Anatomy of an AI reckoning

Whether it’s a ‘bubble’ or a more benign boom, many chief economists foresee an AI reckoning ahead for this investment cycle. Image: REUTERS/Bazuki Muhammad

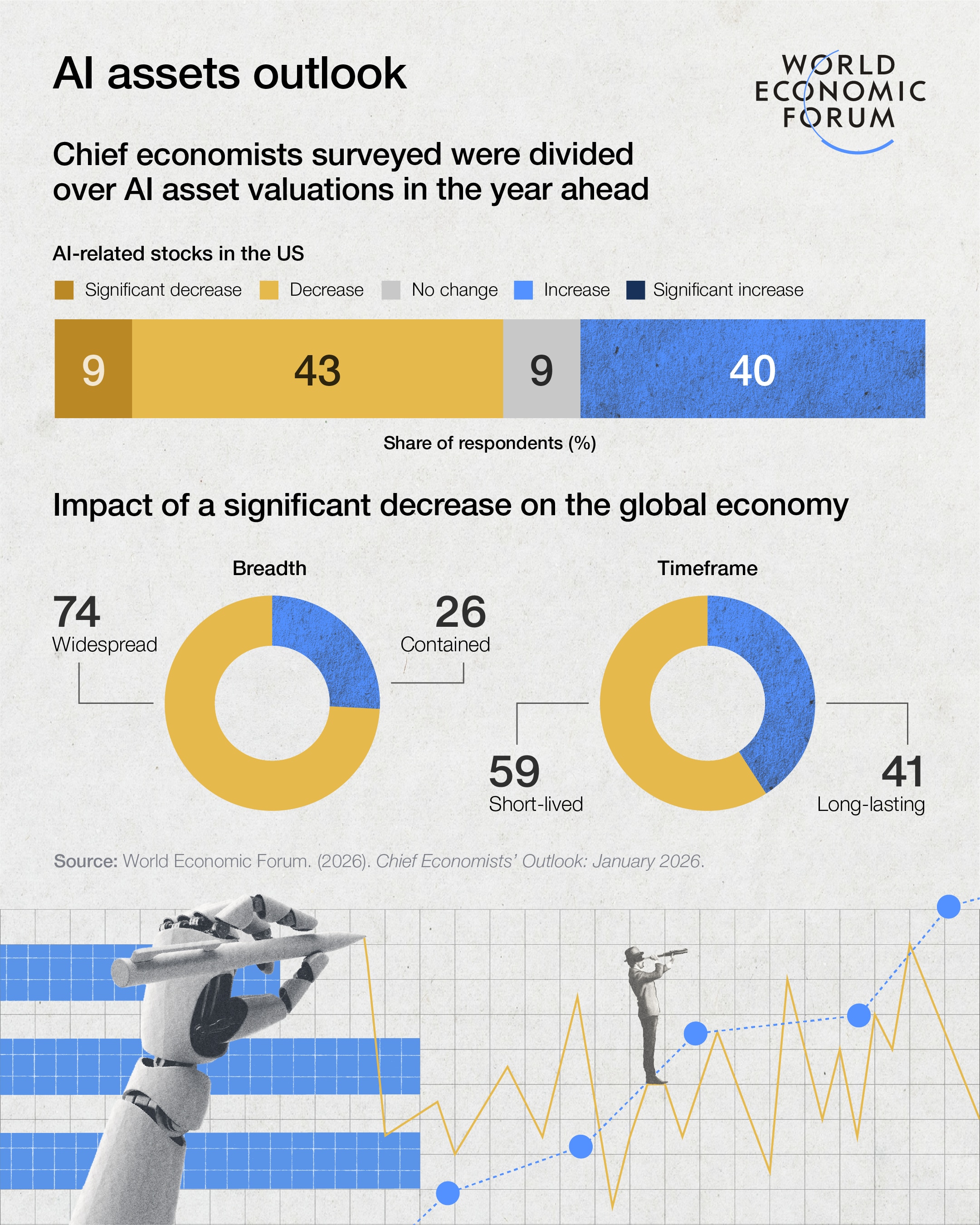

- The latest Chief Economists’ Outlook outlines the potential scope and impact of an abrupt price correction of assets linked to artificial intelligence.

- While some view the AI boom as a bubble, there are credible arguments for and against.

- Regardless of the label applied, this is a theoretical timeline of how it might draw to an end; the ‘T’ in each section signifies the time of AI reckoning.

From the mutations of tulip bulbs in the 1630s through to the wonders of e-commerce promised in the dot-com era almost four centuries later, any novelty in the global economy risks irrational exuberance. Irrationality is the defining characteristic of a bubble. An AI bubble could build, and then burst – and that building and bursting would have economic consequences.

Building a bubble: T-minus 6 months

The economic consequences of a bubble begin long before it bursts.

As irrational enthusiasm and unrealistic expectations start to grow, financial and physical resources are sucked into AI. These resources must, of necessity, be diverted away from less novel areas of the economy. The cost of capital for non-AI projects rises, at least in relative terms. Non-AI projects may be delayed for want of raw materials or people.

New firms that are able to brand themselves as AI-related can raise money at a low cost during the building of the bubble. These firms lead the real economy investment process. Established AI leaders tend to be less inclined to raise capital in the bubble phase. The act of investing boosts GDP (building data centers is economic activity that creates jobs, among other things). However, the economic output of that investment, when constructed, is disappointing in a bubble environment. By definition, a bubble results in investments that fail to achieve promised results. This means that economic growth during the bubble phase depends on continually building infrastructure, not using infrastructure.

At the point of bursting: T to T-plus 7 days

Bursting a bubble is primarily a financial market and media event, and the initial economic fallout is limited. The immediate macroeconomic concern is to avoid disorderly financial markets. However, the world’s central banks are adept at providing liquidity in a crisis. The financial market focus of AI has been primarily on the US, and so the US Federal Reserve would be looked to as the main liquidity provider. This would not necessarily require interest rate cuts, although political pressure to do so would likely be intense.

The confusion of a bubble bursting would likely generate competing narratives. X users would likely mix resentment (from loss aversion) with avowals to keep the faith, while Bluesky users may adopt an “I told you so” triumphalism. Both narratives would likely exaggerate the economic consequences of the bubble bursting; the ensuing sensationalism may create a disproportionate level of concern that would certainly dominate media headlines, and may start to influence the political reaction.

Once the bubble burst is established as a major event, investors would likely start worrying about financial exposure to AI. Smaller banks that have lent to AI companies or who have AI companies as key depositors would be in focus. This is a point of heightened risk, as social media may encourage speculative bank runs. Lessons from the Silicon Valley Bank incident suggest central banks and regulators need to be unequivocal and quick in offering support.

Risk aversion would likely spread in financial markets, but the AI boom has been unusually narrow in its focus. Contagion should therefore be more limited than in previous bubble bursts. The US dollar would likely be less favoured as a safe haven in this environment than is traditional, given the focus on US companies in the process of building a bubble. The Korean won and Taiwanese dollar could experience some pressure too, but likely not for a sustained period. Bond markets should benefit from safe-haven bids, but the US Treasury market would benefit less than usual.

After the bang: T-plus 2 months

With the initial financial market correction over, the real economic fallout should start to emerge. Any bubble bursting represents a transfer of wealth from bubble buyers to bubble sellers, and inevitably leads to some people suffering negative wealth effects from the sharp drop in stock prices. The concentration of wealth (both with narrower direct equity ownership, and a bubble focused on an unusually small universe of companies) would mean a more limited impact on consumption than is the case in, say, a housing bubble.

Job losses would occur as speculative firms that were dependent on cheap capital are no longer viable. Established technology companies have businesses beyond AI, which would limit their job cuts. The geographic and skills concentration of the AI industry means that fear of unemployment should be relatively contained – few people outside those directly involved in the technology sector would likely know someone who is at risk of unemployment.

Central bank liquidity should still continue. With bank runs likely averted or contained, credit should still be available to non-AI companies, but with some constraints due to a general sense of caution.

Beyond the bubble: T-plus 6 months

Equities not directly related to AI should start to recover, with investors focusing on economic fundamentals. The element of theatre and showmanship around AI fades – fewer references are made to AI strategies in corporate reports, Bloomberg News quietly drops the Summary by Bloomberg AI section of its stories, and euphemisms for AI start to be adopted by corporate leaders – who have to find alternative excuses for cyclical staff layoffs.

US economic exceptionalism could be challenged, as the normalization of the technology sector shows that the rest of the economy is performing more or less in line with its international peers. US growth may initially dip as AI-related investment retreats, but other forms of real economy investment would hold up better. The dollar would likely remain weaker. Pressure on China’s domestic demand as AI investment slows could trigger more traditional stimulus policies there.

Large companies may focus on using existing AI investments, with some strategic rebranding. The pace of investment would likely continue but be slower and less disruptive than during the bubble phase.

The fact that AI has actual value should mute the economic consequences of the bubble.

The longer-term economic fallout would likely be less severe than the global financial crisis of 2008 – though more consequential than last year’s bursting of the Labubu bubble, or the 2000 crash in the price of Beanie Babies.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Economic GrowthSee all

Pooja Chhabria

February 27, 2026