Sizing the $9 trillion climate adaptation investment opportunity

Flooding in Kolkata, West Bengal, India. Private investors have an important role to play in climate adaptation due to the rise in extreme weather. Image: Unsplash/Dibakar Roy

- Research on climate-related investment opportunities has predominantly focused on decarbonization, often overshadowing the equally urgent need for climate adaptation.

- While climate adaptation is often misperceived as solely a government responsibility, the private sector has a vital role to play as risks such as extreme weather events escalate.

- Recent research shows the investment opportunity for select climate adaptation solutions could increase to $9 trillion by 2050 across both established and emerging technologies.

Global temperatures reached record highs in 2024 and this year has already brought a new slew of extreme weather events, making the need for climate adaptation solutions more urgent than ever.

Private sector climate investing has traditionally focused primarily on decarbonization, often overlooking the equally urgent need for climate adaptation. But with elevated physical climate risks becoming more likely and adaptation needs required at all levels of society, companies offering adaptation solutions are emerging as a complementary and increasingly investible part of the broader climate response.

Climate adaptation solutions are still an under-researched and underappreciated theme in the investment industry, however. Some private investors believe the space is too dependent on government funding and so unsuitable for private investors. Others see adaptation investment as challenging due to the uncertainty of climate scenario pathways.

GIC, in partnership with Bain & Company, examined the climate adaptation solutions most relevant to private sector investors to quantify this emerging investment opportunity. Our research shows that the investment opportunity for certain climate adaptation solutions could increase from $2 trillion today to $9 trillion by 2050, offering diverse possibilities across both emerging and mature industries.

Identifying climate adaptation solutions

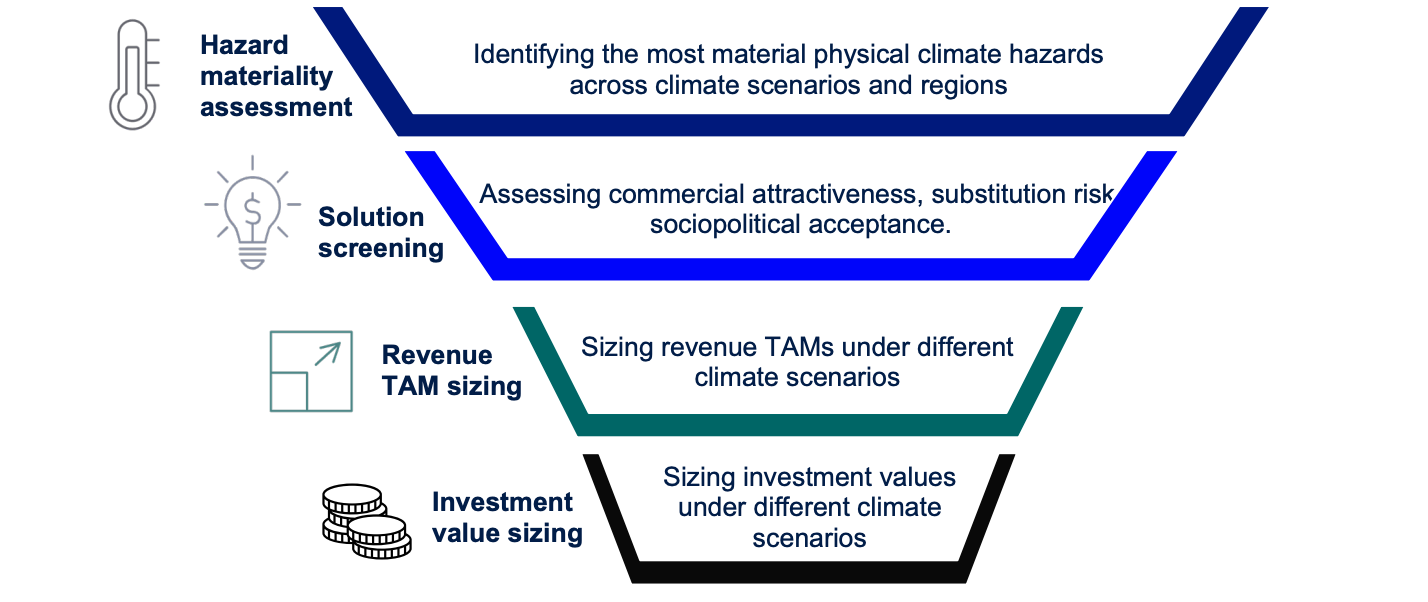

The universe of climate adaptation solutions is vast. The Climate Bonds Initiative identifies more than 1,400 solutions in its pioneering Climate Bonds Resilience Taxonomy (CBRT). To navigate this complexity, we developed a methodology to curate the most critical climate adaptation solutions, size their total addressable market revenues and quantify the value of these investment opportunities.

Beginning with hazard materiality assessment, we focussed on five categories – storm, flood, wildfire, heat stress and water stress – which are economically material. We then screened the solutions, whittling down CBRT’s more than 1,400 adaptation solutions list to 14 categories and then a further 21 products and services for investors to consider.

We also used a proprietary modelling factor called “climate elasticity of demand” to analyse how global warming affects the demand for goods and services. This helped to assess the degree of additional demand for these products and services – the potential investments – that are driven by climate change.

A $9 trillion investment opportunity

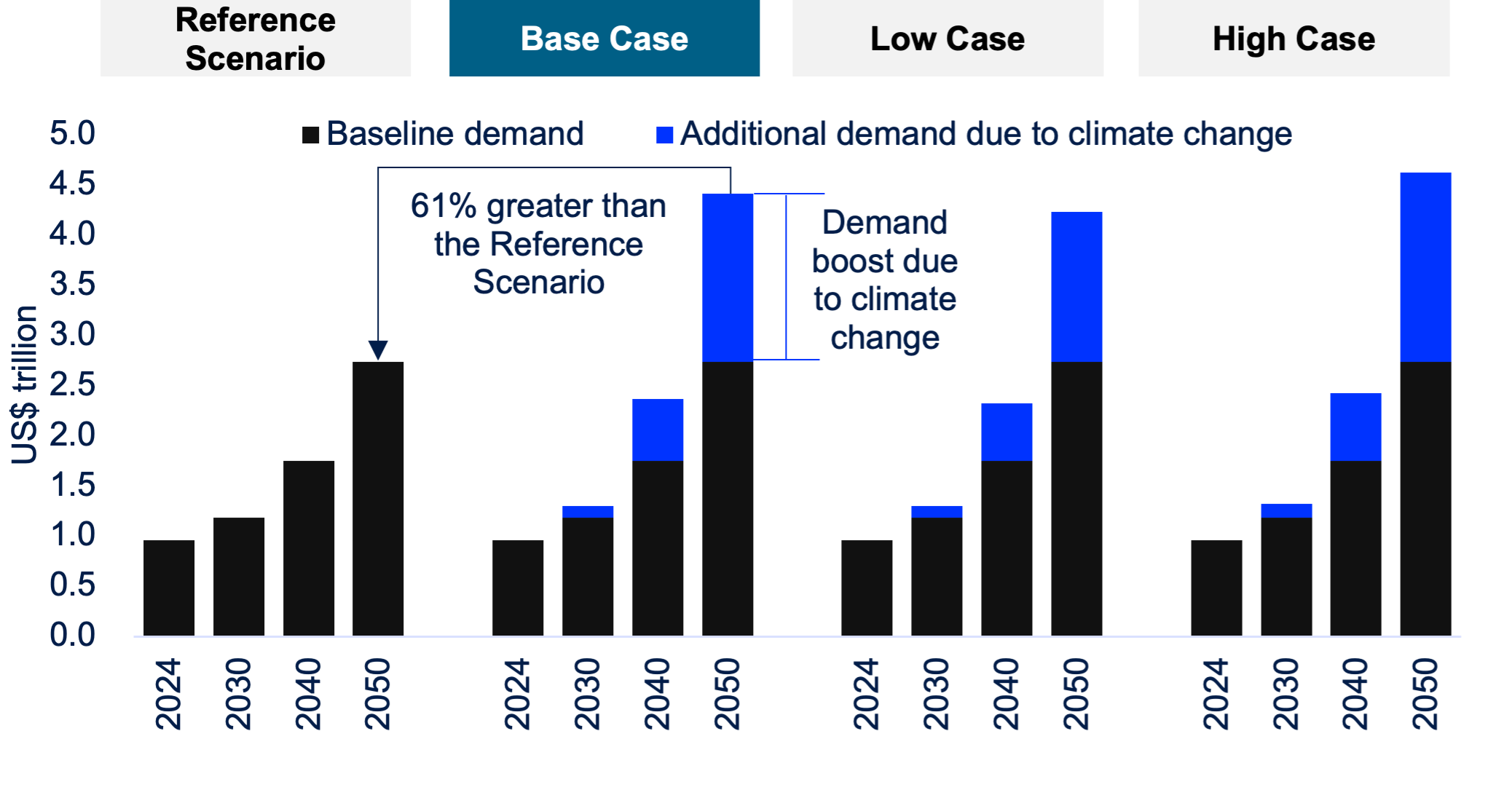

This analysis showed the global annual revenues of our curated set of climate adaptation solutions is projected to grow from approximately $1 trillion today to $4 trillion by 2050.

This projection is based on our base case scenario (the United Nations Intergovernmental Panel for Climate Change’s (UN IPCC) SSP2-4.5 scenario from the Sixth Assessment Report (AR6), which is approximately a 2.7⁰C scenario) and is 61% higher than our reference scenario forecasts. This accounts for an additional $2 trillion in incremental revenue growth driven by global warming – a factor that’s often overlooked in current industry forecasts but that we were able to include in our analysis using “climate elasticity of demand”.

The corresponding investment opportunity is estimated to increase from $2 trillion today to $9 trillion by 2050, with $3 trillion attributed to incremental growth driven by global warming.

One important observation is that variation in estimated value is +/-4% across the different climate scenarios. This is the projected stability of climate adaptation solutions’ value, regardless of what climate scenario pans out. It means that investors can build conviction to invest in this space without having to predict the precise climate pathway.

New and established climate adaptation tech

Our analysis also found that the inevitable need for climate adaptation will fuel growth across both established and emerging solutions. And there are already promising solutions in both of these areas.

Weather intelligence, for example, uses innovative technology to convert weather data into actionable insights. This includes optimizing flight routes and aiding agriculture with irrigation. As climate change increases the need for data analysis, demand for these solutions is rising. We project annual revenues for weather intelligence to grow 16-fold to over $40 billion by 2050, making it one of the fastest-growing segments in our analysis.

A more traditional example would be wind-resistant building components. These resources improve resilience against storms, which, according to one study by the UNFCC, was the climate hazard that accounted for the largest economic losses globally for the 50-year period from 1970 to 2019.

This category includes high-strength doors, reinforced roofs and structural reinforcements. While global adoption has been inconsistent, we forecast demand for these products could exceed $650 billion by 2050, up from around $40 billion today. This will be driven by stricter building codes and increased consumer demand for resilience.

Climate adaptation is a rapidly evolving field, with new science, solutions and standards emerging all the time. Connecting climate science with industry fundamentals can provide private investors with deeper insights into the climate adaptation solutions that are likely to be the most successful.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Climate Indicators

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Sustainable DevelopmentSee all

Pauline McCallion

January 23, 2026