Opinion

Why your portfolio will be your paycheck in the age of AI

If AI threatens the stability of the paycheck, portfolios must be designed as resilient income engines. Image: REUTERS/Akhtar Soomro

- For generations past, a paycheck was the anchor of financial security.

- In a world where AI and machines take on a growing share of productive work, that model weakens.

- Without action, from increasing investment access to broadening financial literacy, the gap between asset owners and wage earners will widen.

The most disruptive force of our time may not be what artificial intelligence (AI) can do, but the worth that AI might ascribe to human labour. We don’t know the limits of AI, the pace of its progress or the manner in which it will transform industries. We do know that there’s a real chance the world of work will look very different in the years ahead.

If large parts of white-collar labour are automated, wages will no longer be the most reliable path to financial security. The new divide will be between those who own assets and those who don’t.

From wages to ownership

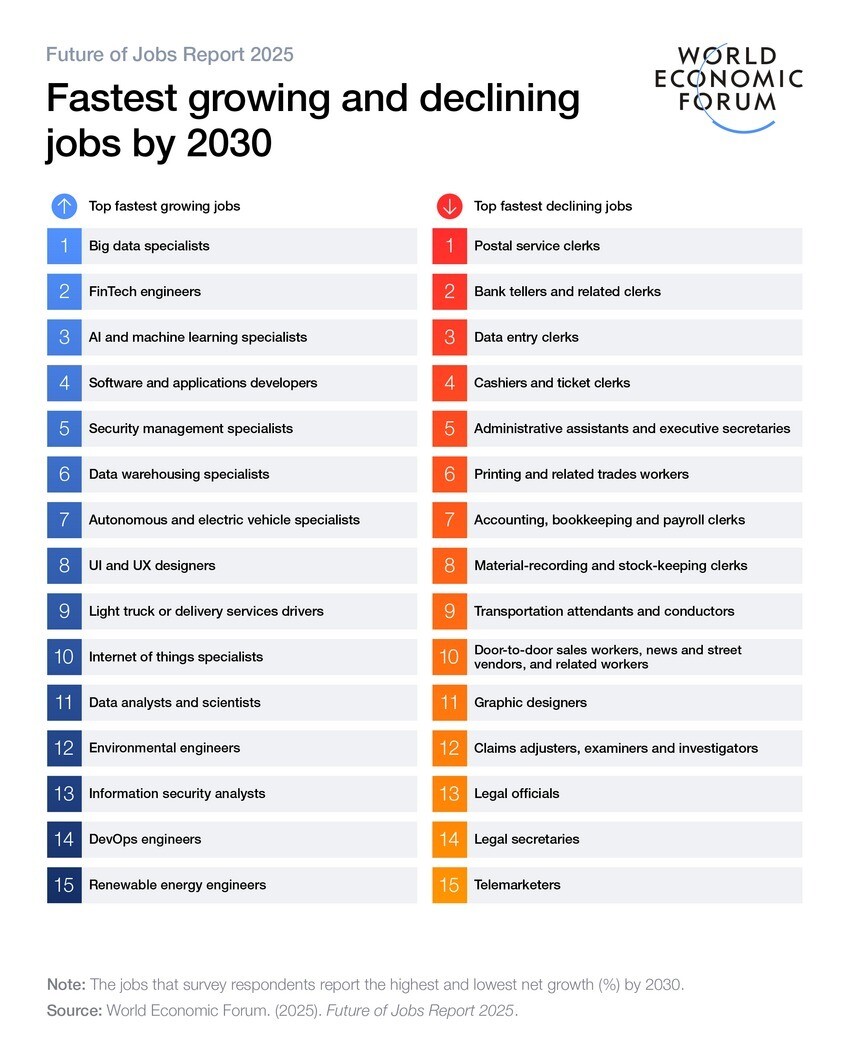

For generations, a paycheck was the anchor of financial security. You worked, you got paid and you built stability from there. But in a world where machines take on a growing share of productive work, that model weakens. According to the World Economic Forum, more than 40% of employers expect to reduce their workforce because of AI. Already, the value created by AI is flowing to the shareholders of the firms that control the data, platforms and chips, rather than to the employees whose roles, with a few exceptions, are being pared back.

This is not an abstract idea. In 2023, companies distributed a record $1.66 trillion in dividends. NVIDIA’s market value jumped tenfold in two years, generating more life-changing wealth for those who owned equity than for those drawing salaries.

Why investing is harder than it sounds

It’s tempting to say the solution is simple: invest. But investing isn’t a flip of a switch. You first need to save, which means resisting consumption, managing debt and building buffers. Only then can you direct capital into the market.

Once you start, you face another challenge: allocating wisely. Owning a single stock or a handful of tokens won’t suffice. Building a portfolio requires discipline, including diversification across equities, bonds, real estate and even new asset classes such as tokenized infrastructure. It requires planning: defining time horizons, risk appetite and goals. It requires habits and consistent behaviour, including sticking with the plan when markets fall.

Most people are not taught these skills. Two-thirds of adults globally lack basic financial literacy. In an AI-driven economy, that gap becomes existential.

How to approach the revolution

If wages are fragile, then portfolios must be designed as resilient income engines. That means three things:

- Planning, not drifting: treat investing as a life-long practice. Define a savings target, automate contributions and align investments with life stages.

- Expanding the opportunity set: don’t stop at domestic equities. Access real estate, dividend-paying stocks, government bonds, alternative funds and emerging tokenized assets. The broader the mix, the stronger the resilience.

- Building literacy and discipline: learn the basics of risk, compounding and diversification. Use digital tools, robo-advisors, auto-enrollment features and in-account or in-app nudges to save, but pair them with human judgement and patience.

Fintech platforms can lower entry barriers, but individuals must take the first step. Companies and organizations should also help them. Employers can expand equity participation and governments can incorporate financial education into curricula and offer incentives for saving. Without such steps, the gap between asset owners and wage earners will widen into a chasm.

The unknowns we can’t ignore

We don’t know whether societies will eventually adopt models such as a universal basic income to bridge the gap. We don’t know whether capital markets will remain as open and rewarding as in the past, especially as companies stay private for longer and the best opportunities remain concentrated. Yet, those unknowns only reinforce the case for acting early. It is safer to plan, save, and build ownership now than to gamble on solutions that may or may not materialize.

A harder call to action

We are entering a world where labour alone may not sustain financial independence. That is not a reason for despair, but it is a reason for urgency. If AI is going to rewire the economy, then each of us must rewire how we think about income.

The paycheck of the future is not a salary: it is a portfolio. That portfolio will not build itself. It requires choices, trade-offs, and effort today. The sooner we internalize this, the better prepared we will be when machines do more of the work.

The uncomfortable truth is that, in an AI economy, those who fail to own will be constrained by the system. Those who save and invest – even modestly – will hold a claim on the future. The clock to build that claim has already started ticking.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

The Digital Economy

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Peter De Caluwe

February 21, 2026