Technology can help the insurance industry win back trust

Brands are increasingly offering embedded insurance at the point of check out Image: Unsplash/Link Hoang

- Insurance is evolving, with embedded insurance providing convenient coverage that could account for a third of all insurance products by 2028.

- The insurance industry sells trust but research shows that younger generations do not trust insurance products.

- The real test isn’t growth, it’s whether new models can close the insurance “protection gap” and win back a lost generation.

Every year, policyholders hand over billions in premiums, cross their fingers they’ll never need to claim and when they do, they’re often left confused by the fine print.

An industry designed to protect people has instead buried them in a sea of legal complexity, hidden exclusions and profit-first incentives. It has been built to protect balance sheets more than the humans it promises to cover. What’s more, until now, customer-first innovation or real evolution has been lacking for decades.

At the centre of this shake-up is a concept commonly known as “embedded insurance”. Instead of forcing people to jump through hoops directly with insurers or brokers, embedded insurance weaves cover directly into the products and services people already use.

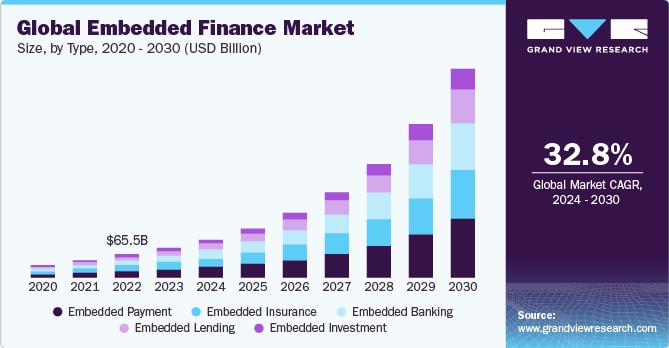

According to Boston Consulting Group, embedded insurance is projected to grow from $13 billion to over $70 billion in gross written premiums by 2030. That’s not incremental growth, it’s an industry rewriting itself.

How embedded insurance works in reality

Various companies, including high-profile brands, are making their insurance product more accessible and integrated into their buying journey.

Airbnb’s AirCover automatically provides hosts up to $3 million in liability and damage protection for every booking. It’s built into the booking flow, with no extra sign-up or separate policy required.

Wanda by Avios is travel protection that travellers can add seamlessly at checkout when booking flights or hotels. It’s fully integrated into the booking journey and managed easily through the Wanda app, turning protection into part of the travel experience rather than an afterthought.

AppleCare can be applied when you buy an iPhone, Mac or iPad online or in-store. It’s an embedded device insurance covering accidental damage, repairs and even theft or loss (in some regions).

Ultimately, the question isn’t whether embedded insurance will grow; it’s whether it can fix what’s broken.

”Why embedded insurance is on the rise

The reason embedded insurance has emerged now can be attributed to an inescapable fact: the world is living through a growing “protection gap,” i.e. the gulf between the coverage people have and the coverage they actually need.

According to Fintech Ventures, between 2000 and 2020, this gap doubled, driven by urbanization, climate shocks and a chronic lack of genuine innovation. Millions have now been left underprotected or overpaying for policies they don’t even understand.

The kicker is that traditional insurance is failing to win over the very people it needs most – the younger generations.

A 2023 LIMRA study found only 48% of Millennials and 40% of Gen Z own life insurance –and nearly half feel underinsured. Many young adults cite perceived cost, lack of clarity and distrust as reasons they’re not buying. This isn’t just an industry sales issue – it’s a generational crisis. If the next wave opts out, the insurance model could collapse.

What will bridge the ‘protection gap’

Embedded Insurance 2.0 could be the industry’s best chance to flip the narrative but embedding alone won’t cut it. The real currency here is trust. EY estimates that by 2028, more than 30% of all insurance transactions will run through embedded channels. However, that number will mean nothing if people don’t believe in what they’re buying.

This is where real-time, data-driven personalization becomes a game-changer, especially for a younger, tech-savvy generation who expect everything to be tailored and instant. Better data can create personalized protection.

Accenture’s research shows that six in ten consumers would be willing to share significant personal data if it means fairer pricing and coverage that better fits their lives.

However, trust doesn't rely on just data, which is built on how you use it. Digital wallets can aid in bridging gaps in coverage. For example, platforms such as Rehuman put clear, jargon-free insurance details into people’s hands using generative artificial intelligence to show policyholders what they’re covered for and where there are gaps.

The real edge, though is that embedded insurance thrives through collaboration, not just isolation. Traditional insurers bring underwriting expertise and insurance tech brings technological advancement. Consumer brands provide the daily trust and data touch points that legacy players could never achieve.

Get this mix right and you don’t just extend your reach, you unlock richer insights and better products that fit seamlessly into people’s lives.

High stakes for protection

EY predicts that embedded transactions will soon make up nearly a third of the entire market. However, these numbers are worthless if the experience doesn’t deliver real value.

Ultimately, the question isn’t whether embedded insurance will grow; it’s whether it can fix what’s broken. Can it close the protection gap? Can it make insurance feel human again? Most crucially, can it win back a disenchanted generation?

The stakes couldn’t be clearer: reinvent or become irrelevant. A new wave of technology is already in people’s hands. The future of insurance will be shaped by the brands willing to show up transparently, partner with innovators, use data responsibly and put people, not just profits, first.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Digital Communications

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on BusinessSee all

Jill Hoang and Pauline McCallion

January 23, 2026