Artificial Intelligence

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Ryan Hardin

February 6, 2026