Logistics is no longer merely a support function but a strategic enabler of growth

The Global Trade Observatory Annual Outlook Report 2026 points to a shift in thinking among 3,500 supply chain and logistics executives. Image: DP World

- The Global Trade Observatory Annual Outlook Report 2026 points to a shift in thinking among 3,500 supply chain and logistics executives.

- They are sending a clear message: modern logistics is a competitive advantage, and the infrastructure must be treated as a strategic priority.

- Across markets and sectors, we see this shift reflected in how supply chains are being redesigned, invested in and governed.

There is still much to be done. DP World’s new Global Trade Observatory Annual Outlook Report 2026 makes that clear.

It combines a survey of more than 3,500 senior supply chain and logistics executives across the world with analysis of today’s fast-moving trade environment, which shows how companies are responding to change.

The results are strikingly positive, even against a backdrop of shifting trade policies, geopolitics and route disruption.

Trade optimism in a volatile environment

Overall, 54% of executives expect trade growth this year to be faster than last year, with 40% expecting it to remain the same. This is despite more than half (53%) expecting high or very high policy uncertainty in 2026.

But what stands out alongside this outlook is the level of ambition. When asked to name their top three strategic changes planned for 2026, supplier diversification was the leading response, chosen by 51%.

When we drilled down and asked executives why they were diversifying supply chains, the data became even more illuminating. The most popular answer, with 16%, was new market entry, followed by new technology enabling change (15%), and the pursuit of agility or resilience (14%). There is clearly a willingness to embrace change in pursuit of strategic advantage.

And this ambitious pursuit of growth was also evident elsewhere. When we asked supply chain executives to select the top three drivers of growth for their business over the coming one to three years, the most popular answer was new markets and consumers (46%), followed closely by deploying AI (43%), and improving infrastructure and transport capacity (42%).

Logistics now shapes growth strategies

Taken together, these findings show how logistics is viewed today: no longer just a support function, but a strategic enabler of growth, powered by technology and increasingly central to competitive performance.

Across markets and sectors, we see this shift reflected in how supply chains are being redesigned, invested in and governed.

And this raises an important question: If executives have ambition and technology is empowering firms, what is needed to turn that intent into sustained business growth?

How the Forum helps leaders make sense of regional, trade and geopolitical shifts

Why warehousing is a strategic priority

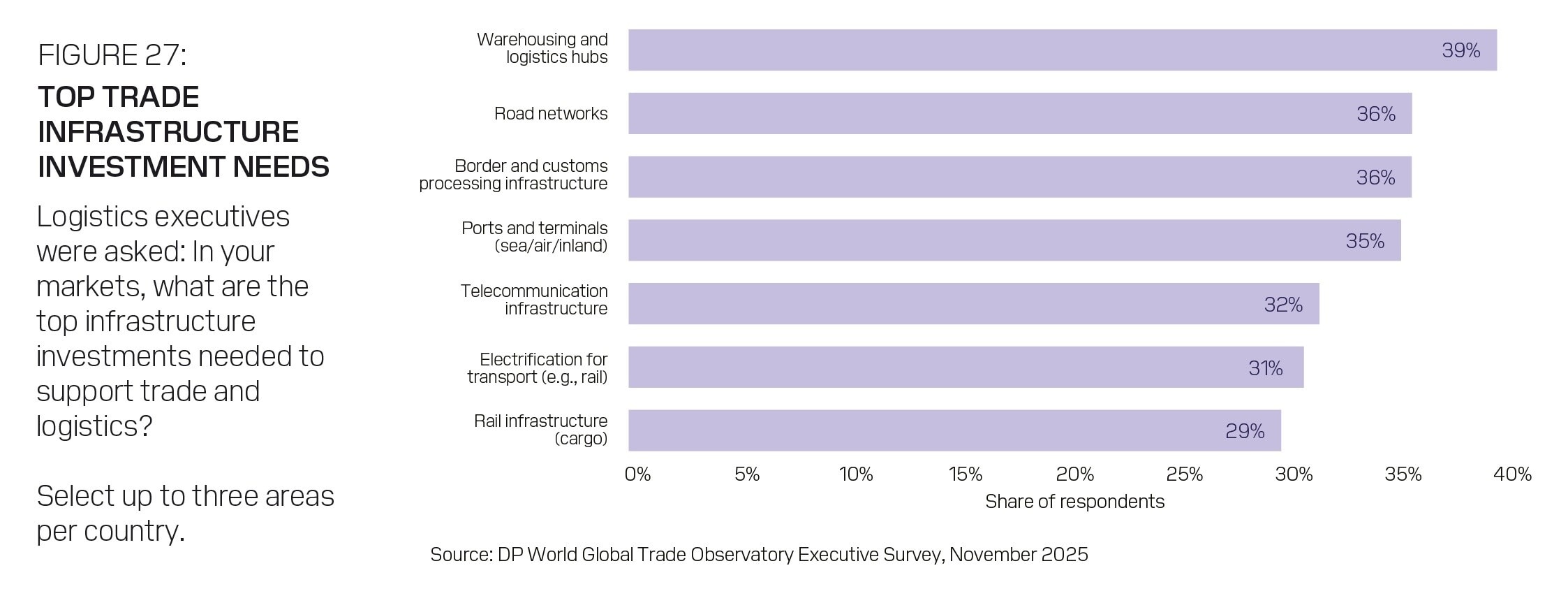

One clear answer emerged when logistics executives were asked to name the top three infrastructure investments needed to support trade and logistics in their markets. “Warehousing and logistics hubs” was the top choice, selected by 39% of respondents.

This reflects the evolution of warehousing. Decisions about location and capacity today are deeply strategic, shaping entire distribution networks, especially in a world influenced by just-in-time logistics and complex supply chains. Warehousing has become a strategic asset, helping determine speed, resilience and access to markets.

The range of warehousing also reflects this shift, from secure facilities needed for the high-value servers powering the data centre boom, to strategically important cold storage facilities. And while cold storage is often associated with agricultural exports and food security, it also plays a major role in high-value industries including pharmaceuticals and speciality chemicals.

Building trade capacity in practice

In India, for example, DP World provides temperature-controlled warehousing to hundreds of businesses, supporting product segments ranging from fruits to temperature-sensitive pharmaceutical products, underpinning vital and fast-growing export industries.

Logistics parks further explain the prominence of this finding. When developed alongside ports or as part of special economic zones (SEZs), they can transform regional connectivity and help establish trade hubs that attract investment and drive exports.

In October last year, DP World launched the Sokhna Logistics Park in Egypt, located close to the port of the same name, which we also operate. Sitting to the south of the Suez Canal, it is strategically located and includes bonded zones as well as other facilities to strengthen Egypt’s role in trade and help drive its exports.

And warehousing and logistics hubs are just one part of the picture. The range of priorities identified by logistics executives, shown in the chart below, highlights the need for coordinated investment across multiple layers of trade infrastructure.

Improvements in customs services may offer a particularly attractive opportunity across new trade routes and corridors. As the report explains, every surveyed executive mentioned customs as one of the top three causes of delays and disruption to their business, with 60% identifying it as the leading factor. Digital solutions, such as DP World’s CARGOES Customs platform, can play a major role in addressing these challenges and improving efficiency. Indeed, just last year, we signed an agreement to roll out the platform in Kenya.

At DP World, we are investing across both physical and digital infrastructure to facilitate trade, increase speed and resilience, and support growth. We know that when public and private sectors work together to align policy, capital and capability, the results can benefit not just businesses but entire economies.

Message from executives

To conclude, the DP World's report findings point to a shift in thinking among the more than 3,500 senior supply chain and logistics executives surveyed.

These executives are sending a clear message: modern logistics has become a competitive advantage, and the infrastructure that supports it must be treated as a strategic priority.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Logistics

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Trade and InvestmentSee all

Kimberley Botwright

March 3, 2026