Tariff tensions drive FX trading to all-time highs in 2025, and other finance news to know

Foreign exchange volumes climb amid volatility. Image: REUTERS/Yuya Shino

- Catch up on the key stories and developments shaping the financial world.

- Top stories: Dollar still dominates FX trading in 2025; Stablecoins in the spotlight as European banks move forward; US shutdown delays key economic data.

- For more on the World Economic Forum's work in finance, visit the Centre for Financial and Monetary Systems.

1. Dollar leads as FX volumes reach new peak, finds BIS report

Global currency trading hit a historic high in April 2025, with daily turnover reaching $9.6 trillion – a 28% increase since 2022 – driven by tariff-related volatility and geopolitical uncertainty, according to the Bank for International Settlements’ (BIS) latest triennial survey.

The US dollar remains dominant, accounting for 89% of daily trading despite notable depreciation earlier in the year. The survey also highlights a rise in China’s yuan to 8.5%, alongside declines in the euro and sterling’s market shares, reflecting ongoing shifts in investor preferences and global finance.

London continues as the top foreign exchange (FX) hub, while derivatives trading in euros has nearly doubled and the yen has surged, partly driven by recent monetary policy moves in Japan.

Key stats:

- The US dollar remains dominant, present in 89% of trades despite recent depreciation.

- China’s yuan share rose to 8.5%, while the euro slipped to 29% and sterling fell to 10%.

- FX spot and outright forwards volumes saw substantial gains; FX swaps remain the largest instrument but with a declining share (42% vs 51%).

- Trading is concentrated in London, New York, Singapore and Hong Kong, with London maintaining the largest market share.

- Turnover involving financial institutions, especially regional banks, institutional investors and hedge funds, increased significantly.

Adding uncertainty, a partial US government shutdown on 1 October, 2025 has delayed key economic data releases, potentially increasing volatility amid an already active currency market influenced by trade tensions and geopolitical risks.

The BIS survey compiles data from over 1,100 banks and dealers in 52 countries, offering a comprehensive snapshot of evolving global FX market trends to guide policymakers and market participants.

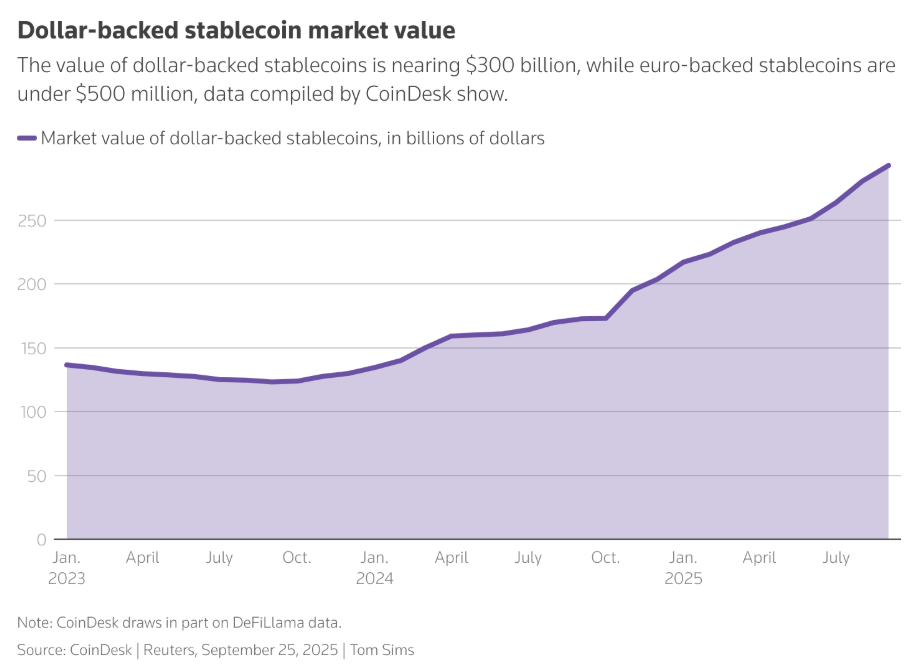

2. Stablecoins under scrutiny amid UK, European plans

Stablecoins are gaining institutional attention as both regulators and major banks consider their role in the financial system.

A consortium of nine European banks, including ING and UniCredit, is forming a new company to launch a euro-denominated stablecoin aimed at faster, lower-cost payments and settlements. This represents a move to strengthen Europe’s strategic position in digital markets, according to Reuters.

At the same time, the Bank of England is preparing regulatory guidance for stablecoins used at scale, covering depositor protections and access to central bank accounts.

Bank of England (BoE) Governor Andrew Bailey, writing in the Financial Times, said it would be “wrong to be against stablecoins as a matter of principle”, noting their potential to foster innovation in payment systems and emphasizing the importance of public trust and financial stability. He added that stablecoins operating at scale could reduce reliance on commercial banks for lending, but stressed the need for a clear regulatory framework to maintain that trust and stability.

The BoE plans to publish a consultation in the coming months to clarify regulatory standards.

The European Central Bank (ECB), however, remains cautious. ECB President Christine Lagarde has highlighted potential risks for monetary policy and financial stability, and suggested that a central bank-issued digital euro could offer a safer alternative.

The contrast between bank-led initiatives and regulatory caution reflects the ongoing challenge of balancing innovation with the need to manage systemic risk in Europe’s evolving digital payments landscape.

3. More finance news to know

US government shutdown halts key economic data: The federal government partially shut down on 1 October after Congress failed to extend funding, pausing reporting by agencies including the Bureau of Labor Statistics, Census Bureau and Bureau of Economic Analysis at a critical time for markets and policymakers. The pause in data releases is expected to increase market volatility and complicate policymaker decisions amid an already fragile economic environment.

This November, COP30 in Belém, Brazil, marks a pivotal moment for climate finance under the Paris Agreement and UNFCCC frameworks. Eric Usher, Head of UNEP FI, outlines key finance-related negotiations that will shape investment flows and risk management:

- Clearer climate investment pathways: Updated Nationally Determined Contributions must translate into ‘investable’ plans to mobilize private capital at scale.

- Scaling climate finance: Achieving the New Collective Quantified Goal of mobilizing up to $1.3 trillion annually by 2035 for developing countries, leveraging public funds to attract private investments.

- Sustainable finance taxonomies: Enhancing global standards and interoperability to boost investor confidence and cross-border capital flows.

- UN-backed carbon market: Finalizing robust rules for global carbon credit trading to expand financing options and risk management tools.

- Just transition finance: Integrating social equity into climate investments to ensure inclusive, fair economic shifts away from fossil fuels.

Non-bank finance reaches half of global assets: The International Monetary Fund reports that 'nonbank' financial institutions - firms providing credit and investment services outside traditional banks - now hold nearly 50% of all financial assets globally. This expands access to credit and investment options but introduces new financial stability risks due to lighter regulation and closer ties with banks, it warns.

Property-linked finance targets global scale: The Climate Bonds Initiative and Green Finance Institute aim to turn the $18 billion US property-linked finance market into a global asset class, reports Bloomberg. The initiative seeks to unlock billions in private capital for net-zero, climate-resilient buildings, offering technical support and financial tools to fast-track sustainable investment in real estate.

Latin America and the Caribbean fintech booms: The region’s fintech market grew by 340% between 2017 and 2023, fuelled by fast-growing digital payments, mobile banking and neobanks. Despite 70% of the population remaining unbanked or underbanked, startups have surged, driving financial inclusion and innovation. Challenges include regulatory gaps and infrastructure, but the sector is positioned for strong growth, says Forbes.

How the Forum helps leaders understand change in global financial systems

4. Read more on Forum Stories

Sustainable finance gains momentum: Capital is flowing faster into food systems, nature, industry and infrastructure, with sustainable debt topping $1 trillion in 2024 and private finance for nature up elevenfold since 2020. Forum experts Derek Baraldi and Priyanka Ramchurn note that, “Nature finance is no longer emerging; those who act early will capture returns while helping set market-defining rules.”

Who will finance the future economy? Nations and corporations are racing to control grids, undersea cables and digital infrastructure. Strategic investment is becoming a key lever of influence, as surging electricity demand from AI, data centres and crypto will require massive, forward-looking financing. Read more about how these investments will shape the resilience and competitiveness of the global economy.

US stablecoin law sparks EU crypto debate: The passage of the GENIUS Act in July 2025 has provided long-awaited regulatory clarity for US crypto markets, prompting EU policymakers to reassess the adequacy of the 2023 Markets in Crypto-Assets Regulation. Officials are weighing monetary sovereignty and risks of global regulatory arbitrage, as transatlantic alignment becomes increasingly important. Discover how regulators are navigating the evolving crypto landscape.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Financial and Monetary SystemsSee all

Rebecca Geldard and Spencer Feingold

February 23, 2026