Chinese investment in renewable energy is thrice than that of US

China now accounts for 45% of the total global investment in renewable energy. Image: REUTERS/Stringer

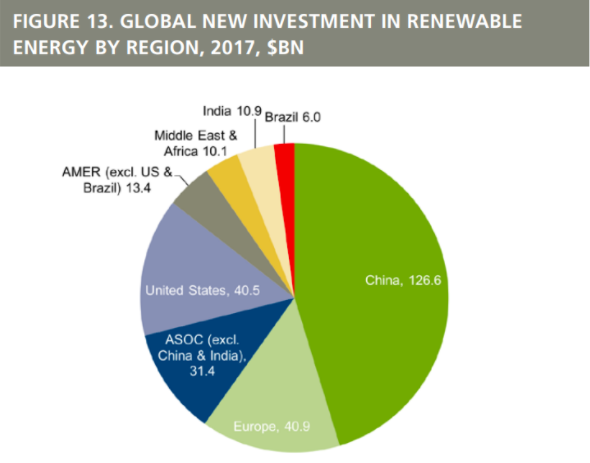

Global investment in renewable energy reached almost $280 billion last year, with China the biggest spender by far ($126.6 billion), followed by the United States ($40.5 billion). This means that for every $1 the US spent on clean energy, China spent $3.

Chinese investment in renewable energy

The scale of China’s investment in renewable energy is such that it now accounts for 45% of the global total, according to a report by the UN, Bloomberg New Energy Finance, and the Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance. The report reveals that 157 gigawatts (GW) of renewable energy was commissioned in 2017, up from 143 GW the year before.

Around 40% – or 98 GW – of this was thanks to a boom in solar deployment, with China alone bringing 53 GW online at a cost of $86.5 billion.

Yet, while China surged ahead, having increased investment in renewables by 30% between 2016 and 2017, the US lagged behind as investment in renewable energy decreased by 6%.

Falling investment in renewable energy

However, the report describes the US as “relatively resilient” in the face of uncertainties around energy policy and President Donald Trump’s decision to pull out of the Paris Agreement.

Europe, meanwhile, suffered an even larger decline (36%) in renewable energy investment, to $40.9 billion. According to the report, this was due largely to a 65% fall in investment in the United Kingdom, reflecting an end to subsidies for onshore wind and utility-scale solar, and a gap between auctions for offshore wind projects.

Germany also witnessed a drop in renewable energy investment, of 35% to $10.4 billion, on lower costs per megawatt for offshore wind and uncertainty over a shift to auctions for onshore wind.

Globally, just 12.1% of the energy used in 2017 was drawn from renewable sources, equating to a 1.1% rise in comparison to 2016. This was despite various countries dramatically increasing investment in renewable energy, including Sweden (127%), Australia (147%), and Mexico (810%).

In response, the report’s authors said: “Last year was the second hottest on record and carbon dioxide (CO2) levels continue to rise. While renewable generating costs have declined, and governments are phasing out fossil fuel subsidies – they amounted to a total $260 billion in 2016.”

Phasing out coal

During last year’s COP23 climate talks in Germany, 20 countries agreed to phase out coal by 2030. And although not legally binding, the move was welcomed as part of the global drive to replace fossil fuels with cleaner energy sources.

However, this group didn’t include China, India or the United States, the world’s three biggest coal producers. Worldwide, 40% of electricity generated still comes from coal, and in 2016 over 7,200 million metric tonnes (MT) of it was produced globally. To put that into perspective, just over 3,000 MT was produced in 1973.

This surge in production – which includes steam coal, coking coal, lignite and recovered coal – was due largely to China increasing its global share from 13.6% in the early 1970s to 44.5% in 2016.

Unsurprisingly, this reliance on coal is also reflected in an increase in emissions, with China’s share of the mix jumping from 5.7% in 1973 to over 28% two years ago, according to the latest Key World Energy Statistics report by the International Energy Agency (IEA).

Clean energy leader

But the world’s biggest coal consumer wants to end its reliance on fossil fuels and to lead the global transition to clean energy sources.

Alongside China’s growing share of global investment in renewable energy are initiatives to clean up air pollution, including a 100-meter-tall smog-sucking tower in the city of Xian. China also announced last year that it would scrap plans to build 85 coal-fired plants.

The country has set various renewable capacity targets. Having already surpassed its 2020 solar panel target, the IEA says it expects China to exceed its wind target in 2019.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

United States

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.

More on Energy TransitionSee all

Roberto Bocca

November 17, 2025