Should a stronger dollar delay an interest rate rise?

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Financial and Monetary Systems

This article is published in collaboration with Project Syndicate.

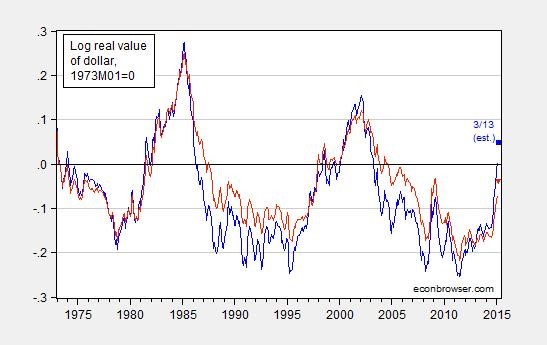

In its September policy statement, the US Federal Reserve took into consideration – in a major way – the impact of global economic developments on the United States, and thus on US monetary policy. Indeed, the Fed decided to delay raising interest rates partly because US policymakers expect dollar appreciation, by lowering import prices, to undermine their ability to meet their 2% inflation target.

In reality, while currency movements can have a significant impact on inflation in other countries, dollar movements have rarely had a meaningful or durable impact on prices in the US. The difference, of course, lies in the US dollar’s dominant role in the invoicing of international trade: prices are set in dollars.

Just as the dollar is often the unit of account in debt contracts, even when neither the borrower nor the lender is a US entity, the dollar’s share in invoicing for international trade is around 4.5 times America’s share of world imports, and three times its share of world exports. The prices of some 93% of US imports are set in dollars.

In this environment, the pass-through of dollar movements into non-fuel US import prices is one of the lowest in the world, in both the short term (one quarter out) and the longer term (two years out), for three key reasons. First, international trade contracts are renegotiated infrequently, which means that dollar prices are “sticky” for an extended period – around ten months – despite fluctuations in the exchange rate.

Second, because most exporters also import intermediate inputs that are priced in dollars, exchange-rate fluctuations have a limited impact on their costs and thus on their incentive to change dollar prices. And, third, exporters who wish to preserve their share in world markets – where prices are largely denominated in dollars – choose to keep their dollar prices stable, to avoid falling victim to idiosyncratic exchange-rate movements.

What little impact import price shocks have on US inflation is highly transitory, with most of the effect tapering off after just two quarters. A sharp 10% appreciation of the US dollar, for example, would reduce inflation for non-fuel imports by 4.4% cumulatively over the next 2-3 quarters, but would have only a negligible impact on inflation after that point.

If one accounts for consumer goods expenditure on imports, that 10% appreciation would lower inflation, as measured by the consumer price index (CPI), by just 0.5 percentage points in the first two quarters. And that is likely to be an upper bound, because it assumes that US retailers will pass through to consumers the full amount of any increase in import prices.

In practice, they are more likely to increase retail markups and lower cost pass-through. The estimated price pass-through for imported manufactured goods, which would better represent what enters the consumption bundle, is even lower than that for all non-fuel imports.

Although these factors insulate the US from the inflationary pressures stemming from exchange-rate fluctuations, they increase the vulnerability of other countries, especially emerging economies. Because the dollar prices of most of these countries’ imports are not very responsive to exchange-rate movements, the pass-through of those movements into import prices denominated in their home currencies is close to 100%.

The impact of exchange-rate movements on inflation in most countries is thus 3-4 times larger than in the US. A 10% depreciation of the Turkish lira, for example, would raise cumulative CPI inflation by 1.65-2.03 percentage points, over two years, all else being equal.

Despite this imbalance, the US dollar’s dominance as an invoicing currency is unlikely to change anytime soon – not least because bringing about a shift would require coordination among a huge number of exporters and importers worldwide. The euro might seem like a strong contender, given the volume of trade among eurozone countries; but, outside Europe, the currency is not used nearly as widely as the dollar.

In deciding when to normalize interest rates, the Fed has placed considerable weight on the weakness of inflation, and its global underpinnings. But while it is true that some global developments – especially falling commodity prices, and perhaps also slowing emerging-economy growth and rising financial volatility – may push down inflation, dollar appreciation will not, at least not in any meaningful way. A stronger dollar thus is not a legitimate reason to delay the normalization of US interest rates.

Publication does not imply endorsement of views by the World Economic Forum.

To keep up with the Agenda subscribe to our weekly newsletter.

Author: Gita Gopinath is Professor of Economics at Harvard University.

Image: The United States Federal Reserve Board building is shown behind security barriers in Washington. REUTERS/Gary Cameron.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Financial and Monetary SystemsSee all

Joe Myers

April 19, 2024

Libby George

April 19, 2024

Valérie Urbain

April 19, 2024

Spencer Feingold

April 16, 2024

Joe Myers

April 12, 2024