The IMF's Kristalina Georgieva talking at the 'AI Power Play, No Referees' session at Davos 2026. Image: World Economic Forum / Ciaran McCrickard

Quotes have been lightly edited for clarity and brevity.

- At Davos 2026, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), was cautiously optimistic about the state of the world economy.

- Speaking on the Forum's Meet the Leader podcast, Georgieva said that uncertainty is the new normal – and highlighted what leaders should factor into decision making as they navigated this new normal.

- She also explained the four factors behind the global economy's current resilience in the face of geopolitical headwinds.

"My message to everybody is, learn to think of the unthinkable and then stay calm, adapt."

So said Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), as the World Economic Forum's Annual Meeting in Davos got underway amid swirling geopolitical tensions.

Talking to Linda Lacina on the Forum's Meet the Leader podcast, Georgieva echoed Canadian Prime Minister Mark Carney's comments at Davos that "the old order is not coming back" when she said, "I don't think, any more, that we will go back to a world of predictability".

Despite these tectonic shifts, the global economy has not foundered as many expected. Indeed, the IMF's latest World Economic Outlook projects global growth of 3.3% this year and 3.2% for 2027. It is, Georgieva admitted, "the biggest surprise" – and begs the question, how has this been achieved?

Georgieva outlined four factors that have helped support the global economy's current resilience. Still, she stresses that structural risks such as debt and inequality must be managed carefully. "We need to not only understand why it is resilient, but nurture this resilience for the future," she said. "We are in a world of uncertainty. Do everything you can to have better buffers."

Hear the podcast here, or on any podcast app:

1. The private sector stepping forward

Globally, governments have stepped back from running companies, enabling the private sector to take over. This is a positive change, said Georgieva, because the private sector "is more adaptable, more agile, and we see the benefits of it".

Two areas that Georgieva highlighted as under-discussed engines of growth are renewable energy and energy efficiency, alongside the power of technological innovation to create entirely new industries.

"We are not talking enough about the unknown – what are the areas, what are the products, the services, the activities that we don't know exist, but are going to come? And how do we make this an exciting engine of growth?"

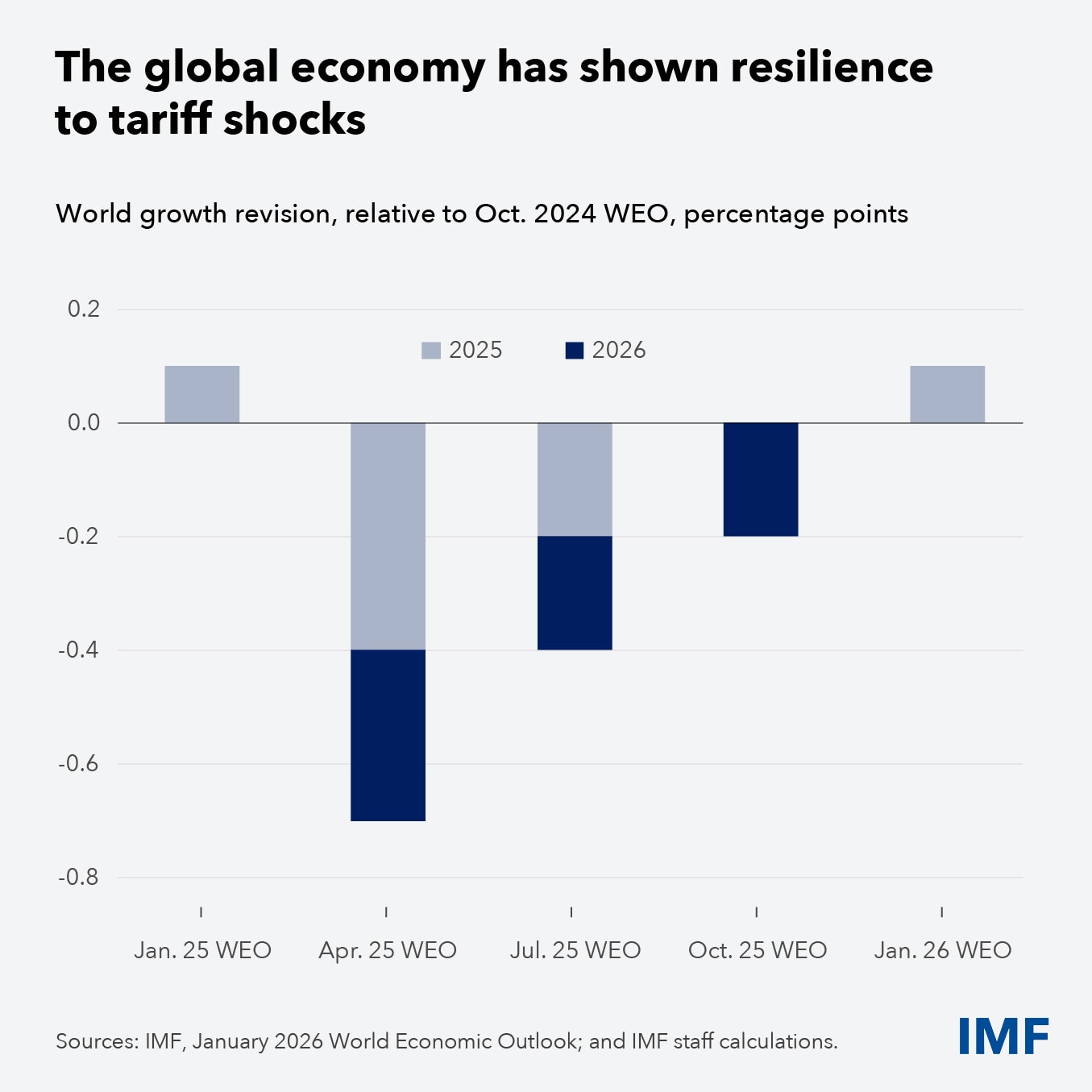

2. Mitigated trade disruptions

Looking back at 2025, "trade tensions did not materialize on the scale people feared", Georgieva noted. This was because the tariffs announced in April were mitigated by "deals, exceptions and corrections", she said, and because the majority of countries – especially small and medium-sized economies – avoided "tit-for-tat" retaliation, choosing instead to keep trade flowing.

"And we are encouraging people, especially now when there is some reappearance of trade tensions, please keep it this way."

Georgieva also highlighted the fact that "we often talk about geopolitical clashes. We forget to recognize that there are geopolitical positive developments". There has been more inter-regional trading and parts of the world are becoming more dynamic and economically stronger – all of which reflects the fact that the world "is now moving to multipolarity", she said.

3. AI driving growth

The continued surge in investment in the information technology sector -- and Artificial intelligence (AI) -- has been an important driver of resilience. It has become "a very powerful driver of growth and potentially prosperity", said Georgieva. The potential bit is key. "Is it going to help the majority to have better opportunities, better jobs, better lives? Or is it going to be a divisive force that widens inequality?"

If AI is deployed in a "meaningful, well-calibrated, thoughtful manner", it could lift growth by up to 0.8%, she said.

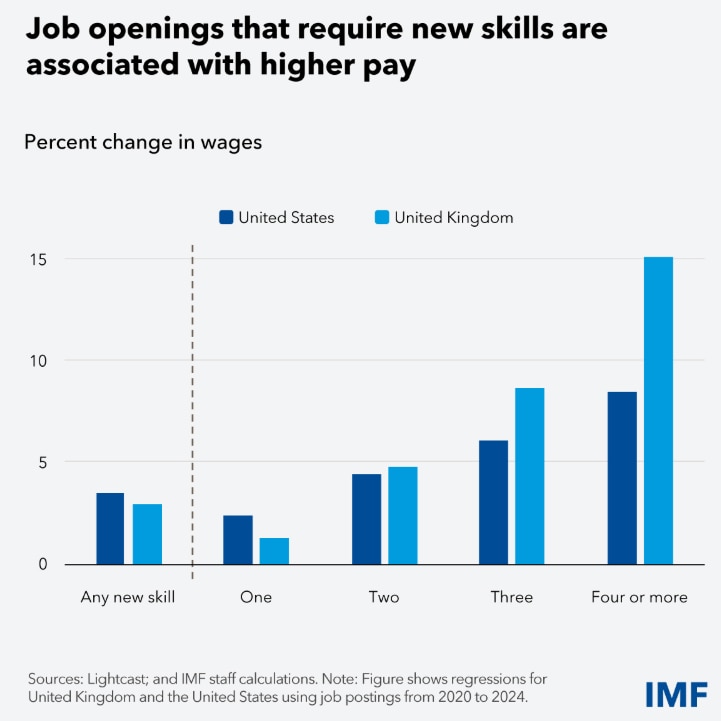

The IMF's recent analysis of jobs in the AI age found that, in advanced economies, one in ten roles requires at least one new skill – and sometimes up to four. At the same time, a 1% increase in general new skills has been found to result in a 1.3% uptick in overall employment.

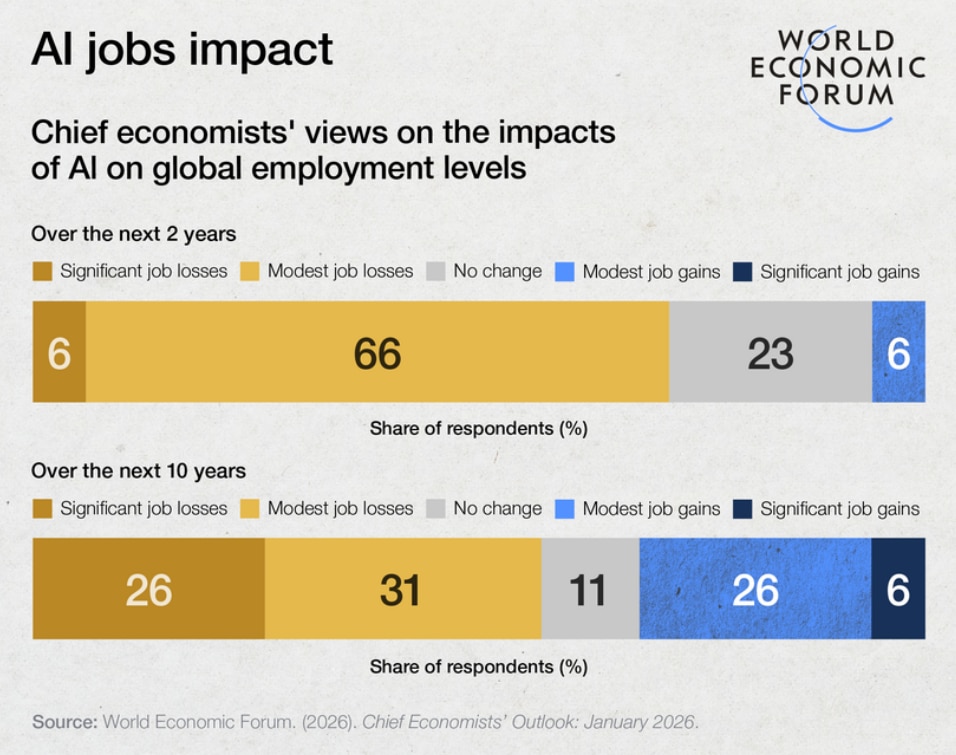

"In other words, the fear that AI is going to not only reshape jobs but shrink employment is, so far, not proven by data," Georgieva said.

Additionally, a quarter of chief economists responding to the World Economic Forum's recent quarterly survey are anticipating significant job losses over the coming decade, while almost half of employees fear AI benefits companies, not individual workers. Georgieva also warned of "AI enthusiasm leading to an increase in financing, but not to an increase in profitability", which she noted could eventually push investors away.

4. Governments getting it right

"Our governments are actually doing a pretty decent job in deploying policies to support businesses and support households," according to Georgieva.

But they are up against a variety of economic challenges. One is ageing populations, she said, which holds back growth. Another is the availability of capital to invest in innovation.

"We have youthful populations, but capital doesn't go there. So how do we create conditions to build a bridge from where the capital is – mostly in the North – to where the young people are – mostly in the South?"

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Risks ahead and key decisions to be made

This resilient growth, the IMF says, "masks underlying fragilities tied to the concentration of investment in the tech sector. And the negative growth effects of trade disruptions are likely to build up over time." Furthermore, governments still have important work to do to reduce public debt "to safeguard financial stability."

In its 2026 Economic Outlook, the IMF cautioned that AI investment offers incredible potential, but also can introduce new risks. Interest could fade if tech firms don't "deliver earnings commensurate with their lofty valuations." A correction in valuations could trigger lower-than-expected growth and productivity losses.

To sidestep this, given the stretched valuations, careful oversight will be needed to ensure "robust underwriting standards" for banks and non-banks exposed to the tech sector. Meanwhile, monetary policy will face a careful balancing act and central bank independence remains critical for both price stability and credibility.

Lastly, AI-driven upticks in wages or job demand are not inevitable, she stressed, and its impact on workers globally will be uneven. Policymakers have a key part to play in lowering barriers to adoption, supporting mobility and creating incentives for businesses to invest in upskilling. They also have a "huge role" in creating the right enabling environment for innovative companies to grow.

Removing infrastructure obstacles is another vital step for AI's potential, as "in many developing countries and in some advanced economies, there is still a lack of the technological underpinning of connectivity. No access to electricity means a big obstacle for AI to come and prosper".

"The challenge for policymakers and investors alike is to balance optimism with prudence," writes the IMF in its Outlook, "ensuring that today’s tech surge translates into sustainable, inclusive growth rather than another boom-bust cycle".

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Pooja Chhabria

January 26, 2026