Global market resilience at the mid-year mark, and other finance news to know

M&A value is up 28% from last year, driven by US megadeals. Image: REUTERS/Jonathan Drake/File Photo

- Catch up on the key stories and developments shaping the financial world.

- Top stories: Dealmaking and liquidity defy global headwinds; White House order targets political 'debanking'; UK tax reform sparks director exodus.

- For more on the World Economic Forum's work in finance, visit the Centre for Financial and Monetary Systems.

1. M&A boom and lending surge signal resilient markets

The global financial markets are demonstrating remarkable resilience at the mid-year mark, with soaring M&A volumes and a sharp rise in securities lending revenues underscoring a deep-seated investor confidence in the face of persistent uncertainty.

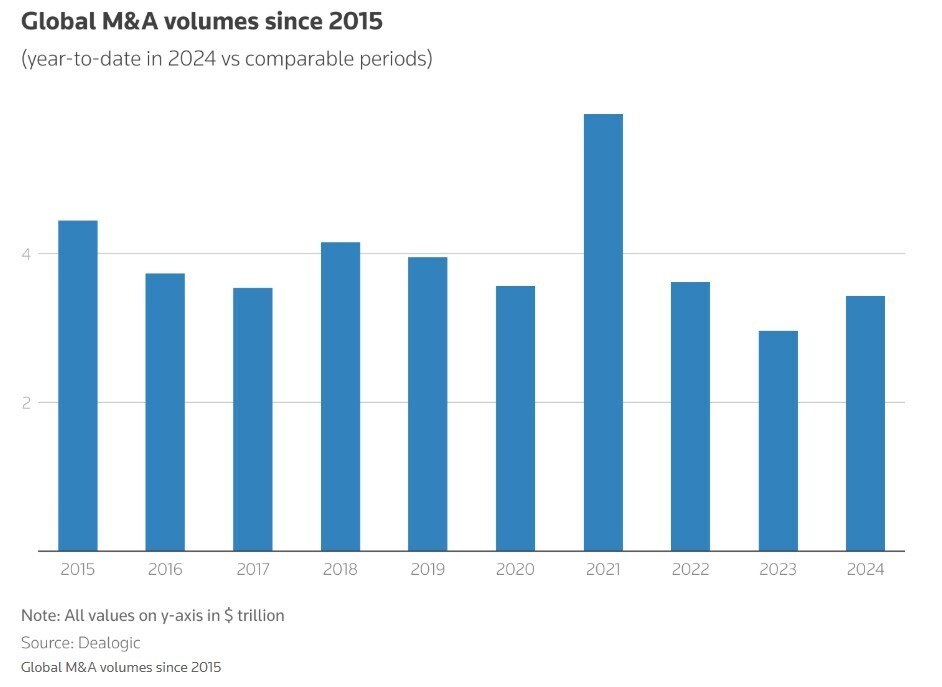

Global mergers and acquisitions have surged to a $2.6 trillion peak year-to-date, marking the busiest period since 2021, driven by boardroom ambitions, a surge in AI-related deals and a rebound in large-scale US transactions, according to Reuters. Other key metrics include:

- Deal value up 28% despite 16% fewer deals.

- US biggest market for M&A - over 50% of global activity.

- Asia Pacific deal-making doubled, outpacing EMEA.

Despite fewer deals overall, elevated valuations and corporate appetite for growth remain strong, underscoring continuing confidence among global investors in navigating economic and geopolitical uncertainties.

In parallel, global securities lending revenues climbed 53% year-over-year in July to $1.57 billion, reports Securities Finance Times. Increased activity in US and Asian equity markets is cited as the main driver, pointing to robust trading volumes and ample liquidity. The surge in lending also suggests a significant risk appetite from investors, even amid volatility driven by trade tensions, inflation concerns and regulatory shifts.

These trends broadly align with recent assessments from the International Monetary Fund and the European Central Bank. Both institutions acknowledge ongoing risks, including persistent financial volatility and geopolitical tensions, while highlighting the solid performance of key credit markets and non-bank financial intermediaries.

2. US banks face 'debanking' crackdown

The White House is preparing an executive order that would empower federal regulators to investigate and penalize banks for discriminating against clients based on their political affiliations, Reuters reports.

The move follows repeated claims by President Donald Trump and his supporters that major US banks have unfairly closed their accounts and refused them services, a practice they term "debanking". According to reports on the draft order, it would direct agencies to use existing authority under consumer protection, fair lending, and antitrust laws to address these claims.

The banking industry has consistently pushed back against these allegations. Industry groups and executives maintain that account closures are driven by legally mandated risk-management protocols, such as those designed to combat money laundering, and are not based on political views.

Financial-sector critics of the proposed order warn it could improperly inject politics into banking supervision.

The potential crackdown on account access contrasts with a broader deregulatory trend, particularly in digital assets, where the administration has stated its goal is to make the US the “crypto capital of the world”. This strategy includes creating legal clarity through the recent signing of the GENIUS Act, the first major crypto legislation from Congress. At the same time, federal banking agencies have supported innovation by easing supervisory rules, such as no longer requiring banks to get formal pre-approval for certain crypto-related activities.

3. More finance news to know

The "Big Four" accounting firms face significant "challenges" in adopting AI due to their vast scale, according to Hywel Ball, EY's former UK head. Speaking to the Financial Times, Ball suggested their size can impede the necessary cultural change for adoption, creating an advantage for smaller, more agile firms in the sector.

European pharmaceutical shares dropped to a three-month low after Trump reiterated plans to impose tariffs on imported drugs. The STOXX Healthcare index fell 2% on 6 August, as investors reacted to his pledge to push companies to move production to the US.

New tax proposals sent South Korea’s KOSPI down 3.9%, denting its rally as Asia’s top-performing market. Despite $4.5 billion in July inflows, investor confidence is wavering amid concerns over reform momentum and the persistent “Korea discount”.

An analysis of Companies House filings by the FT reveals that 3,790 company directors have left the UK since the government abolished favourable tax treatment for non-domiciled residents. This is an increase from 2,712 in the same period a year earlier. The United Arab Emirates is the most popular destination for those leaving.

This comes as UK construction activity saw its sharpest fall since 2020 in July, with S&P Global’s PMI dropping to 44.3, well below the 50 mark that signals contraction, amid a continued slowdown in housebuilding.

Natural disasters triggered $80 billion in insured losses in the first half of 2025, nearly double the 10-year average, Swiss Re estimates. Wildfires in California and US storms led the surge. Losses may exceed $150 billion for the year as hurricane season approaches.

4. Read more on Forum Stories

As climate shocks intensify, agricultural volatility is fuelling inflation and sending ripples through financial markets. Sustainable finance experts Aurora Matteini and Derek Baraldi explore how the financial sector can play a pivotal role in transforming food systems to build resilience, reduce emissions and safeguard livelihoods. Drawing on insights from the Forum's Playbook of Financing Solutions for Food Systems Transformation, the authors call for urgent action to address the growing risks – and opportunities – in the global food economy.

Last month, US President Donald Trump signed the GENIUS Act, the first major crypto legislation ever passed by Congress. The law focuses on stablecoins, setting up regulatory guidelines for this form of digital currency across the United States. The Forum's Sandra Waliczek and Harry Yeung detail what's in the legislation and explore how it will impact the industry.

By 2050, the global retirement savings gap could hit $400 trillion – a challenge far bigger than any individual can tackle alone. In a recent episode of the Forum's Meet the Leader podcast, Yie-Hsin Hung, CEO of State Street Investment Management, breaks down what’s driving the crisis, how longer lifespans are reshaping retirement, and why a multi-pronged solution is urgently needed. For more on this issue, explore the Centre for Financial and Monetary Systems' Longevity Economy initiative.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Eric Usher

February 24, 2026