Global trade isn’t retreating – it’s adapting. Here's how

Countries outside the major geopolitical blocs have expanded their role in global trade. Image: REUTERS/Amanda Perobelli/File Photo

- It’s easy to believe that globalization is unravelling. But is that really the case?

- Global exchange remains near historic highs. Supply chains are not shortening; they are stretching further than ever.

- Globalization will not vanish; it will reorganize, with global trade finding new routes and creating new hubs. That evolution is already underway.

Headlines today are dominated by trade wars, sanctions and rising protectionism. Rivalries are deepening, multilateralism is fading, alliances are shifting and it’s easy to believe that globalization is unravelling. But is that really the case?

A recent analysis of international flows reveals a surprising truth: global trade is shifting, but global connectivity overall has proven to be remarkably resilient. Global exchange remains near historic highs. Supply chains are not shortening; they are stretching further than ever, with average trade distances hitting record levels. The increasing trade in Asia, the Middle East and Africa outweighs the shrinkage of US trade.

Global trade flows shift – and grow

The latest update of the DHL Global Connectedness Tracker, developed in collaboration with NYU Stern School of Business, provides the most comprehensive measure of global connectedness available today. Published in October 2025, it offers unique insights into how trade adapts under pressure – tracking not only goods, but also capital, information and people flows across more than 180 countries for a holistic view of globalization’s evolution.

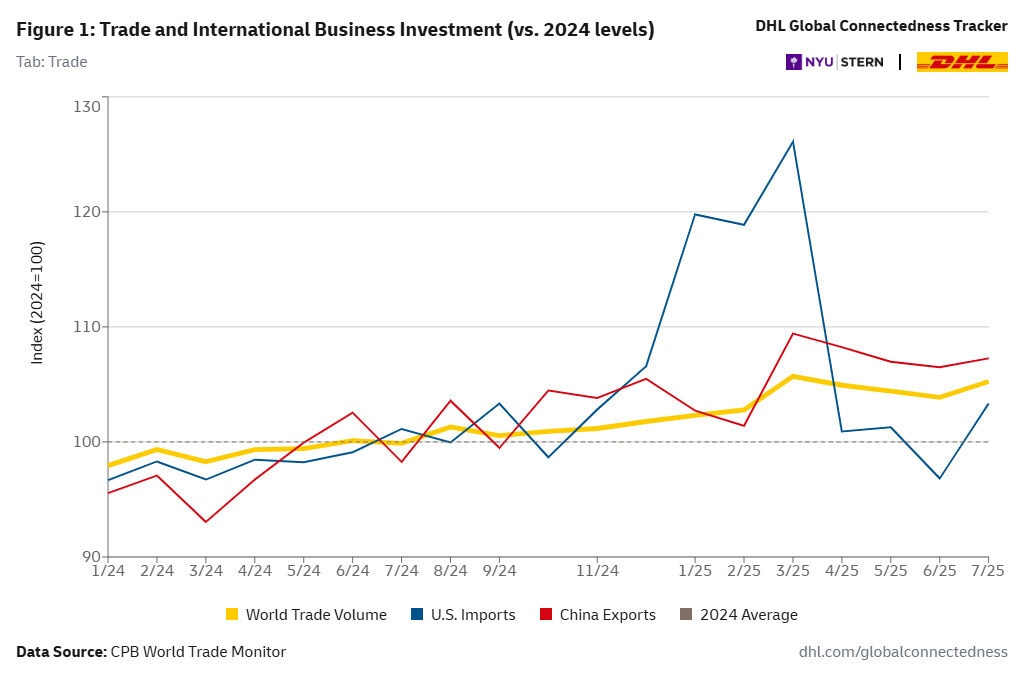

The findings are clear: despite geopolitical turbulence, global flows remain near historic highs. Global trade, in fact, experienced an unusually strong start to 2025, driven by front-loading ahead of expected tariff changes – a reminder of how policy uncertainty can influence timing.

Beyond these temporary effects, the long-term trend remains stable too: trade distances have even reached a new record of around 5,000 kilometres, underscoring that supply chains are not shortening but stretching further. Fragmentation exists, but it is limited. As the US aims to reduce its dependencies and net deficit in trading physical goods, it continues to benefit from a surplus in trade of services, especially digital services.

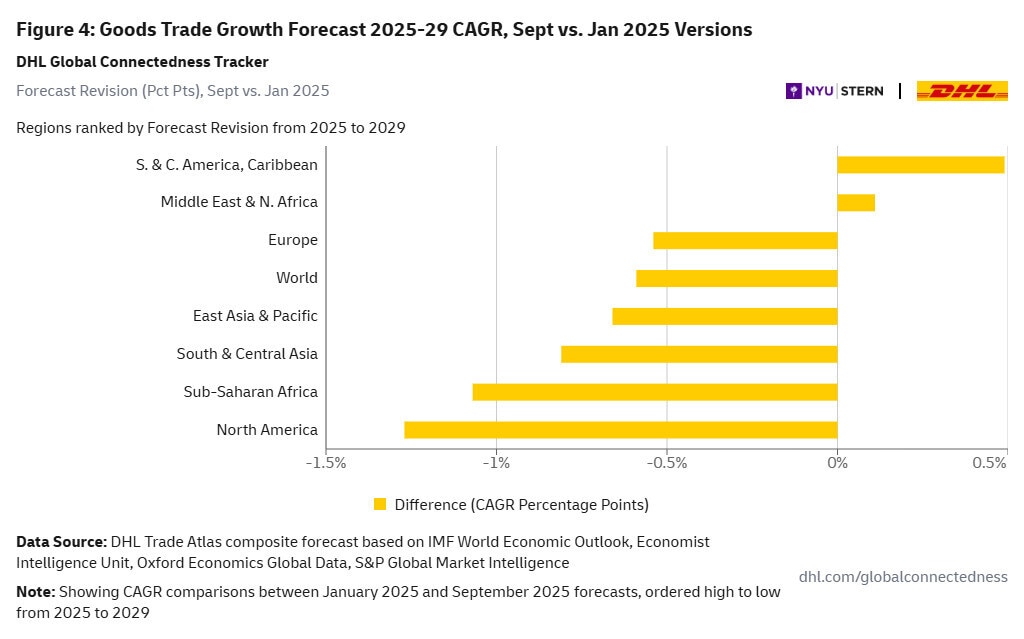

Countries outside the major geopolitical blocs have expanded their role in global trade. Their combined share has risen from 42% in 2016 to 47% today, with India, Mexico, Vietnam, Brazil and the UAE among the most dynamic hubs. This shift illustrates how globalization is not shrinking but redistributing influence, creating new centres of gravity in world trade.

Meanwhile, direct trade between rival blocs has declined only marginally and regionalization is not outpacing globalization. Businesses are reorganizing and widening global supply chains, not abandoning them. Looking ahead, global trade is forecast to grow by an average of 2.5% per year through to 2029 – roughly in line with the previous decade. In other words, globalization is not ending, it’s adapting.

That’s good news, because open trade is more than an economic principle: it’s a lifeline for innovation and prosperity. Without global connectivity, access to products or devices that are produced in only some places worldwide would shrink, costs would soar and competitiveness would suffer. History shows that restrictions don’t create wealth – they raise living costs and weaken exports. Tariffs may encourage some local production, but they raise consumer prices and make exports less competitive. In a world where supply chains are deeply interwoven, isolation is not a path to resilience – it is a recipe for inefficiency.

At DHL, we witness the power of trade every single day. Secure, efficient and diversified supply chains form the backbone of global commerce, enabling businesses to navigate volatility and keep goods flowing across borders. From delivering critical components for renewable energy projects to ensuring life-saving medicines reach patients on time – global trade is the infrastructure of progress and wealth.

Keeping the world connected

Globalization will not vanish; it will reorganize, find new routes and create new hubs. That evolution is already underway. The challenge – and the opportunity – lies in shaping this transformation so that connectivity remains a source of resilience and shared growth.

For businesses, policy-makers and society at large, the imperative is clear: keep the world open for exchange, strengthen the networks that bind us together and invest in the systems that allow progress to move freely. Because in the end, connectivity is not just about trade – it is about trust, collaboration and creating the conditions for shared prosperity in an uncertain world.

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Trade and Investment

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Maira Martini and Katja Bechtel

February 24, 2026