How individual households shape global economic development

Household economics impact economic development. Image: Ninthgrid/Unsplash

- A household of ten people sharing housing costs operates under entirely different economic constraints to a single-person household bearing those costs alone.

- These household patterns have practical implications for businesses and policy-makers.

- Understanding these patterns is essential for anyone trying to predict consumption, housing demand or social policy needs across different markets.

Most economic analysis focuses on individuals: their income, spending and productivity. The household is where spending decisions are made, however, with family dynamics, shared resources and collective needs influencing purchasing decisions. A household of ten people sharing housing costs operates under entirely different economic constraints to a single-person household bearing those costs alone.

When you shift the lens from individuals to households, these structural differences reveal economic patterns that individual-level data cannot capture. Recent research from World Data Lab reveals how households can help explain global variations in consumption, market behaviour and development.

How the Forum helps leaders understand change in global financial systems

Household size

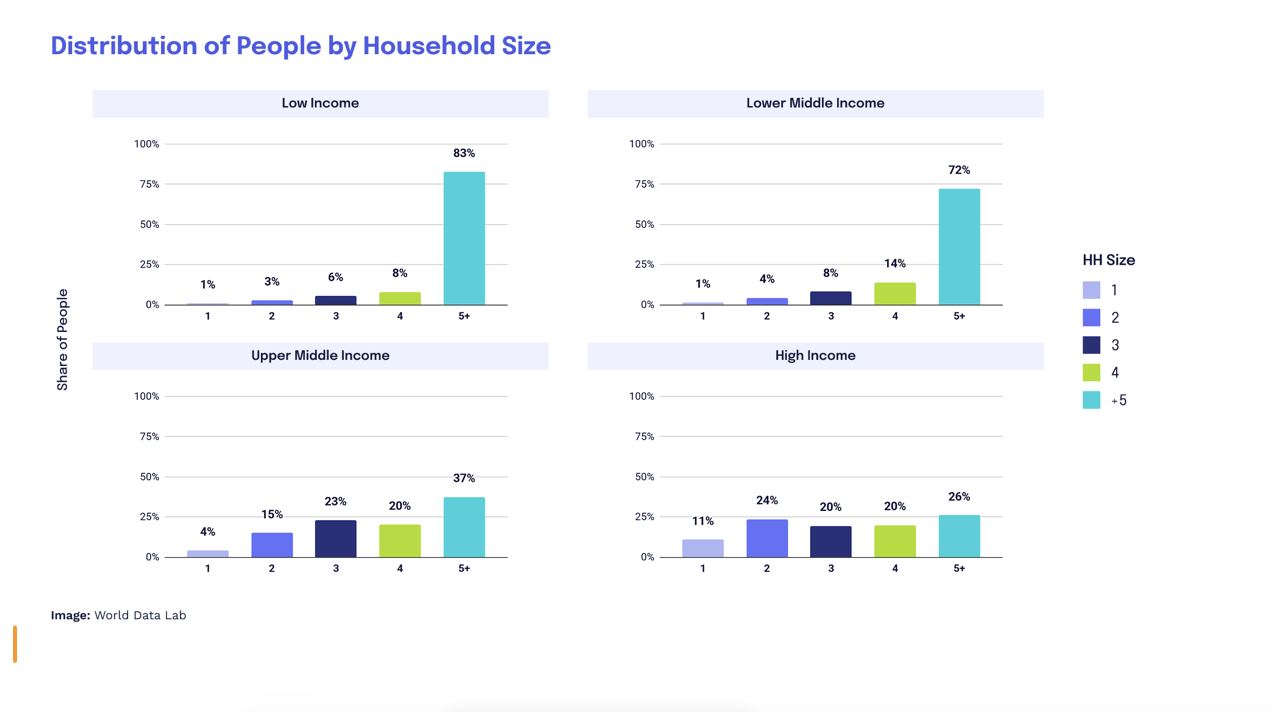

Over 50% of the global population resides in households of five or more people and this share is expected to continue growing. Household size, however, correlates directly with income level. Among low-income populations, 83% live in large households. This drops to 72% among lower-middle-income individuals, 37% among upper-middle-income individuals and just 26% among high-income populations, where smaller households become financially viable.

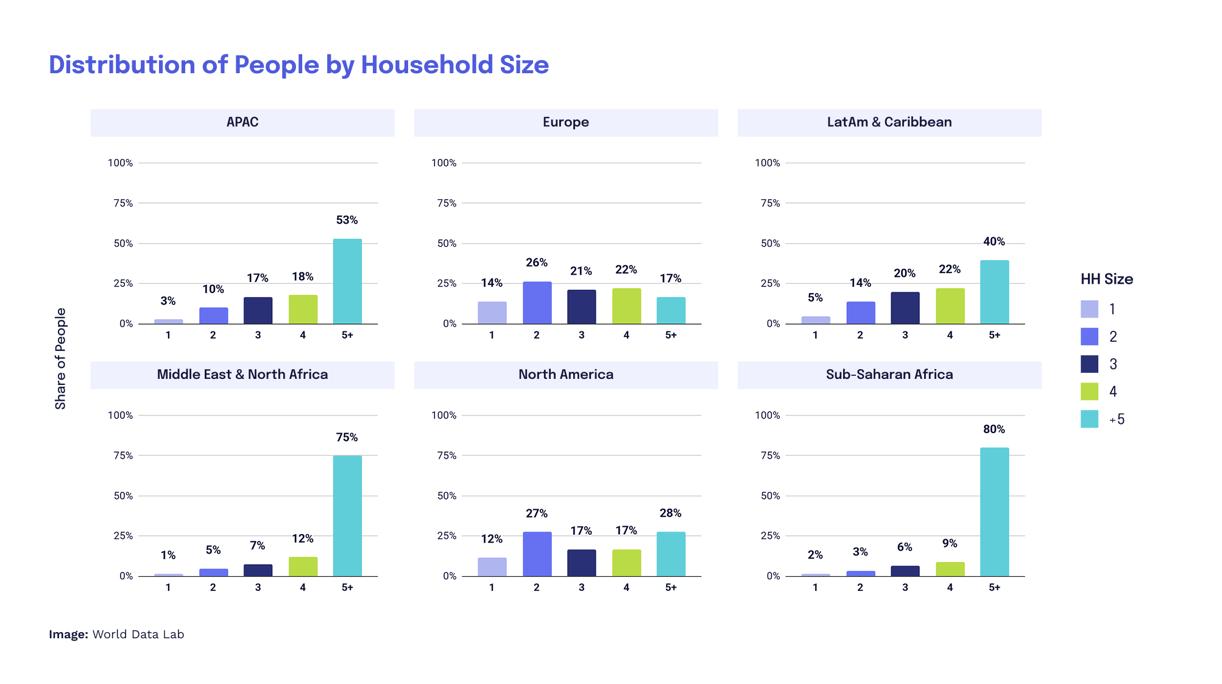

Household patterns also vary dramatically by region. In the Middle East and North Africa, 75% of people live in households of five or more, while Sub-Saharan Africa reaches 80%. North America sits at just 27%. Europe is the outlier, where two-person households have the largest share, but overall, there is a more even distribution across different household sizes than in other regions.

At the extremes stand Senegal and Denmark. In 2025, the average household size ranges from 10.63 people in Senegal to 1.98 people in Denmark. This gap is widening: by 2035, Senegal is expected to reach 10.87 people per household, while Denmark is expected to decrease to 1.93 (and be surpassed by Finland, Germany and Canada in the trend towards single-person living).

Household economics

The relationship between household size and spending reveals a consistent and striking pattern across all regions: smaller households spend dramatically more per person.

In North America, single-person households average $55,760 in annual per capita spending, while five-person households spend $40,400 per person, representing a 28% decrease in spending per person. Europe shows an even larger gap: $32,740 per person for single-person households versus $14,710 for households of five or more, a 55% decrease.

The difference is even more stark in emerging economies. In Sub-Saharan Africa, single-person households spend $9,880 per capita annually, while large households average just $2,250 per person. In the Asia-Pacific, single-person households spend $20,010 per person versus $6,210 for households of five or more. In Latin America and the Caribbean, it’s $24,290 versus only $7,570 per person.

This isn't simply because children don't earn income. Even when we look only at households without children, the pattern persists. In Europe, single-person households without children spend $32,740 per capita, compared to $18,750 for households with five or more people- a 43% decrease. In Sub-Saharan Africa, the gap is 52% ($9,880 versus $4,700). In the Asia-Pacific region, single-person childless households spend 87% more per capita than large households ($20,010 versus $10,690). In Latin America and the Caribbean, we see a 41% decrease ($24,290 versus $14,240). In North America, however, it’s DINKs (dual-income, no kids), not single households, that lead all household types in per capita spending, at $63,160.

When children leave home

Wealthy households globally follow a remarkably predictable life pattern. The percentage of households with children present peaks when the household ages between 35-45, then drops sharply by age 55-60 as children gain independence. The 'empty nest' transition is clean and definitive, except in Sub-Saharan Africa, where, at ages 70-75, children often move back in, perhaps to care for ageing parents. This pattern suggests that income does not necessarily override cultural values around elder care and intergenerational responsibility.

Among poorer households worldwide, those with children experience a peak earlier and at a higher rate and the decline is much more gradual. In Sub-Saharan Africa, 50% of households still house children when the household head reaches 75 years of age. Less dramatically, but still significantly, Middle Eastern and North African households with children maintain elevated levels as the age of the household head moves into their 70s.

These patterns show that the Western model of children leaving home in their early twenties is not universal. In many regions, multi-generational living remains common throughout the life cycle, driven by cultural norms surrounding elder care and economic necessity.

The female leadership trend

Women already head a remarkable share of households globally and there is a steady rise of female-headed households across every region analyzed. In North America, female-headed households reached effective parity more than a decade ago, with the share at 50.2% in 2025. Europe follows with a share of 40.2%, while Latin America and the Caribbean reach 38.1%.

Meanwhile, Sub-Saharan Africa has 28.2% female household leadership in 2025, higher than 21.2% in the Asia-Pacific. While the Middle East and North Africa have the lowest share, they exhibit the fastest growth rate, with female household leadership increasing from 16.7% in 2015 to 20.4% by 2035. These percentages represent millions of households where women make key economic decisions.

Implications

These household patterns have practical implications for businesses and policy-makers. Consumer goods companies face different demand patterns when selling to single-person households versus large families. The increase in women as heads of household, and thus as primary household decision-makers, opens up opportunities for category development. Housing developers must account for vastly different space needs across regions. Social safety nets designed for nuclear families may not work in contexts where multi-generational living is common.

As urbanization and economic development continue, understanding these patterns becomes essential for anyone trying to predict consumption, housing demand or social policy needs across different markets.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Economic Growth

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Martin Jacob

February 17, 2026