How the EU's CBAM will impact the business and carbon pricing landscape

Many jurisdictions are looking at introducing border carbon adjustment mechanisms such as the EU's CBAM. Image: Reuters/Peter Andrews

- The EU's CBAM will be the first fully operational border carbon adjustment policy to charge costs based on the emissions intensity of imported goods.

- Many other jurisdictions across the world are exploring BCAs of their own, implying a potential proliferation of similar policies over the coming years.

- Firms that embed strong governance, credible data systems and long-term decarbonization plans will be better equipped to manage rising complexity.

The European Union’s Carbon Border Adjustment Mechanism (CBAM) enters its definitive stage on 1 January 2026, becoming the first fully operational border carbon adjustment (BCA) policy to begin charging costs based on the emissions intensity of imported goods.

That will mark the first time that the price of carbon in a certain jurisdiction is externalized beyond its borders.

The EU is not alone in exploring border carbon adjustment as an approach to reduce carbon leakage, a phenomenon where the production of high-emissions goods is outsourced to countries with lesser regulations.

Research suggests that carbon leakage can have a significant impact on reducing the effectiveness of domestic carbon pricing policies, offsetting emissions reductions by roughly 13%, according to a recent Organisation for Economic Co-operation and Development (OECD) study on the aluminium, cement and steel sectors.

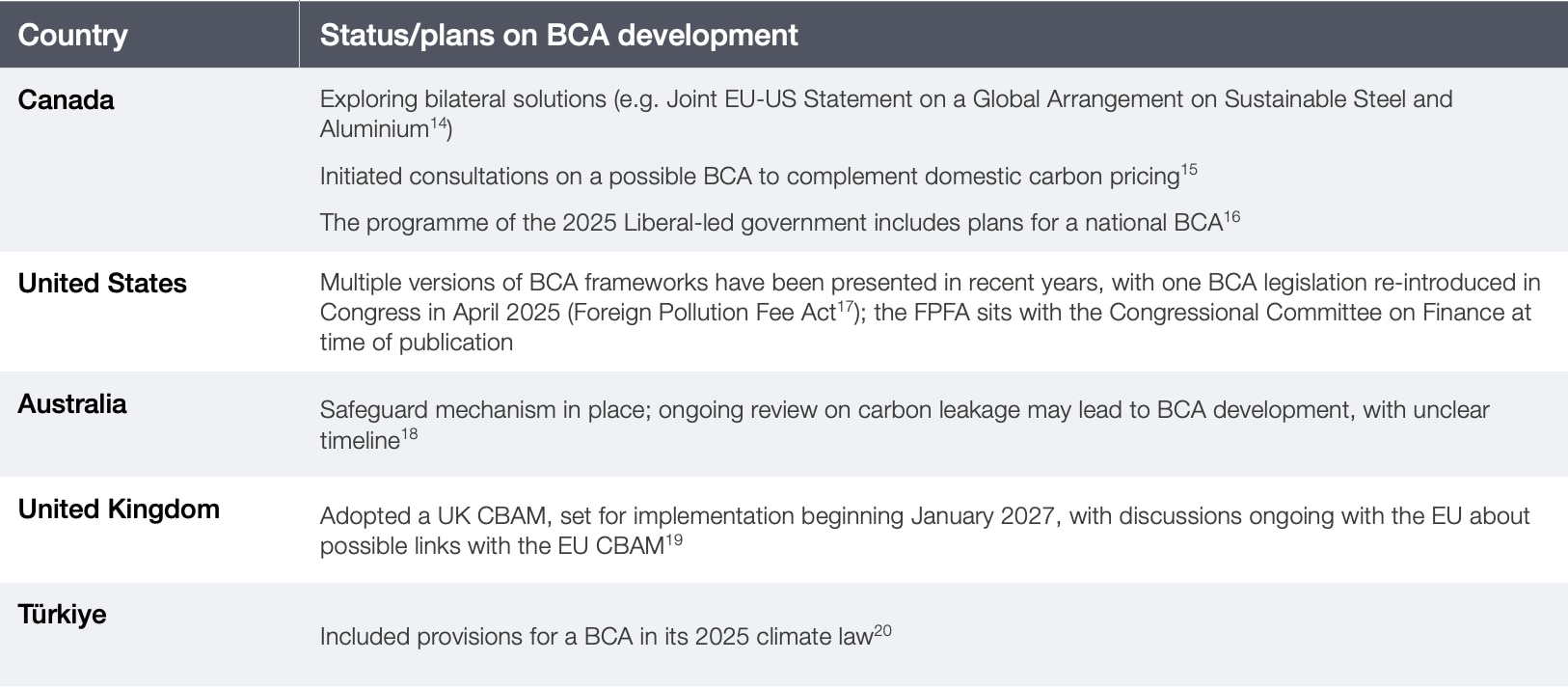

In the wake of the EU’s initial CBAM pilot phase (2023-2025), many other jurisdictions – including Canada, the United States, Australia, the United Kingdom and Türkiye – are exploring BCAs of their own, implying a potential proliferation of similar policies over the coming years.

Border carbon adjustments are controversial, as opponents view them as unilateral trade measures and a form of green protectionism.

A subject of dispute at both COP30 and within the World Trade Organization, the EU CBAM is nevertheless set to enter into full effect from 2026, with increasing costs year over year. In response, companies around the globe – particularly in high-emissions, export-intensive sectors – have been rapidly preparing for the EU CBAM and a potential new era of BCA proliferation.

Preparing for BCAs and leveraging the opportunities they present

By reshaping the climate and trade nexus, BCAs may create new opportunities to align decarbonization with business competitiveness imperatives. Based on an analysis of leading companies in emerging economies, recommendations for how to leverage these opportunities are presented below, and expanded on in the World Economic Forum and Climate Finance Asia’s Climate and Competitiveness: Border Carbon Adjustments in Action white paper.

For exporting companies, the CBAM is transforming how business strategy incorporates carbon management. In the short term (1-3 years), firms can conduct scenario planning, evaluate exposures and BCA implementation timelines to anticipate compliance and trade impacts, and consider internal carbon pricing (ICP) systems, systematically integrating carbon pricing into capital budgeting and investment decisions.

Concurrently, companies could move to deploy digital monitoring, reporting and verification (MRV) systems and automated energy- and emissions-monitoring tools, while conducting third-party verified life-cycle assessments for key products.

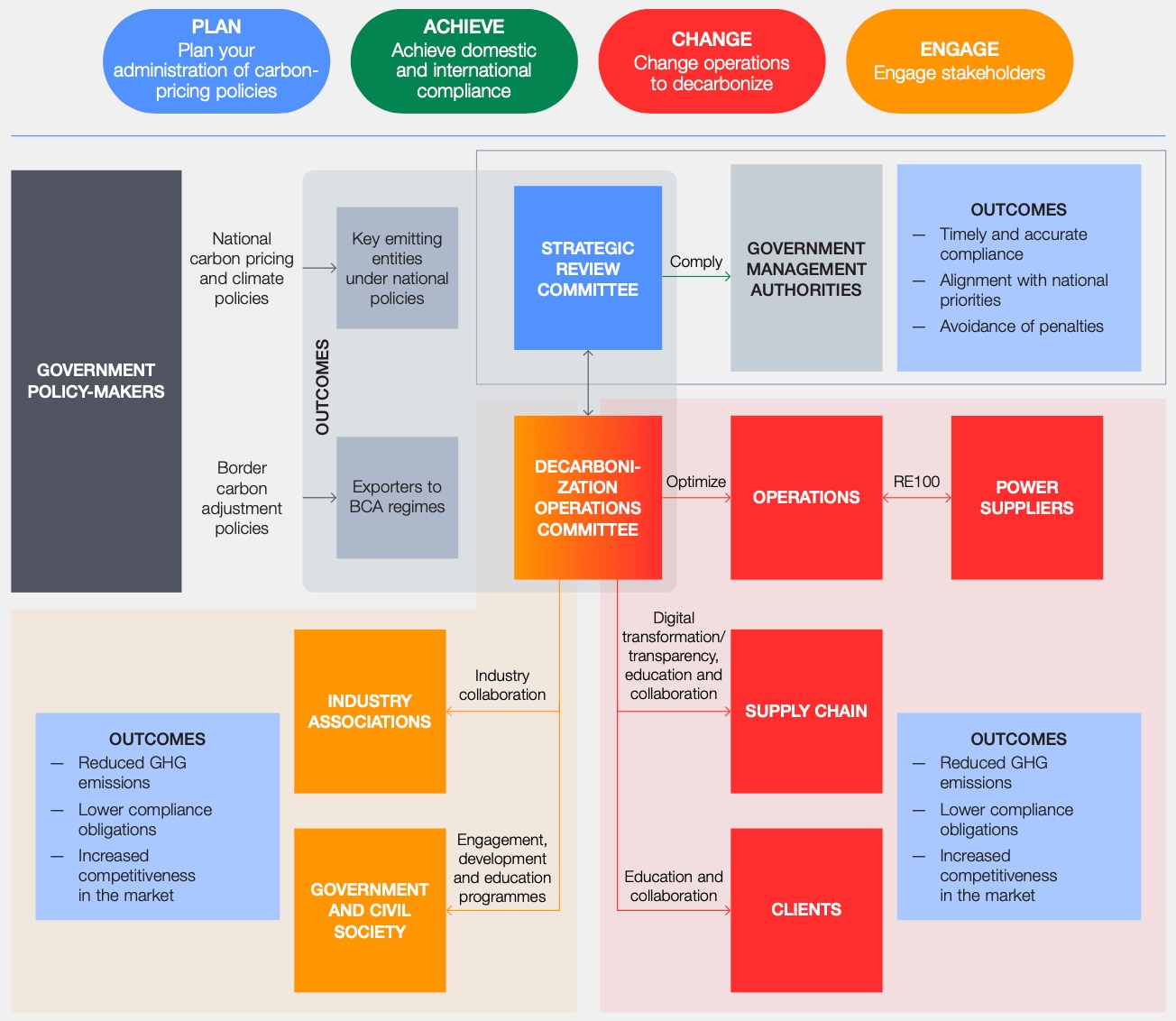

A dedicated governance structure, drawing on the PACE (Plan, Achieve, Change, Engage) framework, can be established:

- Plan by developing internal governance mechanisms and integrating carbon pricing into strategic and financial planning

- Achieve compliance with both domestic carbon rules and international BCAs

- Change by decarbonizing operations, from sourcing to delivery to reduce GHG emissions

- Engage by coordinating across legal, finance, operations and environmental teams, working with third-party verifiers or partners, and collaborating with policy-maker, civil society and stakeholders

Supply chain engagement is also important: firms could consider working to collect upstream emissions data from suppliers, setting supplier-level reporting standards, and prioritizing sourcing of lower-carbon inputs.

Over the long term (3-10+ years), companies can consider shifting toward more structural transformation. This could involve technology upgrades, retrofits to reduce process emissions or energy demand, and adoption of cleaner fuels or energy sources where feasible.

Firms can periodically review supply chain carbon intensity and shift to suppliers that demonstrate lower emissions. A well-integrated governance body, e.g., a strategic review committee for carbon and decarbonization operations, can oversee long-term carbon strategy, monitor evolving policy developments, and guide investment in decarbonization.

Over time, these steps will reduce a company’s carbon footprint, lower exposure to CBAM-related compliance costs and create a sustainable competitive advantage by aligning operations with global carbon-conscious supply chain expectations.

What BCAs may mean for the future of carbon pricing and global trade

As BCAs begin to move from concept to implementation, details remain dynamic and unclear. Nevertheless, the expansion of border carbon adjustments as a possibility – even if many are not yet set for implementation in the near-term future – is prompting governments and companies alike to revisit long-standing assumptions about competitiveness, supply chain design and the role of carbon in global markets.

Only time will tell how the BCA landscape develops, but developing proactive strategies now may yield a competitive edge over the years to come.

On a broader scale, questions also remain about the implications of BCAs on carbon pricing systems worldwide.

At an initial glance, they may appear to be agents of fracture – complicating standardization, requiring different data measurement requirements, entailing significant costs and resources, and requiring companies to think not just about the requirements for their own national carbon pricing systems, but also those of the potentially myriad BCAs in countries they export goods to.

At second glance, however, border carbon adjustments may be a catalyst for change and standardization: because of the hefty requirements a world of BCAs would entail, they may also act as a driving force towards multilateral approaches to carbon pricing.

Following the discussions at COP30 in Brazil, three annual dialogues on trade were established, to “examine how trade policy and cooperation can better support just, equitable and effective climate action.”

Additionally, the EU, UK, China and 10 other economies agreed on the Declaration on the Open Coalition on Compliance Carbon Markets, which calls for the exploration of “options to promote interoperability of compliance carbon markets”.

Over time, this could encourage convergence in reporting standards, MRV frameworks and product-level emissions accounting – all areas where businesses have already called for clearer alignment.

While fully harmonized systems remain unlikely in the near term, the practical demands of administering BCAs may gradually promote closer coordination between regional schemes and could lay the groundwork for more structured multilateral dialogue on carbon pricing.

Taken together, these developments suggest that border carbon adjustments are becoming a meaningful feature of the global trading system. While the next steps are still taking shape, the direction of travel matters.

As carbon costs begin to shape market access, firms that embed strong governance, credible data systems and long-term decarbonization plans will be better equipped to manage rising complexity – and to seize opportunities as carbon pricing and global trade continue to evolve.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Climate Crisis

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.