More emerging economies issue debt outside the dollar, and other finance news to know

Globally, finance leaders regularly underscore the importance of shielding the independence of fiscal and monetary policy to promote financial stability and reinforce investor confidence Image: REUTERS/Thomas Mukoya

- Catch up on the key stories and developments shaping the financial world.

- Top stories: Emerging markets move away from dollar debt; Central bank independence under pressure; Global watchdog flags risks from shell companies.

- For more on the World Economic Forum's work in finance, visit the Centre for Financial and Monetary Systems.

1. Emerging markets turn to alternative currencies amid yield shifts

Developing nations, including Kenya, Sri Lanka, Panama and Colombia, are moving away from dollar-denominated borrowing and turning to currencies like the Chinese renminbi and Swiss franc in a bid to cut borrowing costs, the Financial Times reports.

The shift comes as the costs of global borrowing surge. US Treasury yields are near multi-year highs, UK gilt yields just hit a 27-year peak and French debt is under pressure, as is Japan's. The spike in yields makes issuing dollar debt significantly more expensive, forcing emerging markets to seek cheaper alternatives.

The pivot also coincides with broader geopolitical realignments. At a high-profile summit in Tianjin, China, the country's President Xi Jinping – joined by Russia and India’s leaders – discussed a vision for a new global economic order that would reduce reliance on the US dollar and strengthen South-South financial integration.

While diversifying away from the dollar offers short-term relief, it comes with exchange-rate risks and potential long-term instability. Analysts warn that relying on alternative funding sources could expose emerging markets to new vulnerabilities if global growth continues to slow.

2. Concerns over central bank independence

As developing economies rethink their reliance on dollar funding, concerns over central bank independence in major economies are adding a separate layer of risk to the global outlook. Global markets have largely held up well, but are facing renewed uncertainty as shifting financial alignments and political pressures test long-standing institutions.

In the United States, President Trump’s moves against Federal Reserve officials have prompted warnings from economists about the dangers of politicising monetary policy, which could lead to runaway inflation, damage the dollar's credibility and therefore the global economy at large.

European leaders are voicing similar concerns. European Central Bank (ECB) President Christine Lagarde warned that undermining the Fed’s independence posed a “serious danger to the world economy”, while ECB board member Isabel Schnabel cautioned that political interference could push up borrowing costs globally and spark financial instability.

Highlighting these risks, Adam Posen, head of the Peterson Institute for International Economics, told an ECB conference that Fed help can no longer be guaranteed and urged central banks to pool their US dollar reserves to provide their own emergency liquidity.

Globally, finance leaders regularly underscore the importance of shielding the independence of fiscal and monetary policy to promote financial stability and reinforce investor confidence. This independence was one of the eight principles detailed in the World Economic Forum's Principles to Safeguard the Global Financial System from Fragmentation report.

"History is very clear about the benefits of central bank independence: it lowers risk premia and it eases financing conditions for households, firms and governments," Schnabel told Reuters.

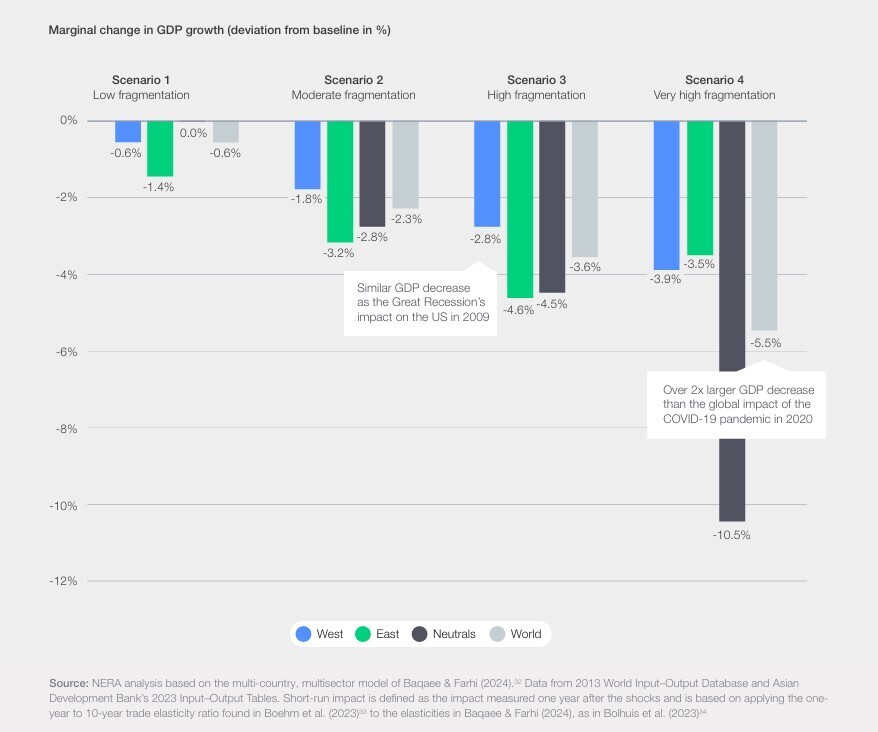

The Forum's report found that global financial fragmentation could reduce global GDP by up to 5%, which highlights risks from rising policy uncertainty, market fragmentation and geopolitical tensions.

3. More finance news to know

The head of the global Financial Action Task Force has called for greater transparency regarding shell companies, labelling them a "getaway car" for criminals. The watchdog will make the issue a key focus of its upcoming national assessments. The move follows recent decisions by both the US and Switzerland to weaken rules on beneficial ownership transparency.

Financial stress among US workers is on the rise, according to a recent Bank of America survey. The report found that the number of employees feeling financially well has dropped to 47% from 52% at the start of the year.

While emerging economies are seeking alternatives to dollar debt, the rise of dollar-backed stablecoins is prompting countries to review payment systems. A Cornell Professor says the focus should be on strengthening domestic systems and central bank credibility, not issuing competing stablecoins.

Global investors increased hedge fund allocations to Europe and Asia for the first time since 2023, a BNP Paribas survey shows. Stronger inflows into European funds – helped by fiscal stimulus in Germany and improving growth prospects – outpaced those in the US, where allocations lagged behind amid shifting investment priorities.

Investors increased their hedge fund exposure to Europe and Asia over the US for the first time since 2023, according to a recent BNP Paribas survey. Heightened US policy uncertainty and tariffs have prompted diversification, with Europe benefiting most – 37% of investors added funds there in the first half of 2025, and a further 33% plan to boost allocations in the second half.

France faces a budget showdown as Prime Minister François Bayrou’s minority government risks falling in a confidence vote over his €44 billion deficit-cutting plan. Finance Minister Éric Lombard said any government collapse would likely require concessions, potentially reducing the size of the fiscal package for 2026.

As gold prices continue to soar, here’s what’s driving demand and market trends:

- Record highs: Gold hit $3,532 per troy ounce, up over 90% since late 2022.

- Central bank buying: Annual purchases have exceeded 1,000 metric tons since 2022; 900 tons expected in 2025.

- Geopolitical and policy drivers: Sanctions, trade tensions, and Fed independence concerns are boosting demand.

- Jewellery slump: Demand fell 14% in Q2 2025, mainly in China and India.

- Investment trends: Gold ETFs saw 397-metric ton inflows in H1 2025; retail bars up 10%, coins down 31%.

How the Forum helps leaders understand change in global financial systems

4. Read more on Forum Stories

Financial inclusion is evolving beyond access to banking, with digital ecosystems reshaping participation in the economy. In the Middle East and North Africa, platforms like Botim are transforming from messaging apps into multifunctional hubs for fintech, services and AI-driven innovation, accelerating inclusion and powering the region’s digital economy.

How should investors adapt as global markets undergo foundational shifts?

With geopolitical fragmentation, rising debt, AI-driven disruption and climate transitions reshaping economies, long-term strategies, diversification and agility are becoming essential to building resilient portfolios in an increasingly uncertain world.

With retail investors now accounting for up to 80% of daily trading in major markets, exchanges are exploring a radical shift to 24/7 trading. Could this move unlock global liquidity and access for all, or does it pose a hidden threat to the stability of our financial system? Hallie Spear Specialist, Capital Markets and Resilience Initiatives, World Economic Forum weighs in on the risks and rewards.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Eric Usher

February 24, 2026