A new age of energy security: navigating the energy transition amid geopolitical shifts

The state of the energy transition was the topic of the "Energy Transition: Amping Up or Powering Down?" panel session at the Sustainable Development Impact Meetings 2025. Image: World Economic Forum

- The energy transition is facing headwinds from geopolitics, rising demand and nations prioritizing energy security and resilience over sustainability.

- At the World Economic Forum’s Sustainable Development Impact Meetings 2025, an expert panel discussed the impact of these trends on the energy transition.

- While aligning with the quest for energy security, the energy transition needs clear policies to boost investment and innovation, the panel concluded.

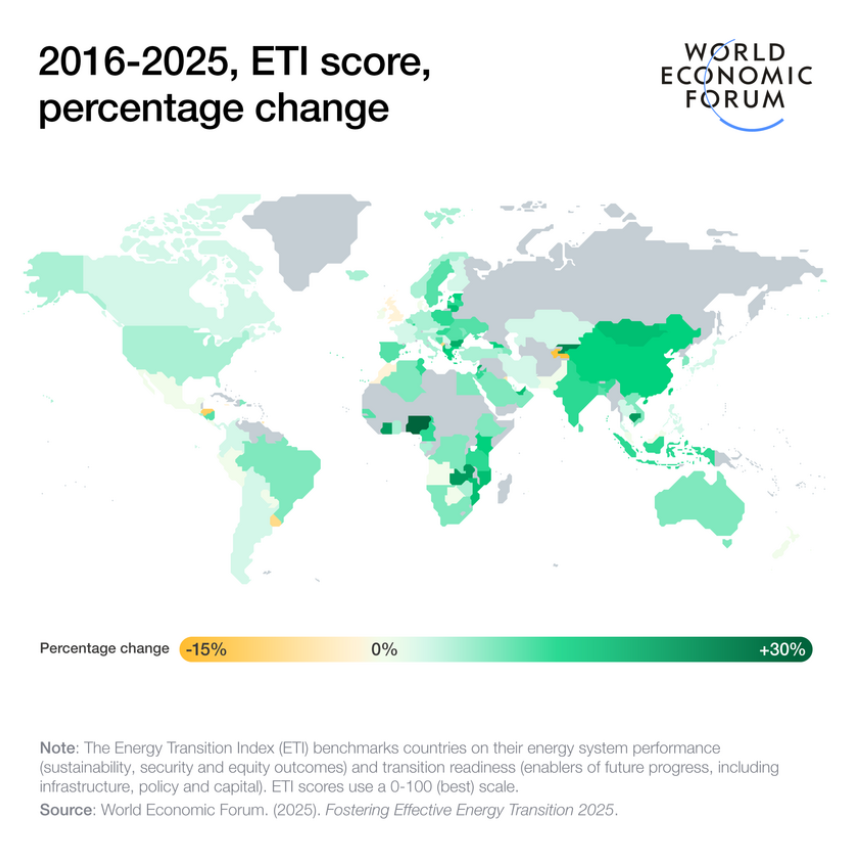

The energy transition is progressing – slowly.

Scores in the World Economic Forum’s Energy Transition Index 2025 rose by 1.1%, double the three-year average. Yet, the shift from fossil fuels to renewables and low-carbon fuels faces many headwinds, including policy, geopolitics, capital markets, and technology.

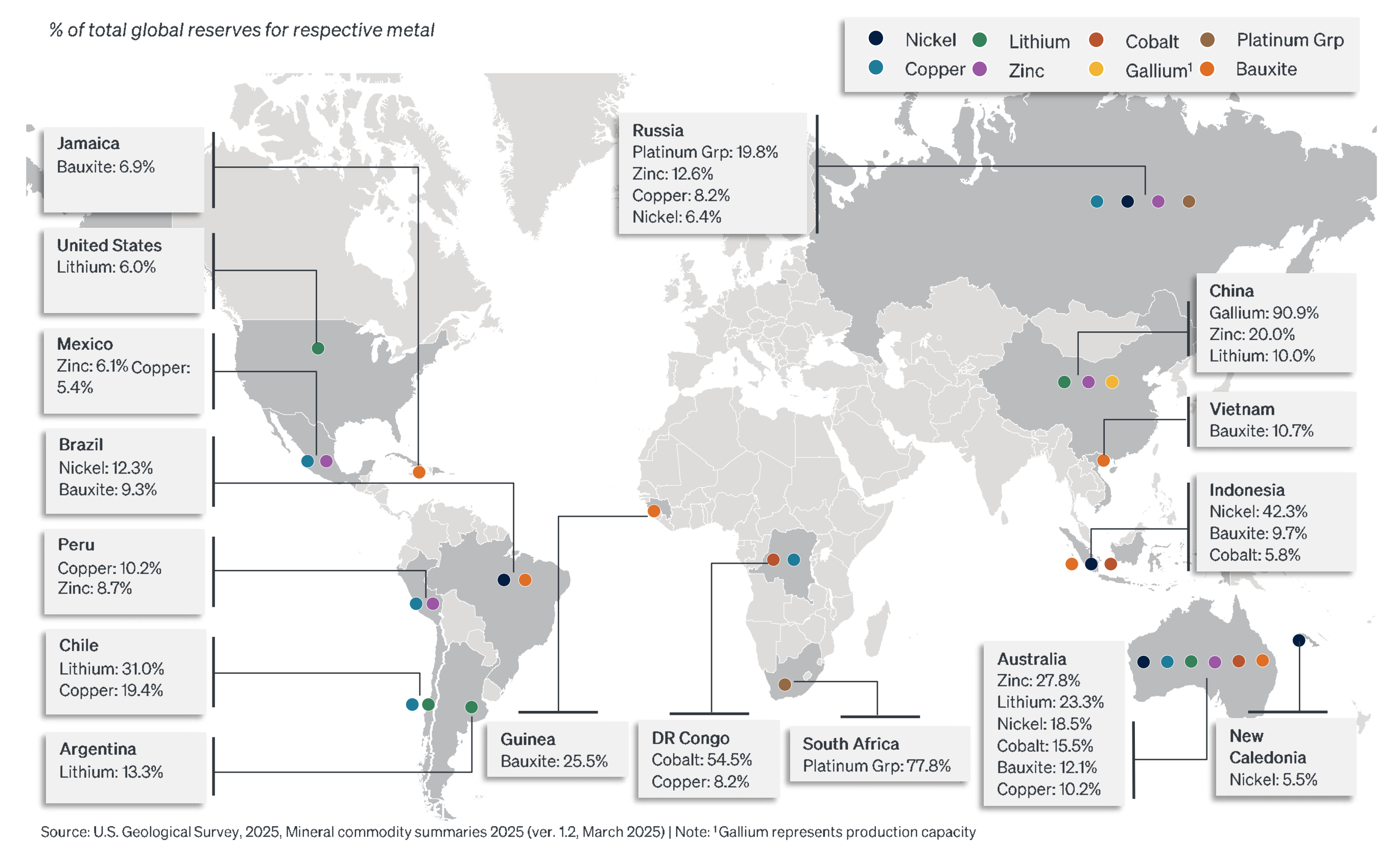

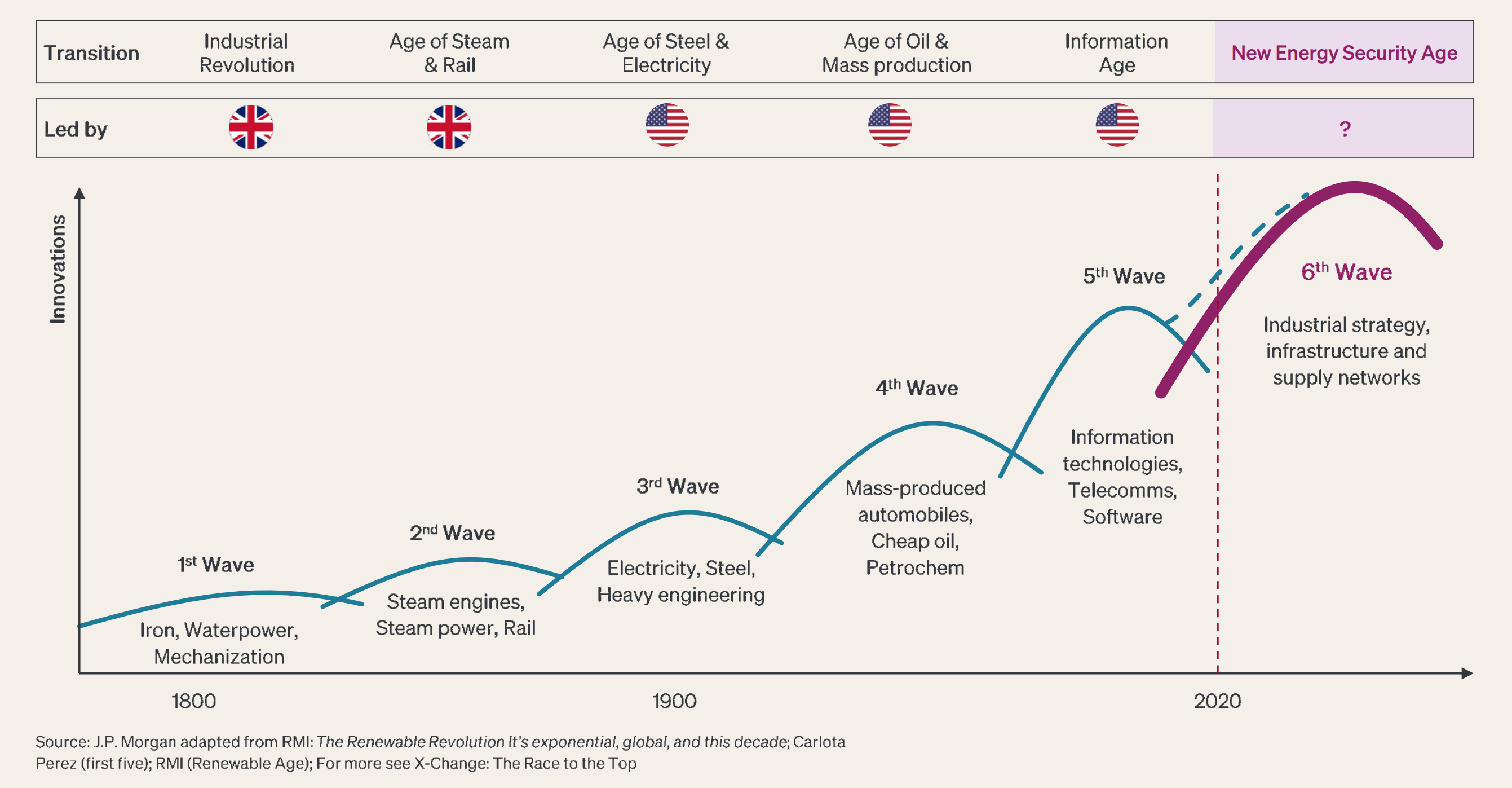

Protecting energy security and resilience are now key geopolitical priorities as nations seek to safeguard their economies amid rising demand, conflicts, and caution. Instead of a unified global energy transition, fragmentation and bloc formation are expected, according to a new JP Morgan Chase report.

Assessing the current momentum for the energy transition was the topic of a panel entitled “Energy Transition: Amping Up or Powering Down?” at the Sustainable Impact Meetings 2025 in New York. It was hosted by Jason Bordoff, Founding Director, Center on Global Energy Policy at Columbia University, who was joined by David G. Victor, Professor for innovation and public policy at the University of California, San Diego (UCSD); Rebecca Boudreaux, President and Chief Executive Officer, Oberon Fuel and Sumant Sinha, Chair and CEO, ReNew.

The energy transition will prevail

“People have been saying that, with the Trump administration’s rollback of credits and tax incentives, the energy transition is dead or dying,” Victor told the panel. “In fact, the fundamentals in a lot of places are doing very well.”

To paraphrase Mark Twain, news of the death of the energy transition is exaggerated.

”He foresees a temporary decline in US renewable deployment but expects the rest of the world to continue the energy transition at pace. He highlighted Europe and China – now the world’s largest energy producer – as leading the charge in renewables and related low-carbon technologies.

“It's very important to recognize that these are global technologies and they're able to be traded globally. That's been very good news overall for the energy transition,” Victor added.

The power sector is spearheading this drive, with technologies such as sustainable aviation fuels, carbon capture and clean fuels also starting to build momentum despite challenges around business models and costs.

“Innovation has always had headwinds,” stressed Boudreaux. “Technology is just one piece of the puzzle. Yes, things are challenging, but innovation will happen, not just on technology but on regulations, markets, financial instruments, and all the other pieces that have to come together.”

Energy security, affordability and climate targets align

Although energy security, resilience, and affordability might seem to outweigh climate in driving the energy transition, this hasn't slowed its global progress, said Sinha.

“If anything, I see ambition being scaled up, because affordability and energy security have become even stronger drivers in these volatile geopolitical times. Those are actually driving the energy transition, if anything, even faster.”

He stressed that India, as a significant net importer of energy, had been reinforcing domestic energy developments to achieve greater control over its energy sources.

“It’s leading policymakers to think more deeply about how dependent you want to be on the rest of the world for your core energy needs, given that renewable energy all operates within your own borders.

“Whether the energy transition happens because of climate change, energy affordability or energy security, we're going to get to the same end outcome eventually.”

How the Forum helps leaders navigate the transition of energy and materials systems

Onshoring and rising costs

Victor cautioned that onshoring or reshoring energy innovation could stifle it, lead to price increases, and affect supply chains.

“The parts of the clean energy transition that have been working really well – think about solar, batteries to some degree, nuclear technology – they thrived because they were global technologies.”

Commanding a global marketplace meant building large market shares and bringing down learning curves and costs.

While countries like the US could depend on their fossil resources and infrastructure for energy independence, said Sinha, countries lacking in natural resources required a different approach to energy security.

“We have to develop our own parallel supply chains, and that is inflationary compared to what you might get from China. However, you must weigh that inflation against security. At least in the case of India, we want to diversify our supply chain away from China.”

Victor advocated for more diverse supply chains as a solution: “Energy security has often been equated with autarky, being able to do it all at home. That’s simply false. Security comes from diversity and diversity alone.

“We need to have a more diverse set of supplies, but that's not the same thing as making all of our lithium and all of our rare earths at home. We have to have diversity and flexibility in market arrangements so that these commodity markets can function more effectively.”

Creating the right framework

Along with playing your cards right in terms of access to natural resources, supply chains and alliances, creating the right policy frameworks will be vital for succeeding in this new energy landscape.

Oberon Fuels’ Boudreaux said: “Technology is sometimes the easiest part. Technology and science follow the laws of gravity and thermodynamics. When it comes to regulatory environments, there are no laws that guide what can and cannot be done.”

A lack of clear policy can be detrimental to the dynamics driving the energy transition, as ReNew’s Sinha highlighted.

“The worst thing for business leaders is policy uncertainty. Wherever you see policy uncertainty, it's hard to make long-term investment decisions. You find areas where that policy certainty exists and then double down on those.”

While there has been considerable support for electrification, political uncertainty has hindered the development of clean fuels, such as green hydrogen and ammonia.

Victor pointed out: “The whole industry and the policymakers made a big strategic error in becoming overly obsessed with green hydrogen and not the whole rainbow, including blue hydrogen.”

Sinha added: “We started developing a lot of projects to produce green hydrogen and green ammonia, especially with a view to selling into the international markets in Europe and in the Far East. A lot of those countries are now pulling back because of other demands on their budgets and fiscal deficits, and we have had to put a lot of our projects on hold.”

A promising outlook

Despite the current volatility, the panellists agreed that the energy transition is heading in the right direction, with the forthcoming COP30 in Brazil set to galvanize commitments and actions as public scrutiny rises.

From a practical point of view, Victor stressed the need for continued momentum.

“We need more projects. Some of the projects are already in the money, especially on the bulk electric power side. On the molecule side, not yet – we need more projects so they become more normal and, frankly, they become boring. But boring means they become financeable with normal financial instruments, because everything that's interesting and deep decarbonization is capital-intensive. Capital intensity is the real barrier here.”

Boudreaux reinforced the key role of regulators in driving the transition. “We need regulators to set the targets. But don't tell us how to get there. Don't tell us what molecules to make, what technology to use, and how we’re going to generate our electrons. Set the target and let the innovators and the technologists, the people with the know-how, do it.“

ReNew’s Sinha concluded: “The most important thing is certainty. Have a roadmap developed for the next 5 or 10 years at the very least as to what that country is going to do. And then don't change it because once you have a plan and there's certainty around it, that's when the corporate sector is at its best in terms of making things happen.”

In its recent report, JP Morgan Chase suggested that the “new energy security age” we have entered would see those succeed that can optimize access, control and resilience of their energy systems. Getting this mix right will require policymakers, regulators, technology companies and investors to work more closely together than ever, forging strong connections across borders and regions.

Watch the full session below:

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Geopolitics

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Lauren Smart and John Morrison

February 20, 2026