What can Latin America’s leaders do to make the region more innovative?

Image: REUTERS/Bruno Kelly

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

Geo-economics

Necessity is the mother of invention, and history shows that a crisis is often the catalyst of rapid innovation. Well, pick your crisis in Latin America today. Economic? Political? Productivity? Skills? Digital disruption?

We have the crises, now where’s the innovation?

None of Latin America’s countries fare well in the latest Global Innovation Index. In the 141-country ranking, most Latin American nations are clustered around the 60s and 70s. Indeed, in the World Economic Forum’s own classification of economic development, not a single Latin American country is categorised as “Innovation-driven”.

The imperative to collaborate

In the meantime, the very nature of innovation itself is changing. Today’s global innovation leaders view openness and collaboration beyond their own firm’s boundaries as critical to innovation success. The logic behind this thinking is simple: why attempt the impossible task of continually housing all the best talent and ideas within your organisation? Companies increasingly seek out partners that can give them access to more ideas, from more places, and at greater speed. From smartphones to smart farming, ecosystems are the source of innovation.

Latin America should be well placed to benefit from this trend. The region places an emphasis on personal networks in business. The culture is famously warm and welcoming. The appetite for connecting with others can be seen in some of the world’s heaviest usage of social media. Yet, evidence suggests that the region’s natural predisposition to connect with one another is not translating into business collaboration on innovation.

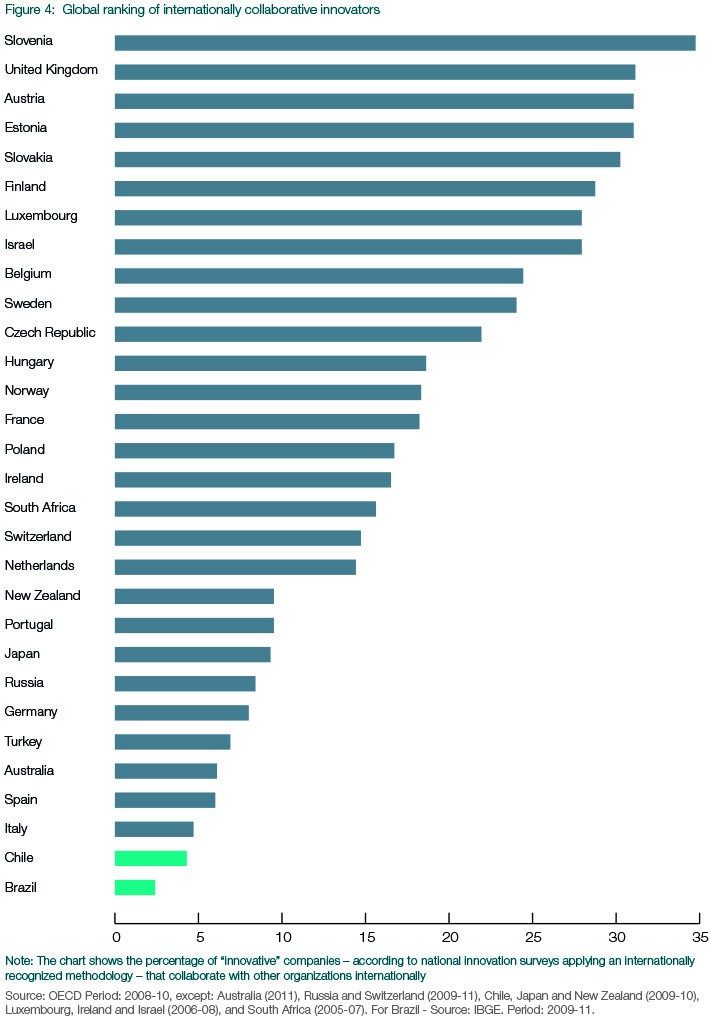

An OECD comparison of innovative companies from 30 economies shows Latin American firms sitting among the least collaborative. Research by the Accenture Institute for High Performance corroborates this trend: we found that Brazilian executives are far more likely to approach new business development as an in-house activity, compared to their peers globally; and they are far less likely than their peers to create strategic alliances or joint ventures. Progress on collaborative innovation remains elusive in Latin America.

It’s all in the mind

Leaders from all sectors urgently need to understand the real reasons for this particular crisis, and what they can do about it.

For decades, experts and analysts have focused on institutional and bureaucratic bottlenecks, evaluating factors like research and development spending, judicial systems and intellectual property protection. Such factors are indeed critical, but decades of tracking these hard targets have not borne significant fruit.

In the meantime, the way Latin American business leaders think about innovation and collaboration has received woefully little attention. Both outside experts and business executives have considered this area too “fluffy” and difficult to measure. This is a cop-out. It underestimates the role that deeply entrenched mental biases play in dictating the strategic options that are even up for consideration in the boardroom.

CEOs can’t be expected to contemplate investing in strategies that violate their natural, unspoken mental models. But they can learn to question those mental models and out-dated assumptions. Through our research, we’ve identified three assumptions most in need of examination.

Working with partners requires too much trust

Trusting relationships form the basis of successful collaboration. And collaboration is required to build trusting relationships. A classic “chicken-and-egg” situation. So, what impedes the triggering of this virtuous cycle?

A critical challenge is Latin America’s trust deficit. An international comparison of interpersonal trust levels in 59 countries underlines this, with most of the region’s major economies sitting in the bottom third of the ranking, and with Brazil, Ecuador and Colombia languishing in 54th, 55th and 57th places, respectively.

Our research with both successful and unsuccessful innovators in the region highlights the overwhelming importance of open and trusting relationships between partners. Such relationships take time to build, especially if the collaborating organisations have different working cultures and behaviours; for example, when large companies seek out partnerships with small technology start-ups.

Building trust is not a question of funding. Rather, it’s a question of time and effort: Time spent engaging with potential partners to truly understand one another’s underlying interests and priorities, and effort in building the organisational capabilities and skills to communicate and collaborate openly and effectively.

Internationalisation is about selling more abroad

The mindset of many Latin American business leaders towards the rest of the world needs updating. The same OECD dataset behind figure 2 above was used to evaluate the degree to which innovative companies around the world collaborate internationally. In this ranking, the Latin American economies dropped right down to the bottom of the 30-country sample.

Attitudes towards international interaction vary across Latin America, but there is significant room for improvement. The outdated way of thinking dictates that firms grow to dominate the local market and only then expand abroad. Executives should flip that thinking on its head and look abroad first, in order to access the new skills, technologies and capabilities they need to grow at home. This reversal of conventional thinking is particularly critical in Latin America’s larger economies, where international expansion is perpetually deferred under the pretext that there is always room for further domestic growth.

Moreover, when the region does emerge from its current economic challenges, its industries will find themselves competing with a far more globally connected set of players. There is every urgency to seek out valuable foreign partners now.

Different sectors can’t really work together

There are hopeful signs of a new breed of innovators establishing themselves in pockets of Latin America. For example, Brazil has the world’s fifth-highest number of start-ups, with clusters spread across the entire country, and Start-up Chile was recently named as one of the world’s best incubator programmes, by Fast Company magazine. Interesting initiatives are underway to connect large firms with these start-ups, as each side increasingly recognises the other’s complementary strengths. But academia, policymakers, civil society and venture capitalists also need to be included in the mix.

Many of these weak or missing connections reflect long-held attitudes. Academics, for example, often fear that working with business will compromise the objectivity of their work. Business leaders often avoid all contact with policymakers to ensure distance from any suggestion of corruption. These are valid concerns. Yet the rigid mental barriers that have been erected also prohibit constructive and valid forms of cooperation that are of wider economic and social benefit. The longer these mindsets persist, the harder it will be for firms to catch up with global innovation trends. For example, most of Latin America’s major economies have spent the past decade slipping yet lower in global rankings of business-academia collaboration.

One of the most potentially harmful absences is the weak discourse between business and policymakers in shaping a vision and strategy for the digitally enabled future of innovation. This is in marked contrast to many other governments across the world, such as China’s focus on developing the Internet of Things or Germany’s ‘Industrie 4.0’ initiative. Latin American leaders should begin now to tear down the barriers to dialogue between groups. Policymakers, business associations and industry bodies are particularly suited to take the lead.

Trust in the future

The future of innovation lies in greater collaboration. It’s inherent in the highest-profile emerging technologies and trends, such as the sharing economy (think Uber and Airbnb), co-creation models of innovation (think Linux), and the potential for blockchain to change transactions of every kind. Latin America’s ability to take part in that future depends on breaking down unnecessary barriers to collaboration.

We end on a hopeful note: attitudes, when they do change, can result in dramatically rapid changes in behaviour as positive results emerge. In our recent survey of Brazilian innovators, we found that 95% of those that had engaged in collaborative innovation reported success, and they are confident about increasing their investments in collaboration.

A crisis can force real change. It can lead people to rethink long-held assumptions about the way things have to be. Today, Latin America has the opportunity, and need, to shed outdated ways of thinking about the best way to innovate. It’s up to the region’s leaders to establish the supportive culture, incentives and reward systems that will encourage and inspire true collaboration.

The World Economic Forum on Latin America is taking place in Medellin, Colombia from 16 to 17 June.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

The Agenda Weekly

A weekly update of the most important issues driving the global agenda

You can unsubscribe at any time using the link in our emails. For more details, review our privacy policy.

More on Geo-economicsSee all

Joe Myers

April 19, 2024

Joe Myers

April 12, 2024

Simon Torkington

April 8, 2024

Joe Myers

April 5, 2024

Joe Myers

March 28, 2024

Joe Myers

March 22, 2024