The future of global trade? Introducing the trade patchwork model

Despite tariff changes and other disruptions to trade, in a patchwork model overall global trade would remain remarkably resilient. Image: Unsplash

Aparna Bharadwaj

Global Leader, Global Advantage Practice; Managing Director and Senior Partner, Boston Consulting Group- In a volatile world, momentum toward all-out tensions versus a return to a rules-based global trading system has slowed.

- Instead, a more moderate and plausible scenario is emerging, one that we’re calling a multi-nodal trade patchwork.

- This model, with four major nodes, allows for continued global trade growth and competitive advantage for businesses that can navigate the complex dynamics.

Despite this year’s headlines, global trade has not collapsed; it is, however, in transition. The rise of economic nationalism and fragmentation of global institutions – long-forming trends – continue to gather pace.

In this volatile context, predicting the future of trade is scenario-based and not definitive. Boston Consulting Group sees several possible future scenarios for global trade that can help companies pressure-test their business decisions.

The good news is we have not yet seen a retaliatory tariff escalation situation. Momentum toward either extreme – all-out tensions versus a return to a rules-based global trading system – has slowed. Instead, we see a more moderate and plausible scenario emerging that we’re calling a multi-nodal trade patchwork, a model that allows for continued trade growth and competitive advantage for businesses that can navigate the complex dynamics.

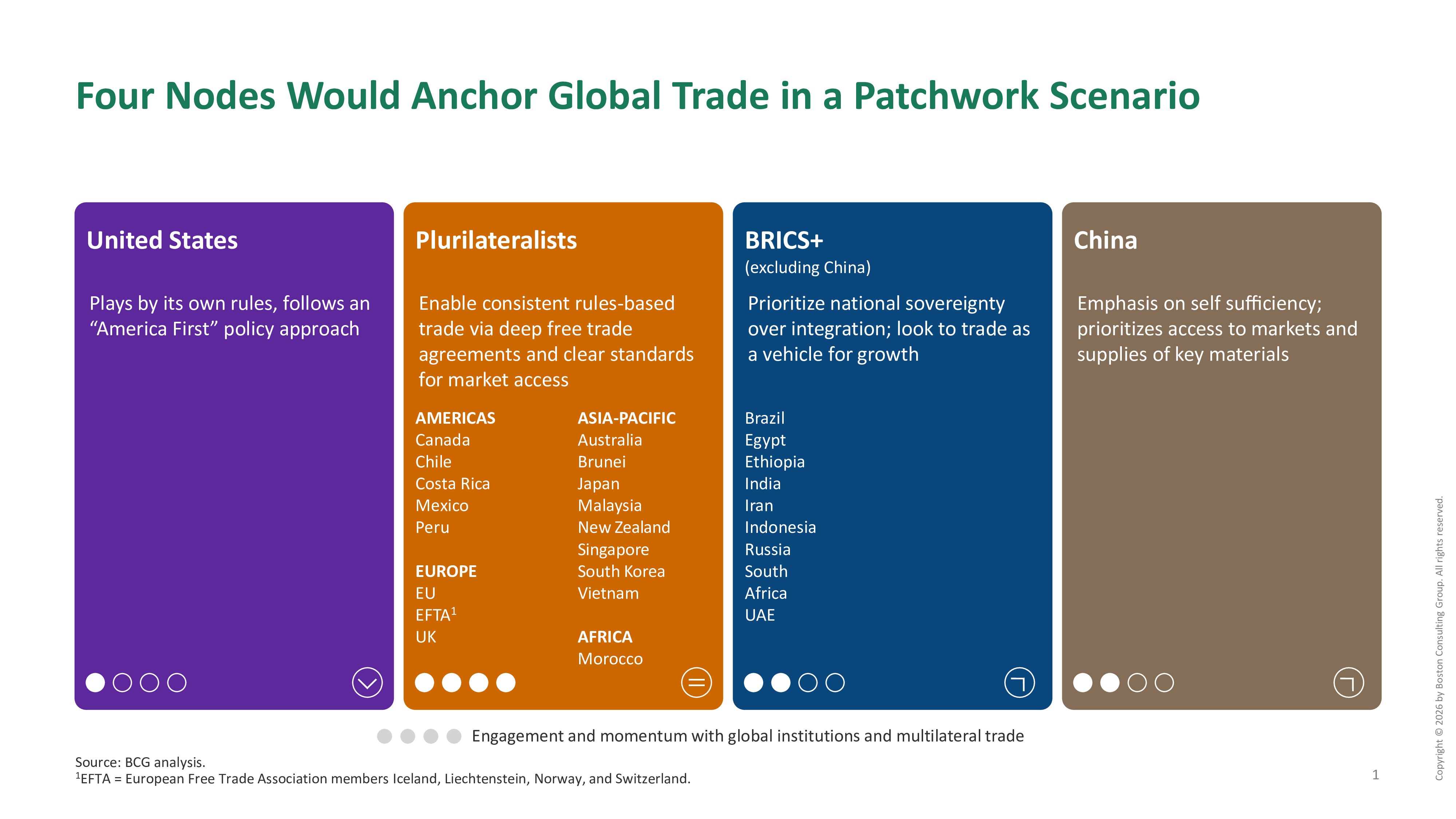

The four nodes of the global trade patchwork scenario

In this trade patchwork scenario four major nodes emerge:

- The US: Shifting from its traditional role as a champion of global, rules-based trade, the US takes an “America first” approach that uses industrial interventions in efforts to rebuild the US economic base and bring jobs back to America.

- China: While committed to some multilateral trade agreements and seeking to trade more with the Global South, China emphasizes self-sufficiency and prioritizes access to sources of raw materials as well as final markets.

- Plurilateralists: A diverse group that spans five continents and includes advanced economies, such as those in the EU, Japan, Canada and Australia, as well as middle-income and emerging economies, such as Mexico, Vietnam and Peru. These countries adhere to plurilateral trade agreements, involving two or more economies but not all-inclusive like the World Trade Organization (WTO). These agreements can require some sacrifices of domestic priorities for the sake of trade cooperation, doubling down on rules-based alignment.

- BRICS+ excluding China: These countries see trade as an engine of growth, but are generally less willing to compromise their sovereignty to join deep trade agreements. This holds them back from being part of the plurilateralists.

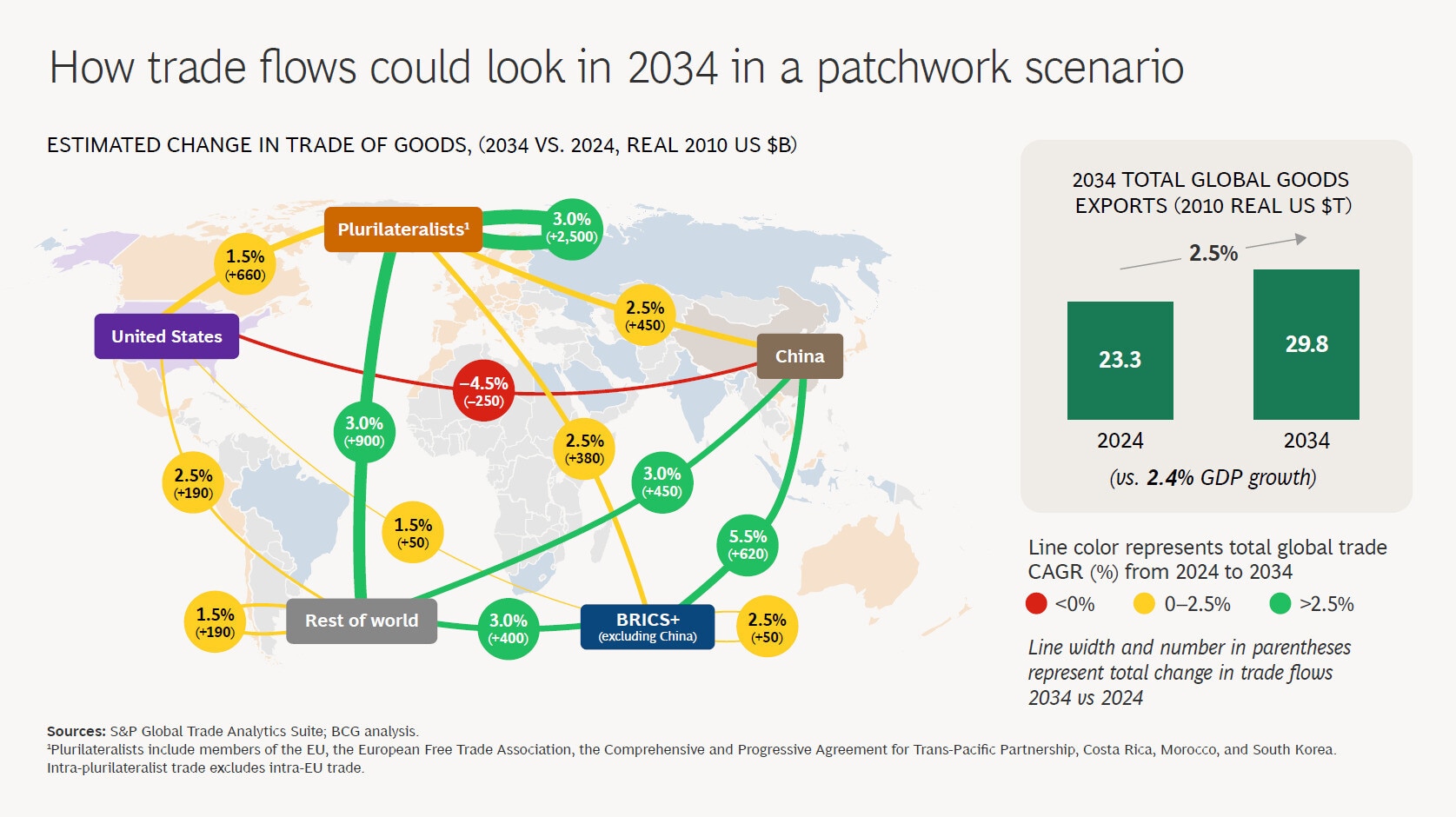

Global Trade growth continues, but shifts

In 2034, in a trade patchwork reality, these are the critical takeaways we see for the global goods trade:

1. Despite tariff changes and other disruptions to trade, overall global trade would remain remarkably resilient, expanding by around 2.5% annually (slightly above GDP). The routes many goods travel will, however, change.

2. The plurilateralist group as a whole would see above-average trade growth among themselves and most of the Global South through 2034.

3. China’s goods trade would grow faster than the US, but more slowly than the global average. China will deepen ties with the Global South, including the other BRICS+ nations. They have already become the top trade partner to nearly half of the Global South.

4. The US’ share of the global goods trade would decline as it focuses on narrowing its trade deficit and increasing domestic production; its trade is projected to grow by only around 1.5% annually, though this may not translate into a corresponding impact on GDP.

5. Trade would continue to grow among the nations of the Global South.

Actions for business leaders and policy-makers

A trade patchwork scenario would have major implications for business leaders and policy-makers. In this scenario, leaders with the right strategies and capabilities will not only secure resilience, but also facilitate growth. Business leaders can succeed by:

- Integrating geopolitics into their business decisions: what we call “building geopolitical muscle”. Understanding geopolitical dynamics is critically important for growth and resilience objectives.

- Strengthening supply chains: supply chains will demand greater transparency and leaders should thoughtfully assess the needs for different, and often imaginative, supply chain configurations.

- Drive cost productivity: taking advantage of trade compliance, implementing strategic pricing strategies and applying new technologies, including AI, robotics and automation.

Policy-makers, for their part, will need to:

- Reconfirm their countries’ competitive advantage in this new world and define aspirations for their country’s role in strategic value chains and systems.

- Define their trade partnership strategies: countries must balance independence against cooperation and choose their anchor hubs and bridge corridors among blocs.

- Adopt business-friendly enablers: expedite and simplify business approval processes to unlock investment and talent for opportunity areas.

The time is now

After a year of extraordinary disruption, one thing is clear: globalization isn’t over, but it is evolving. No crystal ball can predict developments and outcomes, but scenarios are valuable tools for global leaders who cannot afford to wait and see how the trade landscape unfolds.

This trade patchwork scenario would be more complex and costly than the old rules-based system and will require deeper trade compliance capabilities. Yet, it will still reward agility and foresight. The winners will be those who learn to navigate the dynamics among these trade nodes to their advantage and develop the resilience needed to capture new opportunities as they emerge.

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Trade and Investment

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Maira Martini and Katja Bechtel

February 24, 2026