Trade policy uncertainty a 'major drag' on the economy, and other international trade stories to know this month

A new study identifies three key impacts of this unpredictability. Image: REUTERS/Sodiq Adelakun

- This monthly round-up brings you a selection of the latest news and updates on global trade.

- Top international trade stories: The high price of unpredictable trade policy; China's exports up despite tariff pressures; US modifies scope of reciprocal tariffs.

1. Record trade policy uncertainty stalling global growth, UN warns

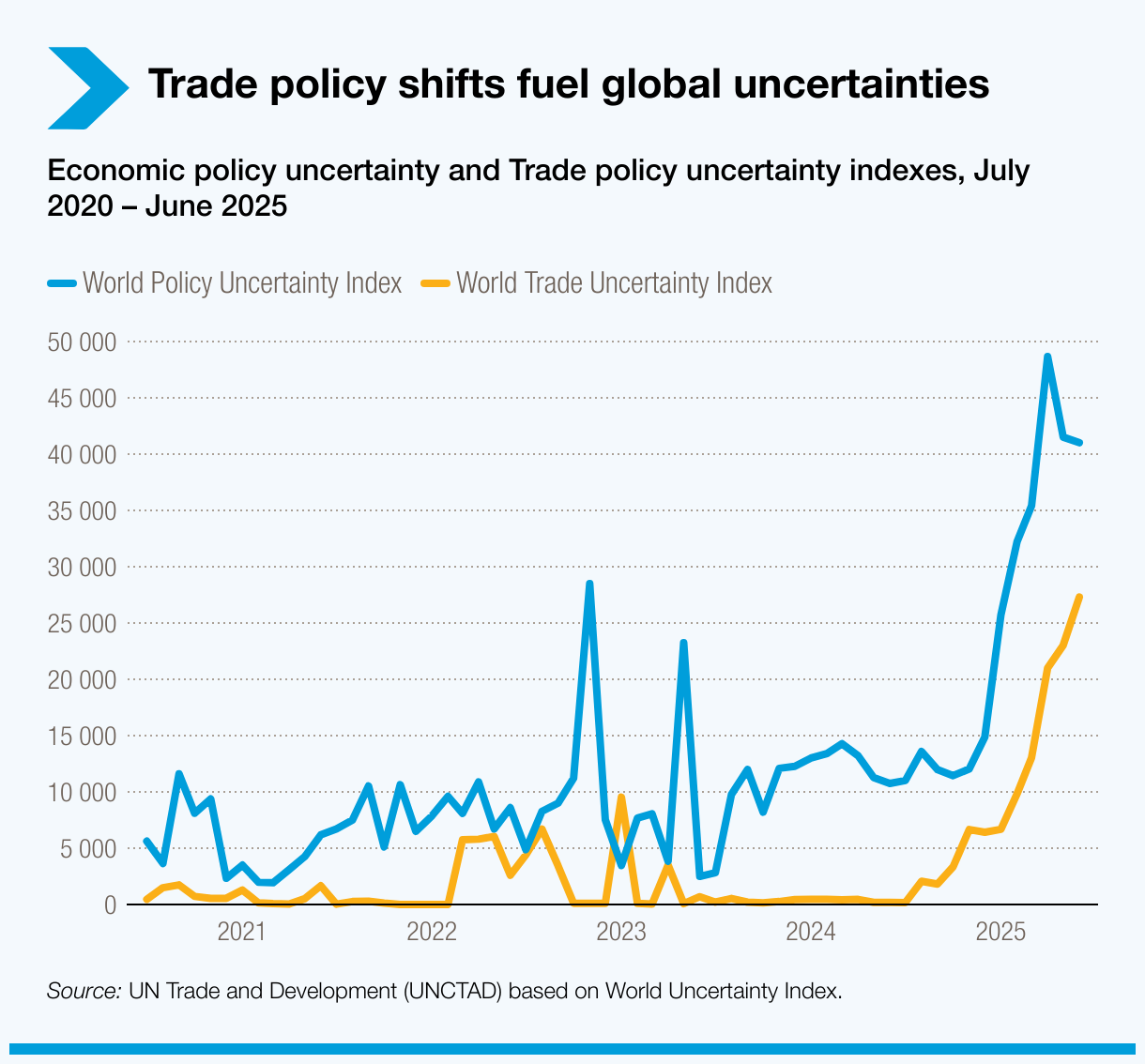

Global trade policy uncertainty has escalated to unprecedented levels in 2025 and is now a "major drag" on the world economy, warns the UN Conference on Trade and Development (UNCTAD). In its latest Global Trade update, UNCTAD identifies sudden shifts in tariffs, subsidies and other restrictions as a primary source of volatility and instability.

Such uncertainty is often a deliberate strategic tool used by governments to gain leverage in negotiations, the report's authors explain. While this ambiguity may serve short-term political goals, UNCTAD notes it comes at a high cost, increasing risks for firms and undermining international coordination. And with the weakening of global trade rules, there is little to constrain these abrupt policy shifts.

The study identifies three key impacts of this unpredictability:

- Higher costs and slower growth, as companies are forced to carry excess inventory and reconfigure supply chains.

- Risks to financial stability from volatile exchange rates and tighter credit conditions.

- An erosion of trust between trading partners that fuels retaliation and weakens global cooperation.

UNCTAD highlights the phenomenon of "front-loading" – where firms rush shipments to beat tariff deadlines – as a prime example of the disruption. However, this option is often unavailable to more vulnerable nations and their smaller firms, who are disproportionately affected by policy uncertainty due to weaker credit and infrastructure. The report urges countries to diversify their export markets to strengthen resilience.

2. China's trade data reveals a decisive pivot from US market

China’s latest trade data reveals a significant divergence in its global trade flows in the wake of US tariffs. Whilst there was a temporary reprieve in the form of a further 90-day pause granted by the US on the highest tariff rates applied to China’s goods imports, its exports to the US fell 33% in August from a year earlier, according to official data. This marks the fifth consecutive month of double-digit declines in shipments to the American market.

Despite this slump, a notable increase in trade with other regions allowed China's overall exports to grow by 4.4%. The customs data showed a surge in shipments to the Southeast Asian trading bloc (ASEAN), which rose nearly 23%, while exports to the European Union climbed 10%.

Trade with Africa has also soared, with Nigerian outlet Channels Television reporting that "construction machinery ranked among China's fastest-growing exports to Africa in the first seven months of 2025, surging 63% year-on-year".

“The story is still that the tariff shock can be offset by a more diversified market and strength in manufacturing goods for China,” said Michelle Lam, Greater China economist at Société Générale S.A, in a comment to Bloomberg. “Over the coming quarters, we should see some gradual slowdown further as US demand slows. But the impact should be milder than we initially envisaged.”

This redirection of trade means China's overall trade surplus stood at $785 billion at the end of August, and is on track to exceed the $1 trillion mark for the first time this year, outstripping last year's record by over 20%. However, analysts noted that falling export prices are squeezing company profit margins, particularly in sectors with industrial overcapacity like solar panels. The tariffs are also harming US businesses, with over two-thirds of major American firms in China impacted, including through lost sales.

3. News in brief: Trade stories from around the world

A new US executive order, effective 8 September, has modified the scope of the reciprocal tariffs first imposed in April. The order adds new exemptions for goods including bullion-related articles, critical minerals and certain pharmaceutical products. Simultaneously, other products like aluminium hydroxide, resin, and silicone goods have been removed from the exemption list and are now subject to the tariffs.

The US is also considering tariffs on a wider range of metals after expanding its list of critical minerals deemed essential for US economic and national security to 54 elements, including copper, lead, silver, rhenium, potash and silicon, according to Reuters. While levies on steel, aluminium and copper have already reshaped supply chains, the next round – pending the final report of the Section 232 national security review due by 12 October – could affect industrial metals from refined copper to rare earths, highlighting ongoing US efforts to secure supply chains and reduce import dependency.

The "Power of Siberia 2" project – a planned pipeline to send 50 billion cubic meters of Russian natural gas annually to China via Mongolia, more than doubling current pipeline flows – is gaining momentum following President Putin’s four-day visit to China this month. If completed, the pipeline could significantly influence global LNG markets by reducing China’s reliance on seaborne imports, which come mostly from Australia and Qatar, and reshaping energy supply dynamics.

At a virtual BRICS summit, India urged fellow members to address trade imbalances, noting its largest deficits are with BRICS partners. The discussion comes amid ongoing concerns over US tariffs affecting Brazil, India and other members.

The European Bank for Reconstruction and Development, alongside the Green Climate Fund and the EU, is providing a $50 million financing package to Egypt’s Suez Canal Bank. The EBRD will raise the lender’s Trade Facilitation Programme limit by $25 million for guarantees and cash advances.

4. More on trade on Forum Stories

With global trade under pressure from tariffs, geopolitical tensions and supply chain disruptions, 89% of economists say governments must boost AI infrastructure, while 86% urge businesses to lead adoption. Companies that invest in intelligent infrastructure now are best positioned for long-term growth. This article explores why investing in AI is critical.

How can countries attract digital jobs, grow domestic ecosystems and protect labour rights in the age of AI? The World Economic Forum’s 'Trade and Labour in the Digital Economy' report explores these questions through Kenya’s digital economy, offering recommendations for governments and businesses to support digital workers.

How can trade-related emissions be addressed as part of global climate action? Around 25% of global greenhouse gas emissions are embedded in international trade, yet they remain outside reporting frameworks. Ahead of COP30, as part of the Forum's event coverage, special envoys Dr Arunabha Ghosh and Professor Laurence Tubiana discuss potential solutions and the role of trade in advancing net-zero production.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Omair Ansari and Manahil Javaid

March 9, 2026