5 things to know about the ECB stimulus decision

Mario Draghi, the President of the European Central Bank (ECB) on Thursday announced there would be no interest change, no bond-buying programme and no other notable actions taken for now.

But often a non-decision is also a decision, and even the hint of a future decision has its ramifications. So here’s what the international press, from New York to Zurich, took away from Draghi’s press conference.

The Wall Street Journal wrote that the Mario Draghi opened the door to bond-buying, even though not everyone in his council agreed:

The European Central Bank opened the door to a dramatic escalation in its campaign to stimulate the eurozone’s stagnant economy, but deferred any moves until early 2015 amid signs of continuing divisions over the right course of action.

The Financial Times saw a similar dynamic, but portrayed Draghi as being on the defence rather than the offence:

Mario Draghi, European Central Bank president, has maintained he can deliver fresh measures to stave off economic stagnation in the eurozone next year, despite renewed signs of tensions between policy-makers at the central bank.

The German newspaper Handelsblatt remained more factual, noting only that: “The ECB defer[red] [the] decision about bond-buying.” It said that it’s the analysts who assume there will be bond-buying, rather than Draghi hinting at it.

During his press conference, the Central bank chief refrained from giving further details on bond-buying. Still, analysts assume the ECB will act soon.

A reason for this more refrained portrayal of the perceived conflict in the ECB might be that the German Bundesbank is one of the main opponents of monetary easing, as The Handelsblatt notes itself.

The suitable means to start the funnelling of money is a bond-buying scheme, as used by other Central Banks – like in the US or the UK – which has already been used before… But [the use of ] this instrument is met by critique of the Bundesbank because of legal considerations.

The French newspaper Les Echos put the focus on the inflation and growth forecasts of the ECB. “The ECB revises its inflation and growth expectations downwards strongly,” its headline read.

On the day before Saint Nicholas (a Santa-like figure celebrated in Northern Europe, red), Mario Draghi didn’t offer a gift in the form of a new monetary stimulus for the European economy. The ECB preferred to temporize, putting the focus on a strongly downward revision of the inflation and growth forecasts for the two coming years in the eurozone.

And finally, for the Neue Zurcher Zeitung, a Swiss newspaper, the focus in Draghi’s speech was the falling oil prices.

The falling oil price reduces the inflationary pressure in the eurozone. If wages go down as a consequence, then the ECB fears a reduction in the core inflation. It wants to defend itself against such a drop by all means possible.

Five newspapers, five countries, five conclusions. Pick your favourite.

Author: Peter Vanham, Senior Media Manager, World Economic Forum.

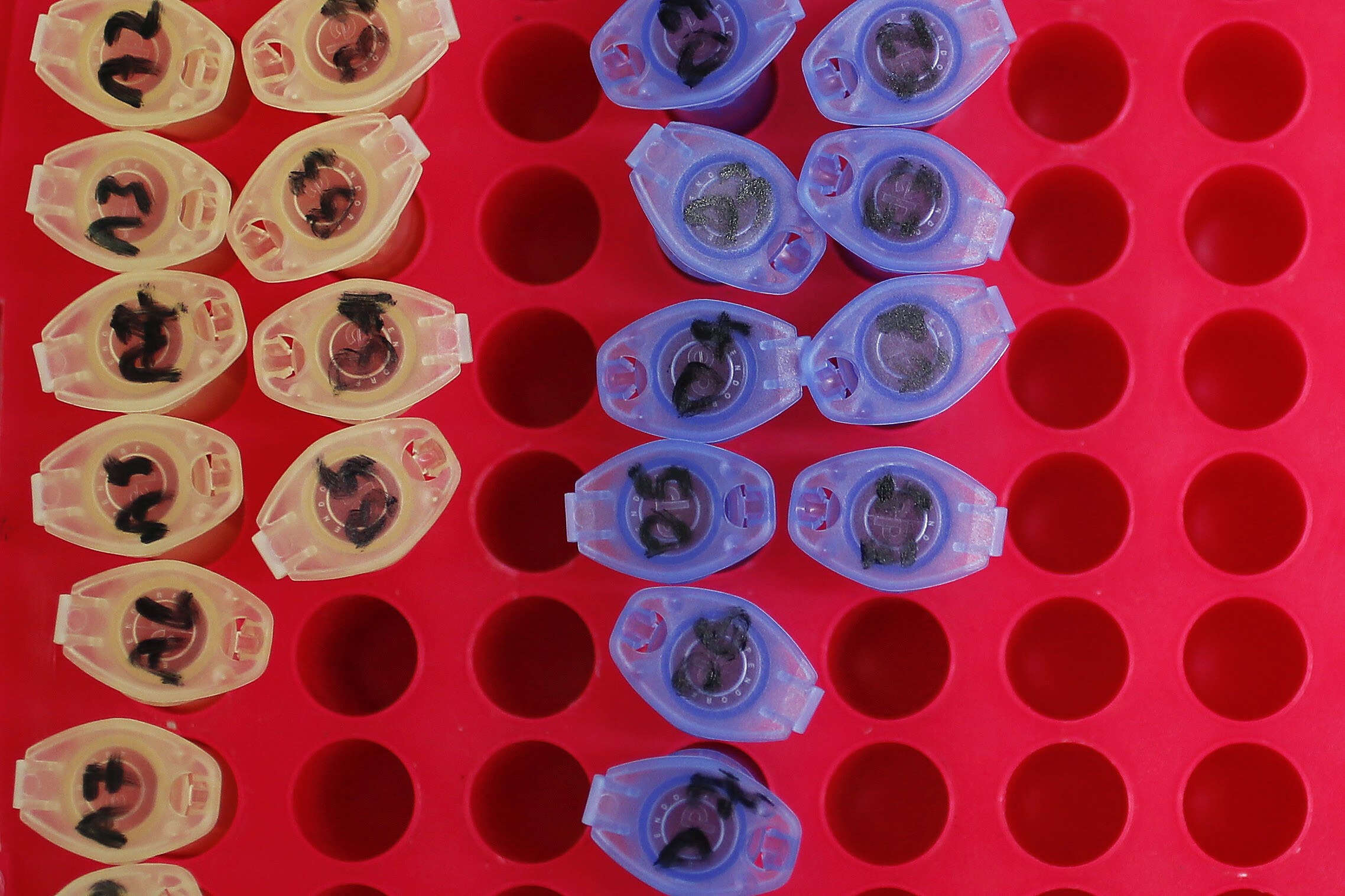

Image: Journalists request to ask questions as European Central Bank (ECB) President Mario Draghi addresses an ECB news conference December 4, 2014. REUTERS/Kai Pfaffenbach

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Media, Entertainment and Sport

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.