There’s a new market cropping up for venture capitalists: data-loving farmers

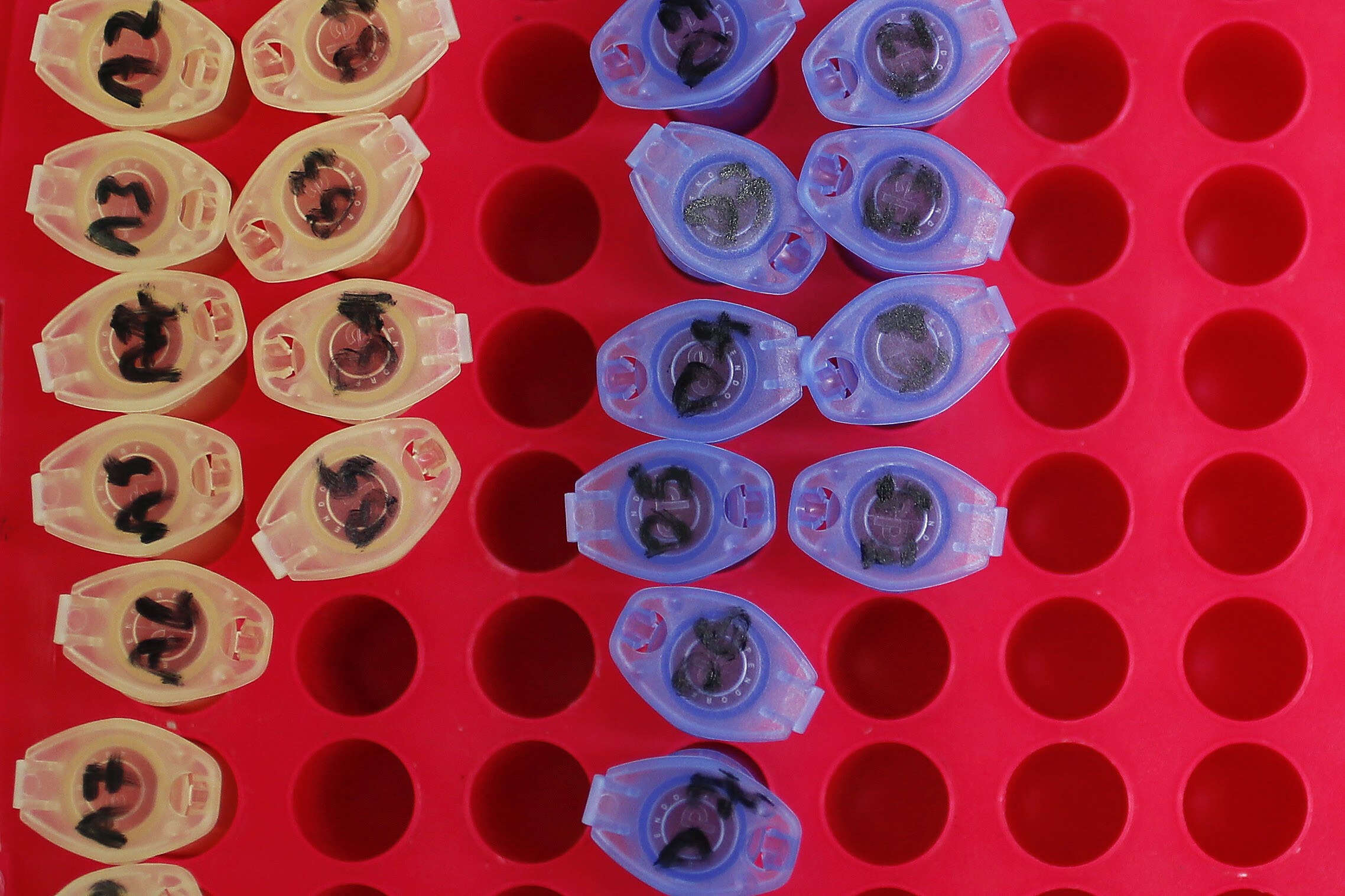

Farm management software is set to be a $1.6 billion market. Image: REUTERS/Stephane Mahe

Technology investors are discovering a new and largely untapped market: farmers in heartland America eager to fly drones, employ robots and crunch big data to boost their business.

In 2017, tech startups in the agriculture sphere raised $670 million to develop software management, big data analytics, automated equipment and other cutting-edge tools that help farmers grow crops with scientific precision, AgFunder reported. Agriculture is one of the last major sectors to experience the digital revolution, and it’s a market ripe for growth.

New technology lets farmers manage their fields down to the square foot — tracking plant health, soil moisture and estimated profit in real time. That requires advanced software, sensors and state-of-the-art imaging technology.

To meet such needs, investors raised more money for ag tech startups in 2017 than during the previous two years combined.

Digitized farming: the next big thing

Satellite and machine learning technologies help farmers better manage the productivity and efficiency of their operations while reducing their environmental footprint.

Startup FarmShot turns satellite data into high-resolution images that farmers can use to monitor crop health; and pinpoint fertilizer, water and pest management needs. The value proposition is clear, and FarmShot recently was snapped up by Syngenta Ventures, the most active venture capitalist in the farm tech space last year.

John Deere is also making big acquisitions as it expands its precision agriculture offerings. Last year, the tractor giant acquired startup Blue River Technology for $305 million.

Blue River uses machine learning, computer vision and robotics to optimize farm inputs. With this technology, sprayers and other farm equipment can predict and apply the exact amount of fertilizerand herbicides down to individual plants.

If these technologies come to scale, the improvements to agriculture’s climate and water impacts would be tremendous.

Farm management software soon a $1.6 billion market

While it grabs fewer headlines than satellites and machine learning, farm management software is just as important to farmers, investors and the environment. It facilitates the entire ag tech revolution.

A vast majority of American growers plan to invest in such software this year — the first and most critical step toward digitizing their operations. This market alone is expected to soon reach $1.6 billion.

Because they make the promises of big data a reality for time-constrained farmers, software startups have high valuations. Granular, for instance, was purchased by Dupont for $300 million.

Decision management software such as Granular’s helps growers analyze and act on hundreds of data points about their operations, making farming more economically and environmentally sustainable.

Farmer-run data startup breaks new ground

Ag tech startups may have piqued investor interest in Silicon Valley first, but precision agriculture startups are expanding rapidly around the country.

In Indiana, father-son duo Steve and Chris Fennig — third and fourth-generation corn and soy growers — built MyFarms. Their ag data solutions startup makes it easier for farmers, ag retailers and consumer-facing companies to integrate, analyze and act on sustainability information.

The Fennigs represent a fresh crop of farmers who will adopt and even develop new technology to meet business and environmental needs.

Expect to see more of that in coming years. There’s a brand new ag world out there, and we can only imagine what comes next.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Stay up to date:

Fresh Water

Related topics:

Forum Stories newsletter

Bringing you weekly curated insights and analysis on the global issues that matter.