Governments are now economic super actors. What does this mean for business?

Governments are actively targeting sectors, supply chains, technologies and commercial choices. Image: Getty Images

- Governments are responding with more assertive industrial strategies to bolster competitiveness, resilience and national security.

- Today, governments retain strategic sector targeting, but use policy to secure supply chain resilience and shape technological dependencies.

- Using foresight, resilience and collaboration, businesses can leverage the new industrial policy playbook and capitalize on government priorities.

Industrial policy is not merely resurging – it is accelerating at a historic pace. As economies face mounting pressures – from supply-chain disruptions to geopolitical uncertainty and the climate transition – traditional market mechanisms and policy tools alone are no longer sufficient.

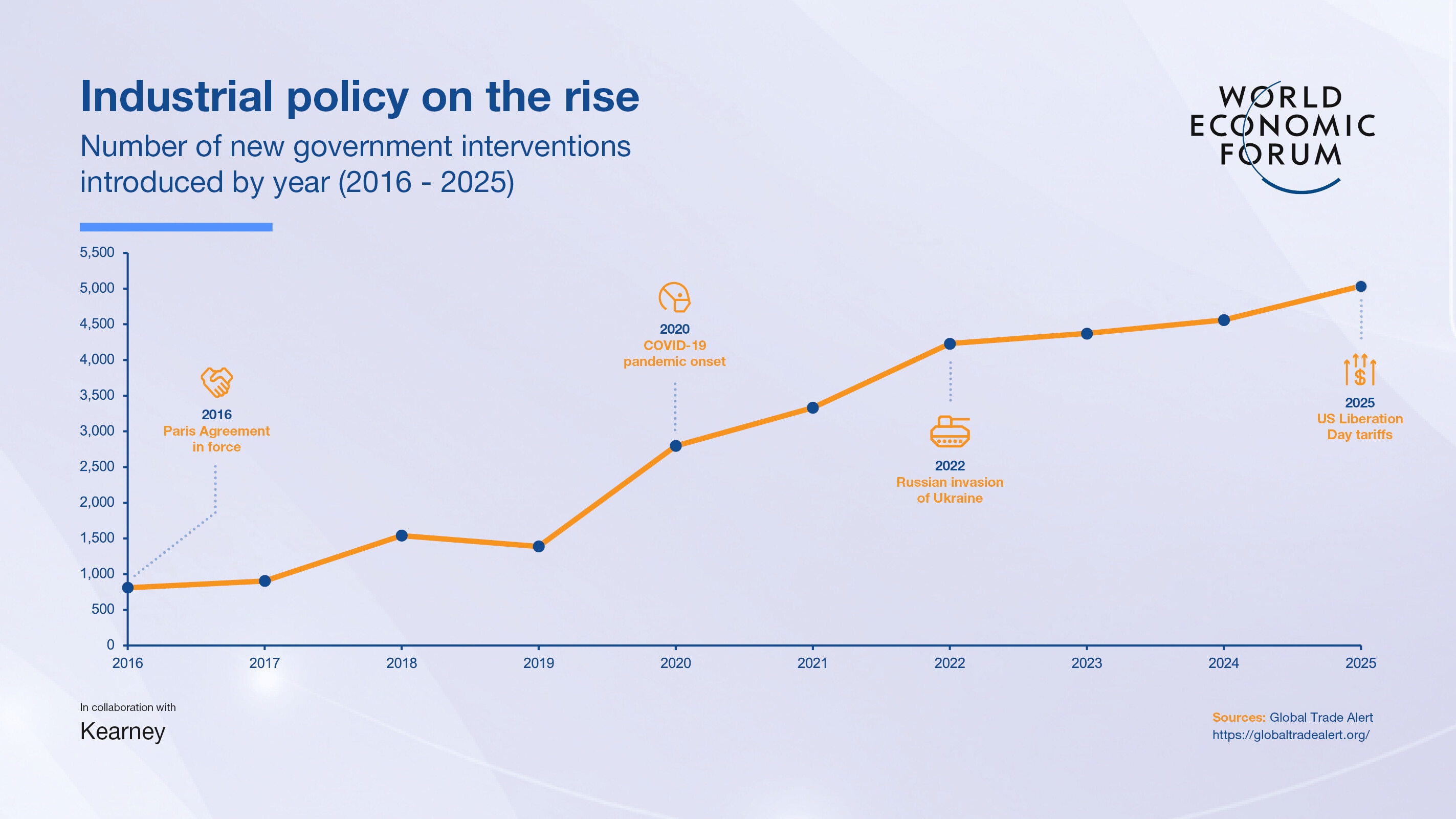

Governments are responding with more assertive industrial strategies to bolster competitiveness, resilience and national security. State interventions, accelerated by the COVID-19 pandemic, surged in 2020 and have since continued climbing sharply. According to Global Trade Alert, new interventions in 2025 increased by 262% compared to the number of new interventions recorded in 2019

This is a global phenomenon. The United States has used tariffs to safeguard national security and fortify domestic industry. A recent report evaluating Made in China 2025 shows how the strategy has accelerated China’s dominance in manufacturing and innovation over the past decade. Saudi Arabia’s Vision 2030 sets a mandate for competitiveness, investing in key sectors and infrastructure projects. And in September, South Korea unveiled a 150-trillion-won ($102 billion) National Growth Fund to supercharge its semiconductor sector and other strategic industries.

These and other national moves underscore a new urgency and a shift in geopolitical and economic priorities.

What’s new?

In many ways, contemporary industrial policy mirrors the old, but the underlying motivations and many of the tools it deploys have shifted decidedly. Earlier industrial policy emphasized national self-sufficiency and relied heavily on protective measures that advanced national champions. Structural changes following the end of the Cold War accelerated globalization, and the world saw greater integration of markets and capital; complex global supply networks; and a more liberalized trade environment; capital; production chains; complex, interconnected global supply networks; and a more liberalized trade environment. Yet, the same dynamics exposed new vulnerabilities, and the world has since wrestled with a fundamental “trilemma” of balancing economic security, economic interdependence and intensifying geopolitical rivalry.

Today, governments retain strategic sector targeting, but use industrial policy to secure supply chain resilience and shape technological dependencies. The key to geopolitical power hinges, in part, on control over economic chokepoints or critical nodes in the global system. Dominance in emerging technologies, such as artificial intelligence, semiconductors, digital currencies as well as critical inputs, is producing new chokepoints. Recognizing this, Japanese government subsidies and investment from eight Japanese companies helped establish Rapidus in 2022 to revive its domestic semiconductor industry.

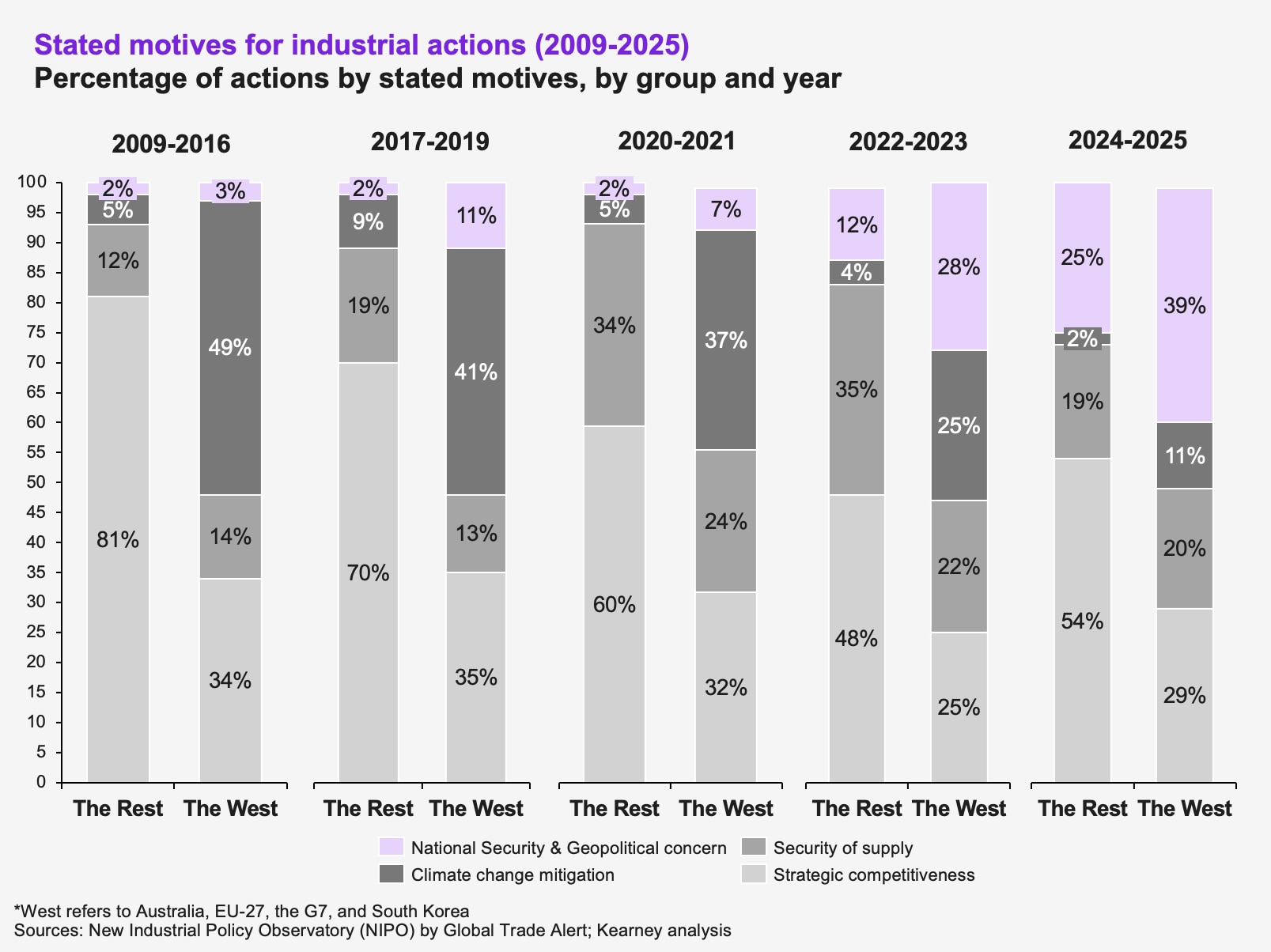

In 2024 and 2025, Western governments cited national security and geopolitical concerns as the driver of 39% of industrial policy actions, a 36-percentage-point increase from 2009-2016. The rest of the world is moving in lockstep, with security-driven industrial policies rising 23 percentage points over the same period. These trends underscore a broader reality: in a globally interconnected world, vulnerabilities in supply chains and technological dependencies are now central to the rationale for and exercise of industrial strategy, making security a defining force behind policymaking.

The tools of industrial policy are evolving alongside its new objectives. Twenty-first century strategies are increasingly focused on securing leverage in specific arenas such as strategic technologies, green energy technologies and supply chain resilience. Subsidies remain a cornerstone of the industrial policy toolkit in both advanced and emerging economies alike, yet advanced economies are now leaning more heavily on trade measures. Meanwhile, China has been leveraging venture capital investments, having recently launched the national venture capital guidance fund to support startups in emerging industries. The effectiveness – and intent – of these instruments in advancing economic security and competitiveness, however, varies widely across countries.

The impact on trade and investment

Industrial policy is producing mixed results for businesses, with its effectiveness often hinging on the type of instrument used and the sector targeted. Tariff liberalization and tax subsidies can attract foreign direct investment (FDI) in some cases to strategic industries, generating vertical spillovers that benefit domestic suppliers and reinforce local value chains. China’s post-WTO tariff reductions in the 1998-2007 period, for instance, accelerated FDI inflows, while corporate tax incentives amplified knowledge and productivity spillovers to domestic firms. Yet the picture is far from uniform. The European Central Bank found that, between 2016 and 2023, tariff hikes boosted greenfield investment in local-market-oriented manufacturing, but discouraged upstream input producers, creating supply-chain disruptions and longer-term investment volatility.

Industrial policy is also fundamentally reshaping trade patterns, supply-chain choices and sectoral priorities worldwide. International Monetary Fund (IMF) analysis finds that 85% of the over 34,000 government interventions identified between 2009 and 2023 were trade distortive. Further, products exposed to geopolitically sensitive trading partners are now more likely to receive government support, reflecting the push for supply chain de-risking since 2020. Other countries supporting a particular product has become a trigger for intervention, signaling heightened strategic competition. Traditional considerations like comparative advantage are losing influence, as governments pivot toward emerging and strategically important industries.

Geopolitical rivalry in high-tech sectors can cause production and trade disruptions for individual firms. For example, Nvidia agreed to a 15% revenue-sharing arrangement with the US government in August 2025 in exchange for export licenses to sell its H20 chips to China, but abruptly paused production after Beijing flagged its own security concerns.

The takeaway for businesses is clear: industrial policy can open doors to capital, technology and partnerships, but it can also reshape competitive dynamics, disrupt supply chains and introduce new risks that must be strategically managed.

What does this mean for businesses?

The resurgence of industrial policy means businesses can no longer rely solely on market forces to determine competitiveness. Governments are actively targeting sectors, supply chains and technologies. Consequently, commercial choices are increasingly intertwined with government priorities.

As we noted last year, this creates both opportunities for growth and risks of disruption for business. To navigate this shifting landscape, companies must act deliberately with three principal outcomes in mind:

- Supply-chain resilience: Reassess sourcing strategies, diversify suppliers and explore regional partnerships to mitigate the impact of trade restrictions or tariffs.

- Collaborative alliances: Forge alliances with local partners, industry consortia and cross-border networks to gain leverage in areas in which industrial policy shapes market access or technology development.

- Strategic foresight: Monitor government policy trends and emerging industrial interventions to anticipate where capital, incentives or regulatory support may flow.

By combining foresight, resilience and collaboration, businesses can not only leverage the new industrial policy playbook, but also capitalize on government priorities to strengthen competitive advantage.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Kimberley Botwright

March 3, 2026