The quantum divide: How to prevent a two-tier global financial system

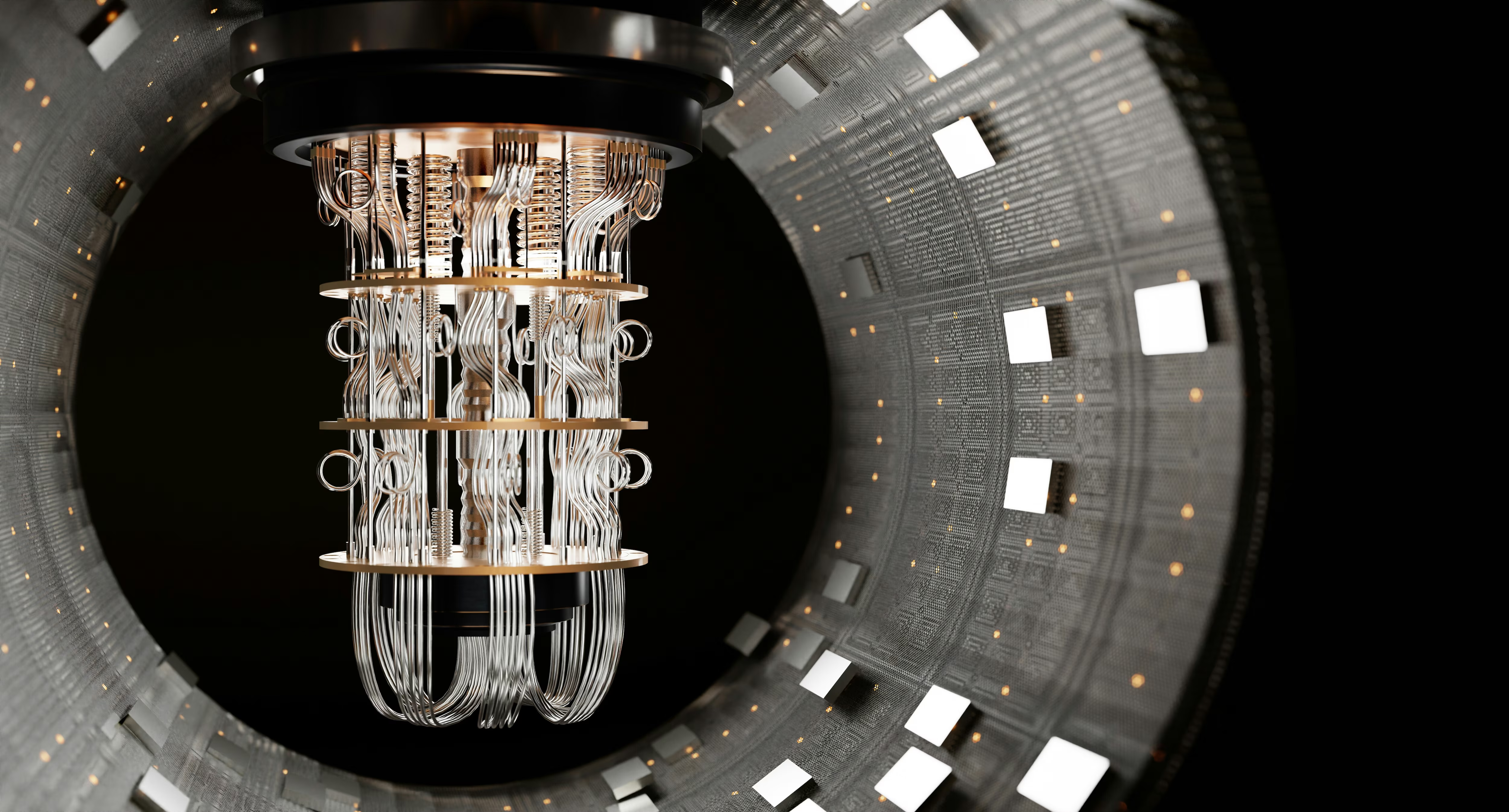

Quantum computing is closer than most organizations and governments believe. Image: Unsplash+/Galina Nelyubova

- The rapid convergence of artificial intelligence and quantum computing exposes deep vulnerabilities in our legacy infrastructure.

- An asymmetric transition to post-quantum standards risks creating a two-tier system that excludes emerging markets.

- Financial leaders must leverage AI-driven automation to ensure a resilient and inclusive global security transition.

Since 2023, the use of artificial intelligence (AI) has exploded. Organizations across industries are building and deploying autonomous AI agents to achieve predictive precision and operational speed. Financial institutions are deploying these systems to detect fraud and improve operational efficiency. Yet much of this innovation rests on legacy infrastructure that has systemic vulnerabilities. Encryption (such as RSA) protecting these systems was designed for classical computing, never anticipating convergence of AI or quantum computing.

Much has been said about quantum computing as a far-off theoretical threat. In reality, it is closer than most organizations and governments believe. Sensitive financial data can be harvested today and decrypted later, once quantum capabilities mature; this presents an immediate risk. It takes years, sometimes decades, to upgrade financial infrastructure and institutions that do not take steps now will be permanently left behind.

The real risk: uneven preparedness

Post-quantum cryptography (PQC) is the practical way forward. It allows existing systems to be secured without requiring quantum hardware or entirely new infrastructure. Governments and regulators are already moving in this direction. For instance, the US government has set a target for federal agencies to become quantum-resistant by 2035, reflecting the long lead times involved in cryptographic migration.

The real danger isn’t that a quantum computer will break encryption tomorrow, but the asymmetric pace of adoption. If wealthy nations and massive corporations become quantum-safe while the rest of the world lags behind, the gap could be catastrophic. For a regional bank or small exporter in the Global South, failing to meet these new standards won’t just increase risks — it could mean being cut off from insurance, correspondent banking and global trade overnight.

This gap is already visible. A recent study of India’s banking, financial services and insurance sector found limited understanding of quantum risks among senior technology leaders, with post-quantum readiness averaging just 2.4 out of 5, an indicator of insufficient preparation. In a global financial system built on trust and interoperability, uneven security standards can quickly translate into exclusion.

From efficiency to resilience

This creates a critical policy inflection point. The future of digital finance must not depend primarily on efficiency gains that are products solely of advanced computing but rather a system that is resilient and inclusive. Currently, even though about 88% of businesses state they use AI in their operations, barely more than a third have taken it beyond piloting into full implementation. The same execution gap that starves enterprises of the full impact of AI also inhibits the shift to quantum-safe systems.

Industry analyses show that the primary bottleneck in post-quantum migration is not cryptographic performance, but basic visibility: many institutions lack a complete inventory of where public-key cryptography is embedded across systems, data flows and counterparties, making coordinated transition slow and uneven.

AI as part of the solution

Automated risk assessment, cryptographic inventory mapping and migration planning can significantly reduce the cost and complexity associated with post-quantum transitions, which will most probably be for smaller institutions and emerging markets. Without this automation, quantum-safe finance is at risk of becoming an ability that only resides within those entities having the largest balance sheets and most advanced jurisdictions.

Treating quantum security as shared financial infrastructure, rather than a competitive moat, is essential. Otherwise, the global system risks fragmenting into two tiers: one that can verify, insure and trust transactions at quantum-safe levels, and another that cannot.

Early signals from industry and science

Some organizations are already taking action. For example, HSBC has piloted post-quantum cryptography over the use of virtual private network tunnels to secure tokenized gold transactions in line with ever-increasing regulatory expectations. This goes to prove that PQC is not a theory — it is being tested in live, regulated environments.

Outside finance, the pace of convergence between quantum and AI is even more visible. IBM and the Cleveland Clinic are running quantum-classical hybrid systems as part of a protein folding study, bringing simulation times down from weeks to hours. The healthcare application differs from that of finance, but the lesson is the same: wherever quantum acceleration has moved out of the research labs, it has entered decision-critical domains. Finance will not be the first.

Why 2026 matters

Experts estimate that a “quantum break” — the point where quantum computers can crack widely used public-key encryption — could arrive in the 2030s under aggressive assumptions. Even if that timeline proves optimistic, 2026 is emerging as a critical planning year, not because quantum computers will suddenly arrive, but because cryptographic migration must begin well in advance. Frameworks such as the Mosca Inequality highlight this timing risk: migration spans multiple years, while sensitive data must remain secure well into the next decade. As standards bodies including ETSI have noted, delaying the move from planning to deployment compresses security runway as quantum capabilities mature.

Regulatory pressure is also increasing. European cybersecurity bodies have warned banks to prepare now for quantum risk, and global standard-setting efforts around post-quantum cryptography are moving from theory to implementation. Institutions that delay may find themselves racing against compliance deadlines, rising costs and shrinking trust windows.

A global solution to a global risk

Preventing a two-tier global financial system requires more than isolated action. It calls for a collective response that treats quantum security as a global public good. Open standards, shared tooling and cross-border coordination will be essential to ensure quantum-safe finance does not become another axis of inequality between nations, or between large institutions and smaller enterprises.

The conversation around AI must therefore evolve. Productivity and efficiency gains matter, but they are insufficient if they rest on fragile foundations. The real opportunity is to pivot towards AI for equitable resilience — using intelligence not just to move faster, but to bring more participants safely into the system.

If the AI-quantum transition is managed collectively, it can strengthen trust, stability and inclusion in global finance. If it is managed unevenly, it risks entrenching a quantum divide — one far harder to bridge once it is built into the system’s architecture.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Artificial Intelligence

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.